The Group of the Progressive Alliance of Socialists & Democrats in the European Parliament issued a report at their press release this morning, part of which dealt with the EU tax gap. This report, which is based on my work (the full report is now available - here), was as follows:

CLOSING THE TAX GAP AND RE-LAUNCHING THE ECONOMY AND JOB CREATION

TWO SIDES OF THE SAME COIN

1. The main finding of the study commissioned by the S&D Group from Tax Research London is that €1 trillion are lost in potential tax revenue every year (EU27).

2. This loss of public revenue plays a substantial part in the deficit and debt levels we are currently facing, which in turn is negatively affecting public investment levels, growth and employment.

3. A large part of this non-taxed liquidity is feeding into financial trading activity rather than private or public consumption, and investment.

Therefore, by forcefully addressing this "tax gap", the EU could at the same time:

- Contribute to the necessary stabilisation of financial markets and of the economy as a whole, by significantly reducing liquidity available for financial trading unrelated to real economic activity;

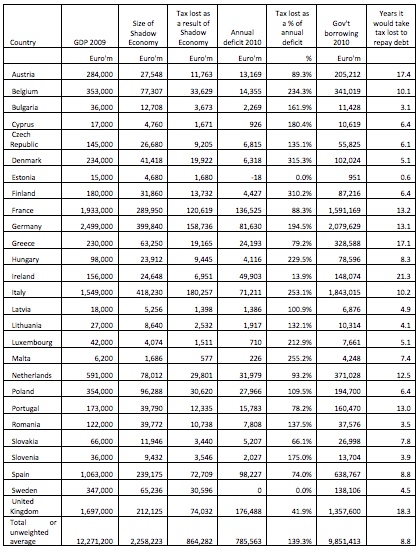

- Increase available public revenue to accelerate necessary fiscal consolidation while reducing its austerity effect (thereby also alleviating current pressure on necessary public spending on education, health or social policy); the study shows that if the tax gap were to be totally closed, EU governments could repay all public debt within 8.8 years (see table below).

- In particular, provide the necessary resources to increase public investment geared towards the strengthening of Europe's international competitiveness and growth potential, despite of the consolidation agenda. By channelling an additional amount of about €200 billion from the reduced tax gap to public investment spending each year, the EU could lift that investment from the current 2.7%/GDP to a realistic target of 3.5% within a few years. This would notably provide essential funding for public investment in sustainable growth technologies.

- This whole new strategy should be framed politically within a strengthened Europe2020 strategy, finally backed up by proper funding.

- The governance of this strategy at EU level (as much is to be done directly at member states level) would need to be managed accordingly via the existing processes involving the annual national stability and growth programmes and the national reform programmes. Available information on the extent of tax avoidance and evasion in each member state must, in this context, be significantly improved in the public interest.

KEY RECOMMENDATIONS

The EU must take strong action at European and at national levels at the same time. To provide the necessary focus, the European Council must agree on an ambitious while realistic headline target: Halving the tax gap by 2020. By moving towards this target, member states would gradually achieve new tax revenue without raising tax rates at the level of several hundred billion € a year.

This target can be reached by ensuring action on mainly five key issues:

- Reforming the accounting rules and corporate accounting disclosure

- Upgrading and extending the scope of the European Union Savings Directive

- Ensuring compulsory Common Consolidated Corporate Tax Base

- Introducing country-by-country reporting for cross-border companies

- Strengthening regulation of company registries and registers of trust

This will have to include adequate EU-wide agreements with key non-EU countries currently providing platforms for financial institutions facilitating tax fraud and evasion activities from within the EU, such as Switzerland. The report provides over 30 detailed proposals for policy action at EU and at member states levels.

KEY FACTS AND FIGURES

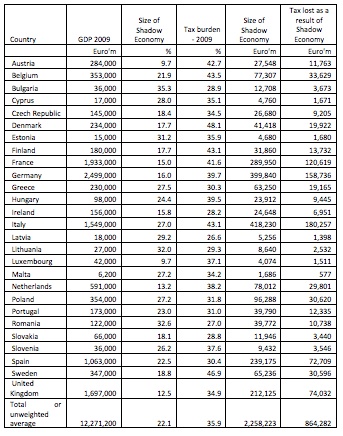

Using consistently credible sources the report provides a resulting estimate of tax evasion in the European Union of approximately €860 billion a year. Estimating tax avoidance is harder; however, an estimate that it might be €150 billion a year is made in the report. In combination it is therefore likely that tax evasion and tax avoidance might cost the governments of the European Union Member States €1 trillion a year.

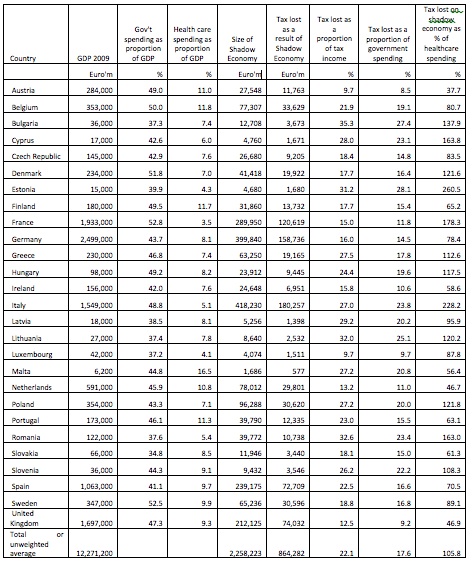

In a significant number of countries tax lost as a result of the shadow economy might represent more than 20% of total government spending and as a proportion of government revenues that sum lost does in some cases exceed 30% of total income.

On average the tax lost as a result of the existence of shadow economies in Europe represents 105.8% of the total health care spending in EU countries.

Furthermore, the amount of tax lost is on average more than 4 times higher than the amount spent on education.

As shown in the table below, there is no clear relation between the level of taxes and the level of tax evasion in the European Union Member States:

Finally, the following table compares tax losses with government deficits and total government borrowing based on European Union data. If tax evasion could be stopped total EU public debt could be repaid in just 8.8 years:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: