The FT reports this morning that:

The EU is threatening sanctions to stop Britain undercutting the continent's economy after Brexit, including “tax blacklists” and penalties against state-subsidised companies, according to a leaked strategy paper.

The measures, outlined in a presentation to EU27 member states last week, show the bloc wants unprecedented safeguards after the UK leaves to preserve a “level playing field” and counter the “clear risks” of Britain slashing taxes or relaxing regulation.

The question is, do they have reason to be concerned? The new Financial Secrecy Index report on the UK suggests that they do.

Firstly, that report and the EU both view the UK's Crown Dependencies and Overseas Territories as being part of the UK for the purposes of assessing tax abuse risk. That is appropriate. Tax risk of the sort worried about always involves the shifting of profit between states. In other words, it's an issue relating to foreign affairs. And the UK is responsible for the foreign affairs of its territories.

Second, these places are more than willing to trade on their UK links and the fact that their legal systems are ultimately bedded in that of the UK, which represents much of their appeal.

Third, the UK can enforce law in these jurisdictions and chooses not to do so.

Instead, fourth, it defends their right to have the secrecy laws that permit abuse.

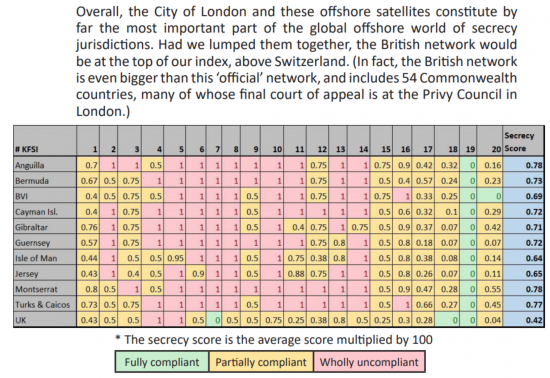

And they do provide that secrecy. This is the TJN summary of its findings for all the jurisdictions in question:

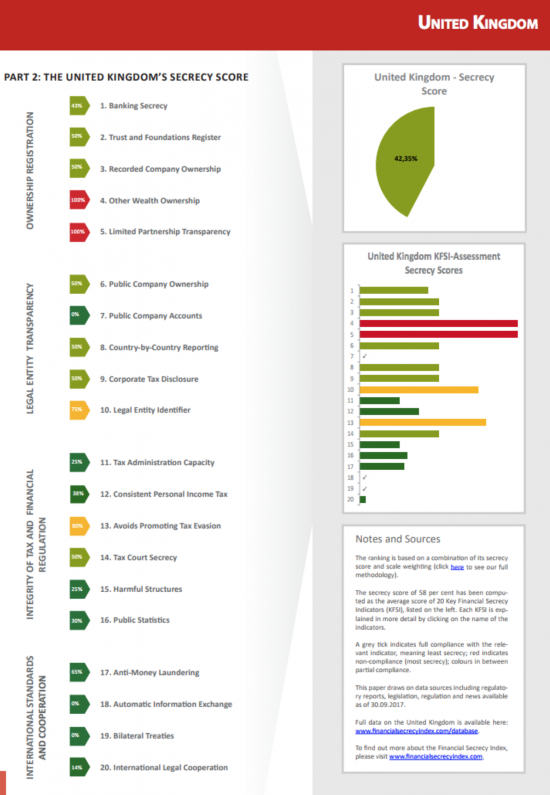

And this, to illuminate what that means, is the finding for the UK itself:

The UK is a very long way from being a place that can be relied upon by anyone when it comes to tackling tax abuse. The EU is absolutely right to be concerned. And so should we be, come to that. This abuse happens at cost to the people of the UK as a whole.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The tax haven dimension of the UK is seldom mentioned in the mainstream discussion and debate about BREXIT. It needs to be.

But it just seems so perfect for a certain percentage of the population doesn’t it, that the result of BREXIT will be an effective uprating of the UK’s role as a tax haven.

It makes you wonder about the BREXITERs apparent ‘surprise’ at winning.

That’s passionate writing, for sure. I find myself unable to say that I don’t disagree with any of it.

‘Jordan Peterson’ ………hmmmmmm

@Jordan Peterson.

There are so many double negatives in that statement you have confused even yourself.

“‘Jordan Peterson’ ………hmmmmmm”

Pilgrim,

I notice there is no ‘B’ in that screen name. I can imagine him thinking: ‘to B or not to B’….

I note that Germany, Luxembourg and the Netherlands are also high on the FSI list. I wonder how the EU justifies this?

It should be tackling it….

Don’t you support the idea of “state subsidised companies” ?

I support the idea of the state being a provider of capital

Do you have problems with the concept of capital?

State subsidised companies , state provider of capital – are they not the same thing?

So are private sector businesses susbsidised? How?

Which is why it is not in the least surprising to see that so many of the backers of the anti EU movement in the UK are the usual suspects from the hard right, pushing their low tax, low regulation, small state ideology. The same ideology that gave us the GFC, and now Carillion and Crapita.

Unfortunately, no one in the UK except tax dodgers and organised criminals are going to benefit from this. Which is why the whole Leave campaign was and is nothing more than a con trick. Pity just enough of the electorate, who have suffered from the right wing policies of these same people for far too long, were daft enough to believe overstretched public services were the fault of the EU, or that we had lost some mythical ‘sovereignty’.

Of course, if the EU’s measures are effective the tax haven dream of the hard right won’t be viable. How stupid will Britain look then?

Brexit and EU tax haven legislation are fundamentally linked.

I believe that is not true

“Brexit and EU tax haven legislation are fundamentally linked.

Reply

Richard Murphy says:

February 1 2018 at 1:22 pm

I believe that is not true”

Doesn’t that depend on what one thinks the nature of the link is ? I would have thought that if the aim of the Brexiteer ringleaders is to create a freebooting tax avoiding haven, then that would argue for its being a link.

Are you saying you don’t belive that to be part of the Brexiteer motivation ?

I don’t think so

I think it may be for some but by no means all

I may be wrong

Andy,

It is quite possible but it does not necessarily follow.

This wretched Brexit controversy will haunt and divide the nation for decades to come, won’t it? I’m not going to revisit all the well-aired arguments but, just for the record, ideally my preference was (and still is) for the UK to leave the Neo-liberal dominated EU. I only voted to remain because it seemed pragmatically right in view of our more socially regressive and equally Neo-liberal administration. Also because culturally I feel more European than simply English. Regrettably there is little debate about issues other than economic.

I’ve just read – or tbh skimmed through – Bill Mitchell’s latest anti-EU tirade (http://bilbo.economicoutlook.net/blog/?p=37942). He is my default authority for MMT guidance and I understand why he is vehemently critical of the EU’s economic policy, especially its effects upon the Euro-bloc.

So – to cut to the chase – is the Tax Haven controversy only relevant because we currently have a Tory government? Is there any suggestion that a Labour administation would take the requisite measures to tackle this abuse head on? And, in the event that it might, would we therefore not be a threat to the EU in this regard?

I appreciate that ‘what if’ scenarios are usually a meaningless distraction, but since ‘Brexit’ has implications way into the distant future, should we not be at least be considering the possibility that the UK will have a different strategy – hence EU relationship – with a change of government? All current analysis and impact assessments seems to assume no domestic régime change.

At least Bill Mitchell, in his inimitably forensic (boring?) manner, argues for what the UK could achieve outside the EU, with a progressive fiscal policy. If he were the Chancellor I would probably have voted to leave. I don’t know about anyone else but, as someone with no formal financial background, I find the whole issue increasingly like wading through a Channel of treacle.

Barista Рun caff̬ lungo, per favore!

I believe a Corbyn govenment would tackle this issue

I think Brown was heading in the right direction at the end of his time

I agree a Corbyn government should put a stop to this. However I think there is a degree of hypocrisy here. If the Germany, Luxembourg, French, Swiss, Dutch nexus is taken into account how would they compare to Britain and its tax havens?

The TJN financial secrecy rankings are a real eye opener. USA, Luxembourg, Germany and Netherlands beat us hands down as much more secretive than U.K. France is pretty similar.

China and Russia are way down the list. It looks like western governments are in open competition in the criminality stakes and Trump is winning. Please tell the full story!

For heaven’s sake: I directed the first ever FSI. I helped ensure the truth is told. And you accuse me of not telling the truth? That’s exactly what I have helped lay out.

Of course there are issues. And that is why I work with politicians of all parties who want to address these issues, who are almost invariably from the left.

The problem is entirely to be found in right wing politics

Hi Richard, sorry I was not accusing you of not telling the truth. It’s my view there is a wider story here. While your focus on U.K. is understandable it is only a small part of the bigger picture. Elements of the EU are as bad/worse than U.K. and that needs to be more widely understood.

I think this is true

But I make clear I have been talking about the Netherlands and Luxembourg for years, as well as Cyprus and Malta

The German case is taken by TJN in Germany and France is largely addressed by ATTAC and the French branch of Oxfam

This issue is not ignored by any means

Perhaps we are looking at this the wrong way around. The UK is already a tax haven by virtue of its links to the Crown Dependencies and overseas territories.

Where tax law is concerned the EU seems to be notably softer on its own members than it is on outsiders (members like The Netherlands, Ireland, Luxembourg. The UK etc.)

So it may be that the EU is not “worried about tax haven UK” on account of Brexit. Tax haven UK already exists, but rather that the EU sees Brexit as an opportunity to treat the UK as an outsider. Pouncing on that opportunity could possibly eliminate a very large proportion of its remaining tax haven problems in one fell swoop.

Either that or the EU threat, as recently reported in the FT, could be part of a negotiating gambit in the Brexit game. Or that and all of the above?

I don’t really know but, to me the thought appeared to be somewhat unavoidable, as a consideration at least.

Richard, I applaud you for your work on exposing tax injustice and as you rightly say your colleagues in France and Germany are doing good work in their own countries. I deplore the hypocrisy of British, German and French politicians of all ruling parties that have enabled their rich backers to put us in the position we are in now. Marco makes an interesting point. I prefer to see the situation more like this. A gang of pirates gets together and forms a small fleet. They do well together with their plundering. One pirate ship that traditionally did well on its own decides to go its own way believing the fleet is being manipulated by other players. The remainder of the fleet, worried that some of its own crew members (some of their best money making pirates) will jump ship and join their former comrades, threaten a broadside before their ex comrade exits over the horizon.

I should add that some of the exiting crew hope that a change of captain will result in the ship giving up piracy and embarking on some honest trade that will mean less cash but better sleep at next night. As there is enough cash for everyone, if it is properly shared out who cares if the ship makes a bit less?

@Phil Espin

A fitting and fun analogy. Thanks – I’ll add it to my Coffee House collection!

[…] The EU clearly believes that the UK is planning to be a tax haven. They are already threatening sanctions if this is to happen. […]

Tax arbitrage (race to the bottom) between countries is just ridiculously easy for Corporations and their owners and executives.

Maybe it’s time to take a different approach entirely to taxation policy?

Let’s begin by recognising that for currency issuing sovereigns like the UK, tax is not required for Gov ‘revenue’.

Thus the real objective is simply to reverse the grossly unfair share of productivity gains that the present neoliberal system of economic policy delivers to the Capital owner and executive class.

The way Capital does this (has been for 40+yrs) is by ensuring the labour class is suppressed by deliberate mass unemployment which in turn causes wages and conditions to recede or stagnate, even whilst productivity of labour rises.

Well, this is easy to fix. Return to a (real) policy goal of full employment. Making sure that we do that directly by using a Job Guarantee, for any who want it. A JG paying a living wage (which will become the de facto minimum wage), locally organised in the community/charity/social sector, nationally funded. (With a simply income means tested social welfare level income for any who choose, for whatever reason, not to do a JG. So that JG remains strictly voluntary.)

The key here is that by taking the labour class share out as *wages*, before the rentiers even get their excessive profits, we don’t need the whole bullshit charade of ineffective Corporation taxes at all.

What we really want is for labour to regain its legitimate power as the majority of citizens in a (supposed) ‘democracy’. By any definition of democracy, the labour class in a Capitalist type of economic system should demonstrably see its collective interests prioritised by government. Instead, we see the opposite. And it hasn’t changed in 40+yrs – in fact its worse now than ever.

The MMT Job Guarantee gives labour back that power. Nor do we need corruptible, self interested Unions, who failed us in the 70s and 80s. (Despite their necessary work for us earlier in the last century.)

If the labour class stick together, and vote for policies that recognise monetary and economic facts (not neoliberal fraud), and candidates with real integrity (like Corbyn, and the 1945 Labour Gov), then we cannot be defeated.

Unless we are divided and fed frauds and lies by the elites of mainstream media. (Which can be easily fixed as well.)

Mike Hall says:

February 2 2018 at 12:19 pm

Much as I think a Job guarantee sounds like it might be nice idea, I don’t understand how it might be achieved in practice.

What might all these jobs be and how is it proposed that they be managed ?

I can imagine how a Universal Basic Income could work, and can see some very positive outcomes springing from that, but JG is something I’m suspicious of (and ignorant about). My mind drifts towards pyramid building projects and serious proponents of JG must have considerably more constructive schemes in mind than pointless makework.

Have you got any good reference material you can point me to ?

Yes, there’s quite a bit of literature about JG, here’s some from Dr Pavlina Tcherneva, and Prof Bill Mitchell..

https://www.pavlina-tcherneva.net/job-guarantee

http://bilbo.economicoutlook.net/blog/?s=Job+Guarantee

One of the things that most people, ‘economists’ and media etc. miss, when comparing some kind of UBI (universal basic income) and JG is that in *macro* economics terms, their effects are quite opposite. Indeed, most people – disgracefully, for the profession – have no idea at all that ‘macro’, as opposed to ‘micro’ economics exists at all. (eg they think Gov is just a big household) As dangerously ill informed for macro policy forming as it was before Keynes.

JG is inherently stabilising and counter cyclical. UBI, depending on the amount given, is either moderately or massively destabilising. However, virtually every piece I’ve ever seen on UBI doesn’t consider it beyond the first 5 minutes of operation, and the vastly more significant *macro* economics effects will take 10yrs + to manifest and stabilise (such as anything can in an unstable dynamic system).

UBI advocates routinely cite various ‘trials’, or ‘pilots’ as evidence of a UBI experiment. Finland etc. However, by definition, one cannot ‘trial’ a macro economic scheme, in any meaningful way at all. Economics is a social science, not real ‘science’, where other variables can be frozen and validation experiments conducted. Basic stuff, but completely ignored in public and most economics discourse on this topic.

UBI advocates routinely never specify the amount of UBI they have in mind. But scale, as regards effects is hugely important for a UBI, since the increase in Gov spending is potentially 10s of % of GDP. Again, this issue is ignored. More evidence, if any were needed, that UBI advocates, as with most public economics discussion is conducted as if ‘macro’ doesn’t exist, and Keynes and others never lived.

So I’ll offer another piece by a PhD student who did consider some scale and macro effects of a UBI – notions that are rarely if ever seen anywhere in the media.

https://jacobinmag.com/2017/12/universal-basic-income-inequality-work

The reason most people do not know macro exists is that most macro is now DSGE – dynamic stochastic general equilibrium – based

This is wholly micro based so that its assumptions on the supremacy of the market can be built into macro by default

Real macro and DSGE do not really overlap in my opinion

Simon Wren Lewis would not agree, entirely

Mike Hall,

Thanks for these links on Job Guarantee.

Excellent stuff and making the case I didn’t (and still don’t anything like fully) understand. There’s an awful lot of it so it will take a while.

I’ve been saying for years that because there are ‘no jobs’ it doesn’t mean there isn’t plenty of work that still needs to be done. JG addresses that by the sound of it.

” most macro is now DSGE — dynamic stochastic general equilibrium — based”

Oh Richard that is just so 2006.

I can imagine that there will be some orthodox academics still entertaining that nonsense in their cloistered obscurity. By now they have become like those Japanese soldiers stranded on remote Pacific islands in the late 1940’s, still fighting on unaware that their war is over.

DGSE is kaput. No one that I know takes it seriously anymore. Thank God.

No one, except 95% of macro economists

Look at the latest review here https://academic.oup.com/oxrep

That would not have been written but for the fact that DSGE still reigns pretty much supreme

Marco Fante says:

“DGSE is kaput. No one that I know takes it seriously anymore. Thank God.”

I know nothing of DGSE, ……but I would observe that ‘no one’ believes in the efficacy of ‘Trickle Down’ yet it underpins the ‘logic’ of QE, and it very definitely underpins the recent Trump tax reforms.

Richard,

Thanks for the link. It provides an insight but it is one that only surprises me mildly. I remember being taught about DSGE and at the same time being told that it was a dead letter. “Why are we learning it?” I asked. The reply came: “so when you say that it is a dead letter you will know what you are talking about”.

I also came to learn of the “New Consensus Macroeconomics”, at the same time being advised that post-GFC, it is no longer a consensus. Q: “That didn’t last long did it”? A: “Nope”. Before too long I was referred to John Quiggin’s book “Zombie Economics” as having the best take on DSGE that was available at that time.

https://press.princeton.edu/titles/9702.html

So remember that, technically, the lecturers and tutors that told me these things would still be counted among your “95%” because they are still teaching it (though not believing it). I think that this excerpt from the article that you referred me to summarises their advice:

“During the Great Moderation, the New Keynesian Dynamic Stochastic General Equilibrium (DSGE) model had become the ‘benchmark model’: the one taught to students at the start of the first-year graduate macro course. Many of us–although not all–were proud of what had been achieved. But the benchmark model has let us down; it explained neither why the GFC happened, nor what to do about it”.

https://academic.oup.com/oxrep/article/34/1-2/1/4781821

You say: “That would not have been written but for the fact that DSGE still reigns pretty much supreme” which is fair in its own way.

I say: That would not have been written but for the fact that DSGE ist kaput.

The Oxford literature that you referred me to (with its gentle, cautious reform approach) essentially reminds us that the macroeconomics profession has been hopelessly discredited by the GFC, has lost the faith of many in the public as well as a great many of its own members. It is stuck in a situation where, after 9 years in the woods, it still can’t bring itself to embrace a paradigm shift because that be would be tantamount to admitting that they had wasted 30 years of our time and theirs. The quote from the article acknowledges that this sort of macroeconomics is no longer in the ascendant but still can’t quite admit that it is in hiding and denial.

I am with basically with Andy on this one. Trump can officially embrace trickle-down and everyone from Colbert and the late show hosts to Krugman and the expert commentators on TV then mock and ridicule. Something can still be official when no one really believes in it.

The Oxford article’s author could write a book about the search for a new DSGE but it won’t sell thousands like Quiggin or millions like Picketty because virtually no one outside of their cloistered realm is really interested.

But people are interested in a new macro

That is a lot of what this site is about

And it’s required because the old is still kicking – far too strongly

DSGE and its micro assumptions are the thing we are eventually kicking – it is the household fallacy model made into theory

Andy says:

Seriously, don’t bother looking into it, not too hard. You’d be wasting your time on a broken toy.

All that you need to know is that it is a delusionally failed attempt trying to reduce the entire macroeconomy, and all of is within it, to single, mathematical model (as if). What’s even more embarrassing is that the model does this by observing the economy as a “representative agent” – one imaginary but typical individual that represents all of us (yep, seriously).

Even some of the the leading orthodox economists that started that trend now disavow it. These quotes from the Wiki page are telling:

“N. Gregory Mankiw, regarded as one of the founders of New Keynesian DSGE modeling, has also argued that:

‘New classical and new Keynesian research has had little impact on practical macroeconomists who are charged with […] policy. […] From the standpoint of macroeconomic engineering, the work of the past several decades looks like an unfortunate wrong turn.'[14]

The United States Congress hosted hearings on macroeconomic modeling methods on July 20, 2010, to investigate why macroeconomists failed to foresee the financial crisis of 2007-2010. Robert Solow blasted DSGE models currently in use:

‘I do not think that the currently popular DSGE models pass the smell test. They take it for granted that the whole economy can be thought about as if it were a single, consistent person or dynasty carrying out a rationally designed, long-term plan, occasionally disturbed by unexpected shocks, but adapting to them in a rational, consistent way… The protagonists of this idea make a claim to respectability by asserting that it is founded on what we know about microeconomic behavior, but I think that this claim is generally phony. The advocates no doubt believe what they say, but they seem to have stopped sniffing or to have lost their sense of smell altogether.'[17] “

Ooops sorry:

Andy says: “I know nothing of DGSE,”

Missed that bit. Oh well, you know what I meant.

I have a question.

If UK was ultimately minded to exit the EU by staying in the EEA and joining EFTA – not as a short term but as a long term option…. are the EFTA states signed up for EU tax haven and cross border taxation of multinational type reforms?

Yes

As we are too, by the way, via the OECD

But trade sanctions through such organisations can be stronger

I forgot this as well.

https://en.wikipedia.org/wiki/Dynamic_stochastic_general_equilibrium

Love the quotes. That’s it, too much forgetting. I’m going to bed.