I was discussing the state of the finances of the UK's large metropolitan authorities with a councillor with reason to know about them over the holiday period. Their concern was real; in fact I'd go further and say it was anguished. Faced with the impending imposition of the benefit cap, further benefit cuts from April and an effective and heavy further cut in central government funding in an area where council tax revenues provide only a small part in the overall revenues of the authority, their conundrum does seem to be legally insoluble.

They are legally required to deliver a balanced budget.

And they have legal obligations to house the people they must evict from properties for non payment of rent as a result of the combination of the bedroom tax, benefits cuts and the lack of smaller properties that they can move people to. They are also subject to constraints on providing over-crowded housing. And that is the problem in just one part of the service they must supply.

I presume the tale of very real woe I was told is not unique to the location that this person represented: I have checked and it appears commonplace to many large cities, as the Observer reported yesterday when noting that Sajid Javid is demanding councils keep to a maximum, five per cent tax increase even if much higher is needed to ensure legally required services survive.

I had only one answer to offer at the time. I referred to the government's sleight of hand with QE on which I blogged yesterday. Despite deficit claims the government will only borrow £8 billion this financial year. Using its power to create money it will pump £60 billion into the economy this year. That is £60 billion of debt it will not have to repay because it already owns it. And £60 billion it will not pay interest on, because just to make clear that this debt really is cancelled, no interest is paid to the Bank of England on its supposed holdings of government debt. That's because they aren't debt at all anymore.

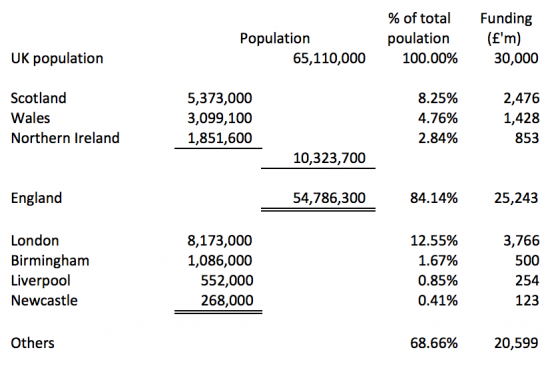

Now let's suppose that the sum in question had not been used to buy government debt already in issue, which had been issued (I stress) to fund central government current spending, but had instead been used across the whole spectrum of government to support what government, whether local, regional, unitary, devolved and central, could do to improve economic well being for the future. Let's allocate just half of the £60 billion to this purpose. Then let's allocate it to devolved governments (they can decide if it needs to be distributed further) and UK councils (of which I have picked just a few a examples). The ONS provided country population data. Its website is so appalling that as usual I could not find other data I needed on it without spending too much time on the task so City data is apparently 2011 census based from here: it will do for illustration. I have simply allocated £30 billion based on sample populations as follows:

Suddenly the funding of local government is transformed because the power of the state to create money out of thin air has been shared.

Take Liverpool as an example, simply because the Observer sent me in their direction because they publish a funding model. This model allocates them £254 million a year. Liverpool is currently looking for savings of £90 million a year on top of the £330 million it has already lost overall a year since 2010. £254 million would not have stopped all the cuts but it would have made a massive difference. And it's not unrealistic to think that this sum could have been made available annually without impacting real inflation. That's because if half of all QE since 2009 had been allocated to councils and devolved governments the average sum allocated a year would have been £27.2 billion and Liverpool would have enjoyed £230 million of extra funding a year from 2009 onwards.

In that case there would be no social care crisis.

There wouldn't need to be 120,000 children without a home in the UK right now.

There could be better housing.

The list of what could have been achieved is endless.

But government kept the power to create money to itself and used it to benefit bankers, to boost house prices in the south east of England and to inflate the value of the stock exchange.

That was its choice. I would suggest it was the wrong choice.

I would suggest councils should be saying so as well.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Are there any MPs you would trust to articulate your understanding of UK Govt finances whether or not they agree with you in whole or in part?

Caroline Lucas

Anyone else?

Not sure

Angus McNeil in the SNP is a good chance

One might draw the conclusion that the lower house currently has no role to play in the construction of a fairer social contract.

What’s driving me nuts in Labour not saying anything on this subject. Am I missing something?

No

What’s needed now is a council of all the councils to decide on a united rebellion against central government. This itself may end up being a preferred version of government, one which the population will find ways to endorse. I wonder if May(hem) and her henchmen have considered this possible consequence?

I tend to agree….

The picture of local government finance that you paint is clear and one I’ve shared since 2009. It’s precisely the reason I have little sympathy left for council leaders and senior department heads who trot-out the pathetic excuse of ‘Central Government is imposing cuts on us; we can do nothing about it’. Because not only is that not true it’s a damning indictment of the calibre and leadership (or lack of it) they have exhibited in the last 8 years.

‘What could we have done?’ they bleat; plenty, is the ready answer. They could have used a range of options available to them within the legal and operational rules that form them. But they have failed to do so for nearly a decade. If you act like a doormat you’ll be treated like one, as my old mum used to say.

In addition they could have worked effectively together (why not on party lines?) to present an effective opposition to the Tory central government; working in concert WITH Scottish and Welsh governments to oppose the funding results that denude midland and northern and regional devolved governments of funds at the expense of central departments and the south east. The normal answer is ‘because we’ll be put into Special Measures’ but that’s not true if 50 borough councils do it at the same time, is it? But they failed to do so.

They could have worked in co-operation with unions and the TUC to show their backbone against such anti-worker innovations as offshore executive contracts. Why WAS’NT the first action of a council cabinet which has the interests of its workers at heart on the morning after the first Chief Executive service contract through Luxembourg being installed to instruct union briefs to create exactly the same sort of vehicle so that ALL council union employees could be paid in the same way, thereby denying huge sums of UK tax to the treasury, and revealing the iniquity of the arrangement to all? We’re not ‘All in it together’ so don’t act as if we are.

And why not get really creative? Develop a local equivalent of a tax remitted to central government and substitute it? Local National Insurance, local business taxes, local levies etc which divert the funds at source from central government to local councils? ‘They won’t be legal and Central Government will fight them!’. Yes, they will but only after the fact and through the courts is it possible to do so; would you like to be on the government side in the inevitable 4 year legal battle that ensues when the message is crafted that it’s solely in response to the blatantly real unequal treatment of the regions by Westminster and the Treasury that the case has to be fought? Have you become aware of how distrusted Westminster politicians are compared to Estate Agents and Vacuum cleaners salesmen? They’d lose even more of the popular vote and reconsider the funding formulas when faced with mass revolt.

But none of this happened. None of it. The people in position in councils through the last decade of deliberate austerity-based cuts was imposed on local government funding budgets did nothing. Relying instead on trotting-out the ‘We can’t do anything about it; it’s the nasty Central Government what did it all, guv.’ Which is true but nowhere near the whole story, in my opinion. When the real picture is portrayed, Richard, as you have done in this post, many more people will come to the conclusion that not just national politics is broken.

I tend to agree local government is weak

My next blog on the issue will attract your support, I think

Tomorrow morning, I suspect

I agree, I’ve worked with a few local authorities, I wouldn’t trust them to run a bath.

I think that too general to be useful

There are one or two that are sort of competent but a few are run like a bad secondary modern.

AllanW assumes that all councils would be in it together on this one. In fact a fair few have done relatively well in recent years – mostly smaller Tory rural districts. They don’t do social care, so aren’t feeling the pinch from that angle. Their taxbases are strong and the way the cuts have been implemented has not affected them as sharply – and by the same token they can raise more money more easily from council tax. Quite a few are buying up commercial properties and trying to live off the income – the leader in ?East Hampshire has stated he wants to reduce council tax to zero by 2025.

I don’t think councils do themselves any favours by talking up ‘financial autonomy’, as they have been doing for many years. Councils with huge variations in taxbase cannot be ‘financially autonomous’ and also run needs-based services based on legislative requirements. That needs to be the starting point for any ‘solution’ to local finance.

“AllanW assumes that all councils would be in it together on this one.”

No, I don’t.

And I think there is very proper logic on their side to rebell – they are to be so underfunded that that will be obliged to break the law in one respect or another. To me I’d have thought mass resignations could be more effective – so elections would be required, which would be fought on the basis of realistic funding or councillors, when elected, will refuse to take up their posts.

There is a basis for judicial review here

MayP;

“mass resignations could be more effective — so elections would be required, which would be fought on the basis of realistic funding or councillors, when elected, will refuse to take up their posts.”

Yes. These and many, more many options are available to local officers and councillors. None have been taken. In fact the rush to regional devolution shows there is no lack of appetite on the part of these people for shouldering the austerity burden on behalf of central government; for example, the Greater Manchester Combined Authority has agreed to implement a five year strategy in which current health requirements across the region will be more than 2 billion pounds underfunded.

I’m in Elmbridge and starting this year we’re turning the street lights out at midnight. And this is Elmbridge! An environment where Tories get elected automatically seemingly without thought or reason. God knows what other places must be like, Labour heartlands for example. So not everywhere Tory is doing well, not unless the local councillors just like messing us around for the sake of it, always a theory I suppose.

Clearly government could have borrowed an extra 30bn and given it to councils to spend.

If the government had done as you suggest the BoE would have given the councils the money and real government debt (ie debt not owned by its subsidiary the BoE) would have been higher by £30bn.

I don’t understand why one of these scenarios is better or worse than the other.

Of course some are better than others

In some people are not suffering

In the one chosen they are

It is true that too many Councils are poorly led. But this is a point that I feel does not need to be made.

The Tory record on funding Councils (who should actually be the local delivery mechanism for national policy) has been utter rubbish since Nicolas Ridley to be honest. The only policy Councils seem to be delivering now is austerity.

If you make swinging cuts to budgets, even talented leaders are faced with huge problems so what hope is there in weaker Councils?

The main issue is this in my view: whether weak or not, our local Councils should not be put in this position in the first place. It should not be happening but it is because by making Councils seem ineffective by under funding them, the Tories are creating the context for Councils and local democracy to be got rid of and replaced with say your local Rotary Club or volunteers or what about NOTHING AT ALL? Or what about the local Duke and Duchess calling the shots on who gets what and who deserves help and who does not?

And do you think that I am joking?

I know that is exactly what is planned

I think I’m getting this now. Rather than rights being observed by elected officials and monies being allocated accordingly, there will only be alms distributed only to those poor considered to be deserving, this by people who are better suited to do so by virtue of their high birth. Does this sound about right?

Well Bill it seems like it to me.

The people who may end up in charge are those whose pictures we see at elite social gatherings and events that we see celebrated in various in local media.

Many Councils in the Midlands are teetering on being bankrupt if not already so.

So many are selling off assets to raise cash to the private sector – land, buildings – which of course is a form of privatisation and a loss to the common wheal. If Councils have no assets, what are they supposed to borrow against for god’s sake when there is no Government grant??

Basically it’s pretty shitty in my view. It’s government nudge policy.

But still we have people banging on about issues with the public sector like they still do about unions when in fact the results of the subjugation of Councils and unions have been self evident for years.

Will get to this issue soon….

I am no economist, so hence my question. I understand that, if the government had done as you suggest, there could have been more houses built and less services cut. But can you say what the macro effect on the economy would have been? I am thinking growth, tax revenues etc. Are there heuristics that link local government spending to economic activity?

As Keynes put it, when in a downturn (and we still are) spend and you increase employment and tax revenue

It really is that simple

The IMF and OECD now agree

I realise that you know Richard.

It’s others however who don’t and think that reminding us that the public sector is not perfect is introducing some sort of ‘balance’ when in fact I cannot think of a sector that has been so ruthlessly undermined by Governments for so long.

You can read all sorts of criticism about the public sector – I remember Professor Martin Laffin’s 1990’s book about professionalism in the public sector where he went over much of the critiques of self seeking behaviours etc., as if they alone could only be found in the public sector (Laffin himself questioned this BTW).

However, much if not all such theories described as being unique to the state and public sectors by such (usually right-wing) theorists can also be found in the private sector too (of which I spent 15 years of working life).

Below is a really accessible article from America of all places looking at the perceptions and realities of public (state) versus private narrative.

http://www.governmentisgood.com/articles.php?aid=20&print=1

Thanks

Could councils support local currency initiatives (like HullCoin) and create their own QE programmes in local currency?

No: for a start local currencies only work when exchangeable into sterling and that means the QE would be in sterling too

It’s not looking very good. The UK will be hit badly by the double whammy of MSI (Monetary System Illiteracy) and Brexit. Apart from the Green Party and maybe the SNP widespread lunacy abounds!