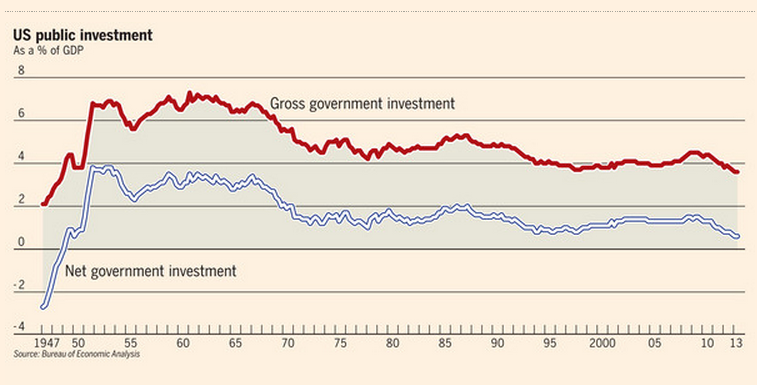

The world continues to face an economic crisis: this graph explains why:

Taken (as is obvious) from the FT this morning, what it shows is that US government investment in its economy has collapsed to the lowest level since WW2.

This is the result of fiscal pressure. Although the US government clearly continues to borrow heavily that is because of the pressure of current spending. And yet it is government investment spending that drives economies forward the way that nothing else does.

It was a pleasure to hear Mariana Mazzucato talking about this on Saturday - and explaining her theory (no, observation) of the impact of the entrepreneurial state, which is the real risk taker and innovator in our modern economies. It is not business that drives growth in her view - it polishes off the impact of government research and investment and the mistake is to give it the credit for the work done by the state.

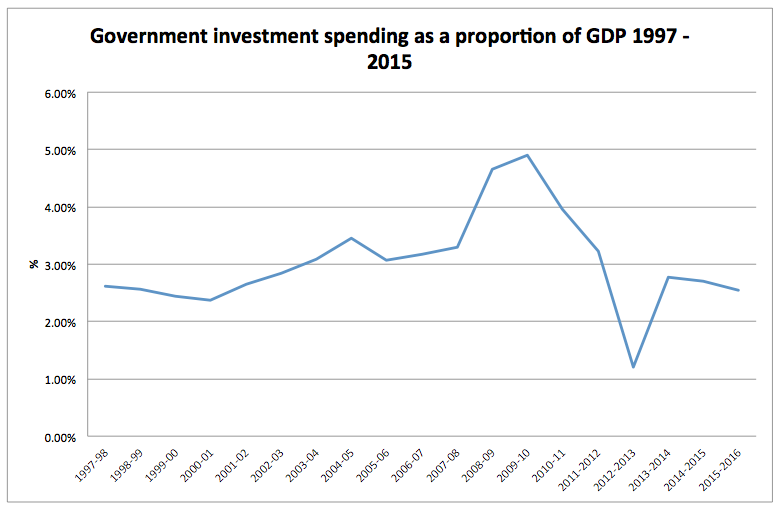

I agree. And please don't think this is just a US problem. This is UK data based on Treasury data updated to March 2012 forecasts ) I should have updated it since but haven't; I suspect the recent data is optimistic as a result:

One reasons why Labour delivered real growth and why Labour also were pulling us rapidly our of recession in 2010 was that they were using government spending wisely - to invest. Since 2010 we have stagnated and it's not hard to see why.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

it’s all very well Lord Adonis (Mariana’s clearly his venus!) prattling on about this but he belonged to a Government that was allowing the banking system to rule the roost -you can’t get economic growth and an effective entrepreneurial state while the banks are syphoning off wealth as it happened. I find these besuited ex labour ministers utterly two-faced.

I think it is fairer to say that the state has played an important role in inventing things. But In terms of innovation and growth it really is private enterprise which has then taken those inventions and then tried lots and lots of configurations and applications in the chase for profits. This is more than polishing off. That’s what really drives growth – the trial and error, profit and loss entrepreneurial experimentation that works out better ways of doing things. To do that you have to market stuff, you can’t just sit in a lab. And this explains why a system like the soviet union could come up with satelites and lots of other scientific breakthroughs, but could never compete with capitalism in terms of actual consumer outputs. Because they didn’t have the economic calculation, the private ownership and profit system that the private sector had in the west.

This is just wishful thinking. It’s like crediting the marketing department with all the success of a product.

Of course the private sector is important – vital even. But your attribution of credit is absurd.

why can’t you be honest about the role if the state which is at least as important?

Chronically poor wages + lack of spending = crumbling economy.