With the election out of the way it's time to look at research again. This was a highlight of recent publications, coming from Alex Cobham at Tax Justice Network, with permission:

-----------------------------

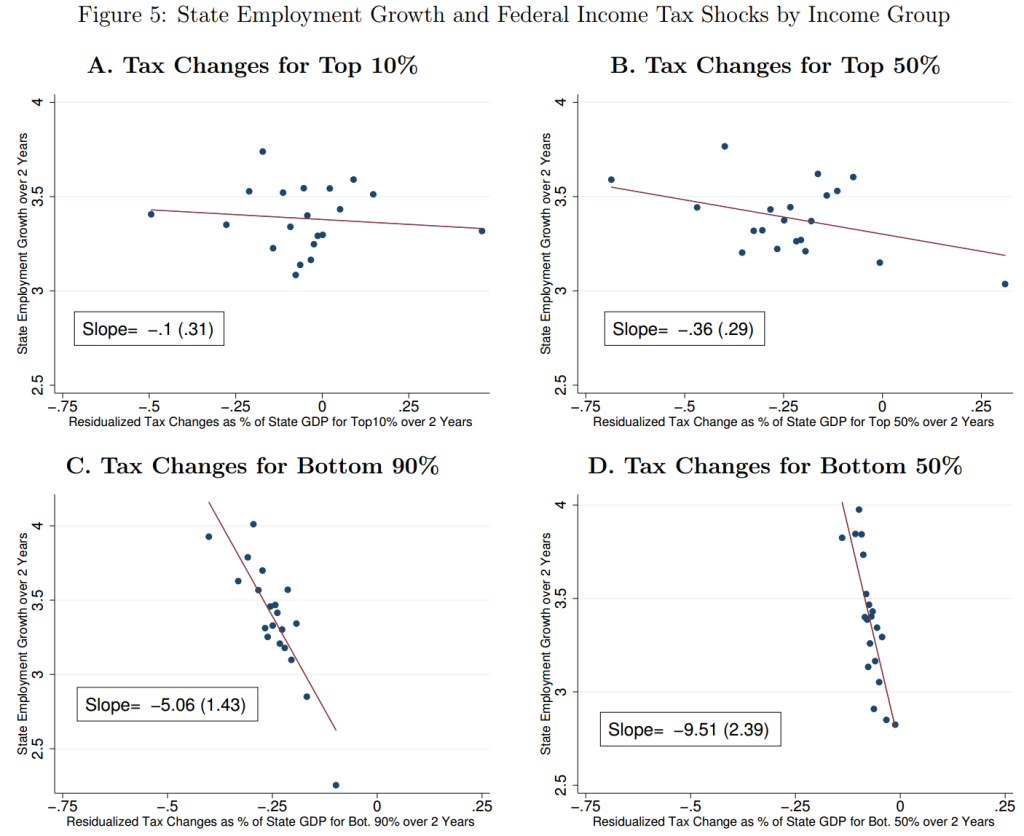

How do tax cuts targeted at different parts of the income distribution affect job creation? This is the question addressed in a new NBER paper by Owen Zidar, an economist at Chicago (not known historically for progressive analysis). But the paper (see the ungated version; and slides) has had a good deal of US media coverage, largely because of the progressive tax implications. First, some graphs:

The paper's main innovation is to overcome the scarcity of time series data by exploiting US data on state-level income distributions, to view each state-year response to a national tax policy change as a separate observation.

The main result is not, intuitively, surprising: but it is not a question that has been commonly posed, nor this well answered before. The result is that tax cuts are least likely to generate benefits when targeted to the top 10% of households; and most likely to generate benefits when targeted to the bottom 90% - or as in figure 5, the bottom 50%. As Zidar puts it:

"Overall, tax cuts for the bottom 90% tend to result in more output, employment, consumption and investment growth than equivalently sized cuts for the top 10% over a business cycle frequency."

the top 10% drive the economy;Why would we ever cut taxes for the top 10% as a stimulus, I hear you ask? Because they're in charge, say the cynics. Or perhaps because policymakers and/or the public have bought a series of economic myths, such as:

- the top 10% spend all their time worrying about things like tax cuts rather than broader factors like aggregate demand, or the availability of sound infrastructure and a healthy, well-educated workforce;

- progressive taxation is bad for growth, and ultimately bad for the poor as well as the rich.

One fairly clear implication of the findings is: the opposite seems to be the case.

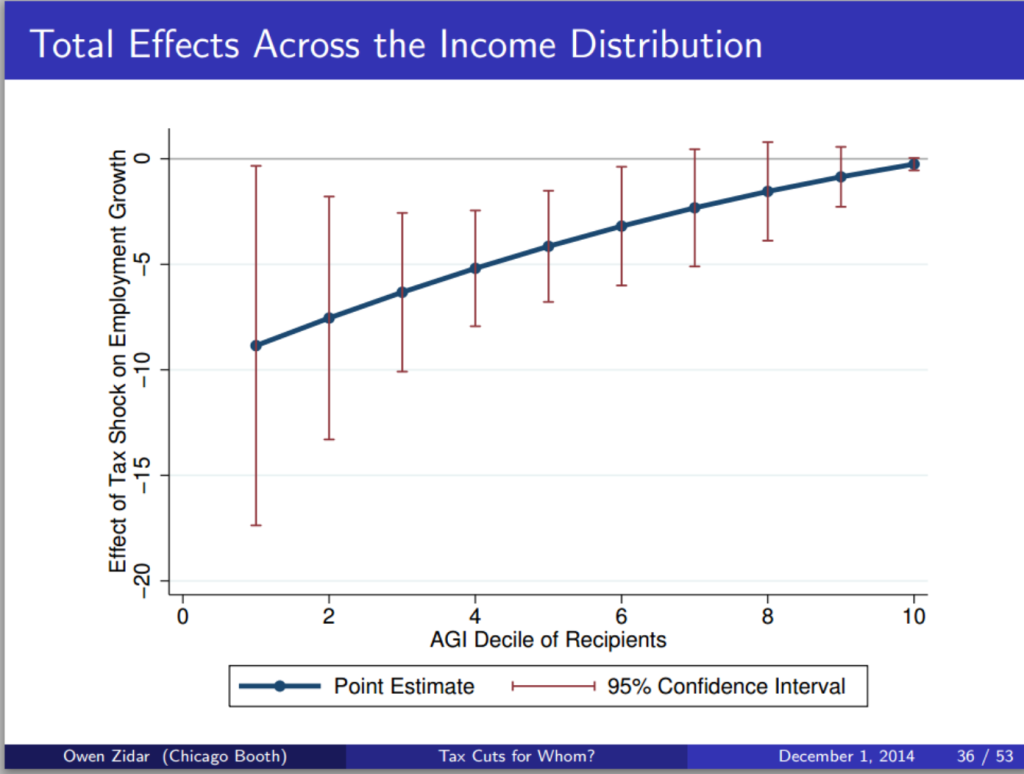

A tax change for the top 10% seems to have pretty much no impact on job creation, so a revenue-neutral change in tax structure that deliberately reduces the Palma measure of inequality (that is, the ratio of incomes of the top 10% to the bottom 40%) will not only be progressive but will have the effect of boosting jobs growth. Zidar's next chart shows this:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It seems obvious doesn’t it?

Is giving more money to those who have money going to increase their consumption in the real economy?

No – although you could say they may want to invest that additional money in say, assets. And who deals with assets and the selling and investment of? The City of London of course. And who encourages the Government to give tax cuts to the rich? The City of London of course. Talk about feathering your own nest whilst you support benefit cuts for the poor.

Cutting taxes for the 90% would be akin to pay rise of sorts. But all it will do is cut back financial support for the services that they are likely to want etc.

I wonder if ‘gorgeous George’ has seen this?