I am doing a lot of background reading on the state of the UK economy right now. This come from the IMF, last year:

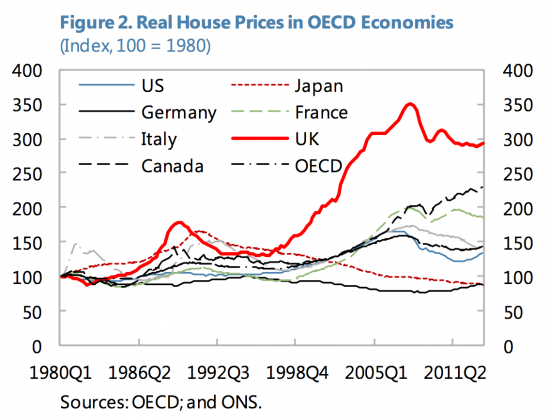

House price increases in the UK stand out among the OECD economies. Over the past 30 years, real house prices have increased the most in the UK when compared with other OECD economies. Indeed, over this period, annual house price increases have averaged 3 percent in real terms, compared with 1 percent for the OECD as a whole. This divergence in house price increases was particularly pronounced from the mid-1990s through the Great Recession. Furthermore, house prices in the UK have also been a lot more volatile when compared with other advanced economies.

The assertion is supported by a graph:

It's a might screwed up economy we have in the UK.

And if we want to put it right we have to resolve the housing, and associated debt problems.

Which means in the coming downturn People's Quantitative Easing may very well be funding the building of new social housing. There really isn't anything we can do that can better recreate the balance we need in our economy.

Well, that, and creating a real investment fund for new small business growth in key sectors like renewable energy, funded in the same way.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

We are building thousands of flats & houses in London, but unfortunately they are being bought by foreigners. We urgently need a comprehensive housing policy that restricts foreigners buying property, caps rents, removes ALL tax perks from buy to let and enforces decent standards in rented accommodation. We also need to ensure that new houses are carbon neutral, decent design and a reasonable size. At the moment we seem to have the option of minuscule shoe boxes or deluxe executive 4/5 bedroom homes all ensuite. And 99% of them are hideous, carbuncles stuck on the sides of villages and towns.

Just building more houses is not the answer, and calling for it also encourages the Tories to increase their call for the removal of the greenbelt and further reduce planning regulations.

I do not think they are all bought by foreigners

But their use as safe haven assets using money laundered sunds could well be a a major issue

oophs, perhaps should say that its not foreigners per set but non resident foreigners buying as an investment.

There is a fundamental problem to the logic of building more houses – there are too many vested interests who in reality do not want this to happen!

Why would an existing property owner want house prices (or rents) to come down, or even level off? As long as land and property is treated as an investment by financial institutions, individuals, corporations, government, etc.. why would any of these entities who are currently invested in existing property want to flood the market with new property?

As for those who are not currently invested, property ownership will continue to become further out of reach, increasing rents and prices for existing property owners (which is of course what they really want).

Unless this contradiction of capitalism can be addressed, it is all hot air and spin to make it look as if politicians can actually make a difference in a market that does not want to play ball.

It is similar in nature to the carrot of “work harder and you’ll do well” which is dangled before the human donkeys, while everyone really knows that they are just going to get beaten harder by the stick because the system will never allow most of them to break free of their chains as capitalism is designed to only allow a few to succeed.

Perhaps it is time for a bit of truth!

I understand many of the brick kilns are now no longer serviceable. Building houses with bricks doesn’t sound like it’s a viable option, not if we want them in a hurry. Then there’s the training of brickies etc unless we want to import them from Poland or wherever.

It might be an idea therefore, if we’re thinking shovel-ready here, to consider 3D printing and hemp. In Scotland they’re running a pilot scheme using a rather large 3D printer to build houses made of hemp products. It might be easier and in the long term more fruitful to consider these as options rather than try to do things the way we’ve traditionally done them.

The conservative-with-a-small-c view of public money is that it is best deployed in actions for the common good which the private sector does not do well. Or at all.

Infrastructure is an obvious one. Housing requires an admission that there is a market failure and, despite tge lessons of history, that is anathema to market fundamentalists – and frontbenchers on both sides of the Commons are numbered among them – as well a direct threat to rent-seekers. Neofeudalists, if you will.

And that brings me to a disturbing suggestion: the question “Should public money be invested in private ventures?” had been conclusively answered “No” in the 1970’s, and will always be greeted with the “Picking winners” narrative of failure…

…But if there is no private sector investment – no deployment of capital in productive ventures, merely the purchase of rents mislabelled as ‘investment’ – there is a compelling case for the deployment of public funds.

Initially, private investors will ride the coat-tails of public investment, just as they did in Silicon Valley (California may well be an exemplary engine of productive capitalism, but is not the poster-child for free-market enterprise) and ‘green’ technologies are an obvious growth opportunity.

…Which is a better bet than watching the private sector ride the sell-off of public services as rents over taxpayers and service users, while suppressing the value added by those services, in the downward spiral to a zero-sum economy of rent-seeking; Peoples QE may well be the only way out of an economic quagmire where neofeudalists compete to deploy their capital in the extraction of value created by others, and displace or suppress all activity creating value in doing so.

If that seems rather abstract, take a look at all the pubs, workshops and small business premises shuttered, demolished, and replaced by rented housing that nobody seems to be able to afford.

Richard

Do you have an idea how many houses we would need (in public ownership or some sort of non-profit status)to stabilise and if possible start to push prices down to sensible levels?

It`s pretty odious seeing some people `earning` more by sitting still in London than in 30 years at the steelworks.

The suggestion is up to 200,000 a year at present

Which is the same number of long-term dwellings according to: http://www.emptyhomes.com/statistics/.

Richard — Re housing

can you confirm social housing providers (excluding council) pay no tax on the rent they receive? Surely that is not right if I am correct it surely explains why they are cheaper than the private rented sector?

If they are charities they do not pay tax

But no one can enjoy the benefit of the rent – it has to be ploughed back in to social housing

I have no problem with that

I do have problems with private schools being charities

As far as the supply of affordable homes is concerned the rot started at the beginning of the 1970’s with Edward Heath relaxing credit controls this was followed by a series of corrupt governments both Conservative and Labour starting with Margaret Thatcher’s regime who deliberately turned a blind eye to affordable home demand. The failure to meet housing demand coupled with lax credit controls enabled the commercial banks and the shadow banks along with their investors to blow a succession of inflationary house price bubbles continuing to this day.

Absolutely Schofield-people need to know that this has a long trajectory sanctioned by both Labour and Tory with the Tories running with the baton and with Labour Massively culpable for the madness between 1997-2007 when bank lending for mortgages increased by 370%-

Sorry to bore people again who have seen this before but I’ll wheel out the Gordon Brown quote from 1997:

‘I will not allow house prices to get out of control and put at risk the sustainability of the recovery.’

As Richard often says: ‘You couldn’t make it up.’

Repeating ad nauseam:

It’s the land element which has become unaffordable. In London house prices are 80-90% land value, which is mainly created by locally provided public goods and services. (Imagine how much London house prices would be if there were no roads, buses, rail, health services, education services, policing, parks, etc.)

New decently sized, well-insulated homes can be built for less than £100k – although most of the current housing stock is worth less than £50k.

Councils should be able to designate some big country estates as new towns/garden cities and then demand full LVT from the owners. They would soon disgorge and councils would be able to obtain the land for next to nothing, put in the required infrastructure (no stupid Section 106s or CIL) and recoup the cost from LVT on home buyers and rents on social housing.

Richard-the transfer of wealth to property owners has been going on for too long and as Keith says above the vested interests have ossified and will be very hard to dismantle.

Labour could and should have educated the public about how this came about but as we know, didn’t because of Overton Window worship. Housing is now the only area for the rentier financial system to continue syphoning the populace and wrecking the general economy without their own wealth being touched-they will fight to the last man/woman to preserve this and be quite happy for displacement/decoy arguments to cloud the truth such as

1. It’s those Immigrants.

2. It’s the benefit claimants

3. It’s those scroungers in social housing

This Government has been adept beyond even their own ghastly imaginings at the supine receptivity of the populace to this sort of crap.

Social Housing is the answer, without doubtbut with banks dangling the mirage of the rungless ladder and similar falsehoods nothing will shift.

I’m afraid the situation is now irredeemable and the stupidity limitless. More significant shifts in perception and human will are needed to unblock this particular toilet.

Have a look at this

http://www.tullettprebon.com/announcements/strategyinsights/notes/2010/SIN20120824.pdf

Tim Morgan is a Tory but here he’s come up trumps

Most of his other work is well worth a read

He’s right on that

I’m afraid that Dr Morgan doesn’t appear to have a clue – a long paper on the housing problem without mentioning the word ‘land’.

We don’t need to wait for PQE to start a major programme of public house building. We could do it today funded by government-backed debt. With current low long-term interest rates such a programme could be self-financing from below market rents on these new homes, even after maintenance. Gains to the Treasury from higher taxes on increased activity and lower housing benefit payments would be a bonus. Any skill or other capacity bottlenecks could be quickly overcome with long-term commitment to this programme.

The economic innumeracy of austerity is providing cover to the vested interests who do not want this to happen because they gain from the current shortage. It’s sometimes claimed that everyone who owns a home benefits from rising house prices but that’s not true. For anyone who wants to move up, rising prices just mean a bigger mortgage when they get there. The private sector has never solved the housing problem, only public investment can do that.

I do not doubt we could use debt today

But over the next few years we may well need PQE

And since nothing is going to happen now I keep mentioning it for use when it is needed

In Manchester, the Labour council engaged in, demolishing council housing, that were better built than private homes. Only to have developers, such as Urban Splash and Bellway, to build more low-quality private homes. So we have a high rate of homelessness, whilst over 5,000 dwellings lie empty. Over 2,500 dwellings have been long-term empty. It is not knew homes that need building, especially if they continue to be energy-inefficient. House prices are high, because developers are able to charge, more that what they are actually worth. There needs to be a complete change of the political-mindset, that has driven this nonsense.

As well as the growing inequality in this country, we also have climate change. Which our politicians, economists, bankers and tax-experts are not combating. And it will not be solved by printing debt.

Evidence would be good

Sorry, I did mean to attach this link: https://www.gov.uk/government/statistical-data-sets/live-tables-on-dwelling-stock-including-vacants. Table 615.

The energy inefficiency as a result of the construction industry addiction to poor building construction is a serious issue. It can only be remedied by changes in building methods/materials such as straw bail and ecological ‘self build’ such as that promoted by the Walter Segal Trust.

The market will never do this, of course and as Carol keeps pointing out, the land issue is ever-present. The whole things a Gordian Knot with no political will to untie it.

I agree re materials and techniques

This is absurd

What are you thoughts on Passivhaus Richard?http://www.independent.co.uk/news/uk/home-news/adopting-passivhaus-building-standards-could-allow-people-to-heat-their-homes-using-power-emitted-by-a6707656.html

It sounds good

And the right direction of travel

A Green New Deal would aim for it

It tends to fall down on ventilation. The original design used active ventilation with heat exchanger/s to reduce the heat loss. Without it, you have a dwelling where humidity is high and air is stale. Breeding grounds for respiratory disease, of which the UK does quite well without help!

We need a property tax.

Firstly, there’s not much hard evidence to show that building more homes gets prices down (unless you build them in entirely the wrong place, in which case they are not homes, they are just piles of bricks), only blind faith.

Secondly, who do you think will be snapping up those new builds?

Answer: exactly the same ‘equity rich’ Baby Boomers who are snapping up a disproportionate number of any other homes which are up for sale. At present, the ratio is one BTL purchase to two first time buyers (,http://www.theguardian.com/money/2015/nov/11/buy-to-let-mortgages-cml-lending-landlords-loans)

but that ratio is worsening (or improving, from the Homeys’ point of view).

We had a perfectly decent residential property tax: domestic rates (although not as good as LVT). The problem was and always is lack of regular revaluation, and the longer the gap the more reluctant politicians are to order one. This is even occurring with Business Rates and is causing huge distortions with consequent patching up.

The City of Pittsburgh, PA, lost its advantageous form of LVT in 2001 becauseof a 30 year delay and a bodged revaluation frightened the politicians so much they abandoned it – and it’s been downhill ever since.

Even Council Tax (which is just about the worst ad valorem tax you can imagine) is suffering from 25 years of neglect.

If we had kept the old rates and had regular revaluations we would never have seen the explosion in house prices, even now after the financial crash, which is ruining the lives of the younger half of the population.

Revaluation is essential but always resisted: it’s costly to carry out and there are losers. Under the old UK rates system there was particular resentment from those who had invested in their homes (central heating, double galzing, etc.) only to find that they now had a higher rates bill as well.

A possible solution would be to revalue at sale (when there is a clear market valuation) and then automatically increment annually by the average increase in residential property values for the area. This would ensure that rateable values did not lag the market and also remove the disincentive on home improvements.

Land is much easier and cheaper to value than bricks and mortar and the value is not affected by improvements made by individual home owners. Australia values its land every 2 years and they could easily do it on an annual basis using computerised mass assessment. In any case I was told that property valuations are not as costly as I had imagined when I was giving evidence at the Scottish Commission for Property Tax Reform recently.