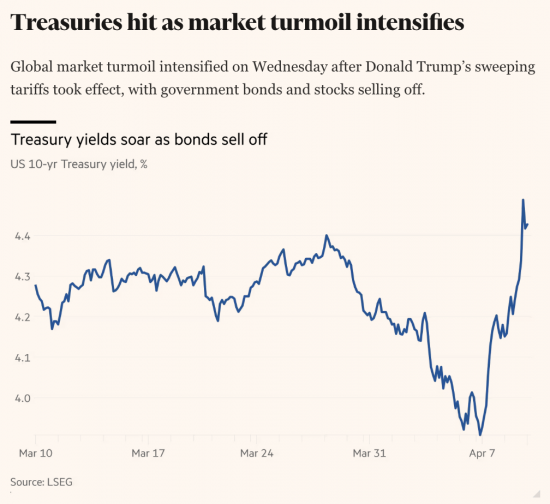

This chart has been published by the FT in the last few minutes:

The world has reacted to Trump's deliberate act of massive risk creation by sending the message that it will not buy US debt. The result is that the price of that debt is falling, and so the effective interest rate on it is rising very rapidly.

This is the exact opposite of what Trump says he wants. He says he wants the US interest rate to fall by a lot. In bond markets, you cannot achieve that by alienating the people who might buy your debt, and that is what he is doing.

What's the fallout?

First, as I note this morning, he might utterly overturn those markets, and in effect default on large parts of US debt by demanding that those holding it swap that debt for long-term or perpetual debt at very low rates.

Secondly, do not rule out that he will do large-scale quantitative easing, with all the downsides that go with that.

Third, do not presume that we will escape from this unscathed. Where US interest rates go tends to suggest where the rest of the world will move. There is, then, very bad news in all this.

Fourth, without coordinated action to work around Trump, there is no way the rest of the world can manage this fallout. It either combines against Trump or is divided and ruled by him, with disastrous consequences.

Fifth, do not expect wealthy America to be happy about any of this. They will react. But they may not react in a way that we think desirable. Their tendency towards autocracy is now well known.

Sixth, then, freedom has a fight on its hands. That chart implies an ugliness is coming our way.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The idiot in the white house is saying that he will default on loans. He doesn’t know how threats work in economics. In business, threatening people may get a good deal. In economics, threatening people destroys your own economy. He doesn’t know economics.

He literally thinks that having run real estate business and casinos – very badly – and been a gameshow host means he knows all there is to know. Those around him are too cowardly and unprincipled to challenge him.

Agreed

Long dated UST yields initially fell as people fled stocks and bought bonds then they fell as the market priced in the recession that is on the way. The sharp rise is a response to the risk of disaster.

Overnight, long bond futures traded down 4 points (although they have recovered somewhat). My friend and I tried to recall the last time we had seen this sort of Asian time zone volatility in the bond market. It was in 2001.

There is an auction of US Treasury 10 year notes today and 30 year bonds tomorrow… could get even uglier.

Agreed, especially re the last

What’s the most ridiculously stupid response imaginable?

That. That’s what Trump will do.

Re: your third point

Under normal circumstances the world follows US interest rate patterns. But the rise in US Debt interest returns is all down to his kamikazee economics.

Shirley the world won’t be following this time around??

We can hope

“… and don’t keep calling me Shirley”

🙂

You aren’t a boy called Sue?

Clive & Richard,

BOYS! BOYS! What are you boys chattering about?

Get back in your chair, pick-op your crayons and get back to work!

LOL! LOL!

This is worrying,

How can economics help future-proof us from this horror, so that we are less vulnerable and can break free from the iron grip of the free market?

Would it not be possible, if more people lived in non-market housing like Andelboliger-styled housing, people would have a much lower cost of housing and therefor personal debt, and so would be less vulnerable to interest rate rises, arguably have more money to spend on energy saving measures so become less vulnerable to rising energy costs too; and perhaps have more money to spend on training and upskilling, so could become more economically productive, arguably this would boost their local economy through more consumption of such spending on goods and services like energy-saving and education; whilst at the same time lowering spend on health, housing linked to health, in this case leading less stressful more secure lives would be preventative of poor health and social outcomes, and lower large government spend?

Perhaps this is a naive view of someone who is learning about economics (but understands the importance of economics is to our lives).

How would you provide security?

People need that

The biggest lie the political rulers of Neoliberal countries tell their populace is actually what they fail to say, because it’s genuinely far too egalitarian for them.

Yes, building social housing costs a lot, just as properly insulating existing stock does.

But, such massive public works create jobs, provide housing security for the in-work-poor populace and shoves it to the rentier class bullies as well.

Win, win & win for society.

But by doing so, you sign your political death warrant.

Yes, and it’s in their interests to make people believe there is no alternative, when this blog, Funding the Future, and options like Andelsbolig non market housing quite clearly shows that this is simply not true!

Yes agree, people need security, security is promoted by reducing threats to safety.

Being exposed to the vagaries of the market, and private housing market is a threat to a fundament need – affordable, secure shelter.

A person in Copenhagen can buy a one bedroom flat for £137,000 in Cambridge a similar is more than double, and Cambridge is not a capital city.

When protected from these forces people from UK and Australia who bought their Andelsbolig flat described a sense of security, see below.

1. ‘peace of mind’ escape from being ‘stuck in a doom-loop of precarious housing for ever’

2. It’s so nice to have the sense of security for the first time. I still can’t quite believe I have a place of my own

1, https://www.theguardian.com/commentisfree/2022/jan/23/cooperative-housing-peace-of-mind-denmark-tenants-landlords

2. https://inews.co.uk/news/housing/moved-housing-co-op-denmark-cheaper-living-uk-3244882?srsltid=AfmBOorsSrdtAd3AKJJlPq6NUmt0c0Nl-9xiz99eG-t9-qlhT8YHHVjo

How can economics help solve this big problem in UK, and help future-proof ordinary people?

What stops you being thrown out?

Thrown out of this form of housing ?

Eviction on an individual level seems to be down to the contract between the members, seems the same as elsewhere e.g. non-payment of rent or loan,

Thrown out by the government? It might be more difficult as unlike council housing this form of non-market housing is not government owned. It might be harder to initiate a mass sell-off of this form of non-market housing in the way that council house sell off was instigated by UK government. Although where there’s a will….

Thrown out of Denmark?

In these uncertain times seems anything can happen, that would be best answered by a Danish lawyer.

So, there is a tenancy agreement that is not enduring.

Few people would be comfortable with that.

Richard

I understand it’s more like buying a share in a regulated structure, the cost of a home is not at market price. It’s renting and ownership, a million Danes live in this form of housing – increased when tenants had the right to buy, if their landlord was selling.

‘An association collectively owns the property privately, and residents buy shares to get a percentage of the value of the building and gardens.

Co-operatives are regulated by law in Denmark, so all andelsboliger are subject to state legislation around selling and purchasing.’ https://atlasofownership.org/entry/andelsbolig.

There are other forms of co-operative housing, our local one offers secure homes for £300 a month, more secure far cheaper than private renting, less of a scam than shared ownership, given social housing and home ownership is not achievable for so many.

I would like to think the U.K. has legal rights to protect tenants in such situations, but I am nit sure what they are, so I have reservations about how this might work here where shared equity has, in my opinion, generality been deeply abusive.

Thank you, your insights are valued to someone who doesn’t come from this field, that sort of abuse wouldn’t be good, we can’t just graft something on and hope it will be OK.

Yes, the issue we have in UK is tenants are not protected, for example a thin layer of protection around vulnerable care experienced young people, with complex histories and lives. Due to this sometimes fall in to difficulty and lose their council tenancy, at which point are deemed to have made themselves ‘intentionally homeless’, and struggle to get another tenancy.

Regarding the housing market and increasing the supply was described thus by someone who has four adult children living at home some of them into their 30’s: Building unaffordable homes which rich people buy and rent out to poorer people.

There has to be a better way.

I agree with your conclusion

Demos Kratos:

I suggest the fine details of how co-operative housing works in Denmark are not really relevant here. But you raise, I think, a very important point, that the economy (UK and other countries)is distorted and damaged by the outrageous proportion of their income that millions of people pay for their housing. In the UK the housing market has been monstrously rigged since the Thatcher regime commenced its large scale sell off of public housing (without building corresponding replacements) in the 80s. Allowing a huge advantage to the rentier class.

But as John suggests, vested interests are so powerful that reversal of this would meet with huge and manipulative resistance.

It was only last week that you were telling us that the UK government / Bank of England controls long-term interest rates (bond yields). Now you are claiming it is the market after all?

Do the facts depend on what point you are trying to push?

Oh dear: you really are folosh.

Of course central banks set the paramters for rates

But unprecedented world events that change risk parameters can also have an impact

By their nature, they are rare

You are stupid enough to not be able to spot the difference

They CAN control yields if they chose. QE during COVID showed that in the US and the UK. The question is whether it is WISE to do it.

Should the BoE act to influence long gilt rates? Yes….. by cutting base rates, stopping QT and yes, if required, buy gilts to prevent gilt yields rising too far.

Should the Fed act? It is not clear – rate cuts would appear to be caving into Trump which might send all the wrong signals.

Agreed

Long gilts in a bit of trouble – surely nothing to do do with the BoE doing QT?? Well, I hear (but can’t see it anywhere) that the APF will unload more gilts into the market tomorrow. Soooooo silly.

That would be beyond crazy – prices are crashing and they are selling?

Off topic

I was just thinking about your explanation of how tax havens work (there’s no money there). John Christensen talked about how the Panama papers revealed that the Chinese elite were using British tax havens and you said in a blog when Reeves went to Beijing that she was probably touting for hot Chinese money.

So is there Chinese money stowed in the City?

Yes, of course. But it is in the City. Tax haven involvement is only for secrecy.

Thank you

If they withdrew it all would it affect the value of the pound?

[…] By Richard Murphy, Professor of Accounting Practice at Sheffield University Management School and a director of the Corporate Accountability Network. Originally published at Funding the Future […]

How can economic security be strengthened if just one man can wreak so much havoc?

Where are the checks and balances? Where are the Senate and House of Representatives?

What happened to the Constitution? Why is the Rest of the World putting up with the USA?