The FT argued yesterday that UK national debt was too large at 85% of UK GDP. They got their figure wrong: in April the UK reported to the EU that:

General government gross debt was £1,731.4 billion at the end of December 2016, equivalent to 89.3% of gross domestic product (GDP); an increase of £65.4 billion on December 2015.

But both estimates are in fact blatant mis-statements of the truth. On 28 June the Bank of England owned £434,961 million worth of government. Let's call that £435 billion for ease.

And let's also note that the Bank of England is owned by the government.

And so the government doe, therefore, own this £435 billion of its own debt.

Now, just spend a moment thinking about this. Suppose you owe your mortgage to yourself. Would you worry about repaying it? Or come to that worry about the interest on it? And would you worry about when you repaid it? Of course you wouldn't. And you'd be right not to do so. That's because the idea of owing yourself money is meaningless, and makes the debt irrelevant. Which is precisely what this £435 billion of debt is: it is irrelevant. Indeed, as I have shown, it is actually shown as cancelled debt in the UK national accounts, which is precisely what it is. It literally no longer exists.

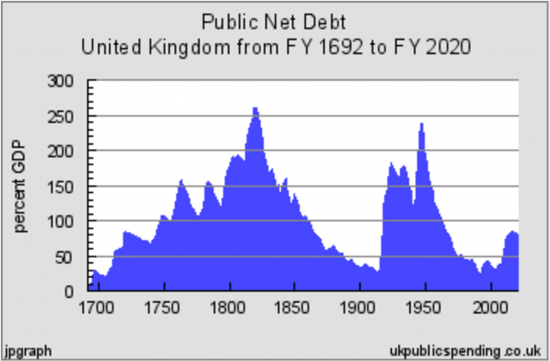

So, in that case the national debt should not have been stated to be £1,731 billion but something like £1,296 billion. And that is 66.8% of UK GDP, which is the same level as we had in 2010 and, to put it in context is below the level for most of the time since the national debt began in 1692:

Or to put it another way, right now there is no national debt issue to worry about. The debt is under control. The real rate allowing for QE is at historically low levels. And we actually need more debt, and not less of it. And to therefore say that we cannot have schools, healthcare, benefits and university education because of the scale of our national debt is a lie.

But worse, it's a lie based on a lie about the level of debt we have. And that is unforgivable.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

So why not wipe out all the UK national debt by doing even more QE?

Why stop there in fact? Why not keep doing it so we can spend as much as we want on anything we want?

Why would tax rates need to go up, or even be as high as they are if this is also true, and all money eventually comes back to the government through tax which is something you also argue?

Because we need national debt because it is in fact national savings

And we cannot do without national savings

But it is a service by the government to provide that savings opportunity

As for tax rates – this works at the margin (which is what is being considered) and not in total

The 15-year gilt yields chart is at 1.42% (16 June 2017: sharingpensions.co.uk). One calculation of ‘inflation’, which includes housing costs, the CPIH (Consumer Price Index) was 2.7% (13 June 2017: ONS). I do not present these figures to ‘score a point’, but rather to suggest the issue requires to be explored further. Clearly the prima facie discrepancy between the two rates shown is scarcely an inducement to save.

Do we need savings?

Tell me why

And don’t say because savings fund investment because it is credit that does that

It may well be that I have “lost the plot” (that is why I find this site interesting), but “investment” was not in my mind. I was responding to your statement that “we cannot do without national savings” and was simply following through why a ‘real life’ saver would necessarily find saving compelling at 1.4% when inflation was 2.7%. I have no preconceptions, nor a hidden agenda; I am asking a question.

But we don’t need savings per se: the government provides a service by letting people save with it. Right now they are paying for it.

The Government provides a service; but it is also (directly or indirectly) setting the interest rate. This is a curious form of “service”.

Low interest rates have kept the economy, people in their homes, banks solvent, some investment going

That’s not a service?

And please don’t say it doesn’t help savers because it does: you’re doing nothing for the economy so having others work is vital and low rates permit that: you only survive because of them

As someone who has commented here in support of AGR/LVT, it seems more than just a tad harsh to suggest (gratuitously) that I am simply supporting rent seeking (“you’re doing nothing for the economy”). I do think you have used the word “service” a little too freely; it is one thing for a Government to serve – what would you wish to term it, the ‘public interest’ (is that actually the case with the Government of the last 10 years, I suspect not, but I do not want to play on the ambiguity of the meaning of the terms?) – it is another to present ‘saving’ as a “service” (when the service is manifestly not to the saver) that indeed guarantees the saver losses (compounded by taxation). At the same time borrowers are paying low interest rates against the collateral of land, that turns public value into private (tax free) profit. I am trying to suggest that there is complexity here; and that is all.

But it is a service to the saver

They want security and the government supplies it

We “need” an in-built national “savings opportunity” to lose money. Hmmm; it seems to me a little over-generous to describe that as “security”. I can receive that kind of security from a major UK commercial bank (becuase the security is actually underwritten by the Government, at least up to a ceiling). Meanwhile the banks are secured against irresponsible speculative failure, on any scale, from over-adventurous ‘investment’ by the TBTF rules. There is “security”, and then there is security.

You have no security for sums over the guarantee at a Uk bank at all

I think I had actually acknowledged the ceiling. Indeed the ceiling itself is a contingency (I presume; we may wonder why it is what it is).

I suspect we may have exhausted the issue (I do not wish to flog a dead horse), but I must say that I remain unconvinced by the proposition that national debt is actually national savings, defined (solely?) as a “need” for a “savings opportunity” that offers some level of “security”, but not a security that for the ordinary saver cannot be matched elsewhere.

If the issue is purely a matter of greater public confidence solely in the security level offered for the capital element of the savings (alone) offered by Government, against all other investment opportunities, then should we just categorise all deposits in UK banks under £80k (or whatever the current ceiling is), as National Savings, or National Debt.

I think you are wrong….and you are ignoring the need for safe deposits by banks themselves, and pension funds and so much else

May I add that in one sense all deposits under the ceiling in UK banks, would be (in the accounts of UK Ltd), presumably a contingent liability? If so, we are in a sense almost ‘half way’ to saying they are part of National Debt.

Agreed

My last comment on this thread, you will be happy to note. With the greatest respect, I am not sure that I am “wrong”, since this was not my idea. I was simply trying to think through where your proposition that “national debt … is in fact national savings. And we cannot do without national savings. But it is a service by the government to provide… [the] savings opportunity” may lead.us I am happy to acknowledge this may not function well as I tenatively proposed, but then my reservations also still stand.

While I do not wish to encourage exuberant rent seeking of a kind that has wrecked our economy, I believe there is, nevertheless, some value in saving (call me old fashioned); indeed your emphasis on the Government actually providing the sevice of a savings opportunity (as the justification for National Debt?) seems to reinforce it. It is however, as it seems to me, a somewhat forlorn looking “opportunity”as you describe it.

If that is the sum and substance od the National Debt; in the words of Peggy Lee’s song: is that all there is?

Yes…

Because remember the state does not need to borrow so it purely does this as a service

“So why not wipe out all the UK national debt by doing even more QE?”

Why on earth would the UK Gov want or need to ‘wipe out’ the National Debt, considering that all the National Debt is, is the choice by the private sector to invest in Gilts rather than hold cash?

For example, you probably own, or know someone who owns, Premium Bonds. If the Government decided, in the interest of ‘reducing’ the National Debt, to unilaterally cancel every Premium Bond and give each holder their cash back, would those Premium Bond holders be happy?

No, because there goes that savings option, and had they wanted to hold cash instead of have a little flutter with their spare savings, they would never have bought them in the first place.

Would a private pension, insurance, or financial investment company want to be given back cash (which only earns 0.25% at a time of 3% inflation, and of which only £75K is covered by the Deposit Guarantee) in exchange for its Gilt holdings (earning 2%>5%, depending on when they were purchased, and guaranteed as the safest possible form of investment by an institution which can never go bankrupt; the UK Government)?

Had they wished to hold cash (higher risk, lower earning) in the first place, they wouldn’t have purchased Gilts, would they?

Apart from the fact that cash is also a national debt( i.e. a liability at the BoE), do you now understand the undesirability – and even more so, the pointlessness – of ‘wiping out all the UK National Debt’?

Thank you

Agreed

A very good question & one I’m surprised doesn’t get asked a lot more. This would be my answer:

Current Neoliberal dogma says that to spend, governments need to either tax or borrow, and both of these are bad. Hence, Austerity – especially if it involves cutting taxes for the rich – is good.

Modern Monetary Theory says that to spend, governments have to tax, but they don’t have to borrow. (Not if they have their own currency, like the UK)They have to tax because taxation gives value to the national currency – everybody will need it to pay tax.

But that does not mean that government can spend without consequence. If they create more money than the economy can soak up, the value of the money goes down – you get inflation.

But 97% of the money in the economy at any one time is created as credit, plucked from the magic money trees growing unnoticed in the back yards of the big commercial banks.

So to be able to spend into existance as much money as it needs to build schools & hosptials, clean power sources, energy efficient housing etc, all government has to do is remove the magic money trees from the back yards of those commercial banks.

That’s all.

The big, wealthy, powerful politician owning, civil servant owning, broadcaster owning, lawyer-stuffed commercial banks.

And that’s why all economics is political economics.

But no bank can create money without a government licence

“So to be able to spend into existance as much money as it needs to build schools & hosptials, clean power sources, energy efficient housing etc, all government has to do is remove the magic money trees from the back yards of those commercial banks.”

No. The two are not really connected.

You are conflating ‘vertical’ money (public spending by government of new money via its central bank), and ‘horizontal’ money, which is not really money but credit, created at a keystroke by commercial banks under license from the central bank, but which, crucially has to be paid back, and at interest.

The govt can spend as much extra new money into the economy as there the is capacity for it to be absorbed, without leading to an inflationary boom.

The purposes of taxation are not to fund debts or anything else. Their actual purpose is

a) to give the currency value;

b)to reduce inequality (room for greater tax at top there);

c)reduce aggregate demand and thereby control inflation and

d) alter t/p behaviour ie tax on cigarettes and alcohol.

When received by treasury they are removed from the economy permanently never to be used for anything.

And to reclaim government created money from the economy

And encourage people to vote

Very interesting, but even if debt to GDP is less than reported, is it not unsustainable to borrow to fund current spending on things like health and education(as a pose to capital investment)?

Why?

When the economy needs the cash why is that the case?

“Very interesting, but even if debt to GDP is less than reported, is it not unsustainable to borrow to fund current spending on things like health and education(as a pose to capital investment)?”

If people are confident that the State will provide for their basic needs, which require both capital and current public expenditure (ie. decent and affordable public sector housing, decent education, decent health and social care, decent state pensions and a decent level of social security benefits) then they will be far more inclined to spend as opposed to save.

This in itself will increase the tax take, and reduce the budget deficit, and in time, the national debt.

However, the levels of public debt or deficit are merely a signifier of those savings desires, and should never be used as any kind of target for policy formation.

Spending (on education particularly but also health, R&D and social security) IS a capital investment – human capital precedes all the other kinds of infrastructure. We need knowledgeable and healthy engineers to the build roads and bridges which enable all those other sectors of the economy to thrive.

@Alan,

You may well think that, but that’s not how government statisticians calculate it.

Salaries are considered to be current spending, whether you like it or not, no matter how idiotic it would clearly be to construct a dozen newly built and equipped hospitals or schools, and leave them unstaffed.

Which is why claiming to be able to counter austerity solely via increased public spending on capital projects alone is patently ridiculous.

It’s not really lying. Whatever the Bank of England says it believes is what we have to believe it believes, and as fiat money is nothing more than a belief system, belief is all there is.

If QE were used to cancel debt this would change what we believe about the way the BoE operates and the nature of money.

Debt cancellation via QE would amount to overt money financing – OVF – printing money without a debt obligation to cover the part not recovered in tax. This is possible (and advocated for example in Adair Turner’s book Between Debt and the devil) but not currently something that is in the BoEs playbook. If you go down this route then the obvious question is, why stop at 67%? Why not just cancel all debt?

Until there is policy change, whatever BoE lists as a debt on their balance sheet has to be regarded as a debt that may at some point need to be refinanced.

Personally, I have no problem with the 89% figure. Afterall the >200% post war debt did not prevent growth or future generations being better off.

This quote from http://blog.pfmresults.com/wordpress/?p=248

(which is otherwise quite opaque) sums on the importance of confidence, psychology, etc. i.e., that fiat money is nothing more than an aggregated belief system.

“The macroeconomic impact will also be the same in either scenario, assuming that the composition of the fiscal stimulus package is identical. The only plausible way in which this might change is if the appearance of lower debt in the grant scenario [or QE debt cancellation] created the illusion that government finances were in better shape, and this had a positive effect the economy via market psychology. However, this might be outweighed by the adverse impact on confidence of the perception that government is engaged in unsound and risky financing practices.”

But the point is the 89% is not on the government’s balance sheet: 67% is. So OVF has happened because that’s the only one that matters.

And why cancel all debt? Because that would cancel money, national savings, private pensions and the security of the banking system. We need that stuff

I have no problem with 89% – but I do with a false number and that’s what it is is

I agree that there is no need to cancel the debt or national savings as I called it in another comment but if 89% is fine then that begs the question why cancel any? What was the point of QE?

Did it only happen because the high-priests of economics were so possessed by monetarism that no-one was allowed to even think that fiscal stimulus might actually work?

The reason was to create liquidity

Of course liquidity is not the same as solvency

The banks were solvent but there was a real risk that the fall in demand for new loans would reduce the amount of cash in circulation: QE was meant to keep the system turning

Did it? Good question

“Why not just cancel all debt?”

Because it’s not really debt.

Much as I hate domestic analogies when it comes to macro, do you consider your bank to be “in debt”, and worry about its ‘debt levels’, every time you pay in your salary, or tie up your money in a 3-yr higher interest deposit account?

Of course not; it’s just a safe place to keep your savings, far preferable to leaving them in your pocket or under the mattress.

Well, it’s the same with Gilts, just on a bigger scale.

If Gilt holders would prefer to have cupboards full of cash, or sitting in a non-deposit-guaranteed current account, rather than hold safe government debt, believe me they’d do it.

But would you be happy if that’s where they stored your pension pot, with the lower earnings and higher risk that that would entail?

“Until there is policy change, whatever BoE lists as a debt on their balance sheet has to be regarded as a debt that may at some point need to be refinanced”

It’s being “refinanced” all the time, as Gilts mature and new ones issued. They are immediately bought up again by those who wish to hold enormous sums of sterling in the safest possible form; Government Bonds.

“Belief is all there is.”

But that’s the same even with a currency on the Gold Standard. You can’t eat Gold, and unless you’re manufacturing highly engineered electronic products, space satellites, or high-end jewellery, it’s pretty useless stuff.

However, if you can have all your property taken and find yourself imprisoned, by not handing back copious amounts of fiat currency when the taxman comes calling, you’d better start believing in it alright!

Yes, I agree. Gold is no different, except that someone has to dig it up.

And I certainly believe in fiat money – as long as we all believe it works pretty well, except for hoarding and the distributional problems.

Why is the FT as economically illiterate as the rest of the media and Westminster politicians? Admittedly, I read only the Saturday edition so maybe I get a highly biased view, but their Leader writers and journalists don’t seem to understand (not that I do either) MMT and where money comes from and how govt spending is financed.

Or much else come to that

I see it all the time, people ranting we have debt of £1.7 trillion, able to quote a headline figure without any context.

It was done on Radio 4 this morning

Profoundly anooying

In BBC interview with Lord Lamont on Today programme this morning he repeated 89% figure as justification for maintaining austerity policy, without being challenged by interviewer!

I’d say the interviewer encouraged it

What really annoys me is when a Government minister blithely state that the interest on the National Debt is costing almost 50 billion a year (48.4bn), and no one pulls them up on it.

There is a readily available Parliamentary briefing paper which is regularly updated with the amount we pay in interest on the National debt – 35.2 billion. The difference is the rebate which Richard often refers to payed back to the Treasury by the BoE via the APF.

http://researchbriefings.parliament.uk/ResearchBriefing/Summary/SN05745

Agreed

Thanks for the link. There are two more points worth mentioning

1. the interest paid as a percentage of GDP is close to lowest paid since 1955 (may be earlier).

and

2. much of that interest is paid to anyone with a pension so effectively just recirculates in the economy anyway.

Still interest on debt is regressive so need to make sure that spend and tax is progressive to rebalance.

Oh, good point! The rhetoric we’re force-fed is all about that debt we’re passing on to our children, and yet (either deliberately like the magician distracting our attention, or out of ignorance) they never mention that the actual interest paid is at, or near, it’s lowest.

I suspect my children, and theirs in turn, would be chuffed to bits if I bought them all nice big houses then ‘lumbered’ them with a 0.25% debt (in perpetuity if needs be)when they discovered, on my passing, that I’d borrowed the money.

A Bank of Mum and Dad…owned by the family, able to lend the family what it needs, and happy to roll over the debt at a very low interest rate as long as the family keep those very low interest payments trickling in. Or the Bank of Osborne and Partners – we want that loan paid off…in the next five years. B b b but we won’t be able to afford a holiday…or a car…or food. The local shops and factories and restaurants will go out of business. We don’t care. The Conservatives – 2017 (etc!)

On the subject of what Gov ‘debt’ really is (for fiat currency sovereigns like US, UK, Japan etc., but not Euro members)…

For Gov (faux) ‘debt’ – Bond – holders, it is akin to to savings deposit (term account) type facility, but which has one major advantage for the large sums banks and others place in Bonds… it is 100% secure, to full face value, backed by the Gov, the currency issuer. Whereas UK savings accounts (as all accounts) are limited to £100k deposit insurance.

This is why there is plenty of demand for such Assets, as opposed to holding £millions in some bank or other vehicle with ‘risk’ attached, even tho’ the interest can be (as now) less than the inflation rate.

From the Gov point of view, including its central bank, BoE, Fed etc., Gov bonds are also a vital part of forcing a ‘base’ interest rate, or interbank interest rate to target.

It works like this… if, say, the BoE, wishes to impose a minimum interest rate in the banking system, as in, on banks’ reserves needs, then the BoE must ensure that there is just a sufficient shortage of liquid money in the system to force the ‘price’ for borrowing (interest) upward to its target rate.

Gov Bonds are, in reality, purely a ‘monetary’ policy, or system operation, run in conjunction with their management of the banking system’s aggregate reserves. They are simply an Asset swap, parked cash to Bonds.

A good explanation is here:

http://libertystreeteconomics.newyorkfed.org/2017/06/the-role-of-central-bank-lending-facilities-in-monetary-policy-1.html

A very good question to be asking then, is…

Why should the Gov/BoE set an interest rate above zero at all, which means providing Corporate welfare for high rolling Bond holders, for nothing whatever that Gov *needs*? (It’s the currency *issuer* remember.. doesn’t need to ‘borrow’.)

No reason at all really.

And before anyone mentions Pension Funds need for such assets… the entire notion of mass saving for pensions is itself an absurd and counter productive (ag. demand killing) Paradox of Thrift…

Of course, BoE interest rates above zero is supposedly the Gov/BoE way of regulating the economy for inflation and/or unemployment… (not that the BoE or any elites give a flying f** about the latter, in reality..)

But the Gov itself can do far better job of regulating for inflation and unemployment (or use of max productive capacity), if properly managed by real economists, not the mainstream frauds, using its vastly more powerful and direct Fiscal policy abilities..

If, by chance, you have concluded that the present operating protocols of both monetary and fiscal policy are deliberately skewed toward an economy operating persistently under capacity, with high unemployment, solely to prioritise the narrow economic interests of the Capital owning elite minority (~5%?) in society, then you would be 100% correct imho.

Thank you. I shall read the New York Fed. paper. Are central banks everywhere suddenly “telling it as it is”? Why? Pinch me someone. I was thrashing around the issue of interest rates above zero to Bond holders for “no reason at all”, without quite arriving there. Still do not quite understand how that works (very counter-intuitive; maybe I am just naive).

Sorry Professor Murphy, I ‘snuck back in to the thread’. Mea Culpa; but it is interesting and I have found it very useful.

Thanks to you, to Mike Hall and well, – everyone. This is a good place for discussion and reflection.

My problem is with “no reason at all really”. While it has a stark simplicity I am a little doubtful that nobody would have registered any scepticism that it has survived so long, with so much at stake, and on this scale. At the same time if there is inflation then there requires to be a mechanism (let us assume full employment) to inhibit it. Taxation is one mechanism, but is the interest rate not another usable mechanism; and probably more rapidly applied, and more rapidly removed, with less disturbance to the system than taxation, with all its leads and lags?

The interest rate has not been an instrument for a decade

And may not be for another decade

Let’s live in the real world then and not create punishing interest rates for real people just so we can control inflation we have not got and which can be better tackled with tax

You really are making up a solution for a question that need not be asked

It seemed to me that the operation of the SOF lent credence to the interest argument you and Mr Hall were making yesterday; and against my slight scepticism. I confess it slightly surprised me.

I should say on your earlier reply to me this morning that I do tend to take a longer view of the relevance of the “real world”. We forgot some of the key lessons of 1929 and made quite similar mistakes with complete, dull insouciance in 2007/8. Hyman Minsky saw it all coming, and he died around 1994. History teaches, and it tends to come round again, and again, and again. The constant in the equation is humans. I also think the “science” of economics is in a rahther brittle state and everything (old or new) requires close textual analysis and the sceptical rigour of a Pyrrhonist. I take nothing for granted.

Surely the interest rate has to reflect the desire to inhibit inflation? That would seem to make sense, not least of recent history (and in spite of Mr Hall’s scepticism/cynicism).

“.. Surely the interest rate has to reflect the desire to inhibit inflation?.. ”

Well, that is the argument they make… aka make money more expensive in the real economy (and stagnate growth) thru’ the indirect mechanism of making banks’ reserves more expensive. (Not, note because banks’ need or use Fed funds to provide loans… they create that money ‘ex nihilo’ as required, as the BoE terms it.)

However, it is vastly easier and more direct to use fiscal spending or tax powers to not just moderate inflation, but actually target the specific sectors where it is arising.

Absolutely

Following up on the New York Fed paper Mr Hall linked yesterday, I see that the BofE’s Standard Operation Facilities (SOF) have two roles: “The first is to provide an arbitrage mechanism in normal market conditions to prevent money market rates moving far away from Bank Rate. So they are a vital part of implementing the Bank’s monetary policy. The second role is to provide a means for SMF participants to manage unexpected (frictional) payment shocks which may arise due to technical problems in their own systems or in the market-wide payments and settlement infrastructure” (BofE website: SOF page).

Notably the SOF has two parts: a “Lending Facility” (interest rate 5%); and a “Discount Facility” (interest rate 0%). The Deposit Facility is “uncollateralised”.

I learn something every day. I would be very interested in Professor Murphy and Mr Hall’s comments.

I am not sure what you are asking me to comment on

Second ‘mea culpa’: for “discount” read “deposit”.

What a ridiculous manipulation of economic statistics.If the assets of the BoE are consolidated with the liabilities of the government, then the liabilities of the BoE should become liabilitiesc of the government. The BoE owes money to the banks. In other words, the composition of the debt has changed but not its total amount.

Effectively the government has covered its deficit by creating money but it is still a debt

There is a liability to no banks

It’s called money

New money created by the BoE

God, it’s a hard slog Richard eh? lol

And yet Philip Hammond is quoted in saying, at the CBI President’s dinner 3 July, that:

…but total debt is still too high and leaves us vulnerable to another shock of any kind.

His entire speech seems devoid of any common sense and yet this has been lapped up by the CBI and media as the gospel truth…

The speech has been posted online at https://www.gov.uk/government/speeches/chancellor-at-the-cbi-presidents-dinner

See blog coming soon…

[…] will we have to repay the debt? The answer is no, of course we will not. Firstly that is because we have never repaid the national debt. Second, that is because we not only know we do not need to do so, but know that it would be […]