The FT had an article yesterday which opened with this comment:

It has never been cheaper for the UK to borrow money over the long term – something the current coalition government has not been shy to promote as a sign of its tight grip on the country's purse strings.

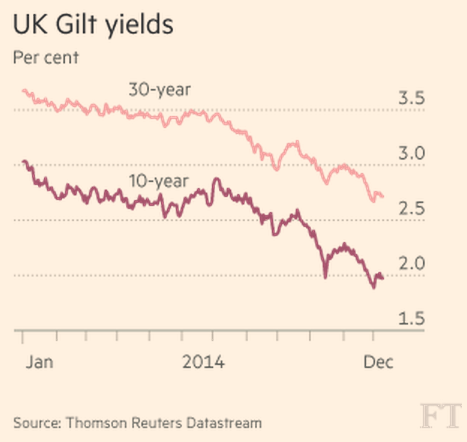

To reinforce the point it included this graph:

The price of UK government borrowing has been tumbling, and the UK government has been exploiting that to refinance part of its borrowing, and is saving money as a result.

The FT is worried though: it says that low gilt yields as shown here either represent a solid and secure home for money in a storm or are clear indication that there is no confidence in the long term growth prospects of an economy, and they think that the latter is the prevailing trend in the UK right now.

U think both are right. Despite everything George Osborne said in 2010 the UK government has, despite its massive and record levels of borrowing in the last five years (which far exceed all that was borrowed in the previous thirteen) UK gilts remain a solid and reliable investment carrying very little risk, and that is why they are so popular.

And it is also true that people are putting their money in gilts because they have little confidence in anything else.

Oil is falling - and there is a lack of confidence (and rightly so) in the whole future of the sector when most of the world's known oil reserves will have to stay in the ground to prevent global warming.

Other commodities are suffering as a result.

Retail is suffering from a lack of consumer spending and management misunderstanding of consumer trends.

Banking exploits still, but the penalties of being engaged in the activity are now so high that only senior employees really win in this sector.

Tech is not offering new solutions to very much, to be candid, which is why apps like Uber are so massively overvalued, whilst tax risk suppresses valuations, and rightly so.

To put it bluntly, capitalism is in the doldrums. It has run out of steam. It has no answers to offer. That's why it is so desperate to get into privatised services and outsourcing: the pubic sector is, many companies have realised, the only game in town where there is a reliable source of income.

And many investors have circumnavigated that process and simply given their money to the state because they think it will make best use of it.

So Osborne has been wrong again. There has been no 'march of the makers'. And there has been no rush of the private sector to fill the void the state has tried to create into which entrepreneurs were meant to flourish, and nor will there be over coming eyars as he pulls back state spending even further. There is just inactivity because markets have no idea what to do any more: the ideas have run out.

But the need for state services has not: that's alive, buoyant, and would be flourishing and be wealth creating on an enormous scale if only we let it get on and meet public demand.

And I do mean wealth creating because wealth is not about accumulating piles of cash: wealth is about setting people free to work.

UK capitalism is not doing that right now. If it used green quantitative easing and the Green New Deal the UK's government could do that. The money is saying it should do that. It's time to listen to the money. The future of our prosperity is bright but it rests with the state, and the state's got to be willing to fulfil the promis of using the money entrusted to it wisely.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“The future of our prosperity is bright but it rests with the state, and the state’s got to be willing to fulfil the promis of using the money entrusted to it wisely.”

They are trying this in Venezuala with predictable results.

Utter nonsense

This is about continuing the post war social democratic consensus

Could I suggest that instead of having a dig at the role of the state by holding up the example of Venezuala, a country that has had a very long and troubled history under governments of all persuasions, you actually come up with some arguments to refute what Richard is saying?

You come across as a typical market fundamentalist I’m afraid.

The Venezuela argument is so lame it’s not worth addressing

Next it will be North korea, a place obviously comparable with a parliamentary democracy embracing Keynesian social democracy

Actually, Venezuela isn’t a bad argument. If you look at what Chavez did with Govt money it was quite revitalising. Venezuela post Chavez is miraculously better than pre Chavez when a tiny handful of landowners & MNCs held the wealth. Even many of his opponents accept that . The problem was that Chavez was, at heart, a benevolent dictator not a democrat & despite being in power for many years he never put in place any kind of systems of government that could run after his death. Its now all falling apart sadly.

You are right to make these arguments, but I think they’re a bit complex. To simplify:

1) Osborne’s view is that the Country’s economy should be run to pacify money markets that we never intend to utilise.

2) We’re often told that tax pulls money into the public sector & away from the private sector where it can be more efficiently utilised. This is, quite plainly, bollox, as the private sector hasn’t a clue what to do with the money its already got. Meanwhile, there are houses to be built, green energy systems to be created & transport links to be built*.

*Although, personally, I’m not convinced HS2 is the right one

I agree on HS2

“Tech is not offering new solutions to very much…” but where it is the essential financial support which only the state can provide to get the technology to commercial viability stage is not there sufficiently or for long enough…..below is the text of a letter I wrote to The National (Scotland’s new pro-independence newspaper), published last Thursday:

“The news that two pioneering wave energy companies have run into difficulty and run out of financing is disturbing. This emerging technology and these sort of companies, which support highly skilled and well paid employment, are exactly what a vibrant new Scottish economy will need. A high wage economy is key to tackling inequality.

The Scottish Government has been providing financial support for the development of the new wave energy technologies but this has been insufficient to support the process through to fruition. This calls for an evaluation of and some new thinking about how this finance can be provided. Bringing cutting edge technology to the stage of commercial viability is a long term process and requires long term thinking and patient capital. Clearly the financial infrastructure which currently exists is not up to the job.

Some new ideas are emerging ; of particular interest are the proposals from the Green New Deal Group for “Green Quantitative Easing” and from Birmingham Labour councillor John Clancy, who has proposed in his book “The Secret Wealth Garden” that Local Government Pension Schemes (LGPS) should be enabled to allocate a substantial part of their assets to investment in the regions whose taxpayers fund the LGPS schemes by paying the employers’ pension contributions.

Investment by Scottish LGPS funds in Scotland’s infrastructure and social housing will in itself create employment but will also release government spending to focus elsewhere where it is needed — such as supporting emerging new technologies and industries.

Green QE can play a role as it would give the Bank of England an option of creating new money to buy Scottish LGPS pension fund assets (instead of buying up banks’ assets as happens with standard QE), thereby providing the cash for the funds to invest in the Scottish economy. If LGPS funds had to generate cash by selling assets on the open market it might trigger a fall in the value of those assets which they retain…..selling to the BoE in a Green QE initiative would prevent that.

How this sort of financial architecture would work in detail will require better minds than mine, but it is clear that we urgently need financing models which can deliver the committed, long term patient capital necessary to create the new technologies and industries our country needs to build and sustain a high wage economy.

Richard is right…..only the state can provide the leadership.

Jim

I wholeheartedly agree. This is something that Green QE can definitely tackle

Thanks for doing this

Richard