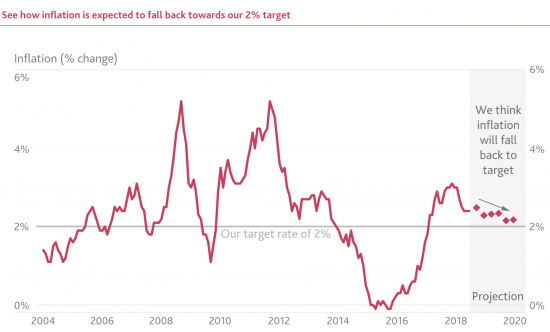

The job of the Bank of England is to keep inflation on target at 2%. In their inflation report they admit:

The prices of the things you buy have been going up by more than our 2% target on average over the past year.

That's been mainly due to the big fall in the pound following the Brexit vote.

The lower pound has meant that things businesses get from abroad cost more. Businesses have been passing those rising costs on to their customers. So that has meant higher prices in the shops. Most of the increase in prices due to the fall in the pound has now happened though.

The price of oil on world markets has also risen over the past year, pushing up prices for petrol at the pumps. Because of that, we think inflation picked up a bit in July.

But unless oil prices keep on rising, inflation should continue to fall back towards our 2% target.

And they evidence this with a chart:

In other words, there is no reason for an inflation rate rise. And as external cost pressures are falling (as they admit) this is unlikely to change.

And as Mark Carney is saying, as I write, investment growth is subdued; Brexit uncertainty remains; consumption growth is modest and below trend. And wage growth is hardly significant, and right now remains below inflation, although he suggests he expects otherwise.

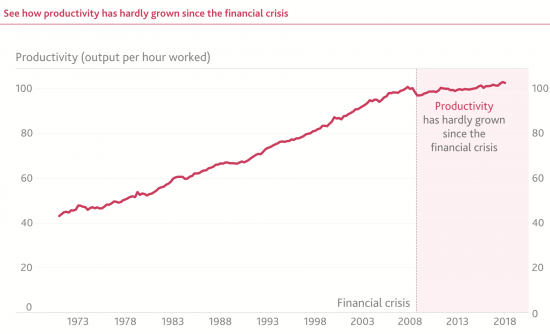

So what is the reason for the interest rate rise? There is none, bar pride motivated by the fact that there has been no real rise since 2008. The charts supplied by the Bank show this. This is on growth:

They use this image:

Growth is simply not on the cards, in other words, in their opinion. The claim that the economy is going to overheat is, then, just wrong, unless it is assumed that the sluggish economy we now have is as good as we are ever going to get. Maybe that is the Bank's assumption. If an advert for the fact that neoclassical economics has failed then this is it, in its own terms. But however looked at, this is not the cause for an interest rate increase.

So move on to wages. The Bank is clearly very worried about this. They say we are at full employment:

The share of people out of work is at its lowest level for more than 40 years. And there are a lot of job vacancies. This means that companies need to compete hard with each other to recruit and retain workers. One way they do that is by offering higher pay.

The pressure in the jobs market means we're expecting to see bigger, more widespread pay rises in coming years. That greater spending power should support growth in the economy.

They support it with a chart:

The only possible explanation for this is that they think so few people will be coming into the UK over the next few years that the supposed Brexit bonus for UK based employees must be killed off at birth by strangling the effect of pay rises that those who cannot make ends meet, and so are borrowing at record levels, might enjoy. You could not make it up.

You could not also make up the fact that the Bank clearly thinks the current type of low paid, insecure employment that so many are suffering will be an ongoing fact of life. That's deeply depressing.

But let me be candid: they don't really believe this. If they did they would not say that they think there might be scope for another three interest rate rises of 0.25% over the next three years, which is the most modest version of them 'taking back control' that they could possibly conceive of if the policy of central bank control of the economy is to retain any credibility at all.

So my suggestion is that this rise has nothing at all to do with economic facts. It has everything to do with bankers' egos. And we have seen the consequences of them running out of control before.

Worry.

That is, yet again, my best advice.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

A lot depends on a favourite tabloid headline “house prices”

Outside of London, they are still rising:

https://www.theguardian.com/business/2018/may/23/uk-house-prices-fall-by-02-for-march-says-land-registry

Whether the rest of the UK will follow is unknown.

As you have previously said, we rely to much on this and consumer spending to prop up the economy.

Those who peruse and post on the house price crash forum have been waiting for a long time for a full on crash, will they get it?

Jim Round says:

‘A lot depends on a favourite tabloid headline “house prices” ‘

Which governments slavishly take note of.

“Those who peruse and post on the house price crash forum have been waiting for a long time for a full on crash, will they get it?”

They’ll likely get a mid cycle correction. There won’t be a major crash because the government knows damn fine how to inject money into the upper end of the economy to prevent it, if it might be going to damage their electoral ambitions.

That’s my guess for what it’s worth, but I don’t own any property, so I don’t care.

More to the point why is there no debate in the mainstream media that progressive taxation might be a better way of controlling any inflation and why is the Bank of England trusted to measure inflation given the revolving door between the financial sector and the BoE. Mark Carney, for example, is ex Goldman Sachs to name but one example and where will he be going after he quits his BoE’s governors job? Voters are so under-educated and therefore naive not to question the way things are done! They also, for example, meekly accept the vast proportion of any private sector issued 30 year house mortgage loan is interest repayment but believe their government can’t create money from nothing and therefore put a basic necessity such as a roof over their heads at a much lower interest rate.

Thoughtful piece.

In Aeron Davis’ book ‘Reckless Opportunists (highly recommended BTW and it is not a long read) he identifies the phenomenon whereby seemingly public interest policy and media announcements are actually aimed at a small number of the powerful elite or key players in the markets. It is a form of signalling over the heads of the population.

If this is indeed the case, what is this announcement telling THEM I wonder?

If you give simple people a job to do where their only responsibility involves deciding when and how many times to push one of two buttons – they’re going to feel compelled to push one of them from time to time.

Things are currently as good as they’re going to be for a while so unless they push the button marked “up” a few times in the near future they aren’t going to be able to push the other one very many times when the inevitable downturn arrives.

If they were doctors, they would still be cupping and using leeches. They haven’t worked out that the same symnptoms can have different causes and require different treatments.

Exactly my thoughts.

Carney has been saying better economic indicators are just around the corner for years but now they have decided they aren’t coming and have begun the process of returning interest rates to a level which suits the banking sector.

Carney of course can’t state that Tory economics have completely shattered the link between the unemployment rate and wages so has been forced into doing a Comical Ali routine.

Absolutely . They’ve been wanting to do this for so many months and talking about it in the media, and now to preserve ( in their mind ) their credibility they’ve done it. As you say it has nothing to do with economics because monetary policy is dead, as is fiscal policy , or any policy. Austerity is only mentioned as an afterthought even though it is still in place .These are indeed the dog days of this remarkably hot summer.

Raising interest rates does not fight inflation.

Raising interest rates causes inflation.

MMT 101.

Pick a graph any graph after 7 US rate hikes

Inflation at a 6 year high and $ is weaker after 7 US rate hikes.

Any chart will do.

Infact the first hike was in Dec 2015 you can see what it did and the 6 hikes after.

https://d3fy651gv2fhd3.cloudfront.net/charts/united-states-inflation-cpi.png?s=cpi+yoy&v=201807121326v&d1=20130101&d2=20181231

SO why does raising interest rates cause inflation ??

Simple : As Warren Mosler has explained for a decade now.

a) When the cost of borrowing increases those increases get passed onto the consumer via higher prices. Higher prices = inflation.

b) Interest income channels when interest rates rise that’s money added to the economy not taken away. The higher the national debt the bigger the fiscal stimuls.

Or as Warren says……

” Raising rates supports the economy via the interest income channels, and the higher the debt to gdp ratio the larger the effect. (Paying interest is like basic income for people who already have $…) That is, the Fed has it backwards. They think they are stepping on the brakes when they are stepping on the accelerator with regards to the economy and inflation “

In addition to all of that and what was discussed at the last MMT conference..

The spot and forward price for a non perishable commodity imply all storage costs, including interest expense. Therefore, with a permanent zero-rate policy, and assuming no other storage costs, the spot price of a commodity and its price for delivery any time in the future is the same. However, if rates were, say, 10%, the price of those commodities for delivery in the future would be 10% (annualised) higher.

That is, a 10% rate implies a 10% continuous increase in prices, which is the textbook definition of inflation! It is the term structure of risk free rates itself that mirrors a term structure of prices which feeds into both the costs of production as well as the ability to pre-sell at higher prices, thereby establishing, by definition, inflation.

https://www.youtube.com/watch?v=ANOiB8GRvfA

https://www.ft.com/content/24a6807c-965d-11e8-b67b-b8205561c3fe

” A false step by the Bank of England

There is no compelling reason for higher interest rates”