I loved this in a Bloomberg article on the merits of UK UNcut this morning (which is well worth reading):

UK Uncut does have detractors. “They are contributing but in a way that's polarizing the debate and demonizing business,” said Judith Freedman, a professor of tax law at Oxford University and the director of legal research for the University's Center for Business Taxation. “And they are highly selective in their targets, which is invidious.”

Oh dear, poor big business. How nasty it is of a few individuals to ask them to pay their tax.

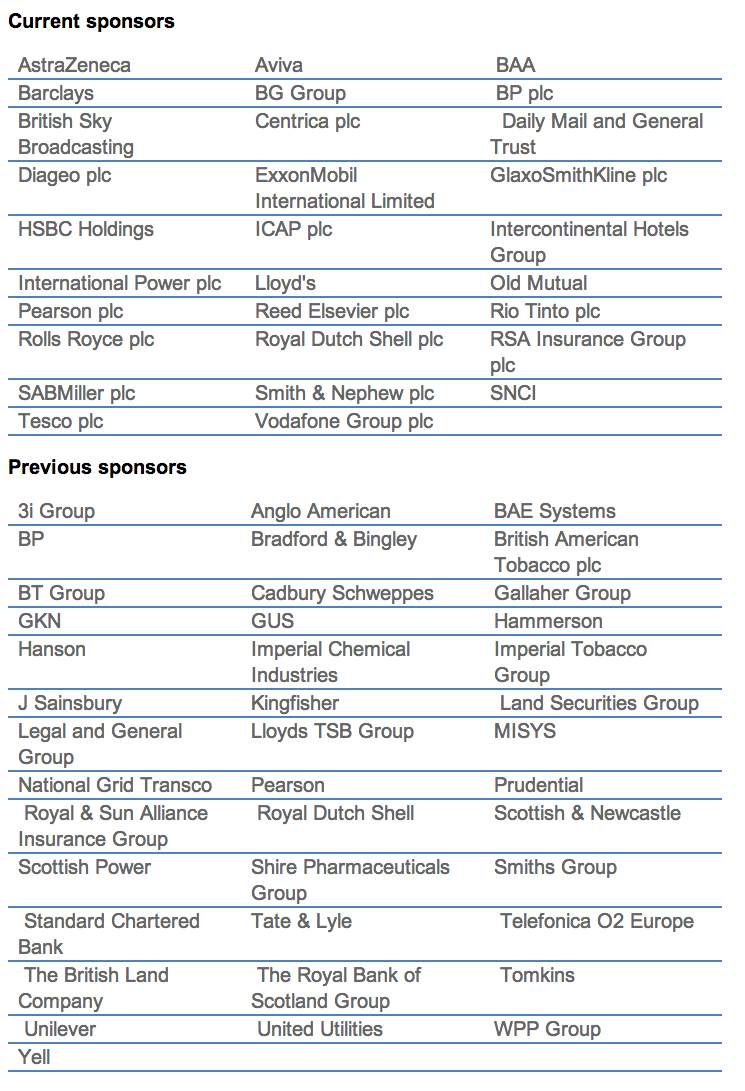

However, I think it more important that Oxford Centre for Business Taxation should declare its conflicts of interest when making such comments. With a little effort I located the current list of corporate sponsors for its work:

I'd have thought criticising UK Uncut was a requirement if that was your sponsor list.

Maybe if Oxford was a little more candid about the resulting bias in its work I might take it a little more seriously. But right now I don't, because this is not something they advertise too well.

I wonder if it's invidious of me to point that out?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I think having a ‘critic’ shows the message has arrived and is hitting a raw nerve.

Invidious: “unfairly discriminating…unjust…likely to arouse anger or resentment”

Well, if one is a sponsored pot calling the sponsored kettle black…then yes, it possibly is.

By “with little difficulty” do you mean they openly declare it on their website?

I gave the link

It was not obvious to find

They do not readily publish it

Richard, actually the list of sponsors on the Oxford Uni Centre for Business couldn’t be easier to find. It took me about 20 seconds. It’s in “about us” in the section that clearly says “Funding”. They’ve not exactly buried it and surely it is a bit disingenuous to say they have. It is at least as clear as your own site.

Well it too me longer than that

Do you mean one sponsored pot representing civil society, who clearly reveals his sponsors and the other supercilious, who does not choose to clearly reveal her sponsors!

No, they were revealed – let’s be fair – but I admit I found it hard to find – although others dispute that

I also wonder why when I looked at documents on the web referring to sponsors they did not give a clear link

Judith Freedman became a professor of tax law at Oxford thanks to a 10 year endowment by KPMG from 2001 to 2011 – covering the same period that saw KPMG plead guilty to tax evasion dressed up as tax avoidance in the US. So, she’s hardly independent in these matters. If she was an independent academic as she claims to be, she would have raised awareness about these problems with the UK tax system all these years but she didn’t because the system favoured her sponsors. So if activists like UK Uncut are doing what academics like her should have done years ago, she can hardly complain about their methods! What a hypocrite!

I think it would not be unreasonable to say Judith Freedman has been bought and paid for!

“Polarizing the debate”, eh?

The poles being “you should pay your share of taxes” on the one hand and “we don’t want to and you can’t make us” on the other?

I note that you can find that list neatly laid out for you in an obvious place on their website.

What makes you say that’s not advertising it too well? It’s exactly what you do about your corporate sponsors on this website.

They do not link to it when making disclosure

It takes some effort to find – I had to work to do so

It’s not being upfront in my opinion

@Pellinor, as usual, you choose to miss the point. most people reading a comment in the media by someone described as ‘a professor of tax law’ would not draw the crucial link with big business. that is the point. perhaps, Jesse Drucker should have explained the links with big business. afterall, Richard is often described as a ‘campaigner’ or ‘activist’, which helps readers to put his comments in perspective. a professor is supposed to independent but we know what when it comes to big money or big business, that is not the case. so, it should be spelled out.

Richard is often described as a “tax expert”, which would also suggest independence.

Academics are always funded by someone. If you spelt it out every time one was quoted, you’d end up with things like the US press releases which have three lines of content followed by five pages of boiler print, which would make papers unreadable.

Medics must disclose conflicts

Oxford requires the same

I pointed out a few years ago (2009, I think) that Oxford Centre for Business Taxation did not. The THE picked up the issue then

We’ve no vested interests to hide, says tax-study centre

23 July 2009

http://www.timeshighereducation.co.uk/407471.article

Openness about social scientists’ affiliations and funders questioned. Melanie Newman reports

A campaign group has raised questions about the way social scientists declare potential conflicts of interest following the publication of a paper by an Oxford research centre.

The worries voiced by the Tax Justice Network concern the University of Oxford’s Centre for Business Taxation, based in the Said Business School.

It was launched in 2005 with £5 million in funding from the Hundred Group of Finance Directors, an organisation whose members are drawn exclusively from FTSE 100 firms.

The campaigners have accused the centre of not being transparent enough about its backing in a research paper published earlier this year, which said that improvements to financial regulations were unlikely to have any effect on international tax avoidance.

They said that the paper did not mention the centre’s link to the Hundred Group.

Michael Devereux, director of the centre, denied that he or his colleagues had “ever sought to not disclose or in any way hide the sources of the centre’s funding”.

He said: “I completely agree that academics should declare the sources of their funding. The centre and its staff have always done so, and intend to continue to do so.”

He argued that the centre’s funding sources did not have to be listed on every paper because they were clearly detailed elsewhere, including its annual report.

“An outstanding issue is whether it should be expected that researchers list all their affiliations and sources of funding on every document they produce,” he said.

“Our approach to date has not been to do this, on the grounds that it would amount to virtually including a CV in every publication. But this is quite different from attempting to hide that information, which is available on our website.”

David Byrne, director of postgraduate studies at Durham University’s School of Applied Social Sciences, said funding sources should be declared “as a general principle across the whole of the academy”.

“When work is funded by an interest group, then that has to be absolutely evident to all who engage with it,” he said.

His view was echoed by Prem Sikka, professor of accounting at the University of Essex, who pointed out that scientific research papers include footnotes that make it clear when work is funded by external interests as a matter of course.

“This is just as important in the social sciences,” he said. “People are not just giving money to fund research out of the goodness of their hearts: they are interested in influencing public policy.”

However, Professor Devereux listed the numerous positions he holds, and asked: “Would you expect me to disclose all of those every time I make a public comment or publish a paper? Or would you expect me to publish only connections to business? If it’s the latter, then it would give a very misleading impression of the breadth of my work.”

melanie.newman@tsleducation.com.

I can’t add any more to Oliver Bird’s comments. He has hit the nail on the head.

OXFORD UNIVERSITY CENTRE FOR BUSINESS TAXATION IS ONE OF THE AGENTS OF THE LIGHT TOUCH REGULATION AND THE CORPORATE CAPTURE THAT LANDED US IN THIS MESS.

THIS IS FROM THEIR FIRST ACCOUNT IN 2005-06:

http://www.sbs.ox.ac.uk/centres/tax/Documents/2005_06_annual_report.pdf

In the spring of 2005, the Hundred Group of Finance Directors proposed the possibility of a Centre for Business

Taxation. The initiative to set up the Centre was led by Dr Christopher Wales, Managing Director, Goldman

Sachs International, formerly a Member of the Council of Economic Advisers at HM Treasury and principal

adviser on taxation policy to Gordon Brown MP, Chancellor of the Exchequer. Oxford University was chosen in competition with other leading UK research universities.

Formal approval for the Centre was given by the University in September and notifications of financial support

from donating companies were received at this time. The Oxford University Centre for Business Taxation was established in November 2005 as an interdisciplinary research centre of Oxford University with donations of £5 million in the first two years by Members of the Hundred Group.

PERHAPS UK UNCUT SHOULD TARGET THE OXFORD UNIVERSITY CENTRE FOR BUSINESS TAXATION. THEN JUDITH FREEDMAN WOULD REALLY BE SORRY!

Excellent idea!

@Oliver Bird, I think it’s worth clarifying that the 100 Group donated £5 million in each if the first two years; so £20 million to get the centre going! Little wonder the boss – Prof Mike Devereaux – continues to argue for the abolition of corporation tax!!!

But if sponsors determine/influence outputs then the same logic means any sponsored work is biased? So we never even get close to objectivity.

I am saying they need to be upfront

I don’t think anyone doubts I am

I’d like to know what you mean by ‘objectivity’ in this area. Isn’t it a question of ethical values?

List of sponsors – quelle surprise!

Well done Richard – the sponsor list makes it quite for whom the Oxford Centre for Business Taxation are batting and it certainly isn’t small or medium size businesses paying tax based on their economic activity in the UK.

Contrast this with Big Business which pays tax based on an artificial edifice put together by Big 4 accountants and “Magic circle” lawyers. Magic being very appropriate as applied to the conjuring trick performed to make profits liable to tax vanish before your eyes.

Sorry that was too good to miss!

All NGOs should be required to publish their sponsors, then the General Public can judge the advice it provides accordingly. The Taxpayers Alliance and The Adam Smith Institute for a start can then be outed!

If I remember correctly, late last year George Monbiot tried to find out exactly this from every major think tank. As far as I recollect, with some exceptions, the more rightwing the organisation the less willing they were to disclose who sponsored them. I dare say a search of Monbiot’s web site would find the article.

Possibly… 🙂

Totally agree. Perhaps UK Uncut can set the standard on funding, sponsors and any political or union affiliations? It would also be good if they could state the evidence and support for the positions they take.

Your comment is deceitful: you well know where UK Uncut get much of their data from and what they want

I may know some of the information but that is probably not true that everyone does. Why is transparency not a good thing generally on both sides of the debate?

I think our side has been incredibly open

I don’t think so.

I have no idea where UK Uncut get most of their information. However, I do know that most of what they (and other campaigners, like 38 Degrees) produce is very hot on claims, which normally seem to be unsubstantiated, incomplete and/or technically incorrect, and rather light on actual information anyway.

I’m thinking of quoting tax paid as a percentage of turnover, using gross profit instead of PBT, calling capital allowances “loopholes”, that sort of thing.

This is just your usual hogwash: it’s all linked to sources

Saying you don’t like it – or saying it’s wrong when it’s the best data available – does not prove your case

it just says you’re suppressing argument

Hold on – you accuse me of suppressing argument, then delete the comment I make in reply?!?

Yes

Because you’re trolling again

Richard, your response here has got me curious.

I haven’t taken much interest in the technical arguments put forward by UK Uncut as I believe most of them are pretty unsound. I do take their concerns seriously, but think they could be better informed as to technical issues.

I do not know where their technical support or funding comes from. And I can’t find it on their website as easily I can similar information for the OUCBT.

Would you mind telling me what we should apparently well know?

To the best of my knowledge the source of all their claims is very easy to identify

My work and that of Richard Brookes is high on he list

And we don’t hide it

It seems to me that the scandal is the capture of academia by big business or other interested groups. There is always a lag when that happens, during which the public are apt to continue to think that they are getting an independent point of view when that is long gone. Before one can dig one has to be aware there is a reason for digging: that is not universally true even now, when the universities have long forfeited their authority and respect. Transparency is not enough. Academic departments should not get their money from such sources, because even after you become aware of it where else can one go for independent comment? It is not like there is any alternative left.

I googled “Oxford University Centre for Business Taxation” and clicked on the first result. It was their home page.

I clicked on “about” and then the option “funding” from the drop-down menu.

They must have changed it since you looked Richard.

It’s worth noting that establishing sponsored centres of this kind is pretty routine across the UK university sector these days, and increasingly elsewhere. As we might expect, it follows the US model and has been “encouraged” by successive government’s policies that have increased the reliance of universities on outside monies (i.e. not public funds) for research activities. And, of course, further encouraged by the breed of neo-liberal, business friendly (or ex-big business), management that’s now a common feature of UK higher education.

What’s interesting here is that it’s standard practice when publishing in academic journals to declare where funding for the research came from. I have the disclosure Sage applies to its journals in front of me. But as far as I know no similar conditions apply when making a comment – as Prof. Freedman has done here.

I should have added that I work for the Open University and receive no funding for my work from any other source.

Noted!

I have in the past complained that the Oxford Centre for Business Taxation have been lax on this issue

Now when they say a donor list is available they do not point to it

@Ivan, you’re quite right but I remember that Andrew Goodall formerly of Taxation used to specify the link between the Oxford University Centre for Biz Taxation and big business each time he used a comment by Mike Devereaux or Judith Freedman. so in this case it was for the usually excellent Jesse Drucker to make the point (assuming that Judith Freedman didn’t consider it important enough to flag it and insist that it was done).

I have spoken with Jesse and he has said he thinks Judith Freedman did mention the point and he omitted it

Actually – I still think the list was well worth publishing as Jesse did not realise quite who was on it

Ivan, I believe it was Edward Bernay (the father of PR) who first came up with the idea of getting an ‘expert’ and using it to sell an idea or product. Bernay had a low opinion of the general public. He believed the ‘masses’ needed to be ‘directed’.

Hence this is why the media (largely corporate owned) is always parading this or that ‘expert’. It’s devious and fraudulent in the extreme. If there’s one thing we need to educate our fellow man in, it’s that they need to question any academic to appears in the media and not accept it as the word of an ‘expert’.

@Anthony,

You’re absolutely right’ It is not surprise that none of these ‘independent experts’ warned us plebs about the banking crisis or the extent of tax abuse!

The work published a year ago, on the extent to which different think tanks disclose their sponsors, mentioned in comments above, is available here:

http://whofundsyou.org/

I would not, as a general rule, require disclosure of sponsors. Defining a think tank would be tricky, and in any case, there is such a thing as the freedom not to tell everything about yourself.

But there would, I think, be a good case to require the disclosure of sponsors whenever a think tank engaged in electoral campaigning, so as to reduce the risk of plutocratic purchase of the political process (as with some of the Super-PACs in the United States), and whenever a think tank received any funds from central or local government.

And we should certainly point the finger at any organisation that hides its sponsors, and say that this gives us good reason to be suspicious of its conclusions.

I admit I don’t offer a pound for pound break down of every penny I get

Equally I try to make sure all influences are known – because I think that important

Very healthy discussion this. Thanks for sparking it, Richard.

Richard,

I have read your blog with interest, having been alerted to it by some kind people- thanks to them.

I am employed as a tenured Professor of Law in the Oxford University Law Faculty. Before that I worked for the LSE for 18 years. My salary is paid by Oxford University and my academic freedom is protected by the University. KPMG founded the Tax Chair in 2001 with a ten year donation, now expired. I was appointed by the University, not KPMG, and am answerable only to the University under my contract.

I helped to found the Oxford University Tax Centre, which is subject to all University rules on independence. We obtained donations from members of the 100 Group to fund the Centre’s work. We have always been clear about the source of this funding, from our first press release onwards. The details of our funding, including business and research council funding, are easily found on our web site by most people able to use the internet.

I have been writing on tax avoidance for many years. My inaugural lecture in 2003

http://denning.law.ox.ac.uk/tax/documents/BTR_version_inaugural_lecture.pdf proposed a GAAR and in fact invented the term ‘GANTIP’

Anyone who reads my work will know that I say what I think. Most of it is available here http://www.law.ox.ac.uk/people/profile.php?who=freedmanj

I am a strong supporter of tax debate. I made clear to Jesse Drucker (who apparently agrees that I told him about my association with the Centre and our business sponsorship when we spoke) that the UK Uncut case had uncovered some interesting material, but I regretted that the debate had become polarised and companies blamed for what I see as a failure by governments to sort out the international tax system. My point about polarisation of the debate seems to be supported by the comments here. What a pity; I would much prefer to debate the issues.

Judith

I have made the point that Jesse made to me that you mentioned sponsorship

As for the rest I note what you say – and cannot dispute it – but I can disagree on the issue regarding polarisation

Of course you would not wish for that: the Oxford Centre for Business Taxation has clearly shown its support for a prevailing powerful consensus that suits a few, most especially amongst your sponsors, and disadvantage many. Polarisation threatens that consensus, and so you will seek to dismiss it as unhelpful when it is in fact the necessary engine of essential change

As such I’d suggest you are not seeking to debate the issues – you’re seeking to make sure they’re not on the agenda, as your Centre proves time anad again by not inviting alternative opinion

Richard

Richard,

You’re completely to point out that: “the Oxford Centre for Business Taxation has clearly shown its support for a prevailing powerful consensus that suits a few, most especially amongst your sponsors, and disadvantage many. Polarisation threatens that consensus, and so you will seek to dismiss it as unhelpful when it is in fact the necessary engine of essential change”.

Prof Freedman “regretted that the debate had become polarised and companies blamed for what I see as a failure by governments to sort out the international tax system”. But with respect, that is an apologist denial of the blindingly obvious.

First, the companies that fund her work corrupt the tax policymaking process as we have seen with the corporate road map reforms that led to the new CFC and patent box rules etc. The BBC and the PAC exposed the scandal of 2 KPMG secondees to the Treasury that helped in drafting the legislation going back to KPMG to advise their clients how to abuse the legislation to place tax revenues beyond the grasp of the Revenue. Vodafone and HSBC officials were in the working group that drafted the CFC rules that benefit them enormously at the same time they were helping themselves to sweetheart deals provided by Hartnett regarding back taxes under the previous CFC rules. In fact, all the working groups that worked on the Corporate Road Map changes were from the 100 Group and the Big 4 accountancy firms apart from Prof Mike Devereaux of the Oxford University Centre for Biz Taxation who was supposed to be the ‘independent expert’. So contrary to Prof Freedman’s apologist denial, the companies are not blameless and should be criticised as much as the govt they’ve captured.

Secondly,in terms of tax administration, we also know that it was the cosy relationship between HMRC and the big companies that led to the sweetheart deals but the likes of Prof Freedman would like to shield her sponsors by claiming that companies are blamed for what she sees as a failure by governments to sort out the international tax system.

I wonder what Prof Freedman thinks of the fact that KPMG admitted tax evasion dressed up as tax and paid $456 Million to the US authorities for Criminal Violations in Relation to Largest Ever Tax Shelter Fraud Case in 2005 when she was still receiving money from the UK arm. http://www.justice.gov/opa/pr/2005/August/05_ag_433.html

Is that also a failure by the US government or evidence that our government is failing by not taking the necessary enforcement actions to show that the problem is not just the rules but the failure of HMRC to enforce the rules.

Whistleblowers told the PAC that Google misled HMRC in their claims that deals were closed in Ireland and handed the evidence to HMRC but HMRC have yet to take any action. So big companies are cheating us in the UK with the complicity of the government and both of them should be attacked.

This is the sort of things KPMG gets up to:

http://www.justice.gov/opa/pr/2005/August/05_ag_433.html

KPMG to Pay $456 Million for Criminal Violations in Relation to Largest-Ever Tax Shelter Fraud Case

WASHINGTON, D.C. – KPMG LLP (KPMG) has admitted to criminal wrongdoing and agreed to pay $456 million in fines, restitution, and penalties as part of an agreement to defer prosecution of the firm, the Justice Department and the Internal Revenue Service announced today. In addition to the agreement, nine individuals-including six former KPMG partners and the former deputy chairman of the firm-are being criminally prosecuted in relation to the multi-billion dollar criminal tax fraud conspiracy. As alleged in a series of charging documents unsealed today, the fraud relates to the design, marketing, and implementation of fraudulent tax shelters.

In the largest criminal tax case ever filed, KPMG has admitted that it engaged in a fraud that generated at least $11 billion dollars in phony tax losses which, according to court papers, cost the United States at least $2.5 billion dollars in evaded taxes. In addition to KPMG’s former deputy chairman, the individuals indicted today include two former heads of KPMG’s tax practice and a former tax partner in the New York, NY office of a prominent national law firm.

“Corporate fraud has far-reaching consequences, both to the marketplace and those whose livelihoods depend on companies that maintain honest business practices,” said Attorney General Alberto R. Gonzales. “Today’s agreement requires KPMG to accept responsibility and make amends for its criminal conduct while protecting innocent workers and others from the consequences of a conviction. The stiff financial penalty announced today means that the firm is paying for its conduct, while the guarantees of cooperation, oversight, and meaningful reform will help to ensure that its future business is conducted with honesty and integrity.”

The criminal information and indictment together allege that from 1996 through 2003, KPMG, the nine indicted defendants and others conspired to defraud the IRS by designing, marketing and implementing illegal tax shelters. The charging documents focus on four shelters that the conspirators called FLIP, OPIS, BLIPS and SOS. According to the charges, KPMG, the indicted individuals, and their co-conspirators concocted tax shelter transactions-together with false and fraudulent factual scenarios to support them-and targeted them to wealthy individuals who needed a minimum of $10 or $20 million in tax losses so that they would pay fees that were a percentage of the desired tax loss to KPMG, certain law firms, and others instead of paying billions of dollars in taxes owed to the government. To further the scheme, KPMG, the individual defendants, and their co-conspirators allegedly filed and caused to be filed false and fraudulent tax returns that claimed phony tax losses. KPMG also admitted that its personnel took specific deliberate steps to conceal the existence of the shelters from the IRS by, among other things, failing to register the shelters with the IRS as required by law; fraudulently concealing the shelter losses and income on tax returns; and attempting to hide the shelters using sham attorney-client privilege claims.

The information and indictment allege that top leadership at KPMG made the decision to approve and participate in shelters and issue KPMG opinion letters despite significant warnings from KPMG tax experts and others throughout the development of the shelters and at critical junctures that the shelters were close to frivolous and would not withstand IRS scrutiny;

that the representations required to made by the wealthy individuals were not credible; and the consequences of going forward with the shelters-as well as failing to register them-could include criminal investigation, among other things.

The agreement provides that prosecution of the criminal charge against KPMG will be deferred until December 31, 2006 if specified conditions-including payment of the $456 million in fines, restitution, and penalties-are met. The $456 million penalty includes: $100 million in civil fines for failure to register the tax shelters with the IRS; $128 million in criminal fines representing disgorgement of fees earned by KPMG on the four shelters; and $228 million in criminal restitution representing lost taxes to the IRS as a result of KPMG’s intransigence in turning over documents and information to the IRS that caused the statute of limitations to run. If KPMG has fully complied with all the terms of the deferred prosecution agreement at the end of the deferral period, the government will dismiss the criminal information.

To date, the IRS has collected more than $3.7 billion from taxpayers who voluntarily participated in a parallel civil global settlement initiative called Son of Boss. The BLIPS and SOS shelters are part of the Son of Boss family of tax shelters.

The agreement requires permanent restrictions on KPMG’s tax practice, including the termination of two practice areas, one of which provides tax advice to wealthy individuals; and permanent adherence to higher tax practice standards regarding the issuance of certain tax opinions and the preparation of tax returns. In addition, the agreement bans KPMG’s involvement with any pre-packaged tax products and restricts KPMG’s acceptance of fees not based on hourly rates. The agreement also requires KPMG to implement and maintain an effective compliance and ethics program; to install an independent, government-appointed monitor who will oversee KPMG’s compliance with the deferred prosecution agreement for a three-year period; and its full and truthful cooperation in the pending criminal investigation, including the voluntary provision of information and documents.

Richard Breeden, former Securities and Exchange Commission Chairman, has been appointed to serve as the independent monitor. After his duties end, the IRS will monitor KPMG’s tax practice and adherence to elevated standards for two years.

Should KPMG violate the agreement, it may be prosecuted for the charged conspiracy, or the government may extend the period of deferral and/or the monitorship.

“Today’s actions demonstrate our resolve to hold accountable those who play fast and loose with the tax code,” said IRS Commissioner Mark Everson. “At some point such conduct passes from clever accounting and lawyering to theft from the people. We simply can’t tolerate flagrant abuse of the law and of professional obligations by tax practitioners, particularly those associated with so-called blue chip firms like KPMG, that by virtue of their prominence set the standard of conduct for others. Accountants and attorneys should be the pillars of our system of taxation, not the architects of its circumvention.”

The nine individuals named in the indictment are:

-Jeffrey Stein, former Deputy Chairman of KPMG, former Vice Chairman of KPMG in charge of Tax, and former KPMG tax partner;

-John Lanning, former Vice Chairman of KPMG in charge of Tax, and former KPMG tax partner;

-Richard Smith, former Vice Chairman of KPMG in charge of Tax, a former leader of KPMG’s Washington National Tax, and former KPMG tax partner;

-Jeffrey Eischeid, former head of KPMG’s Innovative Strategies group and its Personal Financial Planning Group, and former KPMG tax partner;

-Philip Wiesner, former Partner-In-Charge of KPMG’s Washington National Tax office and former KPMG tax partner;

-John Larson, a former KPMG senior tax manager;

-Robert Pfaff, a former KPMG tax partner;

-Raymond J. Ruble, a former tax partner in the New York, NY office of a prominent national law firm; and

-Mark Watson, a former KPMG tax partner in its Washington National Tax office.

The indictment alleges that as part of the conspiracy to defraud the United States, KPMG, the nine defendants and their co-conspirators prepared false and fraudulent documents- including engagement letters, transactional documents, representation letters, and opinion letters-to deceive the IRS if it should learn of the transactions. KPMG, the indicted defendants and their co-conspirators are also charged with preparing false and fraudulent representations that clients were required to make in order to obtain opinion letters from KPMG and law firms-including Ruble’s law firm-that purported to justify using the phony tax shelter losses to offset income or gain. The conspirators allegedly concealed from the IRS the fact that the opinion letters provided by KPMG and the law firms were not independent and were instead prepared by entities involved in the design, marketing and implementation of the shelters. Had the IRS known this, the opinion letters would have been rendered worthless.

KPMG admitted that the opinion letters issued for the FLIP, OPIS, BLIPS and SOS shelters were false and fraudulent in numerous respects, including false claims that transactions were legitimate investments instead of tax shelters; and also false claims that clients were entering into certain transactions making up the shelters for investment purposes or to diversify their portfolios, when these actually served to disguise the shelters. KPMG also admitted that the clients’ motivations were to get a tax loss, and with respect to BLIPS, the opinion letters also included false claims about the duration of the transaction and the clients’ motivation for terminating the transaction. According to the charges, BLIPS was also based on false claims about the existence and investment purpose of a loan, when these were in fact sham loans that had nothing to do with any investment, and at least one of the banks never even funded the purported loans.

According to the charging documents, Smith, Eischeid, and others caused KPMG to provide false, misleading and incomplete documents and testimony in response to a Senate subpoena, which was delivered as part of an investigation into tax shelters being conducted by the Senate Governmental Affairs Committee’s Permanent Subcommittee on Investigations.

Assistant U.S. Attorneys Justin S. Weddle and Stanley J. Okula, Jr.-together with Special Assistant U.S. Attorney and Tax Division Trial Attorney Kevin M. Downing-are in charge of the prosecution. The investigation and prosecution are being supervised by Shirah Neiman, Chief Counsel to the U.S. Attorney for the Southern District of New York. For the IRS, the case was investigated by a team of special agents and revenue agents from the agency’s criminal and civil divisions.

The individual defendants are scheduled to be arraigned by Judge Lewis Kaplan.

The charges contained in the indictment are merely accusations, and the defendants are presumed innocent unless and until proven guilty.

We continually invite opinions from a wide range of people. FYI , recent speakers at our conferences have included Martin Hearson, David McNair, Joseph Stead and Margaret Hodge. We invite anyone willing to engage in debate and are genuinely interested in their ideas.

So when will I receive an invitation again? As you’re well aware – none of them is a tax expert in the sense of having any tax qualification, albeit the first three have clear expertise in tax campaigning. Is that really engaging in debate in that case?

Are you seriously suggesting that people who do not have tax qualifications, such as most people in UK Uncut, cannot debate tax issues?

But, if you rely on ad hominem attacks to argue against your opponent (like this post and many of the comments you have allowed through, that is a good reason not to let you debate with people who might want to actually discuss the issues being raised, rather than who is in the pocket of whom.

No I’m not saying that

But I am saying that it is odd that those invited who do not have such qualifications whilst others who have them are not being heard

I am simply suggesting selective hearing

And as for ad hominems – this site is freer of them than almost any I read

Really? Your difficulty navigating the internet might be the cause of that then. This post is an ad hominem argument.

Instead of arguing the point Judith Freedman raises by defending the behaviour of UK Uncut, you try to dismiss her as being in the pocket of big business and should not be listened to. That is an ad hominem argument.

I raised an entirely valid point that a person sponsored by big business was making an invidious comment at an inappropriate moment

That is not an ad hominem

That was pointing out a fact not disclosed in the article

What exactly are your tax qualifications and do you have any qualification in international taxation and in particular treaty law?

It is well known I am an FCA who has spent many years as a tax practitioner

You want an invite? But there are thousands of accountants who know about tax (very fine people). Why should you be invited out of all of them? Again?

I was invited for some time

And that was because I was (and maybe soon again) an accredited UK academic

And maybe, just maybe, the fact that I have helped form a considerable part of this debate may have something to do with it?

Or maybe not, if you so wish

Richard, you’re being very generous to some of these detractors.

I am remarkably generous

On a right wing blog they would have been treated very differently – as most will well know

Columbia Law School arranged a macroeconomic debate, MMT versus Austrian School, which was livestreamed.

http://www.modernmoneynetwork.org/mmt-vs-austrian-school.html

Surely Oxford Business School have the resources to arrange a similar macroeconomic debate on the “benefits” of multi-nationals offshoring profits.

I’m losing the plot. Some posts warn against trusting experts, others say they need to be invited by Oxford. Some posts demand transparency of all funding and sources and others say its all known. Some posts say business funding taints academics’ views but apparently not for campaigning groups.Posts criticise a lack of disclosure but nobody picks up on the failure of the journalist to repeat what he had been told. What’s happened to a discussion on the original article, the impact of UK Uncut?

“the failure of the journalist to repeat what he had been told” was commented on at least 3 times!

Commented on but not picked up.The quote was still treated as deliberate concealment. And we’re still not talking about UK Uncut.

You publish innuendo about an academic and then accept all but one of her replies. So delete the blogpost. If you lack this elementary level of professionalism, then I think you have answered your own question about invitations.

I have accepted all Judith Freedman’s comments

Every single one

Your claim is, quite simply, wrong

I also did not publish innuendo

I published fair comment

Wjat I can say is what a lot of others have published is factually wrong

The innuendo is that Judith Freedman is a stooge of big business.

It seems that this is not true, yet the post is still live. Why?

In my opinion the Oxford Centre does very clearly argue the case for big business – as was very, very obvious when it was established, in my opinion – and I said so at its launch event

Judith was there at the time

So of course I am not taking the blog down

PS It has also gone out of its way to defend tax havens