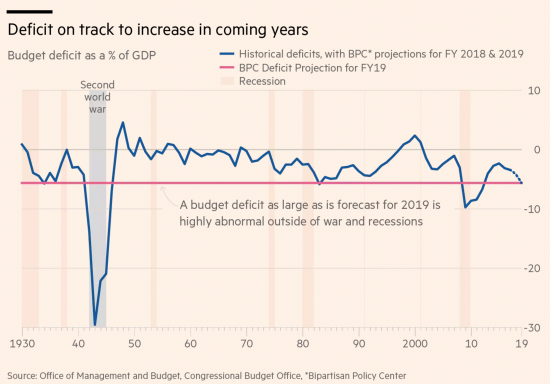

One chart (above all others) depresses me this morning. It is this, in the FT, and what it shows is the actual and planned US fiscal deficit:

That chart is deeply worrying. The US is at near full employment now. Inflation is already rising. Interest rates are following, slowly. This is not the moment then when anyone would suggest that the US is in need of a major financial stimulus. But that is what it is going to get. The Trump tax cuts and planned massive increases in Federal spending on defence and (because the Democrats will demand a quid-pro-quo) non-defence items will means that, as the FT notes there will be an exceptional budget deficit in 2019 in the USA.

This will almost invariably have knock on effects.

First there will be inflation.

Second, that will spread: commodity price rises will deliver that.

Third, interest rates will rise as a result.

Fourth, those too will spread.

Fifth, bond prices will fall, maybe heavily.

Sixth, although it's not rational to suggest that share prices will fall as a result, I think they will because they cannot deliver yield at current prices if there are interest rate rises and inflation.

Sixth, housing demand will fall with rising rates.

Seventh, a weak housing market will be fed with those unable to pay debts seeking to sell before things get really bad.

Eighth, things will get really bad.

Ninth, the US always leads the world into these things.

So, tenth, things will get bad here.

You want to know where a crash comes from? That's where a crash comes from. Trumps economic edifice will fall soon. And it will be ugly when it does precisely because the US will then think it has literally nothing left in its arsenal to deal with the consequence, whether that is right or wrong (and it will be wrong, as usual).

That chart is very, very scary. And it's almost unavoidably going to happen.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

With such a scenario I kind of hope that Trump wins a second term. If democrats win in 2020 and have to mop up the mess over the following four years GOP will still blame them for the mess and people will believe them.

How many bankruptcies has Trump been through?

Lots

He’s indifferent to them

We’re not

It would be interesting to follow up each of his bankruptcies and find the people and businesses who were “collateral damage”. A task for some investigative journalists in the USA, I would think.

Try David Cay Johnston – he is a Pulitzer Prize winning investigative journalist, tax expert and Trumpologist extraordinaire.

You can listen to him on:

https://ralphnaderradiohour.com/its-even-worse-than-you-think/

I know and like David

Great journalist

Richard,

I don’t think we need to worry, since the Fed will always have something in its arsenal: it can always print all the money it needs.

I know

The point I am making is that politicians ar trying to stop that ‘printing’ happening

Richard, the US U-6 (broad unemployment) rate is no where near full employment, around 8% just now.

At Real Progressives, we work with most of the MMT academics, and also Bill Mitchell, Steven Hail and others. None of them believe the US economy is anywhere near full capacity, or likely to be with Trump’s economics policies.

Dr Joe Firestone wrote this the other day..

“.. .I estimate “disemployment”, an idea first put forward by blogger “Hugh”, as U-6 unemployment plus the under-count of people not included in the BLS (Bureau of Labour Stats) estimate of U-6.

The undercount at the end of 2017 is estimated as the proportion of (age) eligible people in the labor force the last time in the economy was “up” during the Bush administration times the age eligible population.

That proportion is roughly .67.

The age eligible population, meanwhile was 256,000,000. So the civilian labor force should be: 171,486,000. (256m times 0.67)

But the actual Labor force is at approximately 160,529,000. So the undercount is about 11,000,000.

The U-6 is at 8.1% of the actual LF or 13, 002,498.

So, roughly disemployment is at 24,000,000 and that’s the likely number of jobs that we ought to create… ”

The Trump tax cuts are biased towards the rich, who are already sitting on mountains of cash with no where to invest it.

I don’t know who this FT author is (behind the paywall) but it looks to me like the usual neoliberal BS propaganda to get base rates up so the bankers and big finance can screw us all over again.

Thanks

I stand corrected, except the data always has this bias

“….That chart is deeply worrying….” Possibly

“The US is at near full employment now….” No it isn’t. !

Workplace participation is very low, there is huge slack. The published figures are manipulated to create a false picture then policy based on the false assumptions further compounds the issues.

But participation is always low so comparatively employment is high

No, Andy is right – the US is NOT near full employment now.

In the US the official unemployment rate (the Bureau of Labor Statistics ‘U3’ measure) is currently 4.1% and it s broadest measure (‘U6’) which includes marginally attached and some underemployed workers is about 8%.

So neither of figures come close to remotely suggesting that “the US is near full employment now” Not unless you are into those old neo-liberal, fictions like the NAIRU or the “natural rate of unemployment”. Even then you’d be stuck

https://data.bls.gov/timeseries/LNS14000000 , https://www.bls.gov/lau/stalt.htm ,

Little more than a year ago the Pew research centre had those “working part-time but not by choice” aka “involuntary part-time” at 22.2% and I doubt that much has changed drastically since then.

http://www.pewresearch.org/fact-tank/2017/03/07/employment-vs-unemployment-different-stories-from-the-jobs-numbers/

Before I continue I should say that I’m not trying to be contrarian. I get it that a stimulus could push interest rates, burst the bubble and deliver a crash but that was probably going to happen anyway. In the meantime some of the FT’s other “facts” and assertions here need some serious checking:

“First there will be inflation” Inflation is already rising”

The Bureau of Labor Statistics (BLS) main indicator the CPI-All Urban Consumers index (the US’s main indicator) had inflation at 2.3% in January 2017 trending unevenly downward across the year to a level of 1.8% in Dec. 2017 barely one month ago. And that is below the Fed’s target rate of 2%

https://data.bls.gov/timeseries/CUUR0000SA0L1E?output_view=pct_12mths

“interest rates will rise as a result.”

If and when the inflation is actually factual, then yes, they probably will.

“housing demand will fall with rising rates.”

Interest rate rises pop inflated asset markets, yes, and affordability will rise with falling house prices.

“what (this chart) shows is the actual and planned US fiscal deficit”

Since when did we here worry about deficits per se and have we not always disavowed the alleged (and discredited) claims about a causal link between deficits and inflation?

“This is not the moment then when anyone would suggest that the US is in need of a major financial stimulus.”

With the US’ truest official measure of unemployment at about 8.5% (the average for 2017 – possibly a tad bit lower now) that claim might be contentious.

We know that tax cuts are the least effective stimulus because they get dissipated by deleveraging (used to pay down debts) and a lot of that which is spent is lost to imports. The deleveraging will be even more acute if the housing market declines. The cuts are even less effective when they are wasted on the rich as this lot largely will be.

Moreover, I do not recall this forum being a place that disapproved of non-defence government spending. The stimulus idea is every bit as justifiable as it has been seen since 2008. It certainly shouldn’t be withheld on the pretext that a subsequent rate rise would burst the asset-price bubble.

The bubble, by definition, is unsustainable anyway. The sooner it pops the better.

Interesting comments, I accept

But let’s be clear, it’s not the rights or wrongs that matter here, it’s how the world reacts given it’s current perceptions on these issues

And I think I described these accurately

That was my point: the wrong belief is enough to deliver a recession

Note:

With regard to the inflation rate comment that I have made above I’ve just remembered that the Federal Reserve does use the BLS CPI index mentioned above and (for simplicty reasons among others) that figure is also the main CPI figure used in the US. However, the Fed has increasingly used the Personal Consumption Expenditures (PCE) index as main point of reference in recent years and it is a confusing bastard to try and track across time. Anyway the PCE for Dec. 2017 was 1.7% and did not appear to be rising across that year.

For those mad enough to take a close interest these might help:

https://www.federalreserve.gov/faqs/economy_14419.htm

https://www.bea.gov/newsreleases/national/pi/pinewsrelease.htm

A lot of low-wage jobs. A lot of part-time jobs. Nothing has changed. It’s the same kind of jobs that President Trump was calling Obama out on. It’s what helped him become elected because it resonated with the people who had those lousy jobs. But of course, now that they’re his lousy jobs, it’s a different story. Everything is great.”

Well, Trump is going for broke in self-serving reform. He serves it up as “delivering MASSSIVE tax cuts for working families across America” — on Twitter.

I suspect Trump, as most politicians view the economy as a cork floating on water – you push it under with the boot, but it will always bob up again. He is well informed to know his businesses have ‘opportunities’ to win on the down as well as the up cycle. Self-serving – to his class.

Trump ignores DETAILS like the aggregate effects or recessionary dangers, in child-like fashion where evidence doesn’t matter – it only gets in the way. A pure barbarian.

He treats other excellent US Agencies in similar Trumpian brutish fashion. He is at “War on Science Agencies” [1]. Cutting the renewable energy agency down to ¼ in 2019, from $2B to $575M [2].

Science agencies are being hit hard at a time when aggregate damage to the environment, feasibly, will lead to exceeding the “Earth system” capacity to handle man-made changes [3].

I am confident few are aware of “the ongoing sixth mass extinction signaled by vertebrate population losses and declines” now [4]. Because the Populist morons make the news; I suspect Trump could deliver a suitable tweet about me and fellow scientists — ‘losers’.

With his Trumpian brutish behavior he and the USA no longer has any right to lead the world. It’s not enough to console ourselves he will be remembered as the stupidest President ever.

[1] https://www.scientificamerican.com/article/the-trump-administration-rsquo-s-war-on-science-agencies-threatens-the-nation-rsquo-s-health-and-safety/

[2] http://www.independent.co.uk/news/world/americas/us-politics/trump-climate-change-global-warming-budget-cuts-renewable-energy-a8188391.html

[3] “Planetary boundaries: Guiding human development on a changing planet

” W. Steffen et al., Science 347, 1259855 (2015). DOI: 10.1126/science.1259855

[4] “Biological annihilation via the ongoing sixth mass extinction signaled by vertebrate population losses and declines”. A contribution from Stanford University, that can not be ignored. http://www.pnas.org/cgi/doi/10.1073/pnas.1704949114

That full employment is rather similar to the ‘record levels of employment’ myth in the UK ( as Andy points out); largely poorly paid , insecure jobs with many American living in cars and mobile homes. Combine this with private debt now exceeding the 2007-8 period then this would indicate the need for more spending on infrastructure etc creating decent jobs so that the debt can be paid down.

There is a theory that the Fed hikes themselves are inflationary ( counter to the conventional ‘wisdom’) because of the ‘price setter’ effect of interest rates combined with increased bond yield channels of income; if this is true then further rate hikes to control inflation will produce the opposite result.

‘This is not the moment then when anyone would suggest that the US is in need of a major financial stimulus. ‘ not sure what you mean by that, Richard. There is clearly a need for more spending on infrastructure which is rickety as hell in the U.S.

But tax cuts and defence spending are not what are needed

“But tax cuts and defence spending are not what are needed ”

This is where we run into the problem of defining what we might mean by ‘reality’.

Sensible policy would endorse your view, Richard – it’s the productive economy that needs to be stimulated and neither tax cuts for the better off (fishing for trickle down) nor defence spending is going to do that.

But big picture (Deep State) realpolitik says that the euphemistic ‘defence’ spending allows the US to keep its dominant position and continue to reap profit from outside its borders. An Empire makes its money from coercion and pillage of subject nations, and restriction of the legitimate interests of its ‘enemies’.

On those terms all military security expenditure is framed as investment, or at the very least as vitally necessary spending.

Incidentally, according to the spokesman for the Democratic Party, on BBC current affairs interview last evening, Russia is an ‘enemy’. Apparently the US is on a de facto war-footing against Russia according to the Democrats. This makes perfect sense when you consider the ‘Russiagate’ narrative and the alleged conspiracy of Democrats with FBI and Langley.

Therefore….”tax cuts and defence spending are ….” exactly what IS needed ! They enable the undeclared US policy to be pursued.

You can’t judge the efficacy of policy against democratic criteria in a country which is not a democracy.

I believe it really is that stark.

We can’t hope to change that, but we could strive to prevent our own government taking us further down the same road.

Hi Richard,

I’ve been reading your blog for a while now but have a question.

I’ve seen a lot of posts where you say that running deficits doesn’t matter for a government, and that they should run ore of them. If that is the case then why is the US running a larger deficit a bad thing?

I’ve also seen you say that inflation isn’t a problem, and we should have a little more of it. Also you have said that interest rates aren’t going to rise at all. Now you are saying they are going to and this seems also to be a bad thing.

UK and US unemployement rates are basically identical at just over 4%, and you say here that the US is at full employment. But elsewhere you have said that the UK unemployment is still a problem and that the government should spend more and help to create jobs.

Essentially what I am saying is, why is the US doing what it is doing a problem, when you are advocating the UK doing a very similar thing – increasing government spending and running larger deficits?

I clearly got this one wrong!

I thought it would be clear that I was talking about how markets will react – which is what the FT were in a sense forewarning

But I accept I missed the mark

And then had a long day at work where the messages piled up…..

“Trump’s Edifice will totter” ?

I don’t think he’s building an edifice. I think his objective is to take down the edifice he’s inherited.

If your observations are prescient, Richard, he’s well on track.

“First there will be inflation.” Given the government is still in orthodox mode of thinking that is a desirable outcome (in those terms). Inflation is the classic solution to reduce the value of ‘debt’. BofE has been wittering for years about there not being enough inflation.

“Third, interest rates will rise as a result.” Well that will please the people who want to see ‘normalisation’. What it will do is collapse zombie businesses. It will also put immense pressure on banks as the loan defaults pile up.

“Fifth, bond prices will fall, maybe heavily.” As we’ve discussed …the trend has reversed. The energy of the shift remains to be seen. The effect across ‘markets’ is predicted to be siesmic because it’s such a vast market, so it will effect all other markets.

“Sixth, although it’s not rational to suggest that share prices will fall…..” It’s certainly not ‘rational’ to suggest that artificially high share prices are sustainable. We have rafts of large companies which are financial constructs which have thrived on pillage, but aren’t producing anything that justifies their ‘valuations’. Carillion and Capita are closer to the rule than the exception in some people’s estimation.

” Sixth, (again !) housing demand will fall with rising rates. ” In a technical (dismal science) sense ‘demand’ will fall. Housing demand will in real world terms increase – that is to say more people who want one won’t have one. I’d call that a failure of supply.

“Seventh, a weak housing market will be fed with those unable to pay debts seeking to sell before things get really bad.” Excellent news. House prices are ludicrously high. The only thing that will prevent the continued stupidity of regarding houses as financial investment vehicles rather than ‘machines for living in’ is a serious ‘adjusment’ aka collapse of the housing market. It can’t happen too soon.

“Eighth, things will get really bad.” Inevitably so, but they are already dire, (for a signoficant proportion of the population) and until they get worse and start to impact, on the bythe and complacent, no bugger will do anything about it – nothing will change.

The Trump manifesto is one of change – disruption. It is why he was elected. A lot of people won’t like it, but he’s going to deliver.

If our politacians can’t see this coming and aren’t preparing to deal with it they are being paid under false pretences. ‘Hovering like flies, waiting for the windshield on the freeway.’

“The Trump manifesto is one of change-disruption”

“If our politicians can’t see this coming and aren’t preparing to deal with it they are being paid under false pretences”

#Brexit

There are so many links between the trump camp and the Tories…and other right and far-right groups…..

Why worry about deficits? Surely it only matters how the money is spent, and if that leads to productive economic activity. It all depends on how the money is spent and what gets done, so, green new deal good, tax breaks for the rich bad. There has been a lack of investment in the US (like here) and one can make a case that the right kind of fiscal stimulus is needed.

I am per se not worried if there is productive capacity to be used

Others suggest there is capacity. I am not wholly convinced. But my point is that markets will react as if it does matter. And that matters

“I am per se not worried if there is productive capacity to be used

Others suggest there is capacity.”

Of course some of that ‘capacity’ will have to be weaned off its opioids before it goes back to work 🙂

Oh really? The US Economy is booming and will continue to do so at a faster space, because Trump is removing the things that stagnate industry and is bringing jobs back home, still upset your beloved crooked Clinton didn’t win?

Wow, you thought I wanted Clinton?

Have you heard of Bernie?

The rest of your assumptions are as dodgy

Trump is embarking on a huge infrastructure spending programme. Something I thought you would endorse as it should ( maybe ) be a real boost to the US economy. Or maybe not.

Except the evidence is he is not: he is hoping the private sector will do that

He is defence spending

And tax cutting

Michael says:

February 4 2018 at 2:03 am

“Trump is embarking on a huge infrastructure spending programme. ”

That was the campaign rhetoric. I don’t think we’re going to see it materialise.

It is not going to happen

His plan is well short of promise and even then relies mainly on the private sector funding a great deal of what he is suggesting

That is not going to happen

Steve says:

February 2 2018 at 4:59 pm

“Oh really? The US Economy is booming and will continue to do so at a faster space, because Trump ……”

…..and the Sun has got his hat on. And the fish are jumping….

I just love the optimism.

Jesus, Steve! (comma included)

Are you a bot or wot?

Like a bot that trawls the net detects anti-Trump stories and delivers the same 2 lines in the hope that the target is a Clinton supporter (that’s bound to work in some cases -right, I mean there’s still a few of those left isn’t there?).

Or just one of those strangely bot-like Trump trolls who, to paraphrase John Cooper Clarke, are “condemned to drift like forgotten sputniks in the fool’s orbit bound for a victim’s future”? No?

If it is humanly possible for you, go back, read my comment, open all the links, check them over briefly and then think about how stunningly daft yours is..Better still, watch an episode of the late show with Steve Colbert you’ll probably blow a fuse before the first ad break.

“Booming” in your dreams buddy.

http://testicanzoni.mtv.it/testi-John-Cooper-Clarke_18642/testo-Psycle-Sluts-1888316

My worry is that this deficit will encourage the US to become more aggressive abroad in order to maintain the value of the dollar.

With a deficit like that, any other country’s currency and economy would go down the pan.

But not so America – with its currency used to trade oil, supply World Bank and IMF loans and debt and whom also insists on your changing your money into dollars before you trade with it or settle your bills. All stuff that helps to keep the dollar strong despite its deficit.

The whole thing is a mirage and why oh why do we continue to put up with it?

Its what happens when you’ve got the world’s reserve currency. Nations everywhere buy US bonds (regardless of deficits or anything else) in order to maintain reserves.

Joe Stiglitz is the best person to read on that general subject. I do note however that, as the electric cars slowly takeover, it will be interesting to see what becomes of the petrodollar arrangement.

Marco Fante says:

February 2 2018 at 10:50 pm

“Its what happens when you’ve got the world’s reserve currency. ….

…….. it will be interesting to see what becomes of the petrodollar arrangement.”

The petrodollar arrangement is in deep doo doos as the Chinese and Russians are making their own arrangements to bypass it. Iran will be highly motivated to join as will Venezuela, I suspect. And any other country which is being squeezed by the US militarisation of money through sanctions. (Shamefully supported in some cases by the UN)

Pilgrim,

“My worry is that this deficit will encourage the US to become more aggressive abroad …”

Couldn’t agree more. If it required serious numbers of (American boys’) boots on the ground they might struggle, but remote control high tech destruction, and infiltration, training and arming insurgents is the modern modus operandi and they are well versed in the process.

And of course ‘defence’ spending is approved without demur because to oppose that would be unpatriotic verging on treasonable.

The US is an empire in decline and it will die with its boots on.

We should remember that the Government’s deficit is everyone else’s savings. So if Americans responded to government calls to save during WW2 they’d simply be adding to the Government deficit.

If anyone is saying the deficit is too high they are also saying the levels of saving is too high. Is that such a problem?

Well yes, it could be

Hmmm. Interesting!

If savings represent skewed income distributions this can be an issue

That’s what I was implying

But I am aware I have been too cryptic today

And that I am knackered….

I think the point is that a loose fiscal policy doesn’t necessarily result in a higher Govt deficit. If the Private sector save any extra money that the Govt is injecting into the economy then it will. But it could well be that a looser policy will result in higher inflation which will induce more private sector spending, which will in turn boost the Govts taxation revenue resulting in a lower deficit.

In other words higher inflation could reduce the tendency to save which has to mean a reduced Govt deficit. So I would be inclined to suggest that the real danger of Trumps policies is higher inflation rather than a higher deficit.

This is isn’t saying anything about the use of taxation policy in the redistribution of wealth.

I will be blogging on this issue

Peter,

“will in turn boost the Govts taxation revenue resulting in a lower deficit.”

Normally, yes, but it seems possible that you may not have yet seen the full extent of Trump’s lunatic tax cuts.

An issue I will address tomorrow if the limbs are up to typing (I am knackered)

@ Richard,

I’ll look forward to it!

@Marco,

You could be right that Trump’s tax cuts are ill advised. But it doesn’t change anything. If the US Govt deficit increases it will , cent for cent, be cause everyone else is choosing to support that deficit by saving more. ‘Everyone else’ does include the US’s trading partners who may well save more of the dollars they earn selling their wares there.

If they take the view that Trump is weakening the dollar by his actions, they may well ‘dump’ them. That can only mean spending them. This will boost US exports. Even if that means after the initial holders of dollars swap them for another currency. Saving or spending accumulated dollar holdings are the only two options.

Peter Martin says:

February 2 2018 at 7:38 pm

“We should remember that the Government’s deficit is everyone else’s savings. ……..If anyone is saying the deficit is too high they are also saying the levels of saving is too high. Is that such a problem?”

It shouldn’t be a problem, perhaps, but it is because of the staggering inequity of distribution. The average level of US household savings is declining (as they eat their future to maintain standard of living or, lower down the income scale, just to survive to the month end)

Meanwhile that debt/savings mountain is accumulating in fewer and fewer hands of the people who have no need to spend it and are stoking the financial economy without supporting the real economy.

The ‘Trump’ tax cuts keep the money flow going in precisely the wrong direction.

reductio ad absurdum: the end game comes when ALL the money is in the hands of a very small few and there is nothing to buy.

Have you ever played ‘Monopoly’ ? It usually ends when someone tips the board and all the pieces onto the floor and storms off to their bedroom or out into the garden.

It’s been a while since I last played but I do remember those tantrums! Monopoly was, or so I’m told, invented by a Georgist who wanted to explain how the economy could be restructured to be supported by property taxes.

The ‘banker’ should have been termed the government IMO. Bankers in real life can run out of money, otherwise they could never go bust. The rules in Monopoly say they can’t! As far as the game of Monopoly is concerned they are the currency issuers.

Peter Martin says:

“….The rules in Monopoly say they can’t! (go Broke) As far as the game of Monopoly is concerned they are the currency issuers…..”

I saw this referred to somewhere recently. Apparently the rules say that if the supplied currency runs out the banker just makes some more by writing on bits of paper. (presumably whilst keeping a close eye on the other players to make sure they aren’t writing their own momey !) Respect due there to the games designer !

I’ve never read the rules and always loathed the game.

I confirm that is in the rules

Hate to say it, but it’s a family favourite

Any idea of the timescale for these things to happen?

That depends on how many get to see the world the FT way and when

Nick H says:

February 2 2018 at 8:52 pm

“Any idea of the timescale for these things to happen?”

It’s already well under way, but it will unravel by degrees.

The ducks are all in a row.

Jeffrey Snider is worth looking at wrt the FT’s view.

Where’s The Inflation? Average Weekly Earnings Flat, Focus on 200k Instead Which Isn’t Even A Good Number

http://www.alhambrapartners.com/2018/02/02/wheres-the-inflation-average-weekly-earnings-flat-focus-on-200k-instead-which-isnt-even-a-good-number/

Thanks

Read with interest

Thanks Roger,

That certainly confirms what I was thinking as well adding a whole lot more besides. So now the question remains: where the hell is this fake “boom” narrative coming from? It can’t all be down to the Fed’s strange inclinations.

Major league panic when there is even a whiff of “wage inflation”.

Let’s not mention runaway asset price inflation which is so corrosive and divisive of civil society.

Andy Smith says:

“Major league panic when there is even a whiff of “wage inflation”…….”

Absolutely agree. Bloody nonsense isn’t it ?

[…] wrote a post on the likelihood of a Trump induced recession on Friday and then disappeared for the day into a series of long meetings and discussions on research work […]