I published this blog last September when The Finance for the Future, in which I am a partner, published its report, Making Pensions Work.

Today we're being told that public pensions don't work.

As the following detailed calculations show, however, the much bigger problem is that in practice private pensions are the sector that is not working: every single penny of private sector pension paid right now is covered by subsidies given to that sector by the state. This is the real pension crisis.

The truth is that right now there is no alternative to state pensions - and we need to recognise it. Unless private sector pension funds are reformed it is they that are failing - and that crisis is not being addressed.

The data on which I base this conclusion is as follows:

In the financial year 2009/10 UK state pensions cost the Exchequer £66.8 billion[i]. In combination that was 54.1% of all benefits administered by the Department for Work and Pensions (totaling £123.3 billion)[ii] and amounted to almost exactly 10.0% of all government spending[iii] and 4.8% of UK estimated GDP[iv]. The equivalent figure for old age pensions in 2007/08 was £57.6 bn[v]. This however, is not the whole story when it comes to the cost to the state of pension provision. When the full story is told the situation is much more complex.

To put this in context, in 2007/08 (the latest year for which comprehensive data is currently available) HM Revenue & Customs record that income from all “other pensions” (i.e. pensions other than state old age pensions) declared on tax returns amounted to £60 billion[vi]. This figure is somewhat bigger than the figure calculated by National Statistics for total pension fund payments in that year, which amounted to £35 billion (plus an additional £6 billion of very largely tax free lump sum payments made on retirement which are therefore not reflected on tax returns)[vii].

The reconciliation between total “other” pension income of £60 billion and the sum paid by private pension funds must, of course, be made up of the unfunded, pay as you go, state pensions paid as a result of accrued employment rights. These arise, for example, for members of the civil service who work for the state and who nominally contribute part of their salary to a pension fund as a consequence, but where the state does not actually invest these funds but does instead use them to pay the pensions of those already in retirement — hence the term ‘pay as you go’. The total of these pension payments, by deduction, amounted to approximately £25 billion in 2007/08. As a proportion of GDP this is 1.7%, a number confirmed to be correct by the National Audit Office[viii].

|

Type of pension |

Sum paid £’bn |

|

State old age pensions |

57.6 |

|

Private sector pensions |

35.0 |

|

State employment related pensions |

25.0 |

|

Sub-total, pensions paid |

117.6 |

|

Private sector, lump sums |

6.0 |

|

Total pension returns, including lump sums |

123.6 |

Of this sum £82.6 billion appears to be paid directly by the state and £41 billion by the private sector of which £6 billion is not treated as income for tax purposes.

It may also be worth noting that National Statistics additionally calculated that pension funds spent £5 billion on administration and costs in 2007/08, bringing the total cost of paying taxable pensions of £35 billion to £46 billion in the year[ix].

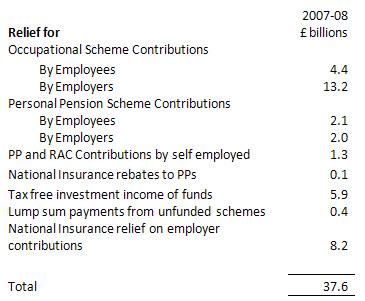

It is then important to note that in the same year, 2007/08, the total sum paid by companies and individuals into pension funds amounted to £83.1 billion[x]. The total tax relief given on these contributions cost HM Revenue & Customs £37.6 billion in the year in question[xi]. This is made up as follows[xii]:

As is clear from this data — a belief in private pensions as the basis for future provision looks forlorn because even in their good years (which may now be over) they appear to have supplied only £35 billion of ongoing pension payments (at most) out of a total of £117.6 billion of total pension payments, or less than one third of pension payments. And they did so at a total cost to the state for pension tax relief of £37.6 billion.

|

Cost |

Sum paid £’bn |

|

State old age pensions |

57.6 |

|

State employment related pensions |

25.0 |

|

Cost of pension tax relief in addition to the above |

37.6 |

|

Total |

120.2 |

In other words, and allowing for inevitable rounding in all estimates of this sort and the fact that these ratios are bound to change a little from year to year, every single pension payment made in 2007/08, totalling £117.6 billion in all (if lump sums are ignored) was made at eventual direct cost to the UK government, even if not paid directly by it. The private sector did not, in effect, bear any of the burden in that year of paying pensions to members of private sector pension funds. Those private pensions were, in effect, paid entirely out of the state subsidies that the pension industry or those making pension contributions (whether as employer or as employee) received, directly or indirectly.

[i] http://www.official-documents.gov.uk/document/hc1011/hc02/0296/0296.pdf note 15

[ii] http://www.official-documents.gov.uk/document/hc1011/hc02/0296/0296.pdf page 49

[iii] HM treasury budget data

[iv] HM Treasury

[v] http://www.dwp.gov.uk/docs/report-2007-08.pdf note 16a

[vi] http://www.hmrc.gov.uk/stats/income_distribution/3-6table-jan2010.pdf

[vii]http://www.statistics.gov.uk/downloads/theme_compendia/pensiontrends/Pension_Trends_ch09.pdf

[viii] http://www.nao.org.uk/idoc.ashx?docId=2fadc187-720d-49a0-a290-442e7e67454e&version=-1

[ix] ibid

[x] http://www.statistics.gov.uk/cci/nugget.asp?id=1283

[xi] http://www.tuc.org.uk/pensions/tuc-16929-f0.cfm. Note the ratio is more than 40% because of the combination of income tax, corporation tax and national insurance reliefs.

[xii] http://www.hmrc.gov.uk/stats/pensions/table7-9.pdf

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

excuse me if i have misunderstood your analysis, but if you’re comparing relief given on current private contributions to payments made from current private pensions, then are you mismatching?

i get tax relief on my pension contributions, but nothing is being paid out from that.. it’s going into the investments that will fund my retirement. the amounts being paid out are coming from the investments made by others in the past.

given that private pensions are a relatively recent innovation for many people, we can presumably expect the figure they pay out to rise over time as those of us who have contributed come to retirement and start to take out as oppose to put in.

there’s no cross-subsidisation of current private payments with current contributions and relief, except insofar as current contributions are invested in the economy which funds those payments… so, for example, with my tax relief i can buy investments from someone who needs to sell them as the draw down on, or cash in, their own savings.

Utter sophistry to state that pension tax relief results in private pensions being “paid entirely out of state subsidies”.

The same logic leads to the conclusion that the income of every single UK resident individual is being paid entirely by the UK government, since any post-tax amounts actually received by individuals reflect the opportunity cost of not imposing 100% direct taxation.

In a similar vein, the mind boggles at the amounts the UK is “paying” to the Russian government by virtue of the fact that the UK could in theory change the rules so that it taxes Gazprom on its worldwide group profits (and denies it FTCs) on the basis that it has a sub operating in the UK, but chooses not to.

Richard Murphy newsflash: “The UK ‘directly or indirectly’ pays Russia billions of pounds a year!”

Seriously, this almost reads like a ‘Daily Mash for tax accountants’ article.

With respect, what has that got to do with pensions for public sector employees, apart from the fact that they also receive tax relief for their pension contributions?

As Lord Hutton, and even Polly Toynbee acknowledges, although there is a net inflow of cash to public sector schemes, the actuarial obligations are rising faster than the pension contributions which means that the government will eventually be obliged to pay out more in value under the state scheme than it has received in contributions plus notional return on investment.

That is not surprising because every body is living longer, and the public sector is simply learning what the private sector has found: that contributing 10% of your salary for 45% of your adult life isn’t going to be enough to cover the cost of paying you 50% of your final salary for the final 55% of your adult life.

@PostTaxHedge

“The same logic leads to the conclusion that the income of every single UK resident individual is being paid entirely by the UK government”

Correct. That’s because they are the monopoly issuer of the nominal currency that we use – Sterling. Any other conclusion is operationally incorrect. The net financial assets of the UK are issued by the government.

In the same way we are taxed in nominal terms when we earn and spend, but only taxed in real terms when the public sector uses somebody or something that the private sector wanted to use at that point. Right at the moment the private sector doesn’t want to use people so there is no real taxation in using them for public purposes.

So why have they put nominal taxes up?

Similarly gilt interest is actually an import subsidy that destroys British jobs and unemployment for feckless banks and corporations that refuse to invest in the UK. We should stop issuing it and leave them with the raw currency.

@MarkT

I’m not quite sure what investment and contributions has to do with pensions – particularly ones paid directly by Government.

That seems to come from financial sector normalisation and the perpetuation of the myth that we need the wizard in the insurance/finance industry to keep us going.

The question should be how much real stuff do we allow a pensioner to have access to when they retire. You then give them the current nominal cost of acquiring that stuff and if there is no slack in the economy to handle that injection you need to tax space for it.

We need to reframe this debate in terms of how big we can make the pie before we start worrying about the size of the slices.

@PostTaxHedge

Actually, just straightforward fact

@MarkT

It shows only the public sector is capable of effecting the inter-generational transfer to keep people out of poverty in their old age

@theboynoodle

See http://www.taxresearch.org.uk/Blog/2011/03/11/the-fundamental-pension-contract/

You fundamentally misunderstand the macro pension contract

The micro pension contract is not relevant – but has been massively misleading

Simply that nobody would expect to receive a pension that on average will equal the nominal sum of all the contributions made into their pension fund many years previously. But the corollary is that it is equally unfair on tax payers fr public sector workers to expect to be paid a substantial pension for a large part of their lives unless the economic value of the contributions that have been made are related on average to the economic cost of providing the pensions at a later date. If people are living longer than 20 years ago, public sector workers should not necessarily expect the same pension arrangements as 20 years ago, or if they do they must expect to be paid slightly less now.

I don’t disagree (except that the capacity of the state to pay pensions is not quite infinite as any public sector pensioner in a burnt out South American economy would tell you), and in my view that is the biggest advantage of a public sector pension over a private sector pension because even with the best intentioned private sector employees they are not immune from bankruptcy of the employer and falls in asset values which would reduce the value of pensions.

@Neil Wilson

I absolutely agree that the question of pensions should indeed be about the real stuff that pensioners need/want. Looking at it in terms of cash simply misses the point that cash is not real wealth – it is just a claim on a share of the wealth. What its worth is hugely contingent on what real wealth is actually there during an individual’s retirement and what other claims exist.

Richard, this is an interesting way of analysing the costs related to Personal Pension provision. When they were first introduced in the 1980s, I do not recall that the actuaries considered the cost of tax relief in this way – it was an incentive to get individuals to provide for their future but also helped ensure that the pension providers, usually insurance companies, could achieve a return above inflation after allowing for introductory commission and annual management costs, etc. You may recall that insurance company’s investment funds lost their tax-free growth status at this time.

Most private companies started to opt out of providing final salary schemes because the annual cost was always increasing at a time when profits were not. These increases resulted from more stringent actuarial requirements and falling investment yields achieved by the pension fund managers.

In the 1980s, the Personal Pension plan product particulars included illustrations projecting annual growth at 8.5% and 13.5%. This of course has not been achieved and the tax relief becomes a more significant part of the cost.

Our only overall consolation is that those just taking their benefits have at least funded some of their pensions themselves, and are not wholly dependent on the state pension and pension credit, because their own provision will be deducted from any pension credit entitlement. Not a happy scenario for those in this position!

i think i’m pretty much with you on the issue of private pension money

not being put to good use (although elements will ultimately trickle

through to genuine investment, not least that which becomes state

borrowing and, therefore, helps to underpin state capital projects).

that said, i’m still unclear as to how that stacks up with your

assertion that ‘state subsidies’ are paying private pensions. in fact,

let me be bolder, i think it’s alchemy.. a spot of mathematical

mumbo-jumbo that’s entirely unnecessary given that the underlying point

about the flaw in the private pension system is bang on. most of the money we put into them doe nothing except float around the system disproportionately enriching the few and doing approximately nothing to develop the economy.

Richard

Do we know how much excessive pension tax relief is given to the very rich? It seems to me that a reasonable limit on such relief would be of the order of £15k – that being more than the vast majority could possibly pay into their pensions every year. People who can afford more than that don’t need more than that, so why the massive tax giveaway for those who can afford to put in up to £255k?

How much would it save if we put the limit down to a level which helps people who need it, without offering a massive tax loophole to those that don’t? Do we have this information, or does it need an FOIA to find out.

Cheers.