In the middle of all this morning's other news, it would have been easy to have missed an article in the FT, which says:

The Bank of England is facing growing calls to scale back its bond-selling programme later this year, as investors warn it risks pushing up borrowing costs further and adding to pressure on a weakening UK economy.

The central bank is shrinking its portfolio of bonds accumulated during bursts of quantitative easing over the past decade and a half, as it attempts to bring its balance sheet back to a more normal size.

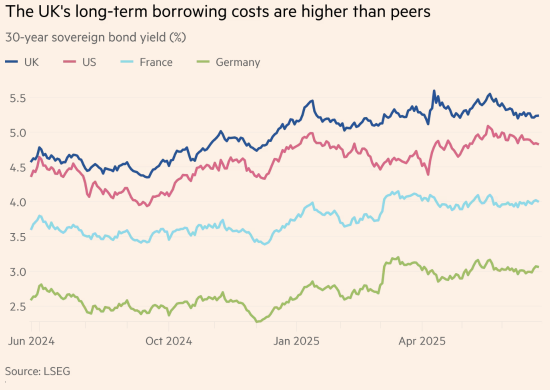

As the FT notes, this is inflating UK borrowing costs, which is a major reason for our economic stagnation, as noted by the Resolution Foundation yesterday:

There is also active opposition in the City:

“The Bank of England should stop active QT,” urged Ben Nicholl, a senior fund manager at Royal London Asset Management.

Active sales on that scale could “reignite market concerns about the total amount of gilts, particularly long maturity gilts, that the market may have to absorb this year”, he said.

Other quotes support the view.

We have suffered high interest rates in the UK for far too long, as I have consistently argued. This has been the result of deliberate, politically driven and deeply divisive choices made by the Bank of England, which have massively favoured the well off in this country, have seriously harmed the well-being of most ordinary families and have led to massive economic damage. Allowing a supposedly independent central bank to cause such harm has been a political failure on the part of all Chancellors who have allowed it.

The time for quantitative tightening has gone.

We might even need to actively force rates down again.

But what we also know is that the time for the facade of Bank of England independence is also over: this has been a disaster, and it is time for it to end.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

And Reform UK Ltd. said… ?

Central bank ‘independence’ seems an absolute touchstone of all ‘advanced’ countries – only Donald Trump seems to challenge it.

It seems to be a key aspect of Manufactured Consent’ (Chomsky) to pretend there is a part of economic policy which can be ‘objective’ and not ‘political’.

When it includes making the rich richer and the poor poorer it begins to look somewhat less than ‘objective’.

The richer including those in charge of these banks.

To think that for one minute The Bank of England is thinking of every day people when considering interest rate cuts is wishful thinking at best. The Tab will always be picked up by low income families.. it always has been and always will!

Why should the wealthy enjoy a few million less in their pot of wealth when the everyday working man, woman and deprived child can suffer the effects of endless high interest rates to keep them in the lifestyle they don’t deserve?

If an independent BoE is staffed by those who understand money and economics, it would long ago have said “this policy makes no sense at all”. Since their ‘independent objective’ would be controlling inflation, anti-inflationary action would have been taken long ago.

Conclusion #1 – yes it’s bloomin-well political decision making

Or

Conclusion #2 – the BoE is run by incompetent people.

If I was working for the BoE I’d be chomping at the bit to get the truth out there,otherwise it would tarnish my cv.

The Bank’s programme of reducing its QE bond portfolio by selling off bonds is called “active” tightening (or QT).

In the US, the Fed is reducing its QE bond portfolio by simply allowing the bonds to mature, which is called “passive” tightening (or QT) and presumably avoids the kind of problems the UK bond market is now facing.

It need not do QT at all

The active tightening is worse in creating and crystallising losses which also have to be covered, but even passive tightening has an impact, and space to support more QE is created just through inflation making the existing stock of bonds smaller relative to GDP.

https://www.taxresearch.org.uk/Blog/2025/06/22/mmt-magic-myth-or-reality/

Dear Richard

Quote from the above video summary:

‘the government spends new money into existence, that new money is created for it by its central bank in the case of the UK, the Bank of England’

On BBC Radio 4 TODAY [at 1:17.26-1:21.23) this morning (27 June 2025) Ruth Curtis (CEO of The Resolution Foundation, also ex-Treasury) and the interviewer agreed that due to the extra cost of the welfare policy that has been forced the government U-turn, this will mean ‘extra borrowing or tax rises’

Q1. If I understand your explanation of MMT the ‘extra borrowing’ part of the above BBC quote is incorrect and need not be said. Am I right? And the ‘tax rises’ part may or may not be correct. Am I right on that?

Q2. You also mention on another video that one reason for creating government bonds is to make a safe place for spare money from commercial banks or businesses, pension funds, etc. If bonds are not needed to cover government spending at all (?) , why does everyone get so scared of a rising indebtedness of the UK government if bonds are partly/largely a savings facility for banks, etc? E.G. Japan has a far worse debt situation than the UK.

Q3. Creating bonds takes money from whoever buys them thus the economy has a reduction in money – why does this not mean that creating bonds might lead to the lowering of taxes, to increase money?

Q4. If the government doesn’t need to issue bonds for its own use, why doesn’t it stop creating them with their liability of interest, and thus save taxpayers the cost of that interest? Why should taxpayers have to pay the cost of interest for the investments of large banks, firms and pension funds?

What am I misunderstanding here?

Many thanks for your helpful videos.

best wishes

Charles Bazlinton

Q1. If I understand your explanation of MMT the ‘extra borrowing’ part of the above BBC quote is incorrect and need not be said. Am I right? And the ‘tax rises’ part may or may not be correct. Am I right on that?

Note qite. There will be extra money creation, and that is technically borrowing, but it can be left between the BoE and Treasury and that falls put on accounting consolidation.

Q2 Groos and deliberate misinformation to fuel austerity

Q3 I am not sure I follow that one. Taxes destroy government created money. Bonds park it out of use with interest added.

Q4. Excellent question. My argument is the economy needs a safe place to save but the net cost to te government must never exceed zero.

Good to see some more people calling to stop QT – there is no real case to be made for it.

Once again, if people looked at the 2.25% difference between European rates and BoE rates, calculated that against an average £200k mortgage and figured out those higher rates are costing an average household around £4500/year in higher mortgage or rent costs (the latter from costs being passed on), then there should be more outcry about this.

People were up in arms about losing a winter fuel allowance that’s less than 1/10 as much and not affecting most households. The scale of the wealth transfer that this represents is far, far bigger than the public generally realises.

You’ve taught us that it’s a policy choice rooted in an outdated doctrine that every pound the Government spends must be “funded” by selling gilts, and that the Bank must pay full Bank Rate on every reserve pound it has already created.

Surely the time has come to make debt management a doorstep political issue – like the NHS was in 1945.

Something like this must be worth a few votes:-

“Do you want tens of billions a year handed to banks for doing nothing, or do you want that money in schools, hospitals and climate action?”

Every manifesto should answer that question. Until the Treasury, the Bank and the front benches are forced to explain their stance, the status quo will prevail.

Agreed

Why does the BoE selling bonds increase government borrowing costs? I thought the government “borrowed” from the primary market where interest rates on bonds are solely set by the government alone and are only influenced by the BoE bank rate at the time the bonds are sold?

They issue hundreds of billions of debt a year – and the primary market is influencded by the secondary market.

But why is the primary market influenced by the secondary market? What is the technical reasoning for it, l can’t find any technical guidance as to this relationship. The primary market acts ahead of the secondary market for newly issued bonds so why is influenced by it? Please could someone share a link to anything that explains it. Thank you

The buyers are the same. It’s that simple, and the secondary market is bigger.

Totally agree. The BoE is out of control. The solution could be so simple:

https://gezwinstanley.wordpress.com/2024/10/28/infrequently-asked-questions-about-quantitative-tightening-that-you-were-never-even-meant-to-ask/

I think a good way to actually reverse their high-rate policies would be a true inversion of QE; forcing banks to purchase bonds. And the best way, I think, to do that, would be to stop paying interest on CBRAs; Give banks a reason to buy bonds.

What is the goal though?

A true inversion of QT would be banks once again offering inflation-linked loans/credit to small & medium business/consumers to get the economy up and running again.

And for the government to invest in the infrastructure/NHS/education etc to chip in with gettingvthe economy up & running again.

Earnings projected to flatline for the rest of the decade is shockingly poor for the country.

I’ve moved from very high interests rates (up to 12% in the 1980`s / 1990’s) to very low interests in comparison with historical trends.

I had a mortgage for approximately 35-years (ended last year) so low interest rates assisted me. I am now retired, with my wife retiring soon, and high interest rates – or at least rates that are higher than inflation – are now my preference as I need to protect my savings to survive old age.

The problem with all interest rates is that they serve some people but disadvantage others. It entirely depends on your position – business owner looking to expand or homeowner looking for a mortgage want low rates – people relying on their saving such as retirees (who are advised not to place too much of their savings into the stock market unlike when they were younger and had longer to ride the ups and downs). The latter also applies to small charities – where I spent most of my working life – who do not have the resources to invest their funds in stock portfolios as the very large ones do and rely on deposit investments as access to funds are required at short notice.

Finally, one of the best decisions that Gordon Brown made (I am not a Labour supporter) was not to join the Euro where we would have had one interest rate set for the whole of Europe which does no country any favours as they may need high rates when its set low and vice-versa.

Arguably one rate for a country is unfair from a business perspective. London does not need low rates, arguably it should have high rates as investment is easy to achieve – supported by all Government putting Billions into the city and ignoring investment in the rest of the county. The north of England could do with low rates to encourage investment.

A bit of a contradiction to my earlier points to some extent but then the economy is entirely perverse anyway.

The caveat here is I am not a financial expert so this is purely my personal view.

There is no case, ever, for interest rates that are, in most cases, higher than net zero i.e. those that maintain the real value of money but make no payment of a return. Aristotle made this point thousands of years ago. Almost every religion banned usury. The reason why is simple. Positive interest rates are exploitation to advantage the wealthy. Everything else is a footnote to this observation.

Hands in the air – I have some savings. More than most according to what I read. So I’ll cop for that.

As for religions and usury. Don’t make me laugh. Religions may ban it (like a lot of things they ban) but no religion abides by it finding myriad ways to get around interest while still effectively charging it.

Making money from other people isn’t necessarily a problem (aka business) it’s that people that make money aren’t taxed progressively on their earnings and wealth – and our natural wealth (land, air, wildlife) is ignored almost completely.

Apologies, moving away from your point in the last few words. Loss of natural wealth is a huge topic in its own right.

You really miss the point.

You can’t derive ethics from behaviour. You really ate getting that wrong.

And charging interest is not the same as a standard business activity.

You really have a lot to learn, I suggest.

I don’t agree with your first point. Ethics does not stand apart from behaviour except in theory. Which nobody lives in.

I take your second point.

I also take your third point – which is why I subscribe to your emails and have started to make comments in order to learn (though not necessarily agree of course).

Ethics is about ideals.

If you don’t get that you need to read about the naturalistic fallacy.

You sound like a logical positivist, the last resort of charlatans.

In a reply to my query (27/6) you say about the report of ‘extra borrowing’ needed: ‘there will be extra money creation, and that is technically borrowing, but it can be left between the BoE and Treasury and that falls put on accounting consolidation’ .

Q 5. Do I understand this to mean that the Treasury borrows from the BoE – money creation – and either a) has to pay it back sometime from taxation? or b) the BoE could write it off?

Q 6. One other aspect: If someone buys a dated National Savings & Investment Bond and receives interest a) does the govt use the purchase money for it general costs ? and b ) does the interest to the purchaser come from general taxation or fiat money creation? also c) Is a NS&I Bond a different facility to a Gilt in purpose and function?

Q5. As I have already explained, it cancels out on consolidation because they are part of the sme greater organisation. The debt is at subsidiary, not group level.

Q6. The money is held. It can it be used. Government spending is only ever funded by the BoE and money creation. The interest in this case is paid by money creation. It is government expense. NS&I offers savings accounts. Gilts are the same.