This is a question that many reasonable people have asked over recent years. Now it looks like the IMF has done so as well, and has published a paper on the subject.

The summary says:

This paper examines whether there is a threshold above which financial development no longer has a positive effect on economic growth. We use different empirical approaches to show that there can indeed be "too much" finance. In particular, our results suggest that finance starts having a negative effect on output growth when credit to the private sector reaches 100% of GDP.

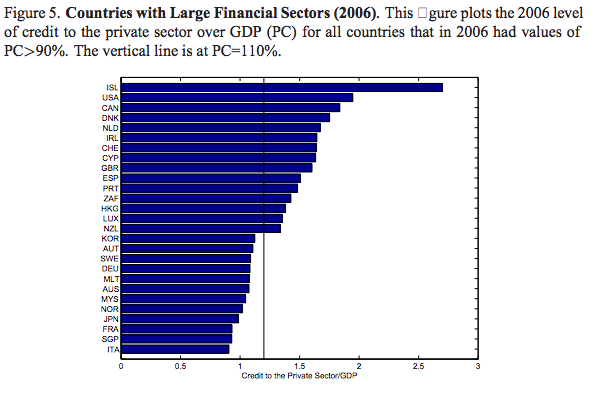

And which countries are affected? This is the table:

And yes, that list is:

Iceland, USA, Canada, Denmark, Netherlands, Ireland, Switzerland, Cyprus, the UK, Spain, Portugal, South Africa, Hong Kong, Luxembourg and New Zealand. That's not quite a list of those who are now in trouble plus those who put them into trouble, but it's pretty much so. And that's very telling.

Hat tip: Markus Meinzer

PS: Update, Cyprus has just requested a Euro bail out

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Are you sure that ISL is Israel? Might make more sense if it were Iceland (Island).

Thanks! Thought I knew all the ISOs. Clearly not!

Rather far from a list of those in trouble – no Greece, no Italy, no Haiti, no Zimbabwe, no Cuba. no Congo, no Mozambique, no Sudan etc etc; South Africa’s problems have little to do and Canada, Denmark, Netherlands, Switzerland, Hong Kong, Luxembourg and New Zealand might take offence at your comments.

I, personally, think that the UK has too many financial services and we need to rebalance the UK economy but such slipshod commentary does *not* help

You have a remarkably narrow view

Sure these aren’t centres of poverty bugs let’s be clear – they do in most cases face major or massive risk

In that case you are wrong, as usual

I am *right* as usual. Go tell Switzerland that it is in trouble and that is why its currency was going through the roof; try it on in Canada or Denmark or Netherlands or Hong Kong or …

Your inability to admit your errors and your continual habit of insulting those who point them out suggest that you may personal problems.

Hang on – Switzerland had to take action on its currency which was strangling its industry

In the meantime its banks make it a pariah state

And the Netherlands can’t balance its budget and is in political melt down

And you say these places are working?

You are joking!

I say you’re wrong on the basis of evidence

Even Denmark has a problem with the over supply of capital now as it is seen as a safe haven

Stop the abuse. Deal facts

The chart shows level of private sector debt to GDP, which may or may not be indicative of a large financial services sector. A country could have no real banking sector and its companies could borrow significant amounts on the global credit markets. Or a country could have a large banking sector, raise large amounts of deposits and then lend them out internationally.

All this study is actually proving is that excessive debt is bad and I think we all knew that.

It may be worth reading it, of course…

In light of your article, here’s a timely warning of the trap that China looks as it’s about to walk into.

http://www.counterpunch.org/2012/06/26/china-embraces-ponzi-bonds/