A couple of weeks ago I started to prepare what I thought would be a quick blog on the differences between HMRC and ONS data on the number of self employed people. However, the more I looked at the data I more I realised that the figures on the self employed had a story to tell, and so I investigated further with the outcome that I have published a report on the subject of the declining income of the UK's growing army of self-employed people this morning.

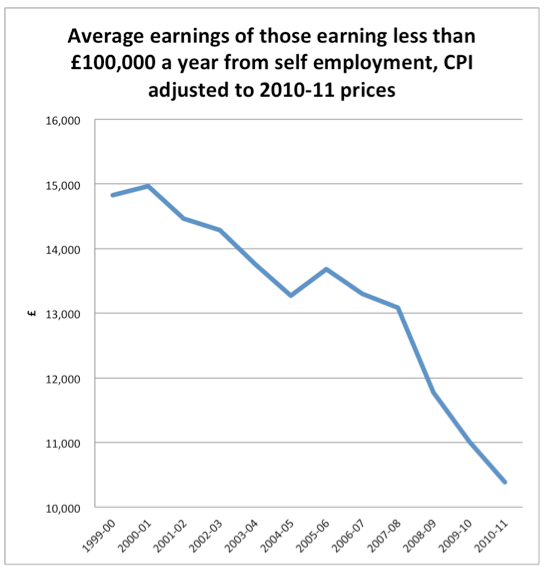

One of the big surprises in the UK economy over the last few years has been that unemployment has not risen to 4 million, which many, me included, were expecting. What's often said is that this is because many people are working part time, for low pay, and so are being kept off the unemployment statistics. What this research shows that this is, at least in part, because of the growing number of self employed people who make very little from that activity. The research covers the number of self employed people and their earnings from 1999 to 2011, the last year for which HM Revenue & Customs data is available and the picture is harsh. Excluding the less than 2% of self employed people who earned more than £100,000 a year throughout this period the picture is summarised in one graph

Using HMRC data on the number of self employed people the average, inflation adjusted, earnings of those who are self employed fell from just under £15,000 a year at the turn of the century to £10,400 in 2011, a real decline of just over 31%.

Using HMRC data on the number of self employed people the average, inflation adjusted, earnings of those who are self employed fell from just under £15,000 a year at the turn of the century to £10,400 in 2011, a real decline of just over 31%.

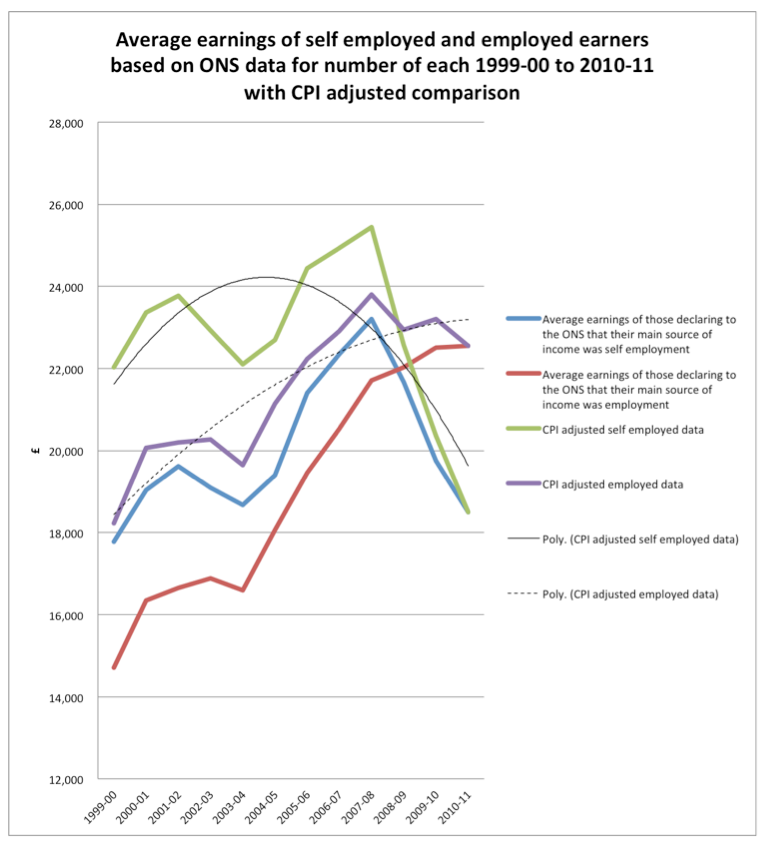

The picture is different using Office for National Statistics data on the number of self employed — which eliminates those who might have a part time self-employment as a well as a job, but comparing that data both unadjusted and allowing for inflation with the data on those who have income from employment makes very clear just how stark the change in fortunes has been for the full time self-employed since 2008 (and this data includes those earning more than £100,000 a year):

Right across all income scales the full time self employed saw their fortunes rise until 2008 — although the vast majority of that increase went to the top 1% or more who had average earnings of £303,000 in that year — after which the income of the self-employed crashed. Allowing for inflation average earnings of those who declare that they have self-employment as their main economic activity fell from £25,400 in 2008 to £18,500 in 2011, a decline of 27%.

Despite this the number of self-employed people is rising. According to HMRC the number has increased from 4.17 million in 1999 to 5.11 million in 2011 — an increase of 22.5%. The ONS, which only records those who have self employment as their main economic activity, think the increase more modest, from 3.21 to 3.92 million over this period, but the percentage rise is almost identical. Despite that national statistics show that the share of national income they have been enjoying has been falling.

As I said in a press release issued yesterday:

These figures are quite shocking. For some time economists have been looking for the missing explanation of what is happening in the UK economy. This data helps explain how we've reached a point where incomes are falling, the economy is sluggish and yet unemployment is apparently not rising. The fact is we now have maybe millions of people working in very marginal self-employments for what are poverty wages because they have no other choice available to them. This is not entrepreneurial Britain and the march of the makers as some would like to represent, this is desperation Britain where people left with no choice scratch any living they can out of the limelight and, until now, out of the sight of economic statistics.

In a culture where only the best are rewarded, where cut-price is everything, and where low pay is officially applauded as a sign of productivity life for many self-employed people is very tough. These people are the hidden unemployed and the hidden low paid. They're self-employed because the safety net has been pulled from underneath them. These are the statistics of desperation UK — the part of the economy that the top 1% or so of self employed people will never know exists.

George Osborne should take note.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard, do your figures take account of the existence of “umbrella schemes” used to conceal income from the tax authorities (especially by IT consultants)? I’ve a feeling that they might swing the averages by a number of points.

Those in such schemes are considered to be employed

Have you considered cash-in-hand? Has there been an increase in such activity? Although how one goes about measuring such things is beyond me

The report does consider that possibility, yes

It may well be a part of this

The benefits system is clearly putting many people under great pressure to become self employed. This has involved creating a ‘sanctions’ culture that makes life so unbearable and untenable on benefits that people become self employed in name only. I am in the process of researching transitioning from ESA into self employment at present partly because of the tremendous haranguing and criminalisation one feels under the present system. My health is still poor and I cannot work full time and face the prospect of only earning about £70 a week at best! benefits will have to top this up.

That fits with anecdotal evidence that Benefit offices are pushing claimants into ‘starting a company’ and moving to self-employed status.

With very few exceptions these ‘startups’ are a sham: of there was someyhing -anything! – the claimants coulf be doing to make a living, they’d be doing it already; and the existing sole traders are.

That aside, I see no reason to doubt that long-established sole traders are experiencing the same income compression as the rest of us, or worse; and I use the term ‘compression’ because the overall self-employment income may well be rising, or falling by the general trend in GDP, with astonishing and disproportionate net gains in income going to the one percent (or nought-point-one-percent) of earners at the very top end.

Some histograms would help you illustrate this income ‘dystribution’, as well as the declining average for ordinary people, if your data has the necessary granularity.

interesting – i was wondering why someone would start a business and earn zero income (see your subsequent blog post). I was also wondering whether there was s distinction between what the self employed are earning, and what they are declaring they are earning to HMRC?

No one knows what that difference is – but I will clearly be working on this data for that reason

Anthony, a friend of mine set up a small biz to launch an app for London tourists. It made less than £100. I reckon that is common.

Businesses also sometimes set up subsidiaries to hold certain cohorts of pensions without actually trading.

Just as examples.

This has nothing to do with companies

I allow for the micro business in the data

Ah, you’ve discovered the bogus hairdressers: http://www.harrowell.org.uk/blog/2013/10/25/the-missing-millions-found-hairdressing/

You assume there are VAT audits

They’re becoming a distant memory

I would also point to a not-insignificant amount claiming to be self-employed but the substantial proportion of their income is really coming from Buy To Let property rental income. Yes, they have an income but hardly edifying stuff!

Any idea of numbers on that one?

Sorry – not true

That is separately declared on tax returns

Richard, this is something I haven’t come across in Australia. When they say these people are self employed, does that include people who go from one contract to the next or are we talking strictly those that set up a company and try and sell their services to other firms?

Those that are setting up a business

This is not contract workers

There is quite a surge in the number of self-employed vacancies in our jobcentres lately.

There is reckoned to be quite a few in the construction industry forced into self employment.

It is a handy way to skirt around the minimum wage rules.

One of the factors in the growth of ‘self-employmeny’ has surely been the trend in industry, e.g. roaad haulage of one sort or another, where employers have forced people on their payroll into ‘self-emplyment’. Any indications as to possible numbers?

That may well be in company stats – next year for that

Sorry – no