As yesterday's Guardian article on the mess Jersey finds itself in noted, that island is facing a financial black hole of £125 million a year. And what slightly irritates them is that I forecast that this would happen as long ago as 2007.

Now, I admit, I forecast that the problem would arise sooner that it did: I did not anticipate that Jersey would be willing to sell everything including the kitchen sink in an effort to stave off recognition of the fact that they are, essentially bust, but the reasons why the problem has arisen are almost exactly as I forecast and the sums involved uncannily similar (weirdly so, in fact: forecasting should not be this accurate as to scale). So I thought it worth sharing that 2007 blog here since some people have asked how I did this:

Jersey has published its budget for 2008, which includes forecast to 2012.

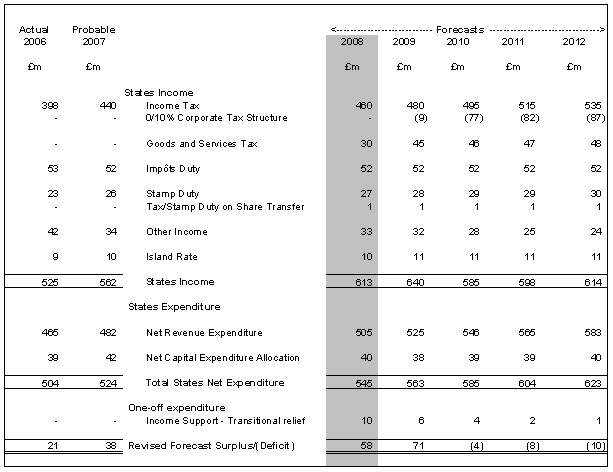

According to the budget all is well in the Isle. Having had a good 2006, with tax paid above expectation, it is forecasting much the same in 2007 (when tax receipts are based on 2006 profits). And it assumes the good times will continue to roll. This is a summary of their projections:

Near as makes no difference there is an implicit growth rate of 5% in the top line, which is the only line that makes this whole equation work. But, as the notes say:

The 2008 revenues are based on specific assumptions about the increase in taxable profits, earned and unearned income for 2007. These forecasts are cautiously optimistic but do not and can not make specific adjustment for the recent ‘credit crunch' as figures are not yet available.

I think the term ‘cautiously optimistic' is a little wide of the mark. The ‘credit crunch' is on the offshore financial markets. It's the SPVs, SIVs and CDOs that are based in Jersey and elsewhere that are being wiped out. New issues are not happening. This credit crunch is not a stage removed from Jersey, as for example the 2000 downturn was. This one is bang in the centre of St Helier for all practical purposes.

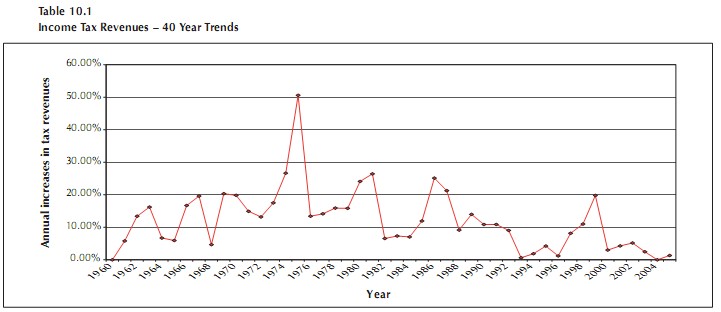

So its important to look at what happened the last time Jersey experience the boom times. This graph shows trends in Jersey tax revenues, and is from its 2004 budget (not on line):

In booms (1984 — 87 and 1996 — 2000) Jersey sees very high tax growth. Afterwards it can flat line. It does whenever there is a downturn in the market (1993 — 1996 and 2000 — 2005).

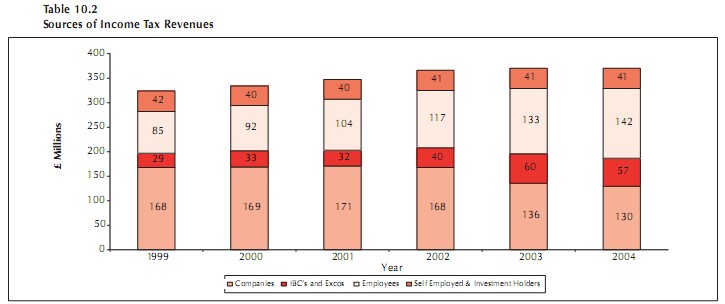

This graph shows that, again from the 2004 budget and showing real revenues to 2003 and anticipated 2004:

The top line would read:

1999, £324m

2000, £334m

2001, £347m

2002, £366m

2003, £370m

2004, £370m.

The actual income in 2004 was, according to the 2006 budget £363m and 2005 was £370m. So, for five years (2001 — 2005) real growth was 1.5% on aggregate, and effectively 0% from 2002 to 2005 inclusive, a real decrease when inflation is considered.

But on the back of two good years Jersey is now forecasting growth of 5% when there is every sign that it's only core business sector is in crisis. 0% might be a good substitute.

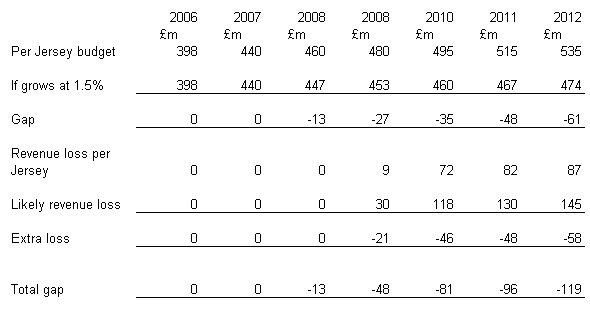

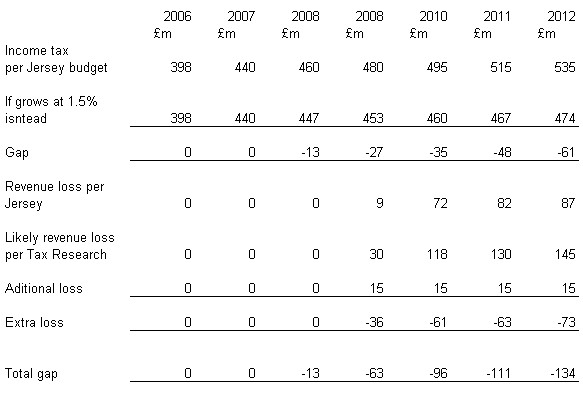

And the loss from 0 / 10 needs to be properly stated. It is not £77 million on 2010 — even Senator Le Sueur admits it is much higher than that now. I estimate (using his own data) that it is at least £118 million, which will of course rise with inflation. So, let's substitute growth at a generous 1.5% and this real loss into the forecast and this is what happens:

But that's not the end of the story. It's ludicrous that the Budget is based on an estimate of the impact of 0 / 10 calculated in 2005. Tax revenues that year were £370 million and the revenue loss was estimated to be £85 million and income from companies which will give rise to the loss was just £186 million (source, 2006 budget). In 2008 the headline income take from companies is £228 million. Just scale the tax loss up in proportion to that and it has to be £100 million in 2010. If Senator Le Sueur's estimate is under by this sum mine must be as well. That results in the following table, for now:

The conclusion is obvious. Jersey is not going to break even. Jersey has a massive black hole.

And even this assumes that the massive increase in tax income over the last couple of years can be sustained, and there is no evidence that this will be the case given the size of the credit crunch and its relevance to Jersey.

Put nicely, the place is going bust. Not quite as fast as Northern Rock maybe, but just as certainly.

I wonder when the financial services industry will begin to bail out?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Most of Jersey’s deficit is due to new projects and at least they are addressing it early. You’d love to see Jersey go bust but I assure you as a person on the Shop Floor its not going to happen. Business is booming and because of that the article yesterday looks completely out of touch with reality.

Too tedious to reply to

I’ve been told that for a decade…..

Well Richard, we have the Conservative govt. for the next four and a half years and the right wing labour crew are not likely to take on board your recommendations so will we survive the inevitable? How? No-one is listening to the more credible minds. If Stiglitz, Pickety and Pettifor and Wren Lewis were running things with McDonnell at the helm, could they salvage the situation now or even in five years time? I am of the belief that our economy is heading for a crash within the next 2 years and some will say I am scaremongering (as I’m sure you would) but what if I’m right. Where on earth does that leave the lower and middle income earners not to mention self employed and small business. Will enough economists be able to influence fools like Osborne BEFORE the crash or will we be forced to watch him destroy our ability to counter the coming disaster? I wish you weren’t so prescient, but your counter arguments always seem to win out over other peoples offerings and too many seem to view you as a threat because they are advocating a different scenario, which is very worrying for the future.

People always think Cassandras are threats

There will be a major downturn

It could be a crash