I was distracted last week and so did not find the time I needed or wanted to discuss the audit issues arising at Tesco, and elsewhere.

I want to cut to the chase: auditing has failed in the UK and that is entirely the fault of the auditing profession and the firms that dominate it and the way that they have changed (or, perhaps more provocatively, manipulated) auditing and accounting standards to suit their purposes over recent years.

UK auditing standards are the responsibility of the Financial Reporting Council, which I do not consider a body independent of the auditing profession because of revolving doors. In practice it says that the purpose of an audit is defined by International Auditing Standards (called ISAs as illogically they are officially International Standards of Auditing) . ISA 200 summarise this purpose as follows:

Now this is really important because most people think that an audit is about forming an opinion on whether the accounts show a true and fair view. And that is not the case according to this standard. Instead the requirement is to say whether or not the accounts are free from mis-statement as defined by the relevant applicable accounting reporting framework, which is for the purposes of all UK based multinational companies International Financial Reporting Standard.

There is, of course, a problem with IFRS: they too are a construct created by the accounting profession to suit its purposes and which now effectively over-ride the requirements of the Companies Acts in most cases, which deem compliance with IFRS to be company law compliance.

So, not to put too fine a point on it, the profession make up accounting rules and then say they have complied with them when they form an audit opinion.

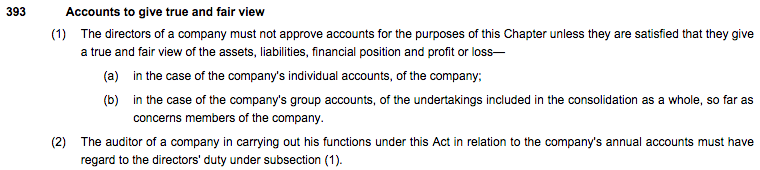

Now, this appears to conflict with section 393 of the Companies Act 2006 which says:

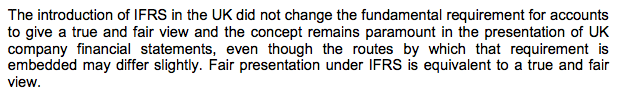

So there does appear to be a need for a true and fair view. But what is true and fair? The Financial Reporting Council has published notes on that, the most recent in June 2014. The key paragraph is this:

Note that last sentence: they are saying that if you disclose what IFRS requires and follow its standards then you have a true and fair view.

There is just one slight problem with that. As Tim Bush of PIRC has argued (and I reproduce with permission)

The core issue at stake is whether accountants should do what Parliament has intended them to do, or whether they have, literally, made up a set of rules to suit themselves? What is the “true and fair view”, the basic legal test that accounts must reach, actually for?

As Tim then noted:

PIRC has compared what earlier key legal opinions that the FRC obtained in 1983, 1984 and 1993 actually say with an academic paper from 1993 by PwC professor of accounting at Royal Holloway College, Christopher Nobes FCCA, purporting to cite those opinions, and a 1993 Financial Times article citing David Tweedie CA (then at the FRC, and a former academic) that does likewise. Remarkably there is a fundamental mismatch between what the law actually is and what Tweedie and Nobes said it was. Nobes is explicit that what true and fair view means (“signifies”) changes according to accounting practice, i.e. it is a dynamic concept with changeable meaning.

But as Tim argues, this is wrong:

However the 1983, 1984 and 1993 opinions clearly state that true and fair view is fixed in meaning, for compliance with the Companies Act (which includes directors' solvency duties). Given that function, the content of accounts to attain that standard can change in a dynamic way over time, but the meaning is anchored by the law.

So, Tim suggests:

After the 1993 publications large swathes of the accounting profession ran with the line that the meaning of true and fair view can also change according to what accountants wish it to mean.

But that is wrong:

True and fair view is a dynamic concept that means the same it has since 1947: it is the test to comply with company law, which above all is a solvency act.

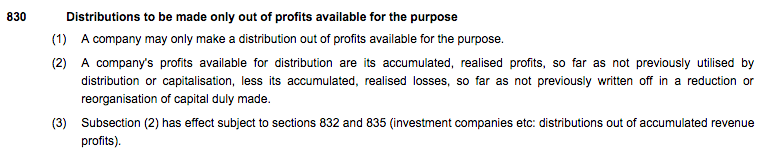

In other words, the reality is not that true and fair means that IFRS has been complied with (as no doubt David Tweedie who went on to chair IFRS would have liked) but is a fixed concept that requires the auditor to appraise whether or not the company fulfils a very basic test, which is that the company is solvent. How do we know this? Because section 830 says so by requiring that dividends of any company can only be paid as follows:

There are no exceptions, including for banks, although auditors like to say there is.

And the basis for determining solvency for this purpose is the accounting data of the company. So, IFRS can require what it likes with regard to revaluations, market values, and anything else. A company has, ultimately, to have realised profits available to it (which means cash is available, or likely to be available as a consequence) or it cannot pay a dividend and that is the bottom line test every aiuditor knows their accounts must be used for and so that is what true and fair means in law.

But the accounting profession says otherwise.

And they're wrong.

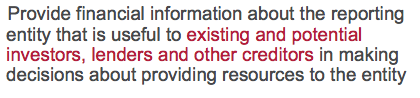

And because they have forgotten this basic test, and that cash is therefore king, and this test has implicit in it first a stewardship obligation to shareholders and second a requirement that the director's protect creditor's interests the IFRS claim that the purpose of financial statements is also wrong. They say that purpose is (their emphasis):

Stewardship is sidelined then, and as for solvency, ne'er a mention.

In other words, we have accounts that are prepared without taking into consideration the legal purpose for doing so and which are audited against a false objective of complying with a set of financial reporting standards that do not recognise the true purpose of accounting.

And you wonder why Tescos could make such a mess of their reporting? I don't. If you make it up as you go along that's what happens because no one knows the rules. And that's precisely where we are now when it comes to accounting and auditing.

It's time to go back to square one and prepare accounts in accordance with the law for the purpose the law intended taking into consideration the users the law has in mind.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

That’s an interesting point: the educated public are well aware that there’s a fair bit of ‘buried in the footnotes of the accounts’ for all those failed projects and payments embarrassing to the directors, but there is near-universal faith in the integrity of Britain’s principles-based accounting and the True and Fair View.

There would be widespread shock and anger if convincing proof came to light that the ‘True and fair view’ of company accounts is a deception practiced with the enthusiastic participation of the accountancy profession and their standard-setting bodies.

True and fair is a deception as it stands at present

…But who’s going to enforce it?

Tesco will lose some of the middle-to-senior managers who brought those ‘payments’ forward, but that’ll ne the end of it.

I worry that there is a culture of impunity in place.

So do I

I’d argue the going concern requirements of auditors pick up your solvency issue. Although I’ve often wondered why auditors have not been challenged on that when they signed off the pre crash bank results. Was it all too complex for auditors to see the writing on the wall? On another point I’m rather surprised that they now equate t+f with ifrs. I always understood that we had and still have the t+ f override.

Going concern is not what the law requires. The law is tougher

And the t+f over-ride appears to only operate within the framework of IFRS

In terms of challege, these are unlikely as Auditors have very wide carve-outs to excuse them from liability in the case of challenge bar fraud.

So legal change is required…

It can be done

Richard,

Insightful as always – as we know, there is a not-so-subtle link between large businesses and auditors that allows for problems such as Tesco’s. Auditors have worked hard to simplify their auditing burden – there are now so many caveats on each audit that the public, shareholders, suppliers, staff, tax authorities and other stakeholders need a “caveat emptor” (“buyer beware”) on them. They do not supply the trust that they imply.

At Tesco, the crisis has been developed because of their inability to be competitive and this has led to a corrupting culture – see my own http://jeffkaye.wordpress.com/2014/10/23/was-tesco-corrupt-ii/ which you were good enough to retweet recently. The auditors look at numbers – which are meant to be the language of the company – but fail to understand the underlying meaning behind them.

Audited accounts with no adverse statements by the auditors should be “True and fair” accounts that should provide a confidence that the company audited is operating well. The accounts should be a reflection of that operation and the auditors need to be linguists – interpreters of the language – not just “number crunchers”. The larger and more complex a business, the better the interpretation has to be so that those without those language skills can rely on them.

The auditing profession repeatedly shows that it cannot be relied upon – and the law needs to be re-emphasised and changed if needed as, in this financially and numbers-driven world, the interpreters have a stranglehold.

I now firmly believe that civil society needs to work on new reporting standards

Country-by-country reporting started that way

We need to do more

Richard

I did a finance module as part of my MBA. In that context I thought that MBA meant ‘Morally Bankrupt Approach’. I’ve looked at the definition Richard provides from the IFRS and like too much corporate babble these days it doesn’t seem to mean anything. There is nothing qualitative in it whatsoever – it’s almost totally non-commital. It sounds OK but as Richard has eloquently pointed out:

“In other words, we have accounts that are prepared without taking into consideration the legal purpose for doing so and which are audited against a false objective of complying with a set of financial reporting standards that do not recognise the true purpose of accounting.”

For example auditing ‘provides financial information’ – no hint here as to any desired accuracy of that info which surely would be crucial as to whether one wanted to invest or not; it has to be ‘useful’ – but to whom and why? How can anything be useful if one is given no expectations as to any standards and which can also be misrepresented? This definition doesn’t even mention the word ‘accurate’ or ‘honest’. It places no requirements on anyone.

To me, the way this is set up may have something to do with the fact that the accounting bodies are reluctant to divulge any real problems with firms because they just want repeat business – huge fees. You don’t kick a gift horse in the mouth do you? I think that we have seen the same sort of behaviour in the stock market ratings agencies to some degree and that helped many of us not to see the credit crunch coming. It’s just so all-too-convenient for both parties to have an ill-defined auditing system.

Preposterous!! (Did I spell that correctly)?