I am grateful to Dr Tim Rideout for drawing my attention to the GDP Now forecast run by the Atlanta Fed in the USA.

The growth rate of real gross domestic product (GDP) is a key indicator of economic activity, but the official estimate is released with a delay. Our GDPNow forecasting model provides a "nowcast" of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.

GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter.

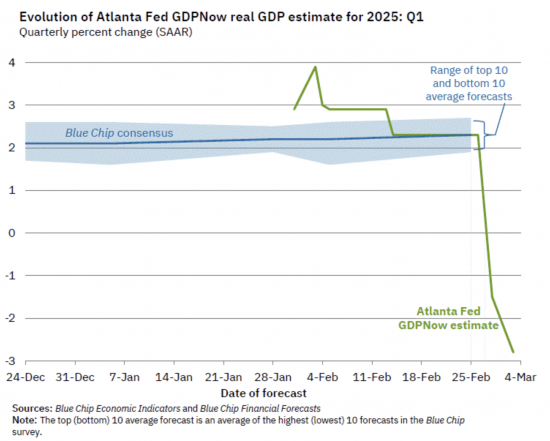

This is their latest forecast:

They say of this:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.8 percent on March 3, down from -1.5 percent on February 28. After this morning's releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3 percent and 3.5 percent, respectively, to 0.0 percent and 0.1 percent.

The obvious question to ask in response is, might the US be about to fall off an economic cliff? It would seem it is entirely possible that this is the case. So much for Making America Great Again. It would seem that the plan is about Making American Chaos Again.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Perhaps that is the point? sew chaos? Make people frightend and… “in your fear you turned to the high chancellor..” (V) Fear of communists in the 1930s was a useful for the human toothbrush – fear or.. XYZ will be used by Mango. Bust-it-&-lets-see-what-happens is the current USM (Mango) ethos of the muskrats.

& for those that think the US people will turn against Mango – no they won’t – they will go along with it – sure some will protest & they will get killed – mark my words.

“Nowcast” is interesting… but some care is needed in interpreting things. The threat of tariffs has led to a bulge in imports as people stockpile things prior to tariff introduction and this is skewing the readout. Nevertheless, the prospects for the US economy are dire; no business can plan in such a chaotic environment.

Richard, could you give the economic L (or maybe P) plate drivers amongst us, an MMT take on your posts about imminent US economic chaos? Because on the omnibus, I can hear people saying, “the Fed can just create more dollars and everything will be okay” and I’m not up to answering questions like that when the answer involves reserve currencies, Chinese loans, and disrupted trade balances and a dangerous fascist like Truskance.

The neoliberal dinosaurs have their persuasive lies ready, and I’m struggling!

Perhaps also throw in some MMT advice on the UK/EU situation too. Things are moving so fast.

Thanks.

Noted…

I will do that..

The answer is that ecoinoimics is never all about money…

But I will explain

We live in a physical world governed by the laws of thermodynamics. Perhaps Gail Tverberg, an insurance actuary from the US, makes some good points here: –

https://ourfiniteworld.com/

@ Mark Meldon:

May I mention the subject of Entropy Economics.

There is a book, Entropy Economics, recently released, by Galbraith and Chen on the subject. It claims to be providing a firm basis for economics in the real world, thus making the subject obey the laws of physics that apply to everyone and everything, a thought I find really quite attractive. At least it gets rid of the neoliberal twaddle.

Hmmm, sounds to me more like Making the American Rich Rich Again.

Might an economic crash finally stir the American establishment to finally take action against Trump? Nothing motivates like money. I hope so. The tinfoil hat wearing side of me suspects that economic chaos might be part of the plan.

When he alienates both Wall St and Main St he’s going to be in trouble.

Apparently Trump went off script at several points in his State of the Union address yesterday – mostly to spout lies – but at one point to tell people/MAGA that there would be some pain but to stick with him as afterwards the US will be great (again).

With regards to Wall Street and Main Street, almost all large economic decisions for the future are on hold as everyone is baffled by what to predict going forward and have no idea how to proceed.

People who voted Trump expecting direct immediate financial relief and benefit to their household are becoming angrier and angrier by the minute.

Do they have pitchforks yet?

Erdogan in Turkey has done incredible damage to their economy, and yet there is no sign of him being removed. Trump, like all dictators, only needs a small base of supporters. I think I read somewhere that it only takes 2% of a population to control the rest. I don’t think driving the country off an economic cliff edge will force him out of power. It just makes people more desperate to be inside the “in group”.

We will have to disagree on that

The actual point is 2 to 3 per cent could bring him down

[…] By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Fund the Future […]

It is interesting to speculate how the next few months could pan out.

Sacking huge numbers of government employees will mean a rise in the unemployment fugures. And those feeling at risk of being sacked themselves will switch from spending to saving. Plus the money no longer being spent by government will show up as a drop in the GDP figures. Once new tariffs show up in retail prices there will be an increase in inflation, and if the Fed responds in the usual way (they may well be bullied) an increase in interest rates.

Already the extreme uncertainty in Trump’s day to day actions is reportedly causing a stutter in share prices. And all the above will amplify that. It won’t play well to Trump’s need for adulation.

Unfortunately it is not just the Americans who will suffer from their choice of a President, the American economy is such a large proportion of the connected world economy that fallout will be everywhere. It is going to demand a lot of non-American political leaders.

(In which context, though outside the subject of this particular blog, Merz’s decision that the old fiscal rules no longer apply is an important move).

Thanks

Trump’s plan includes, I believe, crashing the US economy so he and his cashed up oligarchs can buy up cheap assets and gain further power. Simples!