This exchange from Hansard a couple of days ago is interesting:

Kelvin Hopkins(Luton North) (Lab): The Treasury's problems are, above all, about income, not expenditure. There is a gap of £120 billion a year between the tax that should be paid and the tax that is actually paid. However, the Government have presided over tens of thousands of job cuts in Her Majesty's Revenue and Customs, where senior staff collect 20 times their own salaries and junior staff 10 times theirs. Are the Government not shooting themselves in the foot?

Mr Maude: The hon. Gentleman is completely mistaken if he believes that there is a direct linear relationship between the number of HMRC officials and the amount of tax that is being collected. There is absolutely no evidence of that. The size of HMRC, in terms of headcount, was falling before the 2010 election, and the amount of tax being collected has risen. We can do things differently and we can do things better–we have already shown that that is the case–but if the hon. Gentleman thinks that the only problem with the public finances is that we are not taxing enough and not raising enough taxes, I am afraid that he and I differ. I think that we must cut our costs first, which is what we are doing and will continue to do.

Francis Maude is simply wrong. Of course no one assumes that there is a precise linear link between the number of staff at HMRC and the amount of tax collected. It is impossible to say that each person completely and precisely collects a fixed sum as a result of their work and I know Kelvin Hopkins far to well to think he was implying that - because he was not. Such relationships of precision do not exist.

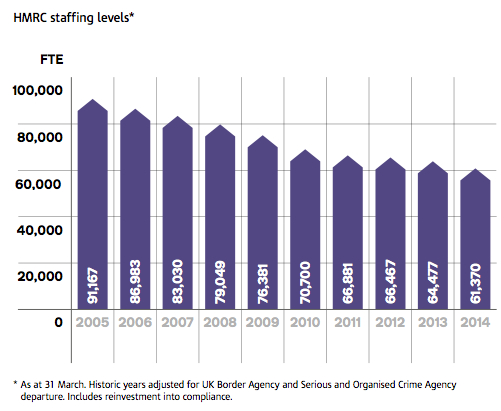

But this relationship does exist:

At least 5,000 staff in personal tax have left HMRC prepared the above table, and many more departures are planned.

I accept there is not a precise link between an individual and tax collected.

But I do think that shortage of people is the very obvious explanation of, for example, the dramatic decline in the number of requests for data from overseas tax authorities to chase tax abuse by UK resident people on which I have also commented this morning. And that decline will reduce the amount of tax recovered by HMRC, inevitably.

In which case Maude is not just wrong; he is not even remotely near to telling the truth.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“But this relationship does exist:”

That is not a relationship between anything, that is just a graph showing HMRC staffing numbers falling. (And it also shows, incidentally, that the greatest fall in HMRC staffing numbers took place under the previous government, but I’m sure you know that).

“I do think that shortage of people is the very obvious explanation of, for example, the dramatic decline in the number of requests for data from overseas tax authorities to chase tax abuse by UK resident people”

Again, your logic goes astray. Why would the number of requests for data from overseas tax authorities have any relationship to the number of staff at HMRC? Explain.

I have

Richard

You haven’t explained at all. You’ve just made an assumption, with no facts to back it up. Pinsent Masons have theorised that the drop is down to HMRC having already tackled the easy and obvious cases and are moving on to harder ones.

Neither you or Pinsent Masons have anything to back up your theories. However, quite clearly there has not been a 43% drop in total staff during the time there has been a 43% drop in data requests so your simplistic correlation does not stand up.

It is of course the case that such requests for overseas data are made by specialist units. Why not try to find out what staffing levels are in these units? Then you would be able to make a more reasoned conclusion.

Alan

Ever the tactic of the charlatan: in the face of the bleeding obvious ask for more data

Richard

A charlatan is someone attemting to gain by deception.

I have nothing to gain by suggesting that an assumption by you made on the basis of partial evidence would be better researched.

You of course stand to gain by continuing to make such claims, regardless of whether they are true or not.

If anyone in this discussion is a charlatan, it is not me.

Alan

I agree I cannot prove whether or not you have something to gain

But I am assuming you have or you would not make the point

Just as I am assuming that HMRC trend data strongly suggests it thinks it has nothing to gain by making too many enquiries via the new information exchange treaties it was signing

And I am entitled to assume someone may be advantaged as a result

I on the other hand am simply pointing out two facts and the unlikelihood that they are coincidence. How I might gain is hard to see. I suspect not a penny of my funding will ever be dependent on my having done so.

“I suspect not a penny of my funding will ever be dependent on my having done so.”

You are claiming that HMRC is understaffed. You receive funding from the PCS, the union which represents HMRC staff members.

I on the other hand am simply pointing out two facts and the unlikelihood that they are coincidence.

I made this comment

PCS did not

They have never paid a penny towards this blog

My core funding lets me form my own opinions free of the influence of others

If PCS agree that is their choice, and that is always the way I work

It is patently obvious that if HMRC numbers are substantially reduced, they are likely to have less capability to engage in pursuing tax evasion. Here at the frontline, we can see it all too clearly and, no, before you ask I do not in any sense work for HMRC.

Obviously there are other factors. Increased technology enables some things to be done with fewer people, but tax evasion, detecting it and collecting the tax does tend to require thought and action and is not so easily automated.

Of course,there are those with a “shrink the state” agenda for whom collecting less tax is a feature not a bug. Are you one of those, Douglas? Would you, perhas prefer to see unemployment benefits cut rather athn see an evader pay his dues? I wonder….

And of course the coalition plans to make things even easier fro their tax-avoiding friends. HMRC’s “Building our (NO) Future” plans envisage closing every tax office in East Anglia and every tax office West of Bristol by 2020.

I know

The cull (for that is what it is) goes on

I wouldn’t pay attention to anything that Francis Maude says, remember this? http://www.bbc.co.uk/news/uk-17545258

Could someone refer dear Alan to Jolyon Maugham’s blog (Waiting for Tax) concerning the so-called Lichenstein Disclosure Facility.

If he reads that he will get a little more ‘triangulation’ for your post Richard which he contends is not accurate. It might help poor old Douglas as well.

The way I interpret it is that if you extend an amnesty for tax evaders then you’ll also be planning to not be over staffed either. Which may refer to why there has only been one prosecution for evasion?

And as Jolyon points out, this decline in numbers and the amnesty at HMRC started under New Labour who we must remember were ‘intensely relaxed about people getting rich’. So you are not being political Richard – just factual. There is some form of perverse continuity here that is undermining democracy.

For Douglas and Alan’s sake, I’d point out that in the USA, the SEC (Securities and Exchange Commission) was hollowed out in the same fashion as a prelude to the deregulation of derivatives – and look what happened after that.

This may be a simplistic argument but I can’t help but consider the tenor of government statements. On the NHS a red faced Cameron bangs the despatch box at PMQs ‘more doctors, more nurses’ etc. Or, perhaps, benefit cuts, bemoaning the malaise of work shy scroungers content to sit back and drain the pockets of hard working families. Then I compare that with the almost complete silence on the matter of avoidance and evasion.

One hundred and twenty billion pounds and hardly a word? If that is a sum that can be so safely ignored why then is the government pursuing policies that have driven food bank demand up by 400% ? If a £120bn shortfall fails to galvanise urgent action why should we be concerned about the piddling £800m deficit in the NHS? Why are libraries closing for the want of a few thousand? Perhaps the answer is to be found in conservative philosophy

The Cambridge Quarterly, a favoured Conservative publication, is worth perusing this quote is pulled from the archives.

“If there is a class war — and there is — it is important that it should be handled with subtlety and skill. … it is not freedom that Conservatives want; what they want is the sort of freedom that will maintain existing inequalities or restore lost ones.” Maurice Cowling

In my last year in HMRC I identified around £400k additional tax due, when I retired last year I was not replaced, so to deny that staff numbers are irrelevant to the amounts of extra tax collected is just plain ignorance

Thank you