I can remember when my post-budget reading used to be all about changes in specific tax laws. I still do that, but I admit that I am more interested in the impact of taxes on the economy as a whole these days. That's an issue many overlook. As a result I have been looking at Part D of the budget report this morning, which is the bit that looks at economic forecasts and what it says is significant in my opinion.

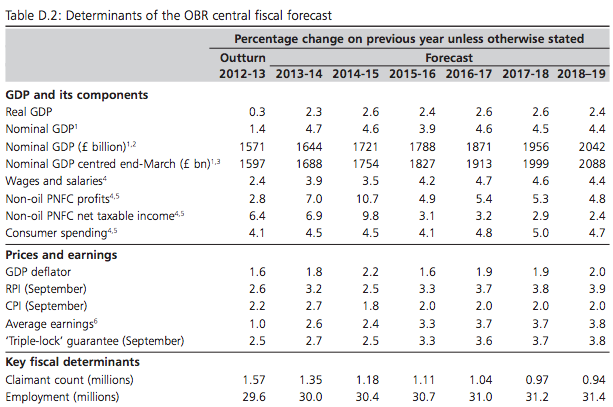

First, this is the overall outlook:

First, the real GDP line suggests that there will be growth in the economy. This, is, of course conjecture. Given that almost all the growth of we are seeing at present is the result of a housing bubble, how long can this be expected to last?

Second, by comparing wage and salary growth with the retail price index (RPI), which for ordinary people is by far the most important measure of inflation, it is apparent that the government thinks that wage growth will very slightly outstrip inflation during the course of this period. I stress the 'very slightly' because once the figure for wages and salaries is adjusted for the number of people in employment what average earnings show is that wages will not quite cheap pace with this inflation marker. The truth is that this forecast says that for most people in the UK the next five years are going to be a matter of standing still, at best.

Third, this, however, will not be true for those living off investment income: profits are forecast to rise at a rate above inflation.

Consumer spending is also forecast to grow at a rate somewhat higher than average earnings. Now we know where growth will come from: the government is expecting us to get increasingly into debt.

All, in all this is not a pretty picture: for ordinary people real earnings growth is not going happen within the foreseeable future and the only way they will make ends meet is by borrowing.

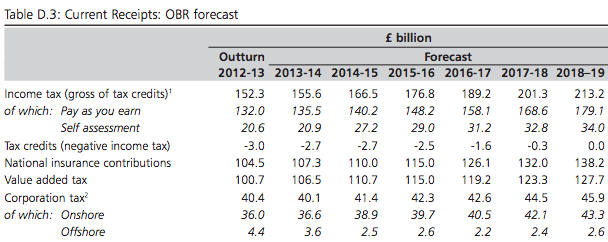

This picture is, however, one that is painted before tax is taken into account. This is the tax data:

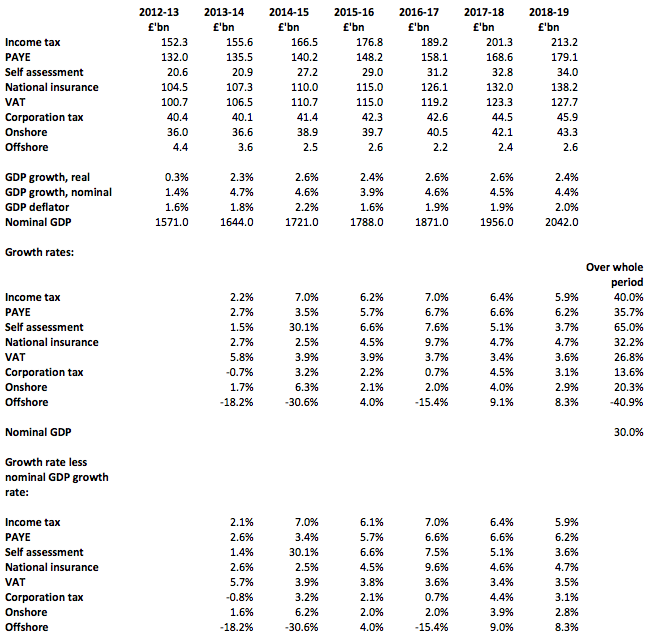

To interpret this data I have done some early morning spreadsheeting:

What I am seeking to find is what the forecasts are really saying as to future trends in UK tax. So, I have looked at growth rates in tax revenues by type and by year and I have then compared these forecast growth rates to the nominal growth in GDP to see whether they are above expectation or not. There are a few niggles in doing this, I admit, but not enough to change the overall conclusions that can be drawn, which are important.

What I am seeking to find is what the forecasts are really saying as to future trends in UK tax. So, I have looked at growth rates in tax revenues by type and by year and I have then compared these forecast growth rates to the nominal growth in GDP to see whether they are above expectation or not. There are a few niggles in doing this, I admit, but not enough to change the overall conclusions that can be drawn, which are important.

First, the overall growth in nominal GDP in the period 2012-13 to 2018-19 is 30%.

But income tax revenue is forecast to rise by 40%. There are going to be real income tax rises after the next election.

The forecast rate of growth for self-assessment income, much of which comes from self-employed people, is astonishingly high: it is more than double the rate of increase in nominal GDP. Either the government is expecting a boom in investment income or, more likely, many more self-employed people. How, however, when productivity is low, and self-employed earnings are falling, they expect the tax yield to grow so heavily I am not sure. This looks wildly optimistic to me.

In contrast to the forecast increase in income tax revenues, national insurance is only forecast to rise at a rate just above nominal GDP. This may be because of the growing numbers of self-employed people: they, overall, pay less national insurance as a proportion of their income but have fewer rights to claim benefits as a consequence.

More surprising still is the forecast decline in VAT revenue where there is suggestion that income will fall at a lower overall rate the nominal GDP. Is a VAT cut on the cards after the next election?

However, by far the most significant change is with regard to corporation tax. Although the government clearly expects a booming profits from the self-employed they are expecting larger businesses, which are almost invariably run through companies, to enjoy real cuts in their tax paid over the next five years despite the fact that they are forecast to enjoy a significantly bigger part of total national income than at present. this is true even when the decline in North Sea oil revenues (the offshore element of corporation tax receipts) is taken into account.

So, what's the overall story? I suggest it is this.

First, for most people will be no income growth over the next five years.

Second, expect significant income tax increases.

Third, many more people will be self-employed.

Fourth, a VAT cut looks like a possibility at some time over the next few years.

If you want to cut your taxes, incorporate. The government is guaranteeing that big business is going to have a good time over the life of the next Parliament.

Sixth, expect to borrow more: there is no other way that the growth that the government is forecasting will happen.

In summary: it's not a pretty economic outlook.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Did you notice Osborne’s reference to Magna Carta? Popularly believed to be the beginning of democracy, it was more about the power of the Barons and the church. He referred to a weak leader who had deposed his brother- we knew from his smirk he meant Brown replacing Blair. Ho HO Tory joke.

Well the brother, Richard, raised enormous sums so he could pursue a war in a Muslim country; an ultimately futile war.

Then he foolishly tried to take a short cut and got captured by the Duke of Austria and had to be ransomed. The folly of the rich who had to be bailed out by huge taxes imposed on England, mainly paid by the poor. I doubt if Osborne had this lesson in mind.

The glaring omission in his Chancellorship, in my opinion, is the lack of attention to preventing another financial meltdown.

But something came out of the crisis. The power of the King was limited eventually.

And, it was the time (in legend ) of Robin Hood. There are modern day Robin Hoods-they are proposing taking from the rich and spending on the people. It’s called the Robin Hood Tax.

I agree – except I think he was referring to the Milibands

of course silly me!

Pretty good analogy, but King Richard didn’t just take a short-cut. During their crusade, he systematically upset and alienated every other European Christian prince, to the extent that he had to make the journey home disguised as a pilgrim. He was caught after a couple of weeks.

Osbourne, on the other hand, will now be welcomed by the super-rich wherever he goes for services rendered.

Richard,

I know from experience that the Treasury/OBR forecasts do not include any unannounced policies.

So the the real term rises or falls in tax receipts will all be driven by assumption such as employment, earnings, prices and consumption, rather than potential tax changes.

If you want to know more you could try getting all the underlying assumptions from a FOI request…

I would be interested to know what will cause the 30% increase in tax from self employed next year!

My FoI success is pretty ow these days….

Always, oddly, unavailable or too costly to answer

And now for something incompletely different:

http://howtobeacompletebastard.blogspot.co.uk/2014/03/budget-2014-review-in-full.html