A number of people have asked me to comment on this article in the FT from a few days ago:

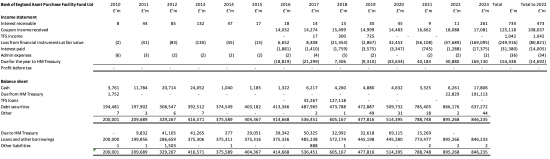

To do so I have prepared a summary of the accounts of the company called the Bank of England Asset Purchase Facility Fund Limited (or APF) that actually operates the quantitative easing programme on behalf of HM Treasury, because it is a sham to say that it is run by the Bank of England when the Treasury has to approve all major decisions made by this company and bears the profits and losses arising from its actions. That summary looks like this, covering all years from 2010 when it began to trade:

My suspicion is that this will be a little hard to read, although clicking on it a couple of times should produce a much bigger version. So, let me offer this summary version instead:

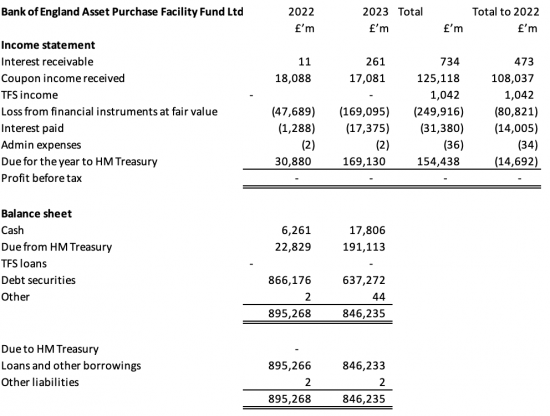

What is now on display are the accounts for 2022 and 2023 plus a summary of all year's income and expenditure to both 2022 and 2023.

Several points stand out:

- £125 billion of interest costs have now been saved as a result of QE

- Until 2022 the operation of QE was profitable in every year

- It was only in 2023 that QE turned from having been a very profitable exercise int being a loss-making one.

- In 2023 a loss of £169 billion was made on QE operations.

- That loss was almost entirely due to the value of the investments held by the APF being reduced in value on its balance sheet. There was no actual cash loss in the year.

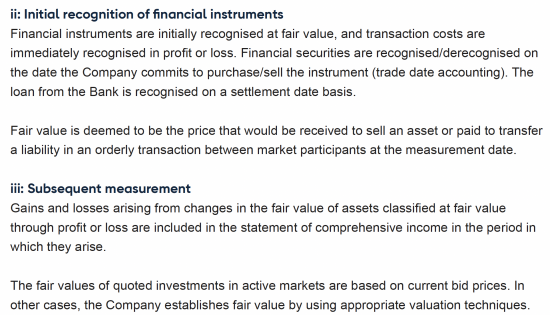

So, why did this loss happen? That is explained by this innocuous-looking note on accounting policies included in the accounts:

What that note, in effect says is that the financial instruments - in this case, all the government bonds that the APF owns - are valued at what is, in effect, their market value at the APF's balance sheet date.

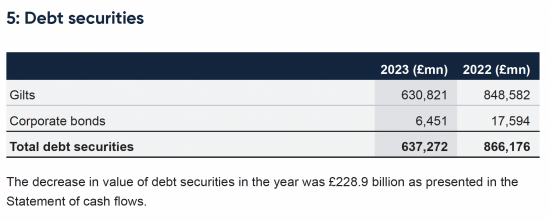

Note 5 to the accounts adds a little information:

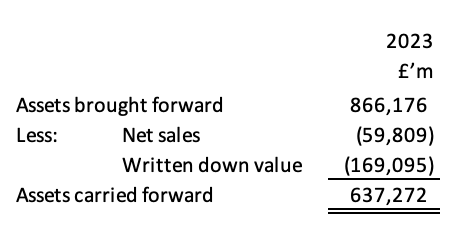

The note is as misleading as it is helpful. The reference to the cash flow is actually to a non-cash movement, and so is not very helpful. What was required was a breakdown in the reduction in the value of assets split between the value written off and sales made. In the absence of this data in the accounts, it is very likely that the split was:

The diminution in value was then because of asset sales under the quantitative tightening programme, which could have resulted in some real losses arising, and, much more significantly, the accounting write-down of the value of the portfolio.

As is now clear from total trading of the portfolio to date, including these losses, is that overall if the fund were to be sold at current values, then to date, the whole quantitative easing operation would have resulted in losses of around £150 billion.

So the question to ask is whether that is a fair representation of what will actually happen? Will the Bank of England really lose £150 billion on behalf of the Treasury, and why?

The answer is that I cannot say whether that is the case or not, because it depends upon the decisions that the Bank of England makes. There are three that matter:

- Will it keep rates as high as they are now for the time being, or even increase them further?

- Will it let them fall to a natural rate of 2% or less, which is what the economy clearly needs when inflationary pressure is over, which it will be within a couple of years at most?

- Will it insist on selling large parts of its bond portfolio at a loss as it is now doing even though there is no need for it to do so?

Those three points need unpacking.

First, it would seem that the Bank of England has now got a deathwish with regard to interest-rate policy, and even the Treasury is now becoming worried that the increases in interest rates that they are pursuing will be harmful to the economy. I can only hope that they bring pressure to bear on the Bank to stop this policy of increasing rates, which is now one of pure folly.

Similarly, I hope that whoever is in office as Chancellor of the Exchequer at the end of 2024 will likewise bring pressure to bear on the Bank to reduce interest rates rapidly at that time to ease the pressure on the economy when there will by then be no evidence of any benefit to arising to it as a consequence of maintaining the high-interest rates that the Bank of England does at present indicate that they wish to remain in place.

Third, if I was to get my wish on interest rates, then the current policy of the Bank of England, which is to sell as many of the gilts in its portfolio as it can at present values is a further example of its pure financial folly. That is because when interest rates are higher in the marketplace than when the gilt was issued, then the value of that gilt does, in current terms, fall. The eventual redemption value of the gilt does not, however, change. In other words, if the investor holds the gilt to the end of its life then they will get back exactly what they were promised. So if they don't sell, they will not make these losses.

Let me use a quick example of a ten-year bond issued last year with an interest rate of 3.25%. The data is here:

This bond was issued at a discount to its £100 par value, which is common.

The price at which it has traded has varied from £101 to £89 over the time it has been in issue. Right now, it is nearer the bottom end of the scale.

If the Treasury had bought this on issue, it would now be sitting on a loss. If it sold now, that loss would be real: whoever bought it would in effect buy it at an undervalue compared to the issue price. There would be a transfer of value from the Treasury to the private sector.

But there is no reason for the Bank of England to sell now, except for its wholly unnecessary quantitative tightening policy. If it held it until 2033 it would get £100 back. It would lose nothing.

So, in that case, why is the Bank claiming a loss of £150 billion? Four reasons:

- It is wholly unwisely putting up interest rates.

- It wants to keep interest rates high.

- It wants to sell bonds at a big loss to keep interest rates high.

- It is doing this because it seemingly wants to trash the economy whilst providing asserts at an undervalue to financial markets.

It is, in other words, incompetence that is driving this loss. It is not needed. It does not have to happen. It may not happen. It just requires sanity to be restored to our central bank to stop it happening. But will that happen? Who knows?

What I do know is that the Bank is recklessly seeking to make losses to prevent the government from spending money to meet social need. And that is the real banking scandal of this moment.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Basically then, the means by which government can generate additional income for other programs (bar simply printing money) – be it the NHS or universal credit – is effectively being hobbled.

‘There is no money – but please don’t ask us why’.

I’m sure that this is in complete connivance with No.10.

Typical British kakistocracy.

“the Bank is recklessly seeking to make losses to prevent the government from spending money to meet social need. And that is the real banking scandal of this moment.”

Couldn’t agree more, and something I might have expected in Victorian times. This austerity policy is not only Dickensian, but it is killing THOUSANDS of people. I find it really hard to believe that it is perpetrated by my fellow human beings. Read:

Mortality rates among men and women: impact of austerity

Edward Scott, House of Lords Library, 6 January, 2023

“Improvements in life expectancy have slowed in the UK since the early 2010s. A recent study argued there have been over 300,000 excess deaths during this period, when comparing trends in life expectancy with those from before 2011. The authors of the study argue this is a result of austerity policies pursued by the government.”

I’ve reached the conclusion that Andrew Bailey is a vicious ideologue in the mould of Paul Vlocker rather than incompetent. Scratch the surface and I’ve no doubt you would find a true believer in the Loanable Funds theory alongside those of Ricardian Equivalence and Crowding Out.

Saddest of all is the likelihood that Rachael Reeves will back both Bailey and BoE “independence” to the hilt. Indeed she has said as much already.

In the immortal words of Private Frazer “We’re all doomed”

“It is doing this because it seemingly wants to trash the economy whilst providing asserts at an undervalue to financial markets.”

The BoE is not an “it” (or indeed an A.I.) it is people. BoE people are making a decision to “providing asserts at an undervalue to financial markets”.

What is the contact between BoE people and the financial markets that will benefit?

Why are the BoE people doing this?

On whose authority are they selling assets of HMG at a discount?

What information has been exchanged by the various parties?

Much like the Met Police (found to be institutionally corrupt and racist), it would seem that the BoE through the actions described is institutionally corrupt.

Note: Sunak is ex-Goldman Sachs, which is a significant player on financial markets. This begs the question, who else in gov and the BoE has worked for large market players, what info has been flowing between gov, BoE and market players and how have said players “positioned” themselves.

& let’s not forget the £40bn of “free money” paid by BoE to the banks, each year.

More to come on this soon…

An admittedly hasty, perfunctory glance at NatWest latest results failed to discover the Central Bank Reserves interest, but I may have missed it somewhere.

I do not think it is disclosed separately

Indeed, if the BofE which being the BofE clearly has no need to is selling at a loss, then cui bono and how come? Is this yet another raid on the UK, less obvious than nationalisation of utilities but a raid nonetheless? Is Bailey going to vastly enrich specific elements of the private sector by creating bonds and then selling them to cronies at sums vastly under their true market value? Is this a grand life after retirement he’s setting up for himself here, anticipating being enriched himself with a share of the spoils from a grateful private sector?

See blog post just out up

Why do you think the bank “ is recklessly seeking to make losses to prevent the government from spending money to meet social need”?

Isn’t the counter argument that the BOE is determined to be considered as a highly reputable central bank amongst central banks in order to ensure there is sufficient demand for UK guilts so that the highly leveraged government accounts aren’t jeopardised.

A £150bn loss today is better than holding £600bn of debt when inflation is at 10%. Those assets become worthless and further substantiate the argument of how broke the government really is.

If the central bank isn’t seen as progressing with QT then how serious are they about combating inflation?

Yo realise that the government is owning its own debt?

It id both dies of the transacyion here unless it sells, when it closes out with a loss?

Do you have the slightest comprehension of how this actually works or do you always write nonsense?

Pure evidence that economics as taught as a degree subject in the UK is a lightweight degree that Sunak should ban because although it may lead to a job it also leads to an appalling mess! The Treasury economists for example need clearing out for not spotting this potential fall in treasury bond value nor that you can’t owe money to yourself!

I listen regularly to classicalist academics. One of them recently said that no one who teaches at university to undergraduates really believes in what they are teaching. The professor’s know that there are wholes and problems with the subject matter. However it is up to students to find them out for themselves. It is part of growing up and self development. Unfortunately some never bother to do so.

I disagree with a lot of that

“Economics in universities can be narrow, uncritical and detached from the real world. It is dogmatically taught from one perspective as if it is the only legitimate way to study the economy. There is no room for the critical discussion and debate that is essential for any student to engage with real world economic problems.” — Rethinking Economics, an international network of students and recent graduates building a better economics for the classroom, with the support of academic allies.

https://www.rethinkeconomics.org/

I think I might agree with that if the word ‘teach’ wasn’t used with regard to what academics at universities do. I thought they lead the student to discover for themselves. So, in my own degree, archaeology, we would have a lecture about a particular topic, read around it and then discuss it in tutorials and seminars, identifying potential issues. ‘Why did the site director assume the skeleton was a male, just because a sword was recovered from the grave? Why was there no skeletal analysis done to establish biological sex and then consider the grave goods’ springs to mind.

Have you seen reports from the Isle of Scilly on just such an issue this week?

Certain academic disciplines need to start working together or just with economists – I’m thinking about sociologists, anthropologists and even psychologists (or even behaviorists). I’m sure that they are the key to giving orthodox economics a reality based slap (or slaps) around the face, to confront teachers and practitioners with their lies that they pose as theories.

I hope that these disciplines start to take more of an active interest in economics.

Because that is all a lot of orthodox economics is: a theory – that is still waiting to be proven for the majority of people.

As for the kids finding the truth out for themselves, how many go on to get a glittering career on a level with those basically telling the lies that are expected? It’s too much a closed shop it seems to me – I even bumped into it at university myself.

@Cyndy Hodgson “I thought they lead the student to discover for themselves.”

You would think so. While teachers are aware of, for example, Bloom’s taxonomy as a hierarchical model of educational learning objectives, questioning your peers is not always welcome, especially if there is a suggestion that they might be wrong.

Physicist Richard Feynman once said “I would rather have questions that can’t be answered than answers that can’t be questioned”. That is now changing by people with undue influence. Physicist Neil deGrasse Tyson recently upturned the scientific method when he said: “I’m not interested in medical pedigree. I’m interested in medical consensus and scientific consensus…The individual scientist does not matter.”

The UK Government now has a “Ministry of Truth”, the so-called Counter-Disinformation Unit, not too dissimilar from the USA’s “Disinformation Governance Board”, in all cases, with the object of squashing dissent and critical analysis.

There are incidences of Big Pharma, Big Food, Social media platforms, the BBC, and politicians all quashing legitimate dissent.

Sources

➡️ Bloom’s taxonomy @ Wikipedia, https://en.wikipedia.org/wiki/Bloom%27s_taxonomy

➡️ Neil deGrasse Tyson speaking on Twitter, https://twitter.com/TheChiefNerd/status/1644107524797345793

➡️ Government Fact Sheet on the Counter-Disinformation Unit, https://www.gov.uk/government/news/fact-sheet-on-the-cdu-and-rru

➡️ US Disinformation Governance Board, https://en.wikipedia.org/wiki/Disinformation_Governance_Board

Remember, dissent is now to be referred to the Prevent unit

I am surprised I have not been referred

Richard: Have you seen reports from the Isle of Scilly on just such an issue this week

Yes, it reminded me of just that discussion, although I think in the Scillies there was virtually no bone to analyse. My specialism was human skeletal analysis so I am a bit biased! Until fairly recently the skeletal material was reburied without any real analysis and all the assessment of the individual was based on grave goods. Many archaeologists couldn’t see a problem.

I know those sites on Bryher…

They act, they publish, as though they are unchallengable gods, as though nobody would dare to question their assessment.

I can’t begin to get my head round what is in your post, but I so honour you for your painstaking thoroughness, for thinking it through and writing so convincingly for us. Bravo, Richard.

Another explanatory post is coming when journalists stop talking to me this morning

We should perhaps reflect on some fundamental, and essentially straightforawrd ideas. The whole principle of issuing Government bonds is surely to defer redemption of the bond principal into the future, to allow Government the financial capacity to function over time; and ‘time’ here is a concept on a much longer longer time-scale than any individual or corporate entity in the State could entertain. The State has to be different. This is the purpose of the National Debt; it is a long-term application of the time value of money that only a sovereign government that issues the currency, demands taxes and protects civil society’s financial stability and security can offer; to allow the Government to govern.

For sovereign States to treat current movements in Government Bond long-term deferred redemption values, as if the bond was already redeemed, casually on a day-by-day, transient basis is at best eccentric, or worse probably irresponsible. It insists on treating the sovereign State as if it was just another corporate institution; by nature ephemeral; here today, gone tomorrow, for sale at any going price at the whim of any sharp market movement, joint-stock company. Governments are different. They have to be; the trap of applying private, corporate, market-orientated protocols wholesale to state finances is fatal.

Redeeming Government bonds in seriously adverse financial conditions is even more irresponsible, and smacks of loss of control, or panic. The deep mindset required to do this suggests the persistence of the old, long exploded 17th/18th century obsession to eliminate, or better privatise the National Debt; what I might term the Sword Blade Syndrome (and if that sounds seriously anachronistic, it most definitely is anachronistic). The difference is, in the 18th century – they learned that hard lesson, from bitter experience.

We had the bitter lesson of the 2007 financial crash, and the constant reminders of subsequent monetary management blunders; and it seems we still ‘lost it’.

“Will the Bank of England really lose £150 billion on behalf of the Treasury, and why?

The answer is that I cannot say whether that is the case or not, because it depends upon the decisions that the Bank of England makes.”

A fair question is; what are the redemption dates of the BoE QE bonds held and open to QT protocols? If the redemption dates are generally 10-20+ years hence, then assuming current redemption values surely amounts to mere speculation (unless I am missing something). Does it not carry the implicit assumption that it is thought by the BoE at least likely that rates at maturity of these bonds are not just at least as high as they are now at maturity, but indeed much higher (after all the time value of money at the current interest rates over the outstanding redemption period does not suggest it would be wise to redeem now i.e force immediate realisation of the present value – so why book the loss)? I might add such rates or even higher rates over such a period would have very serious consequences for the economy, quite independent of QE. It assumes Government and BoE’s policies have badly and perhaps irreperably damaged the economy, and everyones lives.

The BoE seems to be Iturning reality into a mere abstraction, following the conventional short-termism of the everyday financial sector predicament in banking; turning today’s money into rent, to exploit the time value of money, and back again over short time periods; which is how the City and corporate world functions on a day to day basis. The State’s national debt and QE surely cannot be forced into prioritising short-termism of this kind, without serious risks to financial security.

Hi Richard

Very interesting article. Do you know whether other Central Banks (such as the American or European) are carrying out the same policy in regards to winding down QE? Or is the BoE an outlier with sadistic tendencies?

The BoE is a outlier

BoE’s actions regarding the sale of the QE bonds raises lots of questions about motives. I suspect the major Central Banks want to restore the monetary policy weapon of choice ie Interest rates. The current inflationary period was too good an opportunity and they have capitalised on it. With rates at 5% plus they believe they can regain the influence they lost. The selling of the QE bonds which the BoE has made clear months ago was their intention reads like an attempt to be not only operationally independent but strategically too. Part of thinking behind this was that senior players within the Financial System made objections to the BoE regarding the funding of UK govt day to day expenditure because it avoided the debt markets I suppose. The sale of the bonds at a loss to the govt is an attempt to address those objections. None of the major participants in the Financial & Commodity markets want MMT like practices to get a foothold do they?

…”whoever bought it would in effect buy it at an undervalue compared to the issue price. There would be a transfer of value from the Treasury to the private sector.”

There you have it…

It’s not incompetence or stupidity, it’s embezzlement on a monumental scale.

The Tories are doomed and they know it, so they’re hoovering up what they can before they go. Backscratching…

‘……… they’re hoovering up what they can before they go.’ (Ian)

That’s the hallmark of this utterly corrupt government since 2010. Surely the specific purpose here is to create a massive false debt and so claim once again that there is absolutely ‘no money available for the NHS’ and a perfect TINA excuse to finally push through its full privatisation in this last year, realising its intention since 2010.

“…providing asserts at an undervalue to financial markets.”

Isn’t this the real reason?

Losses for the BOE =Profits for the UK Banks.

The UK banks are still hiding lots of bad debts on their balance sheets. Look at Lloyds Bank for example.