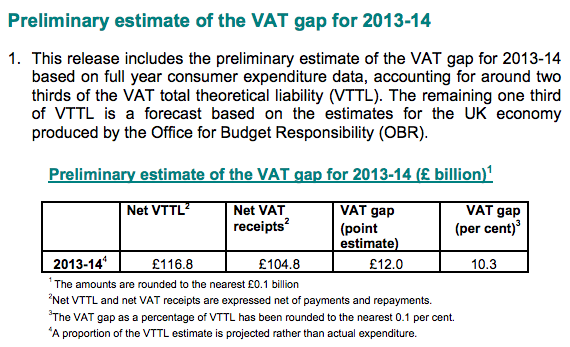

Amongst the many statistical releases made yesterday by HMRC was a new estimate of the VAT gap for the UK, this being the first estimate for the tax year 2013-14. This is as follows:

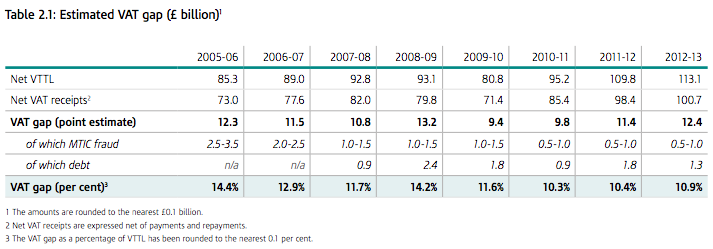

Let me contrast this to earlier years, as taken from the latest HMRC tax gap report:

So, at a time when HMRC have virtually abandoned VAT inspections for small businesses, the number of such businesses is rising and the scope for abuse is growing apparently the VAT gap is falling.

I have to say I find the plausibility of that remote. I'd even ask, how do they know? But I present the facts as HMRC want to state them for now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

HMRC have virtually abandoned VAT inspections? Do you have a source for that?

It’s not my experience – I’ve had several clients (about as many as in recent years) have VAT visits recently. None of which has found anything significant, which suggests to me that routine VAT compliance activity (ie not targeted at companies where HMRC have evidence of noncompliance) is going strong.

The sample size of my clients is of course not large enough to draw confident trends, but “virtually abandoned” is certainly not my experience.

VAT staff at HMRC say they are now as rare as hen’s teeth

I believe them

They tell me there are almost no staff left who could do them

Thanks for the warning. I shall be more careful about checking the IDs of people claiming to be VAT inspectors, and not count their use of HMRC addresses, phone numbers and headed paper as being in any way indicative of their bona fides.

Richard

My experience at my previous employer was much the same as Andrew Jackson’s. VAT inspections of clients proceeded at a steady trickle throughout the 9 years I was there and I only left in August.

A recent development were combined CT/VAT visits.

If you have evidence that VAT inspections have all but ceased and there are ‘almost no staff who could do them’, why aren’t you presenting it?

Because I can’t present conversations

My own experience, as a bookkeeper and Financial Controller in a number of different companies over the years, is that VAT inspections HAVE virtually ceased: at least in small companies with turnover £2m or less. Quite recently I worked in a company where the previous incumbent had not filed a VAT return for 18 months, and STILL didn’t get an inspection. I rectified that situation and brought the VAT affairs up to date, and was there for 3 years- still no VAT inspection.

Amazing….

But your inside sources should have access to the numbers of HMRC staff assigned to VAT inspections and the number of inspections undertaken. Surely you can get this information? Or ask a FOI request of HMRC?

The point is, if you had evidence you would be presenting a damning indictment of government policy rather than an unsubstantiated rumour. Particularly with your PCS backed campaign about HMRC staff numbers it seems to be to be an ‘open goal’ if VAT inspections have been abandoned and there are no HMRC staff capable of undertaken such inspections. The public would be outraged. If you could prove what you say.

There is also evidence of falling inspections and enquiries in tax gap data

But if you’re that excited by it – you go and read it

I left HMRC earlier this year having worked as a VAT inspector for many years – when I left there were around 15 staff in my office carrying out inspections, 10 years ago there were 30.

Thanks for confirming

Old Codger has confirmed that whilst there has been a reduction in staff in the office he worked at, the claims that enquiries have been ‘virtually abandoned’ and that there are ‘almost no staff’ capable of undertaking enquiries is clearly ludicrous.

So, you have accountants telling you VAT visits are alive and well and happening and ex HMRC staff confirming there are still staff undertaking enquiry work but will you change your stance? Of course not, as you have never let evidence get in the way of your political dogma.

No of course I’m not changing my stance

It was and is right

I think a lot depends on which particular sector you are looking at. From a big corporate perspective, the VAT visit is alive and well and uses more and more sophisticated techniques. Given the size of big corporates, VAT visits tend to be targeted at specific sections of an organisation – accounts payable, accounts receivable, reverse charge calculation, partial exemption, etc. – one after another. Any issues that are found are then looked at as to how they flow through the systems.

As for HMRC’s use of techniques and technology, often HMRC only need to get a data extract from a corporate’s systems to target their enquiries. Their computer audit teams (nothing new) are very good and want systems diagrams, documentation, etc.to probe a corporate’s systems and look for particular ares to test.

I can’t talk for small traders as I do not have the experience of dealing with them, but I suspect that, if true, the compliance visits are targeted on the big boys because the compliance yield is higher.

But the losses are much bigger in the SME sector

HMRC’s office closure programme is as damaging as their shedding of trained staff. While VAT offices were never as widespread as Inland Revenue offices they had a presence in towns the size of county towns and the Department is withdrawing a VAT presence form many of these.

Many businesses are a long way from the nearest VAT office now, and, worryingly, HMRC top brass think enforcement can be carried out without ever meeting traders or visiting their premises to inspect records.

The computer teams do good work but they are incredibly overstretched and there is a desperate need to roll out their skills to other staff as more and more they encounter even quite small traders who no longer keep paper records.

You cannot argue as some have here that because you know of a client who had a VAT inspection in which no wrongdoing was found the system is still being adequately policed.

HMRC insiders tell me that you would be astonished at the large amounts of VAT that are written off as not worth pursuit.

I am told the same by HMRC insiders which is why I include the figure for HMRC write offs in my estimate of unpaid debt

Because my clients regularly get VAT inspections and enquiries I would argue that the system is still being policed. Because I know that HMRC’s resources are being cut, I think it is probably not being policed as well as it could be; and speaking as a taxpayer as well as a tax advisor I would welcome more resource for HMRC in this area.

However, I think it is clearly incorrect to say that “HMRC have virtually abandoned VAT inspections for small businesses”.

And with the word virtually in there I think I am right

Fair enough – that’s a matter of personal judgement.

My view of the evidence – that VAT visits have stayed broadly constant over the last few years for my SMEs, and the number of staff in one large company department has halved; both only anecdotal evidence – “virtually abandoned” is overstating the case.

Your view differs.

‘Nuff said 🙂

“HMRC insiders tell me that you would be astonished at the large amounts of VAT that are written off as not worth pursuit”

Doesn’t this make logical sense though? If it’s going to cost more to collect than it brings in why pursue it? Whether you increase staffing at HMRC is irrelevant – the point still stands – there will always be a level at which an amount is not worth pursuing.

Richard mentioned (without providing any evidence at all) that “(VAT) losses are much bigger in the SME sector”, (absolutely? proportionately?) but isn’t the key measurement here yield? My feeling is that VAT inspections probably have decreased amongst the SME sector in recent years – but certainly not to the extent where one can claim they have been “virtually abandoned”, but, and it may be a cliché, they have bigger fish to fry and bigger yields to gain elsewhere.

No it does not make sense

It creates a criminogenic environment of non-compliance that is openly abused

If you call that sense I do not

I have a liking for upholding the rule of law

I know you right wingers don’t share that view

There is, in my view, a lot of value in policing the system even if it doesn’t bring in identifiable yields: the value of inspecting company A’s books is that it encourages companies B to Z to make sure they get things right.

Even if you do decide not to pursues some small amounts, taxpayers need to be clear that you could pursue them – that you have the ability and the will, and are just choosing not to exercise them *this time*.

We agree