I challenged the growth figures for the Isle of Man earlier today. A commentator has said:

IOM Government GDP figures are audited and you’ll need more than a conspiracy theory before they can be tossed aside. Competitive tax rates in times of panic are very popular you know

So I did just a little research on this hypothesis using Isle of Man data.

I have questioned data since 2006. Since then total cash deposits have moved from £54 billion to a high of £70bn at end of 2008 since when they have fallen to £63bn. It’s hard to know how much currency impacts on this but since (rather tellingly for calculating loss of tax to the UK) two thirds of all deposits in the Isle of Man are in sterling (so much for being an international finance centre) the answer is probably not that material.

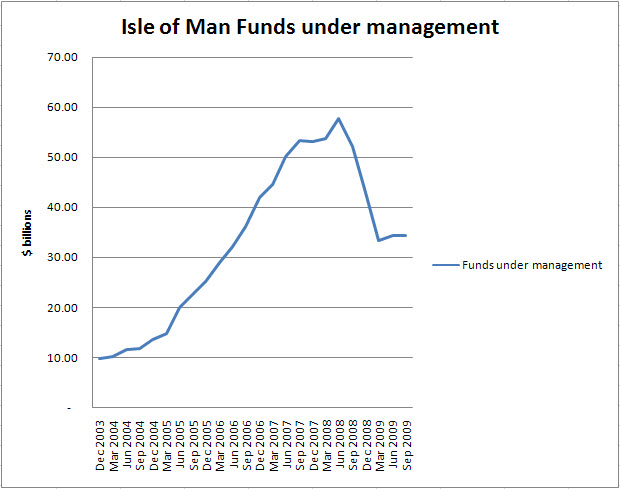

On the other hand loss of funds under management — where people can make serious money from selling services — have been spectacular:

There’s no evidence there to support the claim made.

Nor to support growth in the economy if it is really as heavily dependent on financial services as we think — they being 41% of its economy.

Sorry — your claims don’t stack.

Mine do.

So where did the growth come from? And is it real?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

From your link – between end of 2006 and end of 2008 bank deposits rose from £54.45bn to £69.96bn = +30% or ~15% per year. 15% per year * 41% of economy = 6%

“IoM really did have 8% growth in 2007” – almost certainly.

Still no reason to question data since 2006, for 2007 and 2008.

2009? Have audited figures been released yet?

Mary

I really think you push credibility to clam bank deposits prove such a thing

The margins are small

That’s why I concentrated on the higher value funds under management

Richard

Richard,

Weren’t you saying the other day that fund administration was small beer and tantamount to “doing nothing”? It seems rather contradictory that when it is carried out in Jersey it proves nothing is going on in Jersey, yet when it declines in IOM it indicates the IOM economy is going down the tubes.

Hello Richard,

Thanks for these interesting figures. I am interested to know what your view is on the (seemingly) staggering £22 billion decrease in Funds under management over the past year, why have they dropped off a cliff?

Stuart

@mad foetus

I think I said it adds no value

That does not mean people don’t pay for it

Value and charging are not the same things at all

Richard

@Stuart

Some was initially value crashes, of course

What is more interesting is they have not recovered when markets have

The answer is simple: the ‘Don’t bank in the Isle of Man’ campaign is hitting a nerve that is real and which investors appreciate

Richard

Thanks Richard

I followed your lead to the ‘Don’t bank on the Isle of Man’ campaign. It was quite an eye opener for me and I continued into other links contained within it. It would seem that it all centres around the crash of the Kaupthing bank on the Island where thousands of depositors have been left unsupported by the Isle of Man government to the not so tender but expensive mercies of the liquidators bleeding them dry. Not the first time it has happened on the Island recently and I am sure not the last.

I am now not so much surprised at the staggering £28 billion that has left the Island (in deposits and managed funds) over the year. What does surprises me is that individual depositors, IFAs or fund managers could still possibly contemplate placing money on an Island that holds such inherent risks. I would imagine that the outflow will and certainly should continue until the Island sorts out its obvious problems.

Stuart

PS If the ‘Don’t bank on the Isle of Man’ campaign grows on the internet to the size it should then more people will become aware of this severe ‘wealth warning’ and stay well clear of the place. It should be financially quarantined.

Once again, narrow focus makes apparently good headlines.

The actual amount of deposits in a bank are related to but not the same as its profits (which are a component of GDP = economic growth).

The IOM wasn’t known for its funds sector in any case, but from my knowledge its performance, coupled with some reorganisation in HSBC (consolidation of business in Dublin), matches what I would expect.

Growth is coming from all of the sectors in the IOM that you never think of – real people, real jobs – in manufacturing, shipping etc. etc. There is plenty of evidence, you choose not to look at it.

The Girrl

Richard

Would you happen to know who audits the IoM and produces the figures above?

I am imagine it would be one of the only two auditors on the island. That is, KPMG who were auditors of Kaupthing Singer & Friedlander (KSF) when it crashed and went into liquidation. Or is it PWC who are managing the liquidation of KSF since it went into liquidation and charging fees in excess of £300/hour?

Stuart

Stuart

I’m sure it’s one of them

No conflicts of interest therefore

Richard

Stuart

You need to check your facts. There are far more than 2 firms of auditors on the Isle of Man.

Suart,

You look for Richard’s views on why its “dropped off a cliff”

Why don’t you speak to someone in the Fund Management sector in the Isle of Man?

They could tell you, and they wouldn’t be guessing.

@Rupert

As you’ve checked your facts please enlighten us

Well, in addition to the aforementioned PwC and KPMG it will not surprise you that both Ernst & Young and Deloitte operate there.

From the second tier of international firms PKF, Grant Thornton, Baker Tilly and Clark Whitehill are also there.

Plenty of choice of auditors in the Isle of Man and complete nonsense to suggest that PwC and KPMG are the only big firms there.

@John

John,

Thank you for your suggestion. However I had already previously spoken to friends in the fund management sector, which is precisely why I came to look at this website (amongst others) to ask for another view.

Their views are rather stronger than Richard’s. They are alarmed but unsurprised that this is happening and believe that the smart money and fund managers are getting out and will continue to do so.

Thanks again

Stuart

Many dispossessed Kaupthing bank depositors feel they have a moral obligation to warn expats and others throughout the world of the risks of depositing on the IoM. The FSC says prospective depositors should do their own ‘due dilligence’ before placing money on deposit on the island as deposits carry risk much like investments. To this end several expats have asked banks relevant questions concerning ‘risk’ but have not been given the answers.

It is no longer reliable to trust the glossy blurb put out by banks, so new website DON’T BANK ON THE ISLE OF MAN http://www.kaupthingiom-dag.co.uk aims to help potential depositors to make informed judgements about the risks involved in putting their savings on deposit on the IoM.

Jim

http://ksfiom-blog.blogspot.com

“That’s why I concentrated on the higher value funds under management”

End of 2006 = £41.9bn, end of 2007 = £53.2bn = +27%

End of 2008 = £43.0bn, but what you are undoubtedly unaware of is that, because of exit fees, early surrenders of managed funds is very lucrative; probably more profitable than new business in the short-term.

So you still have no reason to question the data since 2006, for 2007 and 2008.

Mary

To define growth as charging punitive exit fees does push the limits of credibility

Richard

Mary

You seem to have good Isle of Man (IoM) knowledge and numbers at your finger tips. From an earlier comment of yours could you please tell me who (which firm) audits the figures that are compiled and are used to comprise the IoM GDP. I have searched but can not find who does the audit.

Thanks in advance

Stuart