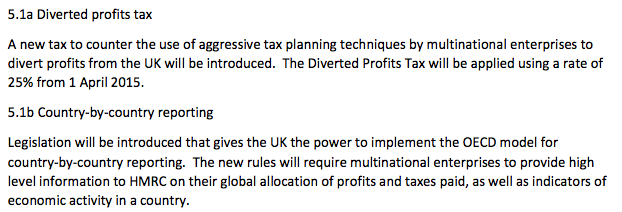

This is what HMRC have to say today on two key issues if concern to me:

I'm delighted by the announcement on country-by-country reporting.

I have no clue as yet how the diverted profits tax might work as I can find no detail as yet.

Could it be they're going to calculate it on the basis of country-by-country reporting and from that work out how much is diverted - which is precisely what I designed country-by-country reporting to do? Now that would be a breakthrough if it were to happen that could lead to a total reform of UK taxation as a whole.

That would be a breakthrough - but as yet it's not clear.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Why do I feel so cynical when they announce they will introduce legislation ‘that will give the UK the power to’ implement something. I know there’s a timing thing here but you can’t help but think there’s wriggle room. The legislation will be there but will the implementation?

This tax is unilaterally aimed at the USA

As I said on the BBC just know, you can imagine how popular that will be in DC

What struck me about this is the heading to the section you quote – namely:

“5.1 Base Erosion and Profit Shifting: Organisation for Economic Co-operation and Development

(OECD) initiative”

The suggestion, or stronger, is that each of 5.1a (diverted profit tax), 5.1b (CbC) and 5.1c (hybrid mismatches) are part of BEPS. Clearly 5.1b and 5.1c are; might the UK be (thinking of) raising 5.1a in the same context?

I wish I knew!