Interest rates in the UK and the USA are way too high, as a comparison with the Eurozone proves. That's because of their incompetent economic leaders.

This is the audio version:

This is the transcript:

Why are worldwide interest rates still so high, and why are they staying right up there, particularly in the UK and the USA, compared to, for example, the Euro?

That's a question that matters because you probably pay interest, and all of us do in some way or other, because the price of interest is implicit in the charge that we have to pay for so many of the goods and services that we buy.

So why is it that these rates are still so high? Let's just look at some data.

This chart is from the Financial Times, and it shows the data for UK 10-year government bonds.

Now, the interest rate that is shown is the amount that you can actually earn at this moment based upon the price that you would pay today for the bond in question. So the fixed rate of interest on that bond is adapted in this chart to show the actual rate of interest you earn based upon the current price of the bond, which is not the one at which it was originally issued. I will make another video on bonds very soon to explain all that, but trust me, that's right, and what it's showing is that the current rate of interest in the UK at the time of making this video was 4.67% on the 10 year government bond, which is the benchmark for the price of UK government debt.

And look at the figures for 2025. It is, near enough, a flat line at around that rate.

Look at the figures before then, and in 2024, it was lower.

It was a little bit higher in 2023.

And of course, if we go back over the five-year period that this chart covers, we go right back to the point where the effect of interest rate was near enough nothing during the course of the COVID period, but it wasn't much higher for the decade before that either.

Now let's look at the same chart, only this time it's for US government 10-year bonds, and it looks pretty similar.

You'll see the same inflexion point. The rate started to rise in January 2022, when everybody began to panic about the rates of inflation that began to rise at that time, after COVID, and because of the war in Ukraine.

And what you will also see is that this year, 2025, the rates are high. Actually, not quite as high in relative terms as in the UK, but very nearly as high. And the current yield on those 10-year bonds is 4.47%. That's the money that you can make at present by buying a 10-year government bond at current prices.

And what that implies is that we're still paying high rates. And note, Trump has not pulled these rates down on average this year. The rate is higher than it was in 2024 under Biden.

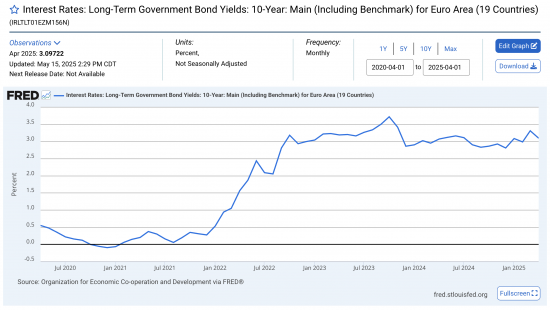

But then compare that with the data for the Eurozone.

And this chart comes from the St. Louis Fed, which is one of the central reserve banks of the USA and is a source of amazing quality economic data if ever you're looking for some information, and this shows the aggregate rate paid on 10 year bonds in the Eurozone, the 19 countries that issued the Euro as their currency. And what you'll see is the same inflection point when rates started to rise in January 2022, as if all the central banks acted in cooperation with each other, which, of course, they did completely against the interests and policies of market economics, and then you'll notice something else, very strange indeed. That is that in practice, the rates are very much lower than for the UK and for the USA. In fact, the current rate is 3.1%. Now it will vary slightly. In Greece it's nearly 4%, and in Germany it will be lower, but overall, the aggregate rate that you can get on a bundle of these bonds if you were to buy them in a weighted proportion to the value of bonds in issue from each of the countries in the Eurozone, would be 3.1%.

You'll also notice there has not been a dramatic change in rates this year compared to rates in 2024. In fact, rates are lower now than in 2023. There hasn't been a major Trump effect of lifting rates.

So, what is it about the UK and the USA and our interest rates that means that we have to pay up to 1.5% more than people in the Eurozone do to borrow money? What is that fact that explains the difference? I'm going to suggest to you there are two reasons.

One is with regard to the USA, and it's being called, and it's not a nice term, but nonetheless, it's now in common use in financial markets, so I'm going to use it; it's called the moron effect. And what the moron effect refers to is the fact that there is a man in charge of the US economy who is absolutely out of control, has no idea what he's doing, and as a consequence is increasing the risk for people who wish to deposit funds in the USA to a point where excess interest rates have to be paid as a consequence.

Now, do they really have to be paid as a consequence? I think that's a good question, because as we all know, the US provides the world's reserve currency and, like it or not, people will have to deposit money in the USA, and therefore whether the rates really have to be as high as is shown here, or not, is hard to tell.

The US Federal Reserve is suggesting that high interest rates in the USA need to be maintained for the time being, precisely because of the Trump effect. Jay Powell, who's in charge of the Fed, and who is at loggerheads in his disputes with Trump, is maintaining the fact that the Fed must keep rates high because of the risks within the US economy created by Trump. Trump, of course, is demanding that rates be cut, but the fact is that the markets are ignoring Trump, and that is apparent from that chart of US interest rates. If anything, they've been rising again of late, and that's because people don't trust Trump. The USA is paying a very heavy price for having a man in charge of its economy who has no idea what he's doing.

But in that case, why is the UK paying even more? Why are we actually paying very high rates of interest when we haven't got somebody like Trump in charge of the UK economy?

Okay, we have got Keir Starmer, and the man is utterly clueless about economics.

And we have got Rachel Reeves, who frankly has no apparent understanding of what macroeconomics is all about, despite having got part of a degree in the subject from Oxford University.

But what we have got is a government that is, first of all, willing to bow down and worship Trump, and so we're getting the spillover effect of that.

And secondly, we have a Governor of the Bank of England, and a Monetary Policy Committee at the Bank of England, both of whom are absolutely dedicated to maintaining high interest rates to supposedly crush inflation when domestically created inflation in the UK is frankly under control and much lower, and I stress the point, much lower, than the rate of interest that is now being paid on 10 year government bonds.

The inflation rate varies at a little over 3% at present, and we all know that the Bank of England expects it to fall to around 2% well within the 10-year time horizon of the value of the bonds that we are looking at here. So, in that case, there is almost no justification for having an interest rate that is maybe 2.5% more than the long-term expected interest rate that will be paid by the government on its bonds, and therefore, the yield is just simply too high.

So why have we got such an excess interest charge, and the answer is, we also have people in charge of our economy who are absolutely clueless as to how to manage it.

We don't use the same terminology as has been used about Trump, but frankly, if you add up Keir Starmer, Rachel Reeves and Andrew Bailey, the Governor of the Bank of England, you have a triumvirate of people who are absolutely out of their depth who managing the UK economy, and might as well be described as Trump is, because between them, they are only there in charge of the economy, it would appear, to cause damage to us all, and that they most certainly are doing.

Look at Europe and the same trend isn't seen. Europe is running an economy that is trying to meet the needs of the people of Europe.

The UK is not.

The USA is not, and those are the big differences.

The UK and the USA are subject to massive increases in interest rate margins because financial markets don't trust the idiots in charge, and in the Eurozone they do.

And we left Europe. Think about it. If we were aligned now, you would be paying a lot less on your mortgage, on your car loan, or maybe even on your credit card loan. All of those things are influenced by these rates. We are paying a high price for having people in charge who have no idea what they're doing.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

If there is a chart I cannot see it Richard!

Rather than incompetence or just incompetence, I think that we also need to consider that it is also intentional. Both the U.S. and U.K have become crucibles of capitalist exploitation based on Neo-liberal values and ideas. At the core of Neo-liberalism is intellectualised theft – the authorised raiding of other people’s money – wealth transfer upwards to those who are already wealthy and whom try to reserve the money supply for themselves. That’s my view anyway.

Apologies….

I make these video based posts in more than one stage and sometimes forget to add the charts

If we’re talking about the 10 year US treasuries chart, it does appear – as a flicker – just before the next chart comes up (Euro Area).

I saw something like it on a previous video, but missed the spot.

It kinda seems like there’s an extra “spacer” type slide or slightly out of sequence, maybe? I really have no idea as I don’t do video editing.

Apologies

We have checked why this happens, and learned lessons

And China’s 10Y bond is 1.7!

https://tradingeconomics.com/china/government-bond-yield

Incompetent leaders of the economy to blame then. Two choices present themselves:

1. Competent leaders of the economy. Good luck finding them as Hayek would say. And setting up a rules based system to dismiss the one who are incompetent.

2. Less economic leadership from the centre in particular by politicians.

The UK has it doubly bad as our lot are incompetent and they have too much centralised power.

No chart showing again

Sorry

Added now…

As in Jane Austens era of course high interest rates are providing a nice little earner for the cash rich

Might avoidably higher interest rates increase the size of the National “Debt”, for no good reason?

Might a bad reason be to create an “atmosphere” which contributes to reductions in spending on public welfare?

In part, yes.

While the Eurozone sips espresso at a leisurely 3.1%, the UK and US are chugging financial Red Bull at 4.5%+ interest rates. Why are we paying a ‘clueless leadership tax’ on everything from mortgages to groceries, while Europe catches a break? Forget the usual inflation panic – through an MMT lens, it’s less about ‘market necessity’ and more about self-sabotage, political theatre, and a chronic fear of actually fixing the real economy.

And this isn’t just academic navel-gazing. That 1.5% premium isn’t a harmless statistic—it’s the invisible surcharge on your mortgage, your car loan, and even your weekly shop. When 10-year government bonds (the bedrock of borrowing costs) sit at 4.67% in the UK and 4.47% in the US versus 3.1% in the Eurozone, someone’s paying for the privilege of economic incompetence.

So why the stubborn transatlantic premium? Conventional wisdom screeches about inflation PTSD and “market confidence.” But MMT—which treats currency as a public tool rather than a scarce commodity—reveals three farcical truths:

The Inflation Bogeyman Has Retired (But Central Banks Didn’t Get the Memo)

Yes, 2022’s inflation spike was real. But today? UK inflation is ~3% and falling. The Bank of England knows it’ll likely hit 2% within a decade. Yet they cling to rates 2.5% higher than that target—like using a flamethrower to extinguish a candle. MMT argues inflation is a real resource problem (not enough houses, green energy, infrastructure). Solution: Government spending to boost supply. Instead, the BoE/Fed chose austerity-by-interest-rate—crushing demand while ignoring the actual bottlenecks.

The “Credibility” Circus

High rates are a performance art piece for financial markets. “See how tough we are?” the BoE and Fed declare, hiking rates to prove their inflation-fighting virility. MMT calls this theatre: for currency-issuing nations (UK/US), rates are a policy choice, not an iron market law. The Eurozone’s ECB, juggling 19 economies, can’t afford such dramatics—hence their pragmatic 3.1%.

Self-Sabotage: Brexit & the “Moron Effect”

The UK’s extra 0.5% pain? That’s the Brexit Surcharge. Markets price the friction, uncertainty, and flatlined productivity of a deliberately smaller economy. Meanwhile, the US suffers the “Moron Effect” premium (a term even financiers now use). Trump’s fiscal grenades—tariffs, debt-ceiling standoffs, and promises of inflationary tax cuts—force the Fed to keep rates high as disaster insurance. The kicker? The dollar’s reserve status should let the US borrow cheaper, but chaos has a price.

How MMT Would Actually Lower Rates

Instead of rate hikes—the economic equivalent of bloodletting—MMT prescribes:

Productive Deficits: Governments should spend directly on supply-boosting projects (social housing, renewables, skills). More supply = less inflation without crushing demand.

Job Guarantees: A federal job offer at a living wage stabilizes wages and spending, making extreme rate hikes obsolete.

Debt Sanity: Stop fetishizing deficit ratios! For sovereign currency issuers, debt is just savings. Focus on real resource limits, not imaginary fiscal cliffs.

The Eurozone’s Open Secret

Europe isn’t genius—it’s just too stagnant to overheat. With growth near zero, the ECB doesn’t need to perform rate theatrics. Plus, political risks (Le Pen? Meloni?) feel contained compared to the UK’s Brexit hangover or America’s election-year dumpster fire.

The Bottom Line

We’re not victims of abstract “markets.” We’re hostages to leaders who think economic policy is either A) worshiping bond vigilantes or B) tweeting. Until governments grasp their power to invest directly in solutions—not just outsource pain to the BoE/Fed—our mortgages will keep funding their farce. Pass the espresso.

I really don’t understand how the Fed can use the tariff excuse (and thus inflation) to justify the interest rates to reduce inflation. If inflation is due to the tariffs, how will a completely unrelated tool that does not impact that help with inflation? And it of course will only exacerbate the issue in my view. Donald Trump is for once right about something…

You know the truth

I know the truth

They will deny the truth

Bear in mind that most of the rates quoted are the cost of borrowing paid by governments. Businesses and households pay more. Low-quality borrowing (such as on credit cards) can incur rates of 20% or more for the impoverished. Banks have long leaaned how to price risk.

Postive real rates paid are slowly damaging society. Nobody cares. Few even understand.

Correct

I have seen an advert offering borrowing at 1,000%??????

I have come across 4,000%

I’m sure if people were confronted with the impact on themselves personally, they would be rather more likely to be vocal.

With an average £200k mortgage being aligned with European rates (1.85% lower) would reduce the interest charged by around £300/month. Renters are presumably getting this cost passed on, too.

If the majority saw this situation as losing £300/month/household, then you could expect far more attention on the matter.

Indeed. As MMT shows, tax is a far more efficient lever for managing inflation than the sledgehammer of interest rates.

Now imagine if taxes were raised by £300 per month on the average mortgage holder. There would be tumbrills outside no 10 and 11 Downing Street by the weekend.

The biggest trick the neoliberal devils played was outsourcing economic policy to the technocrats in so called independent central banks. A nod, a wink and a “not my fault gov” gets politicians off the hook whilst all around us the very functioning and fabric of the country drops to bits

Interest rate policy is touted as one of the most powerful levers in modern economies, yet I suspect its mechanics are poorly understood by many savers, who just want to chase the best rates. Greater literacy – especially about how high rates for savers increase unaffordability for others – could result in more equitable outcomes. Armed with the right information, most people want to do the right thing. It wouldn’t completely solve the problem, but it might help.

Thanks, interesting. I was watching the video, and the second chart didn’t show on screen.

Sorry: we now realise what the glitch was. You learn from mistakes.

Isn’t the answer to the UK/US interest premium the increased need for these economies to fund themselves by borrowing because they refuse to tax enough.

Plus that the market expects their currencies to depreciate against the euro.

And that high interests are needed by the City as liquidity to gamble with.

Isn’t the excess interest rate the true cost of the UK being outside of the EU? ie 2.25% or over £50bn per annum

No

@ Roger

The government is the monopoly creator of pounds sterling.

It therefore follows that the pounds used to purchase bonds could *only* come from prior government money creation.

Selling bonds does *not* fund the government. It simply removes savings of previously-created pounds from being liquid assets in the economy.

Correct