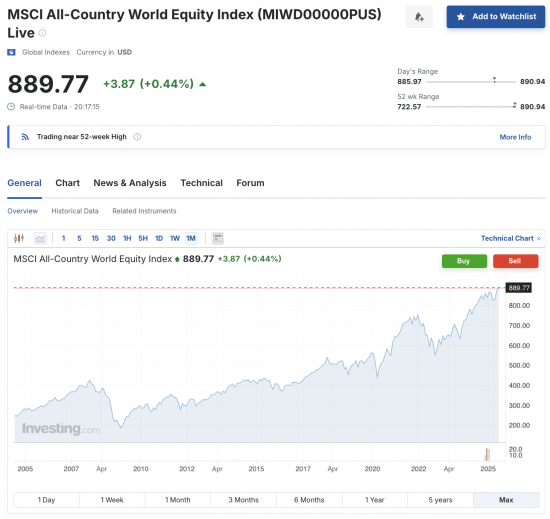

This is the chart of the MSCI All-Country World Equity Index from Investing.com:

The index is a weighted measure of the change in equity shares around the world.

Why note this now? Simply because the index is, you will note, at an all-time high.

We are living in a world where nothing is working, where real markets are in disarray, and we face the risks of fascism in many countries, with some, from the USA onwards, already succumbing. Despite this, equity investing fund managers - probably using your pension fund - have pushed share valuation to this position.

I have three thoughts.

First, this makes no sense.

Second, this could only happen, in my opinion, because they are gambling with other people's (maybe yours) money, to extract a rental reward for themselves in the process.

Third, a crash is inevitable.

You have been warned.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Was at a conf in Bx yesterday: Energy Security or Green revolution: Can the EU have both? Speakers were a combo of the Commission (2) and industry (companies and lobby orgs). Most Euro companies are very very unhappy with high energy costs (Commission response: blather). These costs feed through to ability & willingness to do business (= employ people) in the EU (& by extension UK).

It also feeds through to share prices. I wonder what weight the Index has with respect to countries such as China? which dominates a number of sectors. Perhaps that is what is making everything seem so peachy? One thing for sure, it ain’t in Europe. (& the warning signs are there wrt P/E ratios) At the end of the conf there was a pile-on against the Commission following my question: did anybody believe what the Commission was saying…. apparently not.

Thanks for raising this important issue again. 🙂

There is a limited stock of shares worldwide. There is a constant flow of money into shares as people “invest” (actually save) for their retirement. When more money chases a fixed supply of goods you get inflation, in this case asset price inflation.

Add to this positive feedback. As money flows into equities the price goes up. This makes equities seem like a safe and attractive “investment” (actually gamble), which encourages futher investment.

Increasing equity prices seems plausible even in the current circumstances (where else can the money go?). Equities are, nevertheless a giant Ponzi scheme. At some point they will crash. This will inevitably happen when more money is taken out, as people get older and retire in a no longer growing population. A crash may happen before then. It could happen suddenly (as positive feedback reverses and becomes negative feedback).

Equities are not,in general, a good place for retirement savings. The stock of equities increases only slowly because companies extract profits and don’t invest enough. The only good place, the safest place, for pension savings would be with governments, who can best guarantee to pay them. But to do that governments would need to invest these savings in their respective countries (in infrastructure, public services, education and research) to produce growth and increased wealth to pay for pensions when they are needed. Sadly, at present, governments, in thrall to neoliberal ideology, don’t do this.

None of this is new. All has been discussed multiple times in you blogs. But definitely worth rehearsing again. 🙂

Thanks

There was a report recently that Games Workshop was poised to enter the FTSE 100

Now, clearly they do what they do very well but it struck me as slightly odd that a company that makes plastic figures and imagines the hellish universe in which they fight should attract such a valuation or is it that all the companies that should be in the FTSE 100 have been sold abroad or have decided to list abroad?

They really are that big now…

Weird, isn’t it?

My sons were bith massive fans. I didn;t object. They consumed the books and it is edited English. A teenager who reads is always a good thing.

The index is making new highs…. in dollar terms. It says as much about the weak dollar as it does about global economic prospects.

It hadn’t weakened that much….

The Economist last Saturday had a leading article about the risk of another financial crisis. For an establishment paper, that’s brave.

The signs are all there: out of control shadow banking is the worrying one.

What would it take for a crash to occur? trumps farting from one thing to the next over the last few months created a wobble in US shares before rebounding back stronger than ever. German & Chinese and Korean p/e ratios look healthy. European, UK and Japan seem shaky and US and India look off the charts. Housing is also way overpriced. Even covid only temporarily shook the markets. With financial institutions so powerful these days, are we in uncharted waters?

Events, dear boy, events

If any one could accurately predict that they could make a fortune.

Richard and all

https://www.google.com/search?kgmid=%2Fm%2F04yqflz&hl=en-MU&q=Manias%2C%20Panics%2C%20and%20Crashes%3A%20A%20History%20of%20Financial%20Crises&shndl=17&source=sh%2Fx%2Fkp%2Fosrp%2Fm5%2F4&kgs=6d39248e08d549f4

Good book just in case others are interested.