Research has shown most people have little clue how income is distributed in the UK. In particular, the wealthiest think they are worse off then they are and many on what is called 'middle income' do not realise that they earn much ore than 'middle'.

Latest data from HMRC, just published, emphasis this. I have reduced their table to the most recent year for which information is available, which is 2012-13:

A decile is 10% of taxpayers. People who are not taxpayers are not in this table, so it overstates average incomes.

Half of people in the UK in 2012-13 had declared taxable income (I make the point carefully) of £21,000 or less. Having income of £49,200 put a person in the top 10% and £150,000 or more, unsurprisingly, in the top 1%.

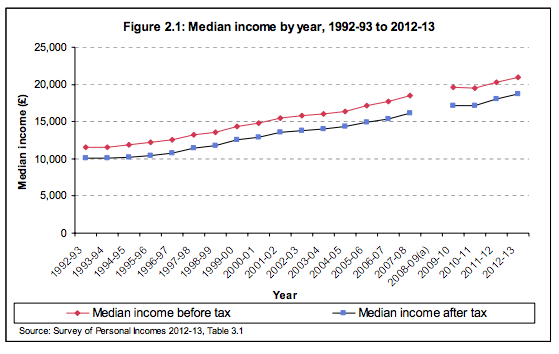

To emphasis the point median income by year looks like this:

There is no doubt that the UK needs a pay rise.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Looks like this is replacing the pay rise:

“PER ADULT IN THE UK AN AVERAGE DEBT OF £28,968 IN NOVEMBER — AROUND 115.0% OF AVERAGE EARNINGS. THIS IS UP FROM A REVISED £28,922 IN OCTOBER.”

The Money Charity

Richard: this is a very valuable piece of information and shows three key things:

1) pay in the UK is generally low (as these figures show, the median is much lower than the mean so often quoted as the ‘national average wage’, which I think hovers around £26k); even at the higher end of this scale, these figures show jsut why so many peopel find it impossibel to buy houses. Not only that, but most families who do manage to buy houses are double-wage couples, which means that their homes, inevitably mortgaged to the hilt, are one senior management decision away from being lost.

2) The so-called ‘squeezed middle’ or Middle England vote is actually that of the relatively affluent rather than the majority of people. So goodness only knows why Daily Mail readers and similar imagine that they are in any sense financially ‘average’ when in fact they are generally much better off than most.

3) Possibly most importantly of all: it shows, at the top end, just how dangerously skewed in favour of a small number of very wealthy people the income distribution is. The income of the top 1%, £150,000, is a lot by any standards: but it pales into complete insignificance next to the kind of sums being taken home by those working in high-end finance. This, of course, doesn’t even take into account earnings from capital.

If you’ve ever wondered why apparently wealthy people earning this kind of money can’t afford a house in a nice part of town, this is why: the bankers and their ilk (not to mention foreign ‘investment’) have bought three and rented two out. £150k doesn’t buy you the ‘Middle England’ lifestyle that the Right would have you believe you can aspire to; school fees for two kids, two posh cars, a house, a holiday cottage and three foreign holidays per year adds up to vastly more than £150k.

As to dangerous inequality well, consider this: let’s take my boss, who is a senior equity partner in a big City law firm. Let’s say he earns £500,000 which , for the sake of simplicity, is taxed in full at 45% (I know that’s not quite true but it’s fine for comparison purposes). That means that his take home is £275k. That’s a lot of money in anyone’s book and is, I suppose, what someone who was lucky enough to be clever and well-educated could, after a lot of hard work and a few strokes of luck, hope to reach after 25 years in a well-paid job.

But what about the banker who gets paid £5million? He pays 45% tax too. That leaves him with £2.75million after tax – or more than five times as much as the senior partner in a City firm STARTED with (and you can guarantee not al of that will be taxed as income at those rates). Even if you taxed the banker at 80%, he’s still taking home a million, so twice as much as my boss before tax.

This isn’t simply a ‘duh, rich peopel have more money’ post – the point is that, once you are so far removed from the normal costs and concerns of society, you end up with a free-floating stratum of super-rich for whom paying tax is an optional concession, and who have no stake in society beyond throwing money at politicians to make sure the status quo is maintained. If you’ve ever wondered why all the major parties get so many donations from bankers, here’s why – in addition to which, even rich lawyers like my boss simply don’t have £50k to chuck at politics.

The level of inequality as it stands is bonkers and outright dangerous. Even within that final fraction of the top 1%, there are bankers earning £15m, £20m – and goodness knows what kind of purchasing power that gives them. On top of which, no job is objectively worth that kind of cash. I know very well that it’s lal based on the financial value they bring to the business (banking wise at least) – but given the damage it causes elsewhere, a great deal more of that should be heavily taxed to pay for the rest of society, without which bankers/CEOs et al woudln’t be able to call on the services of bin men, nurses, water supplies and the rest.

Why, why, why is no national newspaper (Guardian?) ever courageous enough to look at figures like this and intepret them properly?

The last is a good question

Very thought provoking.

It’s amazing when you think that if wages were higher, there would be a higher tax take, more savings, less worrisome levels of debt and funded pensions – all things that we are told we have a crisis with!!

Someone somewhere is not getting it.

Yup. Though interestingly your namesake (assuming you aren’t actually Mark Carney – !) does seem to be getting the message, to judge by his comments this week.

You could state this obvious truth until you pased out, though, and the current government woudl ignore you. What they are doing is about ideology, and has nothing to do with solving the problem. Labour are proposing a milder version of the same, when what we need is full-blown Keynsian stuff to stimulate demand.

The Guardian like every other newspaper is completely dependent on corporate advertising. So naturally they don’t want to frighten the horses………

But why stop at Bankers?………..What about all the Footballers and their millions?………The JK Rowlings of the World and their millions?

Actors, authors, popstars etc the list goes on…….why just bankers that need to be stopped?

Are you going to stop all of them?

Tom

Feel no obligation to reply

Richard is one of the ultimate purveyors of the political of chipped shoulders

Richard M

Total income before tax

Total income after tax

This table clearly gives the lie to the claim the UK tax system isn’t redistributive.

It’s one tax

Over all taxes the rate is almost flat – as is well known

Please do not distort facts

Richard

I don’t doubt this assertion (experience and a few casual sums quickly show that it’s broadly the case) but I don’t suppose you have any HMRC or Treasury links to show which portions of tax come from which income levels? I mena, I know that VAT is incurred disproportionately by the less well-off, but do you know of any data that show this?

Many thanks

This is data to 2006/07 http://www.compassonline.org.uk/wp-content/uploads/2013/05/Fairness-Thinkpiece-40-REVISED_-2smallpdf.com_.pdf

I know Howard Reed has updated it since with much the same result

Thank you – much appreciated.

Excellent piece and my comments would have been very similar to Tom’s. I’m just back from looking at the Compass article and also data on the proportion of the tax base paid by corporates

Tom’s final point is the key one – why is this not being picked up much more assertively by both politicians and media commentators…

Fbecause they have been captured

I can’t get at the figures from my phone, but a few more lines on that median-income-vs-time chart would be interesting: I believe that they show flat or declining earnings in the middle and lower quartiles.

Do you have similar set of time series for cost of living at each decile?

No, sorry

So what exactly are you calling for Richard? and you also Tom? There are many actors, sportsmen, footballers, musicians, tv presenters, and of course accountants, lawyers, and bankers, making over £1 million per year. What top rate would you like for them all? 60%? 70%? 80%? Regards.

I think 50% is essential

I would want a wealth tax as well

And CGT at income tax rates

“And CGT at income tax rates”

With some taper relief as well to realise the fact that long term investments are subject to inflationary devaluation? I’d like to see a taper relief based on actual inflation rates, not the odd calculations used before and not the silly fixed rate for CGT we have now.

Taper has its own problems

But the principle has been long established, I agree

HMRC could just publish a monthly value for the taper allowed based on inflation. They do this now for foreign currency exchange rates for VAT and others, so why not taper? Just multiply up the taper monthly since the asset was acquired. Simple and fair.

They do for corporation tax already where indexation still exists