If there is one thing that I should be grateful to the Bank of England Monetary Policy Committee for it is that their incompetence provides me with seemingly endless material for this blog.

Take, as example, the rationale that they published for their decision to increase interest rates, published yesterday. Four features are worth highlighting.

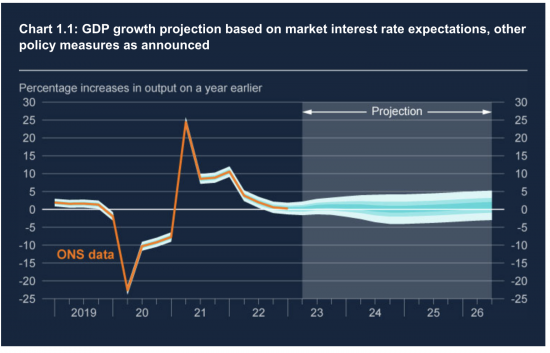

The first is that the Bank of England is effectively forecasting no growth as a result of its policy to create recessionary risk:

In effect, growth has disappeared in 2024 and 2025, albeit it remains possible within the margins for error within the forecast. Rishi Sunak is going to regret promising high growth and low inflation simultaneously as a result. There will be no pre-election bounce now, according to the Bank.

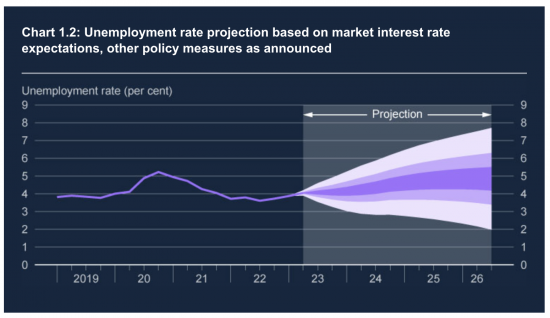

Second, and as a consequence, the Bank is forecasting rising unemployment:

The central forecast is for unemployment to increase by 350,000. I think that, with the previous observation, justifies many of the comments I have been making for a long time about the Bank having the goal of creating a recession.

Third, there is their forecast trajectory for deflation:

As is apparent, the Bank think inflation is going to tumble over the next eighteen months. That would appear to be the good news.

However, as they admitted yesterday, the decision they had just announced on interest rates is unlikely to have an economic impact until at least 18 months have elapsed. That will also be true for all those similar decisions made in recent months.

What that means is that when we get to early 2025 we will still be experiencing the impact of these decisions on interest rate rises on the economy. If, as the Bank claims, those decisions will result in falling rates of inflation, because as they claim they reduce demand within the economy, then come Spring 2025 there were will be significant amounts of such impact still working its way through the economy when inflation rates will have already hit two per cent.

There is, of course, no reason why inflation will just stop falling when it hits 2%, as the Bank likes to imply. In fact, there is no reason why it need stop at an inflation rate of zero, as their charts suggest to be more likely. Instead, deflation is quite possible, most especially if a lot of people have taken new fixed-rate mortgages at much higher rates than they have previously been used to between now and spring 2025. The lagged consequence of that will last for some time. The risk of a serious overshoot by the Bank on inflation now looks to be very real, with recession inevitably following.

In that case, what we should have been hearing about yesterday was what measures were being to taken to prevent deflation and recession, but there was no hint of policy on those issues in their report. That is a massive omission on the Bank's part and a deeply worrying sign of their inability. I think that overshoot is likely now.

I most especially think that is the case when, fourthly, there was within the report a projection of future Bank of England base rates. These could, of course, be fabrications to suit the Bank's current narrative, but let me presume that they are instead a fair representation of what the Bank expects to happen. In that case they are shocking because the rate forecast for 2025 is for a base rate of five per cent when it is quite likely, based on the Bank's own projections, that the rate of inflation at that time will be at or near zero per cent.

In other words, what the Bank is projecting is that we have strong, positive interest rates in the future within our economy, meaning that for the first time in fifteen years those paying interest will be suffering a real net cost to do so when compared with inflation.

This will perpetuate the mortgage shock on UK households, with all the ghastly consequences we are now seeing.

It will also crush the prospect of investment by UK businesses. That will drive down employment and growth and leave the country still struggling with productivity issues.

It will also crush household spending. No wonder that they forecast this:

It will also mean raising funding for the climate transition that we need will be harder.

And it is designed to guarantee government austerity given the mindset of neoliberal governments, which is what we will have.

Add it all up, and the Bank clearly wants to perpetuate the disaster created by it raising bank rates wholly unnecessarily.

Not only will the Bank's beating of the economy not lessen in severity, but it is now their apparent desire to keep it going in perpetuity.

I despair.

And I worry about the wholly unnecessary pain that is going to flow from this utter incompetence well into the future.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I become ever more grateful that my mortgage is fixed at a low rate until the end of 2026.

That said, with this bunch of clowns running the show, that’s no indication that rates will be anywhere near sensible even by then, even if we are in recession.

As far as I know, increasing interest rates do not increase bank costs who hold your mortgage. They are already making money, so the decision to increase mortgage payments is purely financial and devoid of any social conscience.

We have gangster bankers run by a government for whom making money comes before people.

You are right. More on thsi very soon, here….and elsewhere, I hope.

Hello Richard,

growth has disappeared in 2025 and 2025 -> 2024* and 2025?

Angus

Oops

Corrected

I blame too late a night

Thanks to others who have noted errors too

The more I reflect on this, the more I see this as some form of ‘shock therapy’ at the behest of the rentier community.

I was watching Bailey being interviewed on C4 last night twisting and turning under questioning with an almost pleading ‘don’t dig too deeply’ smile on his face.

This is going to cause a lot of damage. Clearly – to me at least – those advocating past low interest as a cause of inflation seem to think that we’ve all had it too easy and in their opinion those who may default on their mortgages should never have been allowed those mortgages in the first place – so tough luck!

And the same goes for those businesses debt funding their operations or/and running very narrow profit margins.

BoE/government policy has all the makings of John Nash’s ‘Fuck you Buddy’ gaming at RAND. Just like Thatcher did in the early 80’s except she had the excuse that it was all new then.

Hunt and Bailey have no such excuse at all.

Shocking.

Agreed

Anyone want a government like the Spanish one?

https://www.theguardian.com/commentisfree/2023/aug/03/spain-inflation-lower-bank-england-interest-rates

And let’s not forget vile-liebore, Kid Starver and Reeves support all this, they are 100% behind the Bank of Imbeciles, they want Uk serfs & pasants poorer.

As for “I’m alright Jack” Bailey – why would he care, he probably thinks its all a bit of a larf.

I agree with Schofield

Agreed.

I would also note that Brazil cut interest rates yesterday (their inflation is 3%) and China is easing monetary policy as inflation and growth are low. Both of these countries are huge exporters so, with oil prices also down year-on-year there is very little chance of imported inflation (unless the self-inflicted Brexit sort of inflation). It really IS bizarre that you tighten policy now.

The BoE’s Monetary Policy Committee (MPC) meets eight times a year to discuss whether it should raise or cut interest rates or keep them the same. Yesterday’s rate rise was the 14th in a row, meaning that the BoE has been raising rates for over 18 months now. Tony Yates, the Bank’s former head of monetary policy strategy, says the MPC has to “operate in the dark”, in that it can take 18 months for all the effects of a rate rise to become clear in the real economy.

The FT agrees: “Monetary policy always comes with a lag, taking about 18 months for the impact of a single rate increase to fully seep through into spending patterns and prices.”. (https://www.ft.com/content/3e46ef18-1c75-4fc3-81fa-37fc580659c1)

So, according to the BoE’s own reasoning, we are now seeing the full effect of the first increases in interest rates – and inflation is coming down. So what on earth is the justification for applying even more increases when the last 12 or 13 rises have yet to take full effect?

I have a good conspiracy theory, if you want it.

🙂

“according to the BoE’s own reasoning, we are now seeing the full effect of the first increases in interest rates – and inflation is coming down.”

That suggests cause and effect. As many have pointed our, we knew that inflation would come down automatically once last year’s energy price rises were no longer factored into the inflation calculations. I’ve seen no-one in government or in the media even suggest this. Have I completely misunderstood?

There is no proven cause and effect here, most especially when other easy explanations of the type you note are available.

Rachel Reeves believes in everything the BoE is doing. Her position, and Labour’s position is that the BoE is running the economy and it is right. The Labour-Reeves argument is that the public must blame the Conservative Party for the mess we are in; but nothing will change because neither the Conservatives nor Labour are running the economy or can have any direct responsibility for it, because the BoE is independent. The economy is run by the BoE, and that is nothing to do with a Labour government. Labour policy is accept your vote and feel your pain, but don’t mention Brexit, borrowing, or interest rates.

Nothing changes, ever but it is really important to vote Labour, because they are nice people. And Labour think all that incoherent drivel is a good argument for Scotland to stay in the Union.

You summarise very well what I heard her say last night.

Over-reaction, too late. Such a familiar British response to events and crises.

As distinct from the other typical non reaction. Heads in the sand. La la la.

Meteor strike required.

From reading this, sourced from the Bank’s own projections, one could be forgiven in thinking that this was by design.. Such straw-man reasoning bely the complexities of the situation I’m sure, though when searching for incentives, i find only cynical motives.