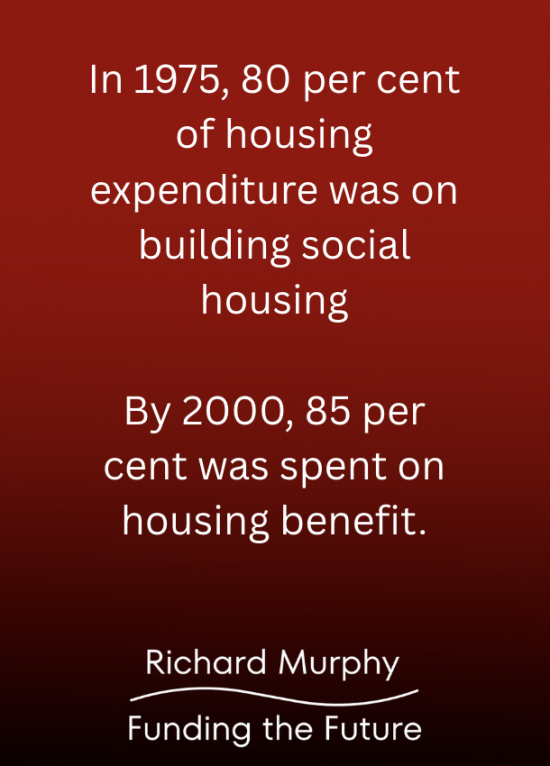

This is absurd and a travesty of justice:

Remember, social housing benefits the tenants.

Housing benefits enrich landlords.

This is what Thatcher did. And no one has ever corrected it.

The source information is here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Back when he was head of Research the impeccably conservative (with a small c) Dr Tim Morgan who writes the Surplus Energy Economics blog produced a wonderful although sadly now unobtainable document about the benefits of Council Housing.

From memory the point he made was that Housing is not a ‘productive’ asset and what we have ended up with is a massive amount of money being poured into something that doesnt ‘produce’ anything

The other good point was made by George Monbiot here

https://www.monbiot.com/2019/07/19/private-taxation/

Rents charged at such rates – far beyond the costs of capital and maintenance – are, in these circumstances, a form of private taxation, levied by the rich on the poor. The penalty for failing to pay this tax is arguably greater than the penalty for failing to pay taxes owed to the state: eviction and homelessness. People say “I work for Tesco” or “I work for Deliveroo”, but the reality for many is that they work for their landlord. While the average mortgaged household spends 12% of its income on housing, the average renting household spends 36%. I have met plenty of people who hand over 50% or more.

So lets talk about what excessive rents and property prices are, Private Taxation

Thanks

Vienna – which I have had the pleasure of visiting many times on business and to see friends – provides a great case study for how you can make social housing work. Fundamentally, take housing ownership out of the hands of financial institutions / investors and recognise that it is a basic service (everyone should be able to have a roof over their head) and that when it is done – as it is in Vienna – it improves affordability, availability, well-being, quality of life and can benefit the many rather than further enriching the few.

On a related topic, I note today that asking prices for houses in the UK have dropped on average. This may be of interest in itself. However, for me, the unasked question relating to the foregoing is (referencing the comment about Dr. Tim Morgan) “Why shouldn’t they go down and why are we so fixated on the belief that house prices should only go up?” They are not “productive assets”. We have – much more so than, for example, the people of Germany and Switzerland – been hoodwinked into the neoliberal, financialisation of what is effectively a basic service / human need.

“While the average mortgaged household spends 12% of its income on housing, the average renting household spends 36%. I have met plenty of people who hand over 50% or more.

So lets talk about what excessive rents and property prices are, Private Taxation”

This is very true, and let’s not forget that the following are usually not included in rent.

Council tax

Water rates

Gas and electricity standing charges

Sometimes the service charge on property is an extra for the tenant to pay.

For many, everything they need takes up a massive amount of their disposable income.

And it is going to get a lot worse for those close to retirement. Those who missed out of getting on the “property ladder”.

People who expect to rent throughout their retirement could need an additional £391,000 in savings compared to those who have paid off their mortgage, according to new analysis from Standard Life, part of Phoenix Group.

https://www.propertyreporter.co.uk/the-cost-of-renting-in-retirement.html

Sky-high rents mean ageing tenants ‘won’t be able to retire’ – adding billions to the benefits bill

https://www.bigissue.com/news/housing/renting-pensioners-housing-benefits-obr-economic-forecasts/

As many as 3.6 million households could be renting in retirement by 2041

https://moneyweek.com/personal-finance/pensions/renting-in-retirement-how-much-do-you-need-in-your-pension-pot

I wonder if the big neoliberal plan going forward is to have a slave army of those that cannot afford retirement, to just carry on working.

I’m sure for the likes of Reform, it will be part of their plan to stop immigration, but then force all the renters to work until they die. And as we know where Reform go, the Tories and Labour follow.

None of them have any answer to the real housing crisis that is brewing.

As Elton John once sang, better off dead.

Shovelling all our money into an unproductive asset makes us a stagnant unproductive country.

Think what else it could be spent on.

I remember when Thatcher did away with rent control in the late 80’s, making the laughable statement that landlords would never charge housing rents that the tenant could not afford. Pardon me for laughing.

Indeed

I’m a simple man with no understanding of economics.

It could be argued that without housing benefits distorting the market then landlords could not charge unaffordable rents. Certainly the one in six tenants [thank you H] whose rents are kept artificially high would be unable to afford them and so those properties would either be rented for less or not rented at all. In either case we might expect rents to fall.

Or perhaps I’ve misunderstood how these things work.

So where would you suggest these people live Tim?

Let’s hear your wisdom.

I think, Tim, that the point you are missing is that everyone needs somewhere to live and, whatever the level of rent someone will find a way to pay it, The fact that Housing Benefit does not, usually, meet the cost of rent, and is only, in any event, available to those who have no pare money, means that very few people who are entitled to Housing Benefit can afford normal rents. (So Hosing Benefit plays litle part.) Most of those live in severely sub-standard housing, to which local authorities turn a blind eye – they have a roof, even if it leaks!

Great source! Other choice quotes ‘Following the deregulation of private sector rents, the Minister for Housing at the time said Housing Benefit would “take the strain” where rents had been increasing:

‘Housing benefit will underpin market rents—we have made that absolutely clear. If people cannot afford to pay that market rent, housing benefit will take the strain […] the housing benefit system exists to enable people to pay their rent.’

One in six households rely on housing benefit. The Government spent an estimated £23.4 billion in 2018–19 to subsidise renters, representing 2.9 per cent of total public spending.

You’ve not mentioned the caps oh Housing Benefit that are below the cost of available properties meaning most on benefits are having to top up their rent payments out of already inadequate Universal Credit payments. So we are subsidising private landlords whilst tenants are struggling to meet costs, often for substandard properties.

Agreed

Thanks Hazel, I was just further quoting from the source material, which I see on closer inspection was published on 20th July 2020 – 5 years ago – as you say, the situation has worsened…(would be good to find up to date figures for these metrics)

I’m a young person, at least that’s what many people including the doctors have been saying. The current rental and property system is at best unfair and at worst makes me want to wish the worst upon some people, though I refrain from doing so as it’s a system that’s at fault.

We recognise that the state pension is the worst, yet if you’re made redundant, you get less than half of that to live on till you find a new job to trade your life for money. The housing component is based on a mythical studio or cheapest property they can find to justify the measly amount paid. Yet in the same breath those who are in desperate and immediate need are put in whatever unsafe place the council can find and they pay the rogue landlord for the privilege. Meanwhile I walk down the local “high” street and about a dozen shops are empty and unused. Several homes the landlord refuses to sell for less than market rate because we financialised a basic necessity.

The local barbers closed, it was fairly successful, no large queue but always 1-2 people in front of you no matter when you went. She nearly broke down in tears when cutting my hair because the rent was so high she was probably making a loss every month. I told her that it’s making her miserable and that no amount of owning your own business was worth that. A few weeks later she quit and started cutting hair at peoples houses. The property remained empty for 5 or 6 years before being turned back into a house and sold, no-one wanted to pay the extortionate rent.

This is the society we live in – where financial exploitation for gain, but not profit, is all that matters.

We are led to believe that all the people who claim benefits are parasites on society. But the truth is that money like housing benefit goes directly from the government to the wealthy landlords and is only routed through the tenants. So the question is who are the real parasites on society? The claimants or the recipients of housing benefits?

Cyndy’s right that I deliberately ignored the basic human need for housing and Richard, I don’t see a way out of the current situation that won’t result in great violence as the owning class fights to hold on to what they have.

It seems to me that housing benefit has, as Steve S says, been designed as a way of diverting funds from those who have no choice but to pay (most taxpayers) to the wealthy. Income support (Universal Credit) does the same: employers get subsidised workers while the slightly better off pay the subsidy.

In fact I’d venture to suggest that rather than a trickle down economy what we actually have is trickle up.