I loved a paragraph in the Treasury's leaked briefing to Tory Treasury ministers last year. It was written when officials were asked to consider the policy the Tories have now announced of allowing homes worth up to £1 million be passed on death to the children of the person who has died. They said:

These are perverse outcomes, to say the least. It is inherently obvious from the comments that the reforms are inequitable. But the Tories are proposing them anyway.

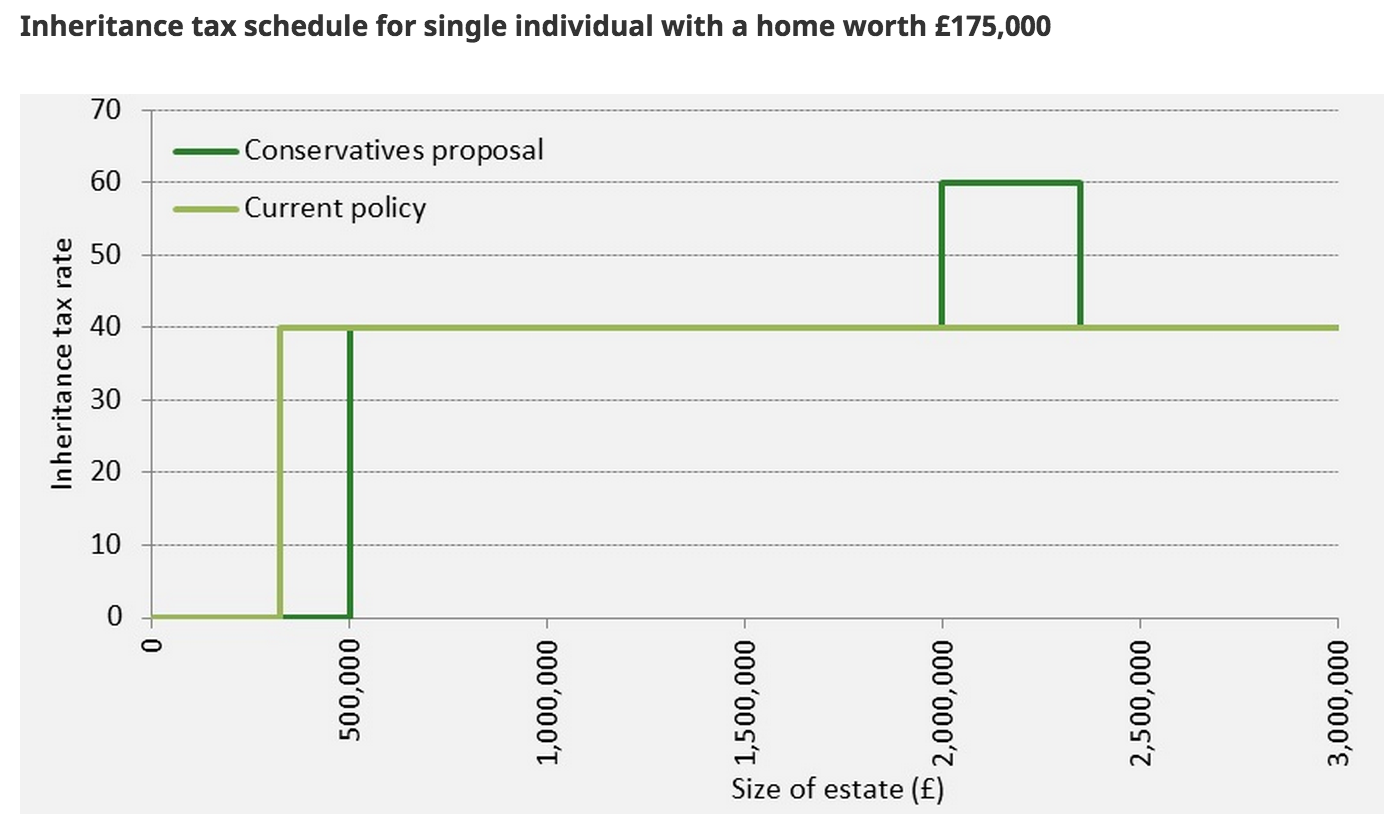

This is also despite the fact that, as the IFS does point out, the relief and its eventual withdrawal will create a perverse 60% marginal IHT rate for estates worth more than £2 million:

This is the outcome of seeking headlines, and not sensible tax reform.

And the relevant point is that this also comes from tinkering with a tax that the Tories instinctively don't like (you can tell that because UKIP would abolish it) but which they know they cannot get rid of because, despite the clamour of a small, noisy, few who would be rid of it, the majority of the population know that to tax wealth is not just right, but necessary.

You don't have to have read Thomas Piketty to realise that there is a growing, and serious, problem arising from wealth inequality in the UK. It's a problem that means that inherently (literally) some are advantaged over others, which then exacerbates the likely consequences of income differentials in favour of the wealthy that will follow. I am not saying those who enjoy those advantages need in any way to be punished because that is not true. I am simply saying that the fact is that the inequality of our current wealth distribution harms everyone by denying those with ability but without advantage the opportunity they deserve, and because capital concentrated in the hands of a few tends to be invested unproductively in asset speculation and not in innovation, which is precisely what is happening in the UK. The result is slow growth and stress in society which harms all, including the wealthy.

I am also not saying inheritance tax is a good tax: there are better wealth taxes, not least because inheritance tax encourages wealth concentration - which the new rule will do to an even greater extent than before. A tax that encourages wealth diversification would obviously be a lot better and that is possible by taxing gift recipients, not donors.

But what is beyond dispute is that we need to have a tax on wealth to encourage its diversification and redirection into productive use and what is clear is that having a political narrative that denies this is deeply unhelpful to the UK and its economic prospects.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

If people have to go into care, they often have to pay for that care when their house is sold. When my mother died a few years ago, the amount which could be passed on was £23,000. If necessary the rest had to be used up-unless the person died first. This seems a sort of tax on those who lose the ability to care for themselves. With an ageing population, the number of people needing expensive long term care will increase, so it will be costly and there has to be a way of finding the money but the low limits hits the inheritance of a wide range of people.

An inheritance is unearned income. Inheritance is the main driver of wealth inequality. The IHT threshold should be brought down, not raised. The 40% rate is fair but could be logically set at the income tax rate of the recipient.

Don’t worry, Ian: George Osborne has already thought of that.

http://www.theguardian.com/politics/2015/feb/16/osborne-advised-using-financial-loopholes-to-avoid-tax-and-care-costs

As has been pointed out by many, people with loads of money sloshing about tend to make sure it gets into politicians’ pockets – I mean, look at America!

The point that this measure discourages downsizing is very telling. Have more bedrooms than necessary? If you’re poor, you pay the “bedroom tax”; if you’re wealthy, you’ll get this inheritance tax cut.

Indeed

The leaked briefing is of course absolutely correct and shows all the reasons why this is a very poor policy.

I am not sure it is right to say that “the majority of the population know that to tax wealth is not just right, but necessary”, I suspect that in reality the majority of the population know that they won’t pay this tax and consequently want to see it collected from somebody else.

It doesn’t seem to matter who you ask, they always know that tax needs to be collected, but they always think somebody else should be the one paying it.

Richard, just a question. How does inheritance tax work where a wealthy family have put all their assets into a trust, company or some other structure?

Would a wealth tax be better at dealing with this?

These days trusts have little impact

Unfortunately family companies and other investments remain largely outside IHT

That’s unfortunate because the logic that the next generation are the best owners is rarely true

See the Green party wealth tax proposal out today

It is strangely comforting to know that our politicians are ignoring the smart people who are paid to advise them, as well as ignoring all the smart people who do it for free.

I think that marginal rate is actually 80%. Although it’s not entirely clear, in order to ensure that the relief is lost completely on the death of the last survivor when the house is worth £2.35m, it has to be withdrawn 1:1 over £2m, because the last survivor will have inherited the allowance of the first to die. The IFS avoid having to deal with this by giving details only for a single person dying, but either the relief is withdrawn 1:1, at least on the second death, or the real point at which it will be withdrawn in most cases (where it will be a second death) is £2.7m.

So, death of last survivor owning property worth £2m: 2 x NRB = £650k, 2 x FHA = £350k, tax at 40% on £1m = £400k. Same facts but property worth £2.1m, FA is reduced to £250k, tax due on £1.2m = £480k.

My working assumption would be that, if they are not constrained by a coalition partner, the Conservatives will put this out for consultation after the election, get exactly the comments back that the Treasury previously gave, plus more about the complexity of the withdrawal mechanism, and announce that they have been “persuaded” that it would be simpler all round just to raise the IHT nil rate band to £500k per person.

Mike

For once I agree with you

They are grandstanding nonsense for electoral gain

But £500 k would also be a step in the wrong direction

We need a lower band and progressive rates

Richard