I have been asked on Twitter whether I have read the new Office for Budget Responsibility report on the long-term fiscal sustainability of the UK, published last week. The honest answer when I was asked was 'no', but I logged the request and what better is there to do on a lazy Sunday evening than settle down with an OBR tome?

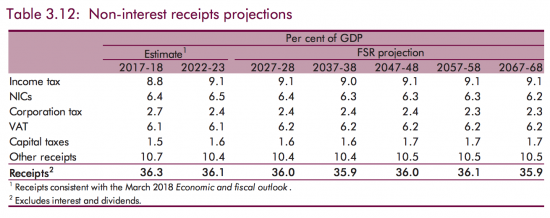

The nub of the forecast is that there are going to be more of us and we're all going (on average) to live longer:

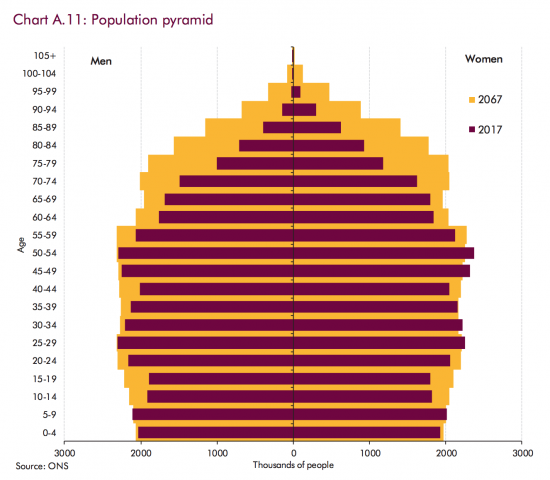

The result is that health spending is going to grow considerably as a proportion of GDP:

But note, not much else is going to change - especially beyond age-related spending. Still, government spending will be up.

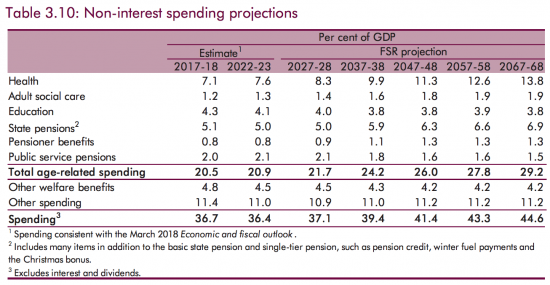

Despite this massive change in the age profile, employment rates are not going to decline much:

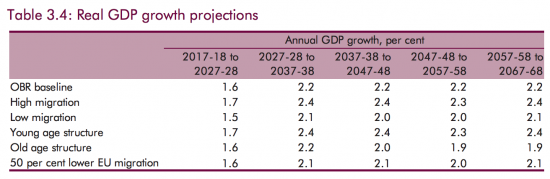

And we're going to experience fairly steady growth:

And note migration does not massively change that.

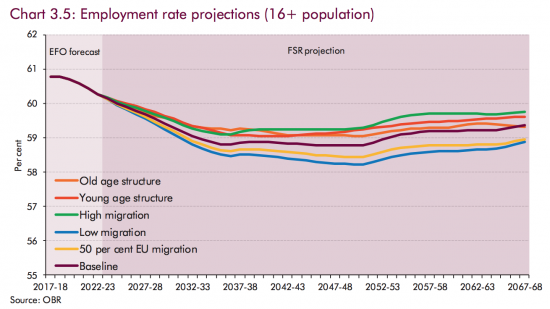

But despite all this the proportions of tax revenues raised to GDP are going to be massively consistent:

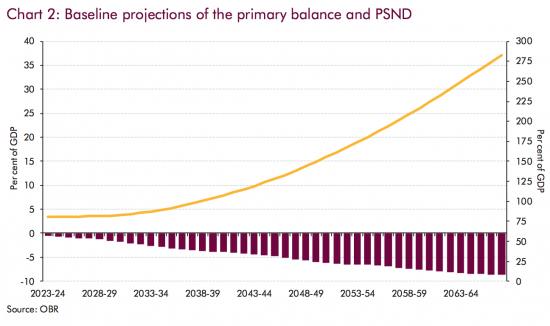

As a result of which government borrowing is going to rise steadily:

And I have to be honest, that by the time I had got to this I was beginning to give up the will to live.

Let me explain why. In a nutshell it is because this forecast is nonsense. What it assumes is that the government is a business operating in an economy on which the government's decisions have no impact. Let me be clear, I have prepared projections in my time for which such an assumption is appropriate. That assumption will, in fact, be true for the vast majority of businesses in the UK. But it is a wholly inappropriate assumption to be made in a forecast of this nature for the government as a whole. What the government does change the economy: the two are not independent of each other. Sheer scale makes that clear. So too does the fact that the government is the currency issuer. And the only agency that can tax. But the OBR does not seem to have noticed this.

I should explain that there is reason for this. That is that the Office for Budget Responsibility is made up mainly of exiles from the Institute for Fiscal Studies who famously say they 'don't do macroeconomics'. That is painfully apparent here.

Let me take one simple example. Health care spending as a proportion of GDP is to nearly double according to the OBR in their projection. The increase is 6.7% of GDP. But, they say, VAT revenues as a proportion of GDP will also rise. And that is not logical. Because there is no VAT on healthcare. And so the amount of VAT recovered as a proportion of GDP should fall given how material the first assumption is. But apparently, the OBR can't make the link. That's either because they are very poor at financial modelling (it would really not be very hard to program an assumption on this: give me a few minutes and I would do it for them) or, alternatively, they're assuming that whatever the government does has no impact on the economy as a whole.

I strongly suspect both my observations are true. With regard to the latter the confirmation comes from one simple search of the document. I searched for the word 'multiplier'. In other words, I looked to see what assumption the OBR was using to explain the relationship between the additional government spending they are forecasting on healthcare and overall growth. What I was looking to find was an explanation as to whether they thought this would add to, or subtract from the growth potential in the economy, and why. This would, after all, seem to be the absolutely fundamental assumption that underpins any projection of this nature. But the word is not to be found in the document. Not once. Not even in a footnote. So this is not macroeconomics as we know it, at all.

In which case let me summarise this projection with which they have sought to scare the populous at large, to no doubt support the OBR / IFS view of the ongoing need for austerity. What they are saying is that because the government has had the temerity to think it must look after the UK's healthcare needs we will all be going to hell in a handcart due to an unsustainable burden of debt.

First, let's make clear that the OBR shows not the slightest understanding of what debt really is. They just don't get modern monetary theory.

Then let's note that they must know that their assumption on tax is crass: they know that eventually funding without tax increases creates inflation as full employment is approached, but they ignore such issues in their entirety.

Just as they ignore the fact that spending in this way will add to UK growth since we are not at full capacity in our economy at present.

Whilst also ignoring that because those engaged in this activity are well paid, on average, that this spending might increase the overall tax take.

And that providing healthcare to an ageing population might also solve the productivity issue (as the elderly are in fact now known to be quite productive and drag up the productivity of younger employees)

None of these things are noted.

Nor is the fact simply removing the stress of old age from people's lives increase their willingness to spend.

Instead, the OBR hold everything constant and say we can't afford to provide healthcare without massive tax rises.

The result is that this might be politely described as a crass piece of work.

And candidly, if this is the best they can do they need to be replaced.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

My first impression, from reading your analysis, is that the OBR is obliquely supporting the case for privatisation of the NHS.

That does seem to be a valid observation. The UK is being led to a dark place by a small clique of millionaires. The OBR is not fit for purpose and clearly can not do the job they are paid to do. It is necessary to ask why this is allowed to persist. But who will do that, certainly not our compliant MSM.

For one of the philosophy essays I was required to write for an MA I had to distill the justification for Socialism to (ideally) an irreducible minimum and defend the hypothesis. My effort produced a single question. Do I owe any responsibility to the person next to me? It will be noted that in this context the word person carries no connotation of age, gender, religion, race, nationality or class. As an old school socialist I argued that to answer yes carried fundamental moral, ethical, political and economic consequences. Follow up discussion revealed that neolibs tend to answer ‘Maybe’ or ‘No’. Their counter arguments pointed not to the principles involved but to the pragmatics. ‘The Soviet system was a disaster’ or Wealth is greatest in capitalist bastions like the USA’. At no point did they tackle the question ‘How can I morally claim rights for myself that I am not prepared to grant to others?’ Nor did they tackle the concept of fairness such as is discussed at length by John Rawls in A Theory of Justice.

In the main my opponents adopted the standard blinkered approach propounded by Robert Nozick or the Cato Institute. Any element of history that is inconvenient is ignored (eg the illegal confiscation of land foreign and domestic) for the sake of pragmatics. Similarly there is a failure to recognise that any human endeavour is likely to be flawed, be it socialist or capitalist. The endeavour, however, should be predicated on principles on which we set our sights and strive to attain. The NHS no matter how flawed has allowed people to live longer, healthier, productive lives all the while paying taxes. Socialism at its finest.

I hold a suspicion that the neolibs I argued with are the very people who are now developing policy. Listening to the arguments put forward by Rees-Mogg and Nadine Dorries and acted upon so enthusiastically by the likes of Esther McVey I am convinced that the NHS has been moved to a corridor closer to the morgue. A new shiny capitalist model is in the showroom ready for use as soon as the ground is prepared. Brexit is but a another step towards that.

In my view Rawls v Nozick is more important than Keynes v Hayek

And Nozick had not a leg to stand on

OBR reports always seem to read as though they’ve been produced by the Daily Mail. In other words they are so ideologically saturated with Neoliberal fantasy beliefs they blow away into oblivion and irrelevancy like dandelion seed on the first sign of a breeze! Their biggest fantasy is government has no money of its own! This is despite the Soviet Union closing down private banks and its government creating money from nothing for seventy years. Also the Communist Party of China doing the same for nearly seventy years substantially contributing to a situation where in purchasing power parity terms China became the world’s largest economy in 2014 according to the IMF:-

http://www.businessinsider.com/china-overtakes-us-as-worlds-largest-economy-2014-10

The OBR is full of ignoramuses! I could say worse because their pronouncements persistently undermine the British economy.

China created billions today, I note

I was looking at the debt /borrowing figures of the USA and saw that since 2007 it had increased from $9.007 trillion to $20.245 trillion in 2017; a growth of $11.238 trillion.

However QE across this period amounted to $12.3 trilion. As a simple soul I took this to mean that the government had repurchased an amount greater than all of the bonds issued over this period. As far as I know inflation is low and GDP growth is running at around 4%.

Also given that the labour share of post tax national income is likely to fall (and the share going to capital rise) over the 50 or so years covered by their forecast, as actual people are replaced by robots and other forms of technology, one wonders how the OBR is planning to reflect this existential threat; by modelling decreases in public spending and increases in taxation?

I think it fair to say they did not think about such issues

@richard – This should be of interest to you – https://voxeu.org/article/missing-profits-nations . The conclusion is quite shocking – Our findings have implications for economic statistics. They show that headline economic indicators — including GDP, corporate profits, trade balances, and corporate labour and capital shares — are significantly distorted. The flip side of the high profits recorded in tax havens is that output, net exports, and profits recorded in non-haven countries are too low. We provide a new database of corrected macro statistics for all OECD countries and the largest emerging economies.

Adding back the profits shifted out of high-tax countries increases the corporate capital share significantly. By our estimates, the rise in the European corporate capital share since the early 1990s is twice as large as recorded in official national account data.This finding has important implications for current debates about the changing nature of technology and inequality (e.g. Piketty and Zucman 2014, Karabarbounis and Neiman 2014). Our work provides concrete proposals to improve economic statistics and the monitoring of global economic activity.

Broadly I am sure the conclusion is right

But the claimed dataset? I would need convincing it is reliable. Simply, at present that data does not exist in a reliable form, in my opinion.

How do the OBR get away with this? I assume, if we leave MMT to one side, there are orthodox economists (silly phrase, I know) who would question such nonsense on the other grounds listed by Prof Murphy. Where are they? Are they scared off by the equivalent of “the independent IFS” meme?

Off-topic but related:-

Whatever you think of the policy options and politics behind the Scottish Growth Commission Report (GCR), it does take into account a number of the factors which Prof Murphy says the OBR have ignored – such as multipliers – and has made a fairly detailed analysis of the effects of demographics and health. It even mentions macro-economic issues a number of times.

Unlike a certain Scottish “spreadsheet guru”, I don’t claim to be an expert. So, leaving aside the currency and other policy choices, I’d be interested to know how you rate the GCR modelling and analysis. In other words:- given the policy choices, are the conclusions on a sound(ish) footing?

Putting your head above the parapet is not career enhancing

I hav3 nit had a career

I have a vocation

That also let me roundly critise the GCR – search it on here

As an avid reader of your blog Richard, I’m very aware of your views on the GCR.

I am not a supporter of the GC’s policy choices. If you are also saying that the modelling used to derive results from those policy choices is poor – as you concluded about the OBR analysis – I’d be even more concerned.

I have little confidence in the modelling

To me the vacuity of the OBR’s analysis is proven by the fact that I do not see any budget lines for bungs to the DUP and other similar parties who can prop up the Tories nor do I see a budget line marked as ‘Next Private Sector Bank Bailout Here Please’.

But of course they wouldn’t would they as they are trying to depict expenditure as a closed loop of tax and spend and to bring two such lines in would undermine the lie they are telling.

‘Nuff said about the OBR in my view.

Oh – and there should also be a line for ‘Propping up the really expensive private pension system’ too.

And there will always be funds for any war that comes along at the request of the USA

Off topic but I wonder what your views is of this analysis?

https://www.newstatesman.com/politics/staggers/2018/07/snp-s-economic-case-independence-incoherent-so-why-won-t-anyone-say-so

Oh dear

They have published Kevin Hague

Not a good idea

Very politely the man has less objectivity and sense than Donald Trump

And even the opening para is wrong

My thoughts exactly!