The FT reports this morning that:

Continuing low interest rates have handed George Osborne a windfall ahead of this month's spending review, leading to expectations that the UK chancellor will use some of the cash to scale back £20bn of planned cuts.

The difference could be £2bn annually, according to the Office for Budget Responsibility's interest rate calculation programme.

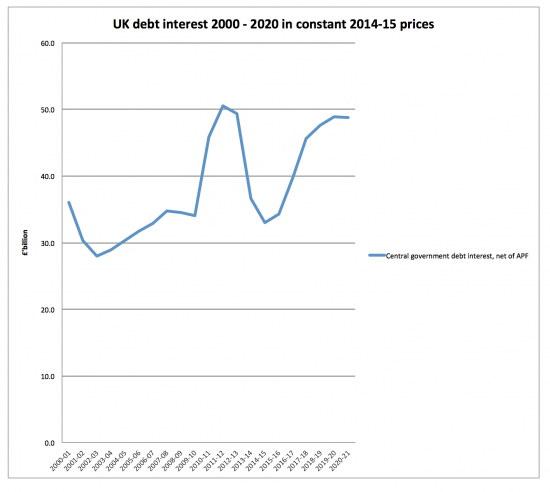

That did not ring true to me, so I looked at the data, which looks like this:

The data source is budgets from 2000 to 2015, including the July 2015 projections from the OBR (who I consider a part of the Treasury for these purposes). Constant prices are used to indicate real changes.

Note that what we are enjoying now are interest costs about the same as those Labour paid, which is interesting, given the narrative on this issue. And the reason why is the note that says 'net of APF'.

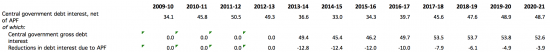

The APF is the Bank of England Asset Purchase Facility, or QE programme as it is popularly called. The impact of this is split out only for more recent years, as follows (click image for a larger version):

The truth is that the QE programme will make the UK £47.2 billion in four years to 2016-17. And then George Osborne wants to give this advantage away because he wants interest rates to rise to keep the banks happy. The cost? Well, not less than £25.2 billion, I would suggest (that's the difference between an average savings rate of about £12 billion a year and forecast savings from 2017-18 onwards).

To put that in context that giveaway to bankers to return them to what they think to be 'normal times' will cost more than £6 billion a year, on average. And tax credit cuts are designed to save £4.4 billion a year.

It's time we stopped wealth flooding up in society and used it to support those who need support. This government does not, unfortunately, seem committed to such a policy, but the reality is that this is all a choice on its part. There is no reason for this cost to rise. The massive gains from QE could be retained if a commitment to low interest rates was maintained. But the government is not making that commitment. It is instead hitting those worst off, and it is fair to ask why.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

So if these figures are correct, we patently do not need spending cuts. In fact, we could do exactly the reverse.

The cuts are for pure ideological reasons only.

Indeed, and for ideological, we can read the spiteful, juvenile actions of spoiled overgrown schoolboys.

…….And their cheerleaders who reside amongst us.

The question is will the opposition parties highlight this? This sleight of hand politics needs to get into the public consciousness.

But do the opposition parties even begin to *understand* this issue, let alone accept the need to highlight it?

Sadly, I seriously doubt it.

Depends which opposition parties and sections of opposition parties you are talking about.

Certainly not those Muffin the Mule donkeys who regard themselves as the loyal (ie establishment) opposition.

Where do Treasury gilts come from? Assuming they have a physical existence and they aren’t just bits and bytes, they’re just a blank piece of paper till they have their Gilty details written upon them. So, they’re just made up then. Where does the money come from to buy them? It’s made up, from nowhere, by the private banks. Where does the BofE get the money to buy them in turn from? Er, it makes it up. Then interest continues to be paid on these gilts. Is it made up for this purpose fresh? Or is it taken from the existing stock of made up money, reducing the amount available? I don’t know, but I do know that awareness of these procedures demonstrate conclusively the sheer scale of the nonsense spoken by our PM and our Chancellor when they declare, respectively, ‘There is no magic money tree’ and ‘The country’s run out of money’.

One wonders, are they dishonest, incompetent, or both?