I cam across the following amazing data on a log called Sturdyblog, to whom I give full credit and hoe they'll forgive my copying such enormously important information:

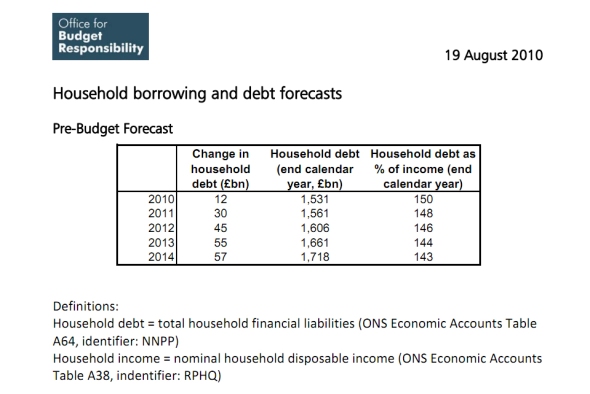

Ahead of Osborne’s emergency budget, the forecast of the OBR for household debt (i.e. the money an average UK household owes, incl. secured loans like mortgages) had been:

This showed a predicted decrease of household debt as a percentage of household income, from 150% in 2010 to 143% in 2014. This had to be revised for Osborne’s emergency budget:

The decrease is now less sharp between 2010 (151%) and 2014 (146%) and actually flat-lines in the last three years of the forecast. Ahead of Osborne’s recent budget, however, as the cuts bite and growth stutters, the OBR had to issue a correction, dramatically revising their forecasts to:

Not only are they no longer looking at a decrease in household debt. They are looking at a STONKING 14% increase over the next five years. In money terms, almost £500 billion is being added to MINE and YOUR personal debt. And this doesn’t even take into account the inevitable, approaching interest rate hike.

So the government is going to cut its debt.

And as I noted they're going to do that by increasing taxes at way over the rate of inflation, whilst cutting services.

And how is the equation squared? Why, they're now predicting we'll go into debt to pay for it.

I guess that's one way to prepare RBS and Lloyds for privatisation.

But make no mistake - what this really means is that the groundwork for the next crash is being laid out in the government's own plans as borrowing becomes the only way people can feed and house themselves and their families. Irresponsible lending will follow, and we all know where that leads.

I am sickened at their sheer gall. So should everyone else. And full marks to Sturdyblog for spotting this.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I found Sturdyblog yesterday with the excellent ‘I slept with Kenneth Clarke’ – http://bit.ly/eW9gtd. Now one of my two best money blogs…

Anyway, because I’m dense, can you put this in simple terms for me? Are we seeing here compelling evidence that the government a relying on large swathes of the population borrowing money to stay alive to get the country out of debt

@Jonnyhotrod

Your analysis appears to be spot on to me

That’s exactly how they think people will make ends meet

And of course people in debt can’t protest as they live in fear

It’s not chance that mortgage means “the grip of death”

I barely spelt anything right there, well done for understanding.

So, they need us to get in to debt – are they engineering aspects of the economy that they can control to ensure that we do?

How bad would be if we didn’t bother? All of us.

@Jonnyhotrod

We may have no choice – there won’t be cash for people to make ends meet if the gov’t gets its way

So people will borrow

Especially the vulnerable

Which makes me very angry

Richard,

Forgive my simplicity, but are you saying that, at a personal level, if we *don’t* all increase our debts and instead live within our means, govt income will be less than Osborne has factored in to his “Plan A” (because VAT income will be less) and so the deficit will not be cut as predicted in his budget? And wont any borrowing less than the 14% mentioned also mean GDP grows less than he estimates?

Pete

@Pete B

Not at all what i’m saying

All I’m saying is tjat the gov’t knows people will not be able to make ends meet when the cuts happen and taxes rise so they’re assuming they’ll borrow more – and that is really crippling the next generation

Are any new figures also published on private non-financial corporate debt and more significantly financial corporation debt (excluding depositor and shareholder debt), and forecasts of the amount of tax relief on interest payments on these debt? Individuals are unable to claim tax relief on interest payments on their debts. Corporations should not be able to either beyond a reasonable cap. This tax relief should be cut. It may even cut the deficit in record time without harming our society, in contrast to the current approach.