There were two reports of some importance out yesterday. The High Pay Centre reported that:

The poorest fifth of UK households are significantly worse off than the poorest fifth in other Western European countries, according to analysis of Organisation for Economic Co-operation and Development (OECD) data published by the High Pay Centre think-tank today.

In the UK, the incomes of the poorest fifth of households have an average income of just $9,530, much lower than the poorest fifth in other North West European countries such as Germany ($13,381), France ($12,653), Denmark ($12, 183) or the Netherlands ($11,274).

In fact, the poorest households in the UK are closer to the poorest in former Eastern bloc countries Slovenia and the Czech Republic than to the poor in Western Europe. This is despite the fact that the OECD estimates average incomes in the UK ($25,828) are similar to Denmark ($25,172) and the Netherlands ($25,697). The UK's average is inflated by the incomes of the top 20% of households - at around $54,000, the third highest in the EU. In Belgium, the Netherlands and the Nordic countries, the top 20% make between $44,000 and $49,000.

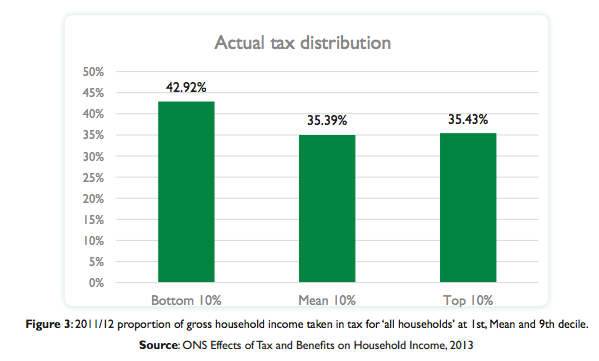

Despite this fact that the poorest households in the UK have such low incomes the Equality Trust showed we tax them heavily:

So, we not only pay badly, we tax heavily.

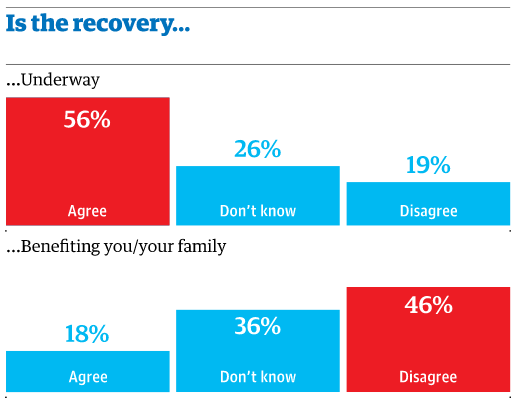

Is it surprising then that, as the Guardian finds in a survey on the state of the economy:

In other words, just in in 5 think that the economy is working in their favour even though more than half think there is a recovery.

What the data from the High Pay Centre and Equality Trust shows though is that this is not by chance, or as a result of wilful refusal to recognise benefit when it arises. The simple fact is that a great many people are not benefiting from recovery, or jut as likely, fear they will not.

This is the reality of inequality in the UK. First, it is happening. Second, tax is exacerbating and not relieving it. Third, the fear those combined facts creates harms well being for most. And that is why I argue that to be successful politics in the UK has to offer hope and not fear but right now the only thing on offer is more fear, more cuts and more despair.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

…and the only alternative for the incoherent anger is UKIP. We need a party that could educate the public to see the true nature of the scam being played out on them. Countries like Brazil are far ahead of us because they realise that the obsession with inflation as an end in itself lacks any social purpose -at least the debate is alive there. Here we have a populace drugged by the media thinking that a policy-less party that bangs the anti-immigrant drum without mentioning money/banking is going to be their saviour.

“This is the reality of inequality in the UK. First, it is happening. Second, tax is exacerbating and not relieving it. Third, the fear those combined facts creates harms well being for most. And that is why I argue that to be successful politics in the UK has to offer hope and not fear but right now the only thing on offer is more fear, more cuts and more despair.”

How an organisation with Research in its name can ignore the effect of benefits before making such statements is beyond me. Once benefits are taken into account, according to the same ONS survey you quote, then the figures for ‘tax and benefit’ rates look much more progressive.

Why not start from the net position after all government intervention, rather than selectively assess the position as bad based on what government takes whilst ignoring what it gives back.

Because when benefits are continually threatened income is key

It’s not hard to work out

But benefits still exist, and are fairly generous in the UK in comparison to may states. You still have to compare like for like. You find this little trick pulled too often – like comparing pre and post transfer Gini coefficients.

No this is no trick

It is like for like comparison

The issue is income

It is simply nonsense to ignore post-tax transfers when talking about income and taxation.

You may say so

But when so m,any are denied benefits I do not agree

That’s a straw man. The benefits bill is a large percentage of GDP, with some 64% of people in the UK receiving some form of benefit from the government.

To totally ignore the effect of the benefits system by focusing only on income is pretty poor analysis – it sounds very much like cheap point scoring.

You have made your point

And oddly a great many very considered opinions disagree with it

We need someone with the boldness of Kirchner in Argentina who wont pay debts back to who she calls ‘speculators in misery’. Why is britain so morally craven?

Just seen a news report which told us most of Argentina’s creditors have agreed to reduce their demands. However, the hedge funds have not agreed and got a ruling in their favour from a US court.

Which is, however, I think under review, again?

Are you serious?

Argentina is a complete and utter economic basket case – thanks to Kirchner and her policies.

They are locked out of financial markets, real inflation is running at around 27%, GDP growth has collapsed and unemployment is rising fast. The Peso has dramatically devalued and inward investment has all but dried up.

I assume you are now going to tell us that Venezuala is also a model economy.

It’s all perspective, isn’t it

And I’m not enamoured by yours

Perspective?

Not sure what you mean by that. The information available shows that Kirchner’s policies in Argentina are leading to economic disaster. Certainly not paying back debt only makes the problem worse, but its only a small part of the problem – a fig leaf to mask much more substantial problems.

Wages are not even keeping up with the more modest official inflation rate (and that rate is highly questionable, given the political interference) and are miles below the unofficial rate. Again, officially the poverty rate has barely moved at around 5%, but thanks to soaring inflation and the devaluing Peso, unofficially it is estimated at around 25% – by the world bank no less.

How is any of this good news?

I suppose you thin zero hour contracts: a million IN employment on housing benefit; hand outs to the banking sector and bond markets; trebling of food bank usage in one year; 900,000 benefit sanctions; millions unable to afford housing and cope with energy costs all spiffing achievements for a wealthy country?

We are all still feeling the hangover of cheap and easy credit. Before the crash in 2007 the previous 7 to 10 years have been a fun time, on easy credit. A bit like a party at New Year. It was fun the bits you remember. For some people who left school and Uni in the late nineties only know of an easy credit life.

The UK and the US in some respects has been building an economy away from mortgage release growth. For some people life wont ever be the same again. So the report that people don’t feel it isn’t really news.

Are you serious?

That would be the party which the poor were not invited to attend? The party they are now paying for?

I realise that this narrative is pushed hard in the media: it bears no relation whatsoever to what actually happens in this country.

I admit to having no clue what you are saying

Correct me if I’m wrong Fiona, but what you are saying is that it is a myth that the poorest people of the UK and the global economy were able to take part in the credit fuelled bubble that preceded the crash of 2008. Even then, we the poorest were shut out of access to that money, yet we are the ones taking the biggest hit and suffering the most, both financially and morally, for a situation that was not even caused by us.

4% of total income on tobacco duty compared to 4.6% on income tax.

Now there begs a question.

The truly interesting thing about this report is that it says that the taxation of the rich is roughly (within 4%) of where people think it ought to be. It’s the taxation of the poor that is higher than people think it should be.

So, excellent, the argument is that we should tax the poor more lightly. Maybe raise the personal allowance and the NI limit for example? As some of us have been suggesting for some time now.

And without raising top end taxes as those already seem to meet the democraticaly desired levels.

And then people will discover there is no NHS

No thank you Tim

You can cost such a definitive response Richard?

You can show that if taxes were reduced for the least wealthy without increasing top-end taxes then the shortfall would mean “no NHS”.

When some people claim “if we keep letting immigrants in we’ll have no NHS” we dismiss this as scaremongering. What’s different about your claim if you have no figures to back it up?

If most paid tax at the rate suggested I am quite confident that we would see more than £100 billion in tax lost

And that’s most of the NHS

It’s not rocket science

And actually if we don’t let immigrants in we won’t have an NHS. Have you noticed who staffs it?

“If most paid tax at the rate suggested I am quite confident that we would see more than £100 billion in tax lost”

Hang on, Tim suggests lowering taxes for the least well paid without raising taxes for the highest earners. You’re saying that would mean £100 billion in lost tax? The lowest 50% of earners only paid £16.2 billion in income tax in TOTAL in 2013-14. That’s the most we would lose if the lowest 50% of earners paid no income tax at all.

That £100 billion is just another one of your numbers plucked out of thin air.

Oh dear. You really are assuming income tax is everything, aren’t you?

Start again

Oh dear

You really are talking nonsense again.

Tim’s only suggestion was to reduce income tax on the lower paid.

You say (without any evidence at all) that this will result in 100 billion tax lost. I point out that the MOST that would be lost by reducing income tax to nil for the least wealthy 50% of the population would be £16.2 billion.

If you think that reduction will spin off in to a reduction in take in other taxes you’ll have to explain how.

I’d have thought that (for example) if the lower paid have more income they might spend more on (for example) VATable goods.

But you think reducing income tax on the lower paid, people having more income to spend, will somehow result in less tax being paid elsewhere?

Start again? You haven’t even tried to begin.

Sorry, the time for your one line, glib, meaningless responses backed up with no facts or supporting evidence has to stop.

Where’s the missing £83.8 billion in taxes we’d lose? Will you give us any numbers or just more meaningless one-line puffery?

The Equality Trust report was on all tax, not income tax

Tim missed the point

So have you

if the poor were paid more -as in the examples of elsewhere in Europe, they would need fewer benefits or lower amounts of help. The extra purchasing power could support the profitability of companies. Why should it just the government who pays?

I have made the point before that the refusal of political commentators in both Parliament and the media to quote modal average wages is deliberate. It is a point that is central to the reason why so many people think that the recovery is underway, but do not feel they are (or will be) benefitting by it. They’re not.

Were you to create a co-efficient that included personal indebtedness, modal average earnings, taxation (including purchase taxes and others) and cost of living, then projected it over the last ten years the truth would become evident. On a graph it would be clear that the ‘recovery’ is in fact a rebalancing in favour of the wealthy and financial institutions, and, as such, not a recovery at all.

Ignoring the modal average wage allows the Right in this country to perpetrate the lie of the recovery.

Have you done the data?

Serious question?

It’s a (rather slow) work in progress, Richard, due to the limited resources at my disposal (i.e. me).

Understood!