The Guardian reports a spat between the UK's Trade Union Congress and the Confederation of British Industry on whether corporate tax rates should go up or not.

The TUC says yes, they should. Everyone has to make a fair contribution to the cost of running the UK, they say.

The CBI says no; angrily apparently. John Cridland of the CBI is reported as saying:

'What planet is the TUC living on? The tax burden on UK business has risen consistently over the past decade, just as other major economies have cut their business tax rate, causing a slide down the Organisation for Economic Co-operation and Development's tax competitiveness tables.

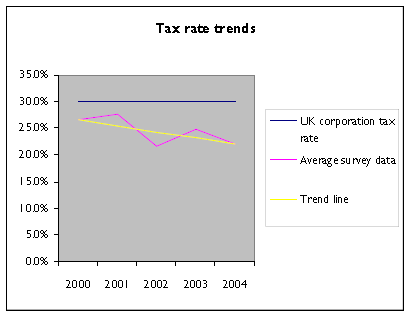

Well, I hate to point out the obvious to the CBI, but over the last decade the UK has seen a fall in headline corporation tax rates; from 33% to 30%, and it's seen bigger falls for smaller companies, proportionately, so as a matter of fact that claim is wrong. And so too is the claim that the tax burden on UK companies is rising. My work published earlier this year showed that the real tax liability of the top 50 companies in the UK over the last 5 years or so has gone like this:

Try as I might, I can't make that trend line go up. It's falling. As, by the way is the liability companies pay for social security.

I agree, the total tax paid has gone up, but so have profits, enormously. So unless the CBI reckon that business should pay a flat rate poll tax their argument makes no sense whatsoever. And it is also, to put it simply, wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard, if I can mention the ‘little man’.

The tax burden on the small company is 19%, not so high I hear you say, but then if he/she employs staff there is the 12.8% employers NIC cost on top of an above inflationary rise in the national minimum wage, add in to this mix that fuel costs whether for heating or road have risen at a alarming rate, and these costs remain unchecked with no doubt more rises on the way, then we have insurance hikes, this coupled with being squeezed on price by everyone and their dog, well!

Small businesses in my humble opinion can not take anymore rises, the majority are only just surviving, so rather than always looking to tax rises as the answer what about more accountability on how this and successive governments waste/spend the tax take.

Rising taxes is a short term argument in my opinion, looking at how the taxes raised are spent is what is needed, that and closing down the loop hole which the big corporations and others use to minimise their tax contribution to the running of the UK.

Considering the number of SME’s out there why doesn’t a future government look at making the UK and entrepreneurial environment in which the ‘little guy’ is encouraged the grow.

Sorry to go on, but, sort out the tax system, sort out the loopholes, look at how the tax take is spent and maybe, just maybe the UK will be in a stronger position for the future.