There are many people in the UK who wonder where the money's gone.

Many more wonder why we are so much in debt.

Yet more wonder how the deficit is paid for.

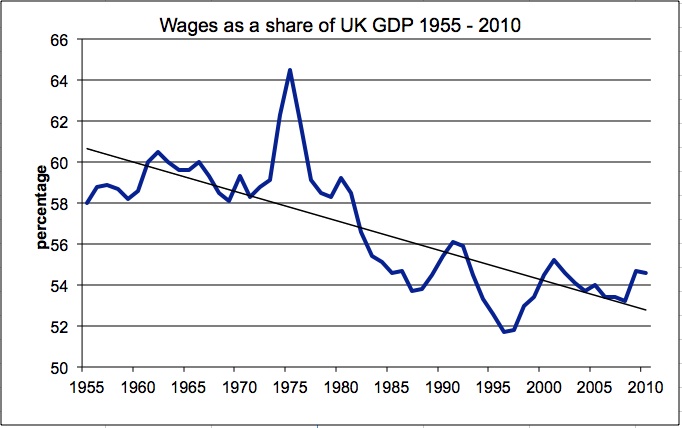

Let me offer you a graph as explanation. It was prepared by Stewart Lansley, author of The Cost of Inequality: Three Decades of the Super-Rich and the Economy, to whom I am grateful. The data is from the Office for National Statistics and shows the share of wages in UK GDP:

I have added a linear trend line to make clear just what is happening.

In the early 60s wages were 60% of GDP.

Now they're running at about 53% (the upward blip in 2010 was due to a fall in productivity at the start of the recession; now unemployment is rising that will reverse again).

Give or take over 50 years labour's share of GDP has fallen by 6 or 7%. That's about 10% of its start point.

In cash terms, given that GDP is about £1.4 trillion a year, in the UK, consumers have around £100 billion less in their pockets today than if the national cake was shared as it was in the 1960s. That has meant around £100 billion less in consumer spending each year of the crisis.

This is money that has shifted as productivity has risen from labour to capital since profits have risen to absorb this shift. The shift has been especially marked since the 1990s.

The result was a rise in consumer borrowing to maintain living standards. That borrowing was funded by those earning excess profits, which have not been invested (especially since 2000, since when the fall off in real investment has been dramatic) who simply lent it to those who were being squeezed by them. The result was obvious: we had more debt, greater inequality and the recipe for economnic disaster.

And now that people aren't borrowing so much? Well now the excess is simply being lent to the government instead. That excess profit is what is now funding the government deficit, as Martin Wolf has pointed out in the FT, often.

There's a tale or two in this. First those who claim we need fiscal conservatism 'because the money has run out' are not telling the truth: the money's there all right. It's just been shifted to wealth owners, who don't want to pay tax on it which is why government is borrowing so much. To accept the 'money is run out' argument is to simply say this shift and the resulting inequality is a done deal.

Second, if we could collect the tax due on capital as we can on labour then we wouldn't have a debt crisis now. Enabling this is the basis of much of the campaigning I do.

And third, nor would we have a debt or economic crisis if we had more equality in our society. So again those calling for fiscal conservatism and the inequality that is an inherent part of it are simply wrong.

I do not for a minute accept the argument that the money has run out in the economy and so fiscal conservatism is necessary. That's not, as its proponents say, Keynesian. Keynes would be arguing for big deficits now and the proponents of fiscal conservatism are not. What they're saying is the bankers have won, the shift in wealth in the economy is permanent, there's nothing we can do about it so austerity for most whilst a few enjoy massive wealth without responsibility is the new order we must accept.

We do so at our peril. Down that route lies social chaos and worse.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting – 1975/6 were hardly glory years for the economy were they?

But relatively people were better off, and the trend is ongoing anyway

So you’d rather people were “relatively” better off even if it meant they were absolutely poorer? The graph shows a decline from 58 to 55 per cent. Hardly earth-shattering.

As even the OED admit – the massive increases isn wealth disparity are massively destructive

I am happy for people to be better off – but not if the result tears society apart

GDP is not everything – as I argue in The Courageous State

Yes but that was just a spike and unsustainable on the terms in which it occurred which probably had something to do with the oil price rises and other stresses in the economy. The long term trend looks pretty clear and does need to be addressed but not by reinstating the conditions of the mid 1970s.

“Interesting — 1975/6 were hardly glory years for the economy were they?”

Two words – Oil Crisis.

As Bernard Lietaer constantly reminds us in his 2001 book “The Future of Money” – national currency is deliberately scarce but complimentary (local) currency can be created as it is needed.

I increasingly think that is a direction down which we (and I) need to travel

No better place to start then, than here http://www.reinventingmoney.com/

Richard, I am pleased that you have analysed this in a way that the majority of people should understand. What really amazes me is that this trend has only recently begun to be discussed in the UK whereas in the US it has been apparent for some 30 years. As both countries have been following the Anglo-Saxon neoliberal model it should have been obvious that the UK would end in the same position. Of course the policymakers preferred to gloss over this and the weakness of the trade unions, resulting from legislation and the destruction of manufacturing industry, enabled this trend to continue unabated.

A very Luddite way of looking at the world. A lot of the productivity gains have come from technology and to a large extent the share of GDP that has been diverted away from Labour costs have been diverted towards technology. Labour’s share oif GDP has gone down, but in absolute terms it has increased dramatically, most of which is attributable to technology in one form or another.

I’m not being Luddite at all

There’s nothing wrong with innovation

But when it results in massive wealth inequality the resulting rewards are highly destructive – as even the OECD says today

The Ludditism is in your thinking and contempt for your fellow human beings

Technological innovation/improvement is the result of labour. Labour is the only factor which deserves a return.

I’d dispute that. Technology is part of the story, but most of our economy is now based on service industries, often badly paid, and financialisation.

Real productive wealth like manufactuirng has been eroded since the early 1980s and into banking and finance, who have derived their enormous profits from equally enormous levels of debt.

The consumerism of the last 20 years or so has been funded almost exclusively from debt, chiefly mortgages and credit cards. It is the huge abuse of derivatives like Credit Default Swaps and Collaterised Debt Obligations that has blown up the world economy, leaving unwinding debts that will probably be impossible to pay off.

We need a progressive income tax system, a break up of investment banks from retail banks, a Financial Transaction Tax and huge investment in housing, transport, infrastructure and manufacturing. That can either be funded from borrowing and spending or by the government simply created its own debt-free money to finance it.

As Richard says, don’t kid yourself the money isn’t there – it clearly is!

[…] usual, Richard Murphy offers some really interesting economic commentary. Here are the main points and some questions they raise, if you don’t have time for the […]

[…] services through investment using the money that is available rather than printing or borrowing it: Tax Research UK, There’s Plenty of Money and Michael Roberts, US Investment Strike and Eoin Clarke, The Green […]