I've put this FAQ sheet up on the site this morning:

Time and again I hear comment that implies income tax is the be-all and end all of the governments income and all policy must be designed around it - and those who pay a lot of it.

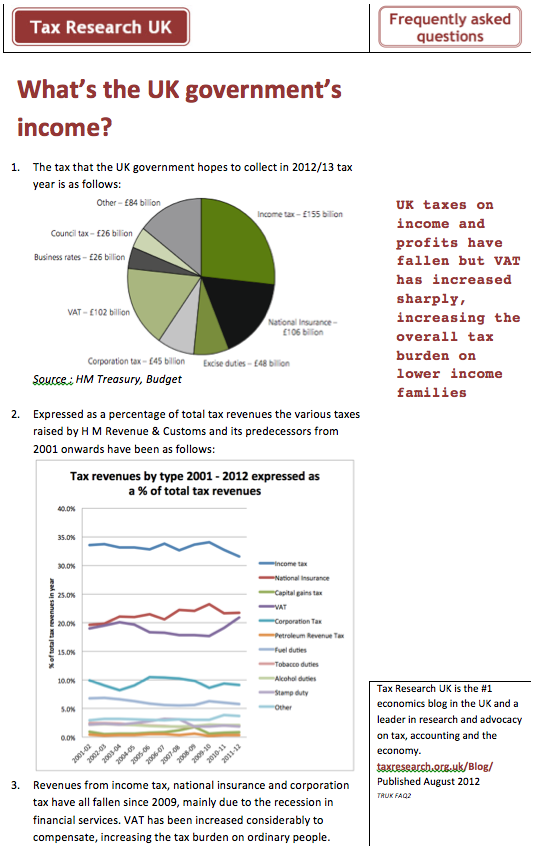

This FAQ sheet shows first of all that's not true. Income tax is our biggest revenue earning tax but is only a just over a quarter of the government's income.

Second, it's importance amongst taxes (the lower table excludes "other" government income which is why the data looks different) has been declining, especially during the current recessions. VAT's importance has been rising during the recession.

The impact is clear: the tax paid by the best off has fallen and that paid by the rest has risen of late, and that's one reason why we are still in recession.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It’s the ‘lucky duckies’ WSJ argument; too poor to pay income tax, lucky beggars: see Krugman blogs April 22, 2011 ‘Zombie Tax Lies’ and July 25, 2012 ‘Zombie Straw Men’.

What do you think about a land tax to balance out taxation on wages, profit and consumption?

I think a land value tax useful

But nothing like as useful as most of its proponents claim

A huge revenue source; cuts wealth inequality; no more house price bubbles; no more land banks holding back development; redirection of financial capital to productive investment (instead of swelling the banks’ coffers); cheaper houses. Not very useful?