Bridget Phillipson MP, who is the Education Secretary, is telling the morning media rounds that if the government were to restore the winter fuel allowance, and remove the two-child benefit cap, then markets would panic, the pound would collapse, interest rates would rise, and we would have a full-blown, Liz Truss style financial meltdown.

Let's ignore the fact that Liz Truss did not cause a financial meltdown single-handedly, because the Bank of England did that with its announcements on quantitative tightening, and instead just consider this claim.

Reinstating the Winter Fuel Payment to all pensioners would cost around £1.5 billion per year, increasing eligibility by about 10½ million pensioners as a result. The estimate allows for the savings of removing a means-tested system.

The Institute for Fiscal Studies estimates that abolishing the two-child limit would cost the government about £3.4 billion annually. This policy change could reduce relative child poverty by approximately 500,000 children (4% of all children).

Alternatively, the Resolution Foundation has suggested that removing both the two-child limit and the benefit cap would cost the government £3 billion.

These are estimates, but they will do.

So, the total commitment would be around £8 billion at most.

What it was suggested Liz Truss did was:

- Announce unfunded tax cuts for the wealthiest.

- Not economically justify the tax cuts.

- Therefore, not explain the rationale for her policy.

- As a consequence, a 'black hole' was left in government funding, requiring borrowing without a sound explanation being given, especially when it is known that the wealthy save the benefit to them of tax cuts, creating almost no multiplier effect.

In contrast, this policy:

- Has sound economic logic to it. There is a need in society.

- Has strong multiplier effects, and so could pay for itself from the resulting income and GDP growth.

- Has a rationale as a consequence to justify short-term borrowing.

- Could easily be covered by tax changes.

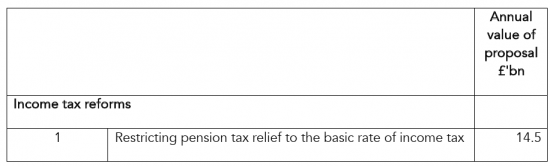

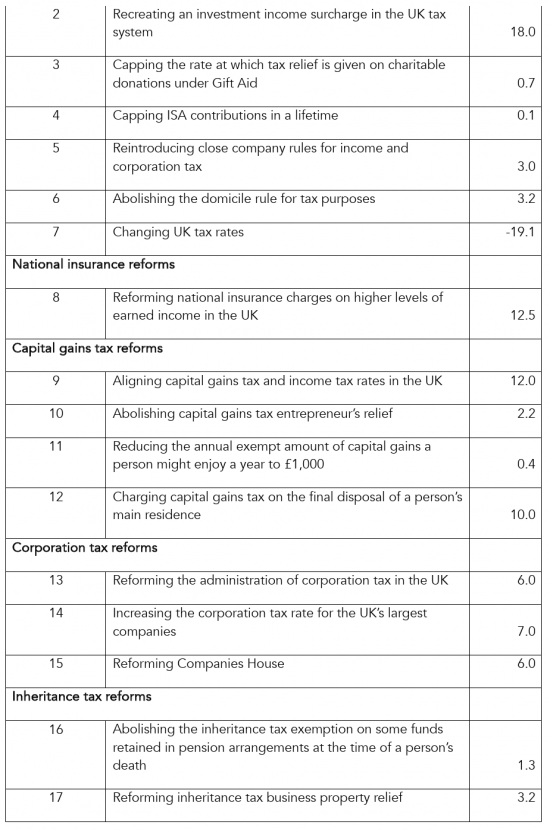

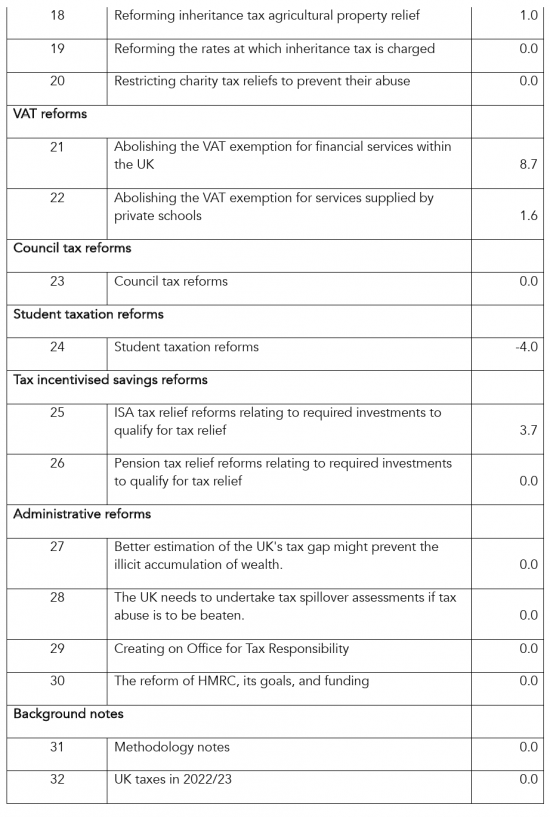

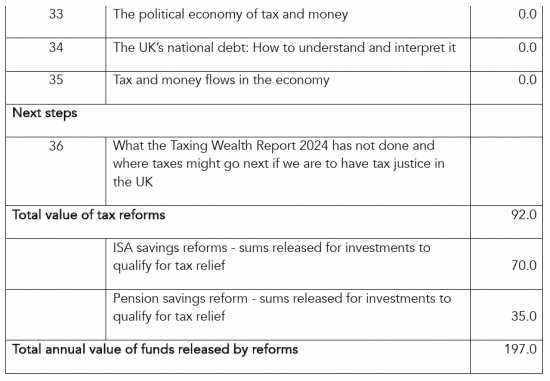

Which ones? You take your pick from the Taxing Wealth Repor

My choice would be to add VAT on financial services. The result would be a direct transfer from a socially useless activity, in the main, to a socially useful one, and from the wealthy, who consume financial services, to the least well off, who need support. I estimate that it could raise £8.7 billion, enough to cover these benefits, of that logic has to be used (and it does not, of course: the cost could be covered by money creation and it could be covered by the multiplier impact, but Labour ministers haven't got that far in their economic understanding, unfortunately).

Problem solved.

Bridget Phillipson is talking total nonsense, in other words.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

All I can say to your post is WTF is that stupid ****** Philipson talking about? (the ******* is not gender specific, be assured).

This is just stupid, so stupid – she’s on how much a year to believe in this crap?

So the finance sector calls the tune eh, Bridget? On the money that your sovereign government has power over?

If that is the case, then we might as well close Parliament down because it is all just a waste of time.

But at least now we know why Starmer is stymied and Labour are laboured.

And who really rules this country is reified yet again.

Some democracy this dump is I tell you………………………………..

I share your anger and frustration, Pilgrim (something me and you have been doing via Richard’s blog for a long time now). And yes, of course the finance industry is calling the shots – why is Blackrock such a key advisor if that isn’t the case.

But this constant comparison or referencing to what happened with Truss is just theater isn’t it. Of course they know these pathetic policy changes won’t lead to the kind of meltdown that happened with the Truss budget, but they know (or McSwine does) that the public can still remember what happened and so it’s done to try to ‘scare’ the public into thinking, ‘Of course we couldn’t risk having another Truss moment so aren’t Starmer’s Labour being so very sensible.’

Lots of us see through that nonsense, of course, but many people who don’t spend time following politics (reading blogs like Richard’s) won’t, and that’s the audience this type of grandstanding and lying is directed at. And sadly, it’ll register and they’ll believe it.

On a related note, when I was working on a comment to one of Richard’s blogs last week I ended up reading something on Antonio Gramsci that I hadn’t read for a long time. Part of which was that it was his interest in why the British never rebelled against their government (unlike in France, Italy or Spain, for example) and how this lead him to his thinking on ‘manufacturing consent’ (hegemony), and I’m afraid nothing has changed. Indeed, I think hegemony, and thus the exercise of hegemonic power, in the UK is now even stronger than it was all those years ago when Gramsci looked at the UK.

In short, we’ve become a nation of neo-serfs, with our masters the controllers of the MSM (as was always the case), social media, finance and extreme wealth (as opposed to the landowning class). There are some of us who realise this – much like the central character in ‘The Ragged Trousered Philanthropist’ – but the majority don’t and never will. But then, that’s the nature of hegemony when it’s working well – which is why the Chinese ‘communist’/totalitarian rulers covet what we’ve had in the UK for centuries now, and attempt to copy it with their model of autocratic, state controlled, capitalism. And as my wife would tell you from her experience of teaching Chinese undergrad students, they all believe they are ‘free agents’, and simultaneously beneficiaries of both capitalism and state controlled communism. As I’ve said to my wife on more than one occasion, I’m not sure what Marx would make of that were he to return. But maybe he’d conclude – as Gramsci did – that this is just another example of hegemonic power and control.

Depressing, Ivan, but you may be right.

Thank you, Ivan.

My parents and I were in Normandy for a few days and noted place names (Bolbec, Carteret, Tourville, Granville, Tancarville, Colleville, Vernon and Montgomery) still associated with British aristocrats. When chatting with locals and mentioning preparations to celebrate the anniversary of William’s birth in 2027, we added that their descendants still own much of Britain.

All too compelling Ivan, all too compelling.

As Mirowski has pointed out, the Neo-libs never let a disaster go to waste and the ‘Truss -effect’ is evidence again that this is true. Fear mongers eh?

I’m so angry with Phillipson – she’s literally talked her self and the concept of democracy into the catch pit of politics, where the wreckage lies smashed up and useless.

And as long as her and her ilk talk like that, it is true, democracy is useless and our leaders are as much use as a colander to save a sinking boat.

Goddamn them!

As always, I agree with your assessment, PSR, but here I have a quibble: you refer to “that stupid ****** Philipson”, and assure us that the “*******” is not gender specific”, but “*” makes a world of difference, as closer examination will reveal……

That the current education secretary is cited as a potential victim of a reshuffle is not a surprise. She has can make stupid ideas sound as stupid as they really are. I am convinced this is completely unintentional. It seems to be the main qualification for membership of the Cabinet at the moment.

“then markets would panic, the pound would collapse, interest rates would rise”………….and the 4 horsemen of the apocalypse would appear and we would all be doomed, doomed I say.

Looks like McSwine has sent out a useful idiot to manage expectations, Uk media lap it up & ask no questions, not that Phillipson could answer them even if asked. The contrast with Leuttuce politices was good – but beyond the wit/wisdom of the media to consider or even remember? UK media seem to have almost no memory or a capacity (or willingness) to compare and contrast.

I wonder if they ever read this blog?

I doubt it

Thank you, both.

May I crow bar something that I have thought about over the week-end. Corbyn suggested that a new party may be set up by May’s local elections. It has separately been suggested that a Green Party led by Zach Polanski and outcast Zarah Sultana may ally.

One wonders if Richard, Mike, PSR and others in this community would be interested in helping out.

I admit that i am totally unsuited to party polotics.

Would be happy to advise.

How about abolishing VAT and adding tax to the wealthy to cover the revenue loss?

Not sure how the sums would work out but at a stroke you would release an extra 17.5% spending power into the economy which might contribute to a bit of growth.

Would also provide a hefty hit to inflation as well.

You’d need to find well over £100 billion.

Possible, but not easy.

The transiion would take some time, but it could be begun.

Quite true. We could abolish VAT, as the reason for us introducing it in the first place was so that we could join the Common Market as it was called then. Back in the 1960s (and I assume earlier) we had purchase tax that was levied on a far smaller range of goods and not on services at all, I think. As the initial rate of VAT was 10% as I remember it (and reduced to 8% by Harold Wilson), there is no obvious reason why we need a rate as high as 20%. Also under the old purchase tax, the Chancellor had a power, called the regulator, that enabled him to raise or lower purchase tax by 10% of its rate. I sometimes wonder whether that sort of flexibility in taxation might be better than asking the Bank of England to adjust interest rates with the aim of hitting the 2% target in two years time (which has always seemed to me to be quite arbitrary).

Purchase tax is a really poor tax.

Is it not obvious that she is reading out this brief because the government of the day has only a tenuous connection with economic policy? These matters are governed by the permanent members of the treasury who ensure that the majority of people in the country remain poor, docile and controllable.

Thank you and well said.

I would add fearful and desperate to find the next meal, so they have no time to think, plan and dream.

I don’t think the public at large is aware of how venal many people in politics and even the civil service are. They want people to exist, not live, in that state. May I add, corrupt and obsessed with the US, too.

I caught up with posts yesterday evening and, in particular, note what John S Warren wrote about the British state. I shared that post with my parents. Dad said it was the poor and little educated mass of Mauritians, not the educated and middle and upper class, who voted for independence from the UK and they were right. As John said some time ago, “No former colony has regretted independence from Britain.”

The last is undoubtedly true.

No one has ever asked to come back.

We should take note.

Think of the consequences. We are all going to end up like Greece. Spending money that we don’t have is reckless. Being reckless with the finances is evil. Yadda yadda. The messaging never seems to change apart from we know that things do change. Greece has lower 10 year yield than the United States. Why is it that consequentialism is always used to persuade us not to do things. What about all the things we should be doing? Like helping people out of poverty.

Much to agree with

Interestingly, Bill, that is the message currently being pushed by Starmeroids on social media. How dare we criticise!

Thank you and well said, Richard.

Have Richard and readers noticed that, for example, when politicians warn of Mr(s) Market having a melt down, Mr(s) Market is never asked if that is / will be the case? I doubt that bond traders would say such a thing.

A dozen years ago, when ring fencing for banks was proposed, colleagues and I discussed the proposals with equity and bond traders. Opinion was divided. Equity traders felt that returns would diminish, but may be more stable. Bond traders were in favour of ring fencing and banks as a utility investment. What I want to say is that City opinion is not monolithic.

With regard to the Resolution Foundation, yesterday morning, I listened to the Today programme and heard Stella Creasy and the Foundation’s David Willetts discuss the cap. Creasy wanted the cap lifted lifted, but still referred to fiscal constraints. Willetts was his usual self. I wondered how he got so high in government and recalled his nickname, “two brains”. I thought of Richard and what Willetts told Major about some backbencher making trouble, “Wants our advice.”

🙂

My wife calles me “two brains” because whe is well aware I can be writing and talking to her simultaneously and know all she haas said, and reply intelligently. She also knows I will stoip writing if she throws in a curve ball, which she often does.

Thank you, Richard.

I was in Normandy for a few days and thought of you when coming across the birds.

Thanks

I have not been for some years – but love the area.

Talking of curve balls, no doubt you’ve seen George Monbiot’s article in The Grauniad on Starmer and co and the need for PR. Superb!!!

https://www.theguardian.com/commentisfree/2025/may/27/smash-britain-two-party-system-election-labour-reform

I might share a bit of it. I read it just now in a break from editing and mpderating..

My ex-husband regularly bemoaned the fact that I could do that. He started to throw in curve balls, such as “….and the house is on fire…”.

Unfortunately for him, I learned to recognise the curve balls fairly quickly, which further incensed him.

🙂

Thankfully, we are both capable of doing this: it helps our understanding of each other.

Thank you, Richard.

I forgot to mention that, as I listened to the R4 discussion, I thought of Mauritius where even big private sector employers are giving money to staff for child care. The big firms see it as a way of attracting staff.

The Mauritian economy is dominated by colonial era oligarchs, but they are local and see that they sink or swim with the rest of the population. It’s interesting that oligarch family members who prefer to live off the private income and stay overseas are kept away from management and sometimes are bought out.

It’s really not hard to work out the right thing to do, unless you’re a minster at Westminster, it seems.

I should add that “cited” is a reference to the general media, and not PSR’s comment.

They can see no way out of their own self constructed ‘there is no money’

cage.

As to VAT on financial services Neidle said Murphy ‘misunderstood the numbers’ – whatever that means.

And as I have already told you, Dan Neidle has a great many unknown knowns because he made his fortune as senior tax partner of one of the biggest firms of London lawyers, undoutedly earning well over £1 million a year as a result. Of course he does not understand my perspectives. It is in his interests not to do so. What are you trying to prove, Andrew?

Not trying to prove anything – just to understand whatever discussion and critiques there may be.

The more things are out there – especially your TW report – being discussed or argued about – the more salience they will have.

I did put to Neidle that the gross increase in inequality of income and wealth over the last twenty years in our financialised rentier economy wasn’t sustainable – and why could he only tolerate a modest reform of CGT which would have minimal effect .

Didn’t expect a response and didn’t get one.

Where was this exchange? Do you have links?

The twitter exchange – such as it was – here https://x.com/DanNeidle/status/1926565287173775666

Thanks

I will muse on this.

Dan Neidle does not like the idea of using the tax system to recoup WFA from the wealthy. I am not going to argue with Neidle about tax law; he is an extremely well paid tax lawyer, and if I had a tax problem and could pay his bill, I would no doubt use his tax services; he will never pay me for tax advice, in any version of reality.

Neidle is still wrong about using the tax system for WFA payments and taxation. His argument is that 85% of pensioners do not submit a tax return, but with a WFA payment through universal benefit would automatically require even modest income pensioners to submit a tax return. The problem is many pensioners would not comply, and would then pay penalties. The effect is a mess. Neidle refers to the precedent of exactly this outcome, with Child Benefit.

Neidle would be right if HMRC could do nothing to change the process. You need only state the problem to see that he is wrong; for two reasons. First, Child Benefit is in HMRC tax process terms, exactly the same as WFA. This means we know exactly what the problems taxing WFA are. Where Neidle is wrong, is assuming we can’t fix it. This is just HMRC process bureaucracy; HMRC requires to construct a tax process that eliminates the problem, which is not insurmountable difficult; indeed taxation is not there to serve mindlessly the convenience of HMRC and tax lawyers.

I am not going to attempt to write the small print for HMRC, but I can offer some ideas. HMRC provides a list of situations where tax payers require to submit a tax return (see HMRC website). The list could be amended provide a carefully worded exception for pensioners caught by the requirement solely because of WFA. It could allow wealthy pensioners to reject payment (this is the reverse of what they do just now – oblige pensioners to apply for WFA). The could tax wealthy pensioners through the tax code, require pensioners to decline the WFA, and if they don’t replace the requirement to submit a tax return with a modest, additional and one-off tax penalty for non decline and non submission, and waive the requirement for tax return submission solely for WFA receipt. There may be better variants, to HMRC’s operational convenience. It can be done.

I am sure that HMRC could do this, and we should be able to assume HMRC will be resourced to do its job properly.Frankly I believe the real reason Treasury and Government make it all so difficult isn’t the Neidle’s process conundrum, but the fact that obliging pensioners to apply in a means test is that it saves £2Bn a year, not because of the means testing (which is hopelessly inefficient, costly and doesn’t work), but because they know around 37% of pensioners don’t apply, and do without; and suffer – usually in silence.

There is another reason for this mess (pensioner poverty, that Neidle has little to say about). HMRC is an exceptionally powerful Government Department. It is run by a Board, and is answerable to NO Government Minister. The reason for that is – supposedly – to ensure HMRC operations are “fair and impartial”. This, I submit, is not working very well (we know it is a mess – read the Whitehall Whitewash Inquiry into the Supergun Affair, 1990). What happened there was that two out-of-control Government operations (MI5/MI6 and HMRC were running amok, and tripped over each other without knowing). It is also an extraordinary proposition; it follows that we can be faily sure that Government Ministers are incapable of being “fair and impartial”. Simmer for thre hours, and taste that one.

Dan Neidle is far from impartial.

He likely earned more than £2 million a year at Clifford Chance.

Al, his prescriptions appear to be dedicated to maintaining the status quo of power the wealthy have. He has never come remotely close to supporting tax justice. Of course he does not understand pensioner poverty.

I’m amazed that national treasure Liz Truss hasn’t been given a peerage, for services to the “maintenance of (neoliberal orthodoxy”.

If she didn’t exist, we’d have to invent her, to justify balanced budgets, public parsimony and fiscal rectitude in the face of overwhelming evidence to the contrary.

Perhaps there is a daily ceremony involving cracking open a bottle of “Liz’s fizz” in homage to her, in 55 Tufton St., the LSE, and at the commencement of every PPE lecture in Oxford? Maybe even a little blue plaque on the wall, in the office of the Permanent Secretary at the Treasury?

Richard, have you ever estimated how much abolition of the ‘7 year’ rule would raise?

No

The difficulty with such a calculation is what do you replace it with?

Options: a lifetime gifts received tax; extending it from, say, 7 to 10 years; ending it entirely (so that all gifts, whenever given, still count as part of a person’s estate on death) have quite different effects.

There is a saying in politics that you should never ask a question if you do not already know the answer to it. I suspect that none of these would be easy to quantify and the last would be the most difficult of all.

If I were looking at raising more tax from the wealthiest in society, I would look at the treatment of trusts; 6% of the trust’s value every 10 years is pitiful.

It would be too subjective to be useful.

I would simply say “we can afford this, since it would be an increase of less than 0.1% on our total expenditure, and we care far more for pensioner’s comfort”

There is this unshakeable belief that when the Government spends money to feed hungry children or stop pensioners from freezing, the money just disappears into a black hole. Surely even a politician can see that when the money is used to help those in most need, it supports businesses and provides jobs? The Government gets “growth” and it gets the money back as tax. The case for elping those in most need is not necessarily about morailty. It is simply the most efficient investment that the Government can make.