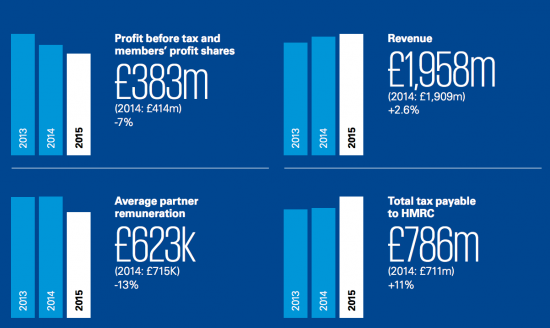

KPMG's 2015 accounts were drawn to my attention by Alex Cobham of the Tax Justice Network yesterday. They include, upfront for all to see and absorb, this extraordinary table:

Taken at face value, and I am sure that is what KPMG would wish, the claim made is amazing: KPMG pays 40.1% of its revenues in tax, a sum that represents 205% of its profits.

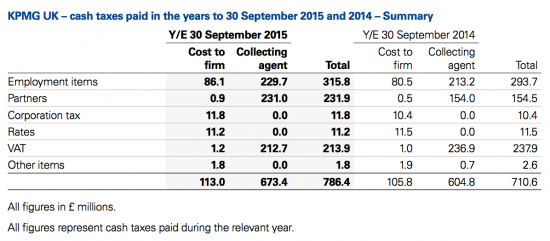

Then go to the detail and you find this is not the case:

The business actually paid £113 million in tax, much of which would have been treated as a cost itself capable of offset against income in the calculation of taxable profits of the partners. And the rest? That was paid by employees and customers and had nothing to do with the partners as such at all. What is more, the figures are actually supplied on a cash basis, so they are not even prepared on a basis comparable with the rest of the accounts.

This then is neither relevant or reliable evidence in accounting terms. Nor are the figures included comparable: some are based on pre tax data and others on taxable income and others still (VAT) on neither. What is more, a cash basis is not consistent.

To be blunt, this figure that KPMG trumpets is accounting data of the lowest form. In fact, it is hard to call it accounting data at all so flawed is the basis on which it is prepared.

I have welcomed KPMG's interest in the Responsible Tax debate, but providing data of this sort does not help them or that debate. This is just propaganda when facts based on proper accounting are needed and that will not do.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“The business actually paid £113 million in tax, much of which would have been treated as a cost itself capable of offset against income in the calculation of taxable profits of the partners. And the rest? That was paid by employees and customers and had nothing to do with the partners as such at all.”

Isn’t the £231m figure of tax on the partners’ line what the partners’ tax bill was? If so it would not be correct to say that the rest of the tax other then the £113m was “nothing to do with the partners as such at all”.

You are criticising KPMG for not being clear enough. Are you calling for all LLPs to publish full details of the tax their members are paying?

An LLP has no radon to know what a partner’s tax bill is

And it remains the case that they are adding apples and oranges

I was not saying they need publish their tax: I do nit call for the publication of individual person’s tax bills

So you get it all wrong, as usual

“An LLP has no radon to know what a partner’s tax bill is”

You will find that KPMG has a centralised tax function. Payments of Member tax arising from LLP profits are calculated, managed and paid on behalf of the Members by that function.

So KPMG certainly do know what the Members’ tax bill from LLP activities are.

That, I am certain, will be where that figure of £231m comes from.

So you have got that wrong.

They may choose to do that

BUT they are not required to do so

I remain right

So they paid 3% corporation tax then in 2015!

How does that work then?

This is an LLP

Most is paid by the partners

But it looks like employer’s NIC in respect of the salaried partners is included in this payments

THe CT is only dud on the audit practice

So I wonder how many of their partners have taken “aggressive measures” to reduce their personal tax liability?

I’m sure they will be using every trick in the book to reduce their taxes to the absolute legal minimum.

Be nice to be able to see a comparative total “corporation tax” rate for an LLP versus a PLC (i.e. what the company owners/shareholders are really paying).

This is “total tax contribution” isn’t it? Essentially KPMG are volunteering additional information that they are not obliged to disclose. For PR reasons, of course, but so what.

Many (perhaps most) large professional partnerships (and LLPs) will know something about their partners’ (or members’) tax bills. As I am sure you are aware, they will typically pay monthly drawings after deduction of an amount on account of tax (which is often used as working capital until the tax is due) and arrange for the tax to be settled centrally (the firm does not want a partner to fail to pay their tax). So the £231m is likely to be pretty close to the cash tax paid by the partners in the relevant year on the taxable profits of the business.

Income tax paid in cash in the year to 31 September 2015 will include payments on account in January 2015 and July 2015 for profits in the 2014-15 tax year (the September 2014 accounts), and a final amount in January 2015 for profits in the 2013-14 tax year (the September 2013 accounts). (I hope I have got my basis periods right – no doubt someone will correct me if not – but the point is that in principle you can connect the payments to the years.)

The partners own the business, so between them they paid about £344m of tax as a result of their firm’s activities, and acted as an unpaid tax collector in sending another £442m to HMRC (mostly PAYE, NICs and VAT).

Actually a lot if that £231m is PAYE I suspect and includes employers NIC I suspect on Schedule E partners

So it is not as you suggest

You can’t get a 60% tax rate otherwise

So again the data is misleading

So what is the £231m? Payments on accounts of partners income tax/NIC’s? If pre tax profits were £383m that implies a 60% tax rate. Is that enough for you?

I suspect many of the partners will be paying much of their tax at 45%

And many will be in Schedule E so employers NIC will be due

Nearly 60% is plausible on that basis

Except that payments made during the year to 30 September 2015 would relate governed by 2013/14 profits. The January 31 2015 balancing payment for 2013/14 and payments on account of 2014/15 based on the 2013/14 liability so we cannot compare profits earned in the year to September 2015 with tax paid in that year.

“Many will be in schedule E”?

Do you have a source for that remark, Richard? My understanding is that few Big4 Members have been caught by the new rules in ITTOIA 2005. Besides, any Member so caught would have their salary treated for accounts purposes as an employment expense and so tax paid by them would not be in the £231m. Certainly all indications in the accounts are that the £231m is Self-Assessed self employment income.

I suspect a significant number of partners are not equity

I may be wrong

Let me ask you: do you know?

I have offered lausible explanation

So far you gave added nothing

Kpmg don’t have salaried partners. Only Deloitte in the big 4 have this grade

OK

And alternative explanation of the high tax rate has been offered

It all comes down to using cash accounting – which as I said is not reliable for any purpose

What is the point of publishing this information if no-one can understand it?

What is a “collecting agent”? Is this a common term in use by LLPs?

Is KPMG the collecting /paying agent for its partners / employees.

It is propaganda

“Collecting agent” no doubt refers to the tax that KPMG collects from others in its role as unpaid tax collector, such as the income tax and employees’ NICs on its employees’ wages collected through, and the VAT is gathers from its customers.

I expect “cost to the firm” will include employer’s Class 1 NICs, irrecoverable VAT incurred on the firm’s own costs, tax due to non-deductible expenses (such as entertainment).

I also suspect few if any of KPMG’s partners will be taxed as employees, even if they are not full equity partners. Most likely, they will fail one of the tests in the salaried members rules: either enough of their profit share will be variable, or they will make a large enough capital contribution.

As Pardeep says, the cash tax actually paid in the year to September 2015 would be based on the 2012-13 profits, which were higher, about £455m I think. 231/455 is about 50%.

Maybe

Ah, propaganda, the tool of choice these days, as pioneered by HM Government and refined by those who know how to make the most of it.