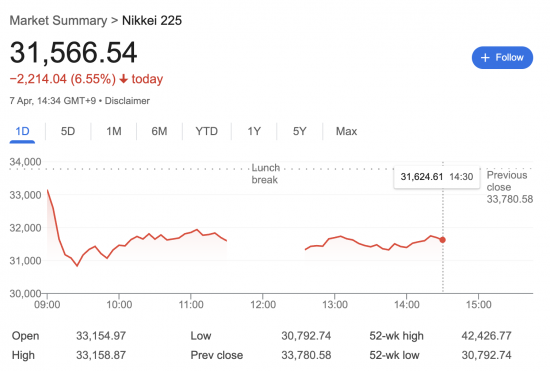

As I am writing this before 7 a.m., the Nikkei 225 stock market index in Japan is having a torrid time:

A loss of 6.55% is heavy. It was around 10% at one point.

However, this may represent the fallout from Friday's trading in New York more than it does new losses or uncertainty. The fact that the market stabilised after initial trading might suggest that.

This would fit with the pattern of 1987, for example, which Investing.com shows to have been like this:

An overheated market crashed, stabilising at around the level it had been at before the crash, before lowly rising again (the pension fund Ponzi scheme guarantees that will happen).

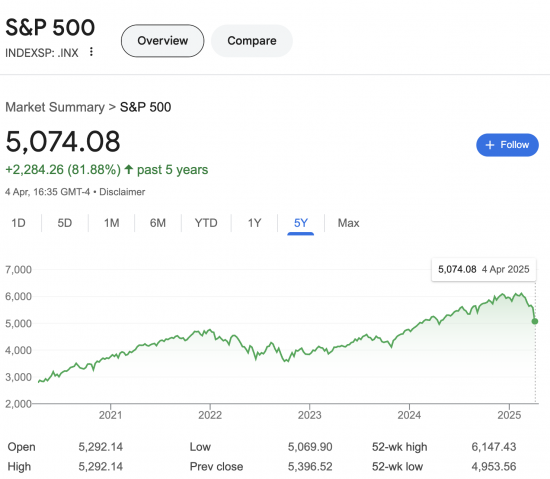

Compare that with the S&P 500 now:

The market got overheated in 2024, and most definitely so after Trump was elected.

Now it is in major correction territory, which was always going to happen, but for which Trump will now forever take the blame. But note, it could still fall and be well above levels at the start of 2024.

What will happen today? Will prices stabilise at around the Friday level? Will they be intensely volatile whilst approaching that new norm? Or will they fall further? I do not know. But I can spot patterns, and there is nothing odd about this one, except that Trump chose to precipitate it.

My suspicion is we will have a bumpy ride, but once the immediate panic is over - which will be within days - the hard work will begin. That will be the massive task of building a new world economic order that works around the USA. With Trump in charge, that must be the requirement.

The one fallout of all this that seems most likely is that no one will trust the States again. That might be no bad thing. Their influence has been malign for a very long time.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

If I look at the second graph though, it starts at about 2020 with the market at about 3000, it hits 4000 at the start of 2024 and is 5000 at the close of business on Saturday.

So its got a long way to go before we get back to the levels of a few years ago, on 4.4.19 before Covid it was 2800.

Agreed

I believe you mentioned this in a previous post Richard, but didn’t you allude to the fact that if the markets are so clever, why didn’t they realise that this would be the outcome of a Trump presidency? Surely in his pre election rhetoric, he, Trump, clearly stated that his aim was to introduce tariffs? Shouldn’t they have factored in this possibility?

Yes

But they are not clever. They did not notice.

I don’t think markets contemplate the long or even medium term. Increasingly (presumably made worse by algorithmic trading) it’s all about the ultra-short term (i.e. next few seconds/minutes/maybe days). I suspect “markets” (to the extent all the computers and traders can be viewed as a homogeneous whole) effectively took the view that a Trump election would drive price increases in the short term and jumped on that bandwagon. If pressed and being honest, “markets” probably knew Trump would be a disaster, but that was irrelevant, except in one regard. They couldn’t SAY it because that would defeat the object of their short term profit ambitions. PRETEND Trump would be an economic success, bank the ultra short-term profits that follow from that pretense, then watch the crash that you knew in your heart would happen.

Looks pretty dire but Euro weapons companies are doing OK – lost a bit but still very healthy (perhaps that’s a contradiction in terms?).

I’m guessing but the froth stocks are likely to suffer, whilst the ones that make stuff (e.g. renewables and weapons) – provided USM(ango) is not a major customer could do OK over the next couple of years (this is NOT a stock recommendation btw).

On a realted note: Prediction: TSMC the Taiwnaese semiconductor outfit is investing $100bn in the USA. My guess is that once the USM(ango) has got the fabs built (and some onsite expertise) Taiwan will have reached its “sell-by” date. I have suggested repeatedly that EU should offer Taiwan a nice home in Europe.

Over the weekend I found your ‘Trump wants a crash’ video. Before that I was delving into your archives from 2008. All very chilling, but better understood than simply feared. Thank you Richard Murphy. Everyone else who comments on here seems to be very knowledgable, but I hope there are others like me who are simply getting better understanding, and will as a consequence be able to better articulate what we want, and do not.

[…] FTSE is, this morning, rebounding in the way I suggested was inevitable only early yesterday morning. This is the way that markets always work. They react […]