Financial journalist Stephen Bouvier published three tweets yesterday to coincide with Prof Prem Sikka's review of the work of the Financial Reporting Council. What he showed by doing so was that the Financial Reporting Council was well aware of the opinion of some (me included) that the International Accounting Standards Board's International Financial Reporting Standards do not comply with the requirements of UK company law.

It is the argument of those holding this opinion that UK company law requires that accounts be prepared in a way that shows that the company has protected its creditors - who might otherwise be prejudiced by limited liability. In other words, the primary goal of accounting is to make sure that the privilege of limited liability is not abused at cost to society at large. It's not a hard logic to follow. And the reasoning behind it is clear. It is that the meaning, in law, of the term 'true and fair' is defined based on the ability to pay a dividend to the shareholders, which is only permitted if creditors are not prejudiced. This also impacts auditors, who have a duty to report on the availability of reserves to pay dividends in some situations, and so by default should always have to do so. It's easy to work out that in that case the Companies Act puts creditors first. It's equally easy to work out that IFRS does not: their rules on loss provisioning have always been deeply prejudicial to creditor protection, for example.

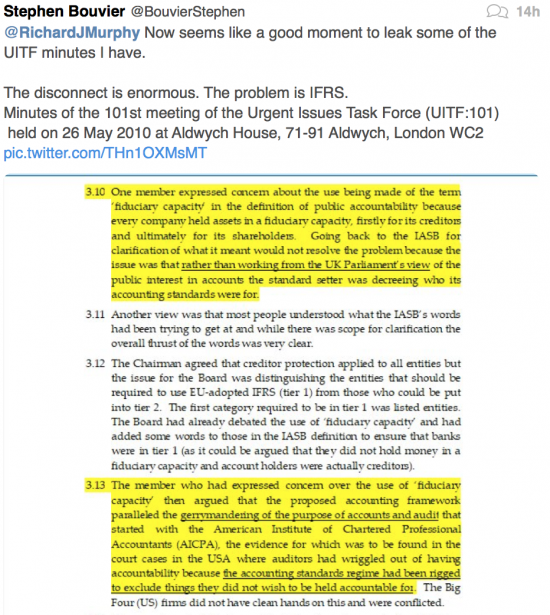

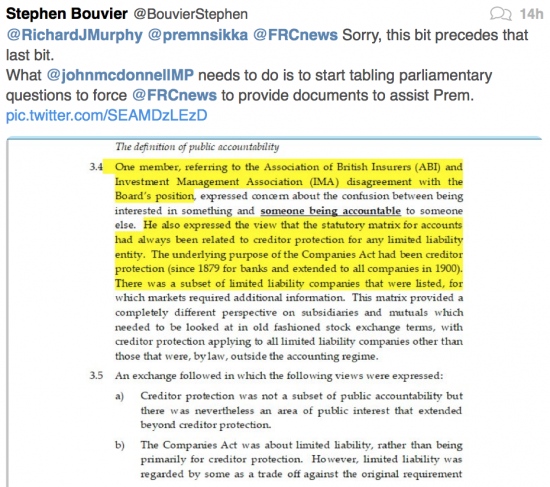

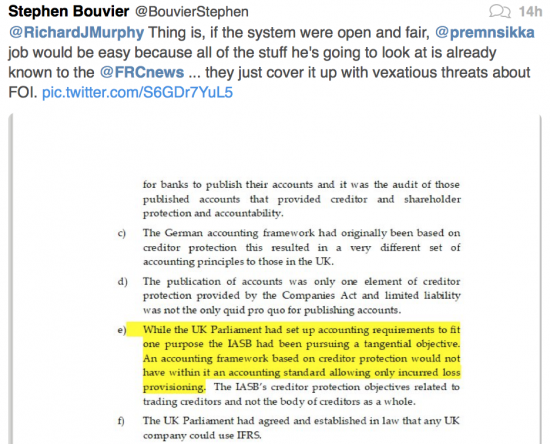

These are the tweets that make it clear that this discussion has been known to the FRC since 2010, at least:

The lost point could not be clearer. And the Financial Reporting Council has persistently ignored the point. But it did not need to do so. It could have said that International Financial Reporting Standard conflicted with UK law, as I think it does.

The result of their failure to take note is that we have suffered Carillion, BHS and so many other insolvencies of late.

These failings weren't by chance. They were the result of systemic flaws in reporting that permitted the abuse of creditors that the law should have prevented.

The FRC knew of this weakness: that fact is in its own minutes. And that's why it has no place in the future of UK financial reporting.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It would be bloody outragous if any of the Big 4 were allowed to cite IFRS, which they played a big part in creating, as a defence.

And where were ICAEW in all this; bigging up IFRS unless my memory fails me?

Why does everyone worship global banks who give no appearance of giving a damn about anyone but their elite customer base and, ultimateley, their own place in that base?

You will be interested in my speech on Thursday

Is the contention that the insolvencies of Carillion, BHS, and others, were caused primarily by lax accounting standards? Rather than by, say, deficient management, poor business decisions, or insufficiently challenging or insufficiently independent external audit?

I am very clearly suggesting that lax accounting standards have helped those seeking to extract value from companies without consideration of the needs of most stakeholders since the introduction of IFRS.

Since our supposedly independent external auditors have been wholly complicit in the introduction of IFRS and in reducing the scope of their work to simply checking compliance with it I am suggesting that it is not just that they have undertaken insufficiently challenging or independent audit but that they have engineered the end of such audit engagements.

Agreed We have an unholy alliance of auditors, standard setters, finance directors and infiltrated regulators. How do we create a turn key operation to transform them all?

The state has to ask the right people

And pump prime it with cash