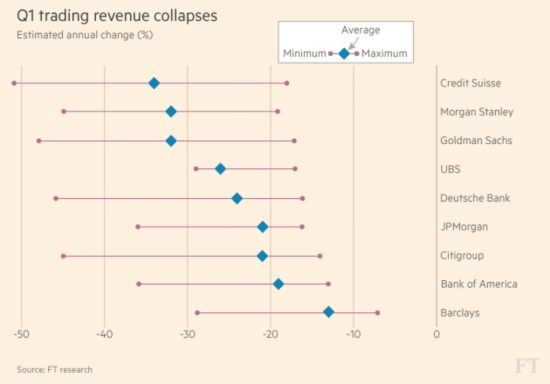

According to the FT the trading revenue of most investment banks collapsed in the first quarter of this year:

As the FT notes:

Trading revenues are especially important to the European groups because they make up about three-quarters of their “investment bank” revenue. The category also includes fees charged to clients for advice on stock market listings, debt raising and mergers and acquisitions.

What this collapse - reflecting the decline in asset prices and the fall in appetite for risk - records is crisis in a major industry. Now I am not mourning it: this is a largely parasitical, rentier activity that does not add value to the economy, but costs it dear. But, and the point is important, such a scale of collapse brings risks. These banks are 'too big to fail'. Only one noted here is British, but be sure there are knock on effects. And banks are already, in my opinion, under-capitalised. We are at risk of being in bail out territory because this collapse must lead to losses.

Those watching the steel industry should take note. That adds value, but we know where the government's heart lies. There may be trouble ahead.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Yves Smith (Naked Capitalism) has been spreading alarm about European banks for a couple of months now

http://www.nakedcapitalism.com/2016/02/market-freakout-as-bank-stocks-in-europe-and-us-tumble-japanese-stocks-plunge-and-bonds-rally-in-panic.html

http://www.nakedcapitalism.com/2016/01/wobbly-italian-banks-may-get-bad-bank-resolution-vehicle.html

http://www.nakedcapitalism.com/2016/02/hard-times-for-italian-banks.html

It all sounds a bit complicated, but as I understand it, the new supervisory regime will be Germanic, but the problems it throws up will devolve to weaker countries and depositors

Not sure why comments are currently closed on the thread above about people’s QE for the steel industry, which takes the closing theme of this thread in a logical direction.

However, the obvious point which will be made here is a comparison of the UK Government’s differing approach to manufacturing industry – in this case the steel industry – and finance when it comes to financial support.

I have picked up some chatter this morning suggesting this could be due to problems with UK power/energy generating capacity. The argument being that existing generating capacity is insufficient to sustain supply and that heavy energy intensive industries like steel manufacture – and a proportion of those plants at risk produce specialist high grade steel – are being sacrificed as no one wants the lights to go out on their watch.

It would certainly be interesting to see some empirical substantiating data for such an argument, particularly when considering existing known facts such as the UK Government’s deal to build nuclear generating capacity with the Chinese whose massive steel subsidies appear to be the source of the economic case for closing down yet another periphery outside London industry. Perhaps that’s why the UK Government argued in the EU to limit EU subsidies for European steel production, knowing increased subsidies would upset their new partners and might jeopordise this deal.

Not at all sure! A mistake

The energy argument is a very weak one, especially when the Tories still can’t make their mind up about the Swansea bay tidal lagoon project sitting waiting for approval and which could provide massive amounts of electricity every day and night without fail.

It is just a complete lack of joined up thinking from a government with insufficient mental synapses to connect the glaringly obvious dots!

Plants like Port Talbot use, as their main energy input, coal. Sure they are big users of elec’ (which is partly why 2x double circuit 400kV lines run past the place)- but Port Talbot does not use elec as a primary input to make steel.

I put the current convulsions down to Tory competence or rather lack thereof, coupled to a total disinterest in people that generally vote anything rather than Tory.

Mike Parr – any idea where they get their coal from?

My guess would be the lowest cost provider no matter what the externalities result in e.g. domestic mine closures, pollution from shipping, unemployment etc etc.

The Tory “free market”, “private sector”, “globalised financial interests” ideology is what is driving this and so many other UK “lack of public investment” decisions. Despite all evidence to the contrary that following this failed ideology for the past 40 years is why the population of so many developed countries are falling to rack and ruin.

A sane industrial policy is not their interest, the division of the financial spoils amongst themselves, their friends and their backers is what they really care about in my opinion.

You can be sure that Javid, Osborne, Cameron et al will be talking to all their City mates to find any way they can to avoid re-nationalisation by the UK government, even if the eventual deal they come up with costs the UK public and the Tata UK employees an even greater financial cost in both the short and the long term. Even one re-nationalisation under their watch would be a signal of the failure of the Thatcher/Cameron ideology at a time when they have plenty more privatisations in the pipeline.

These are the wasp larvae killing their hosts.

But don’t worry unlike the UK’s steel industry which must suffer the consequences of the “free market”, these banks will be cosseted by a special form of “socialism”.

BAIL INS

having exhausted the scope for earlie version of socialism “BAIL OUTS”.

I will leave it at that, because I fear that should my thoughts be expressed in words, my language would be rather immoderate!

Interesting that many of these are the US based global banks/speculators which supposedly are in better shape than their European peers. Not sure the US is prepared to bail out their banks again now that the public has realised the game that is being played out.

But if they try to do bail-ins in the US, that is the point that I expect to see armed (middle class) vigilantes out on the streets, because you really don’t try to steal money from a heavily armed population.

It would not surprise me if the US considered full nationalisation of its banking system as the only viable option in the next financial crisis. Interestingly I watched the Obama documentaries on the BBC yesterday, followed by part two of Michael Hudson on Days of Revolt.

Worth considering what Washington does next if the sh*t hits the fan again in Wall Street.

http://www.bbc.co.uk/iplayer/episode/b07470xw/inside-obamas-white-house-1-100-days

http://michael-hudson.com/2016/03/traumatized-worker-syndrome/

The Hudson interview with Chris hedges mentions that Hudson was the godson of Leon Trotsky – now that’s something to have on your c.v!

The Michael Hudson interview is fascinating if troubling. He stresses the importance of outlining a proper alternative to the neoliberal line. And whilst Sanders is at least doing that for America it hardly seems to be happening here. McDonnell still gives the impression of polite othodoxy…

Meanwhile there is a programme on radio 4 tonight about the way economics is taught

http://www.bbc.co.uk/programmes/b074zgr2

which might interest many of us!

I ought to listen

MayP the interesting thing about watching the Obama documentaries though is how little power the US president actually has over domestic policy (unless he has a majority in both the congress and the senate which Obama has never had). US politics is clearly a game of luck and maths, almost as much as it is about money and the media.

Corbyn/McDonnell actually would have significantly more leverage in changing domestic policy in the UK if they won in 2020 by a reasonable majority (or even with a strong left of centre coalition) unless the Tories have succeeded in stuffing the Lords with their cronies and rigging the constituency boundaries by then.

Even without majority support in the less than radical House of Lords, the principle of parliamentary “financial privilege” has been used by the Tories to force through attacks on welfare and disability benefits, so there is still plenty of scope for reversing the Tory cuts and taking apart their new class war agenda.

It could even happen later this year or early next year if they lose their majority over the EU vote or other matters e.g. gaming the 2015 election spending rules. There is still hope!

France in uproar over loosening of labour rights (working hours/sackability etc)-general strike in the offing, huge protests all over country -and this under a nominally socialist Government- surely a sign that the neo-liberal oil tanker is in reverse?

I do agree almost entirely, but the prospect of having to wait until 2020 fills me with dread. I do hope the Conservatives rip each other apart after the EU referendum so they can no longer continue, because I think the election spending rules case will be protracted.

Or I suppose we could ‘hope’, on the basis of the current post, for another banking collapse.

But for me the real fear is what Hudson calls “The Dark Age is what happens when the rentiers take over”, which the Tories seem determined to facilitate.