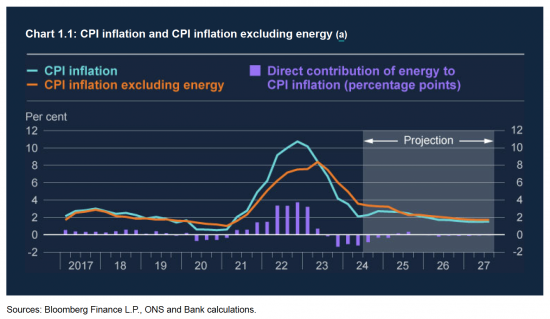

This chart comes from the Monetary Policy Committee quarterly report to the Bank of England published in early August 2024:

It shows that the Bank knew that inflation was going to rise at the end of this year, and then descend steadily thereafter.

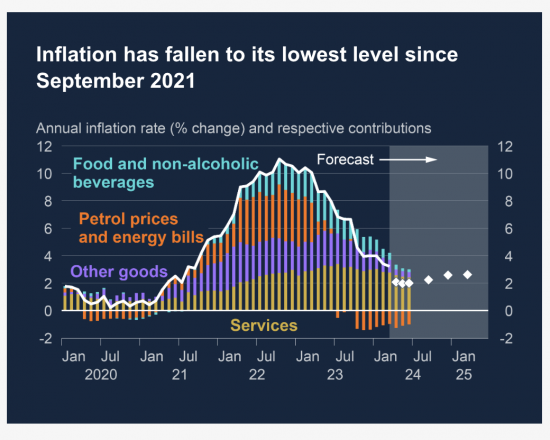

For the record, this version of that chart was published by them in May:

It shows the same pattern. The Bank knew inflation would be increasing now, six months ago.

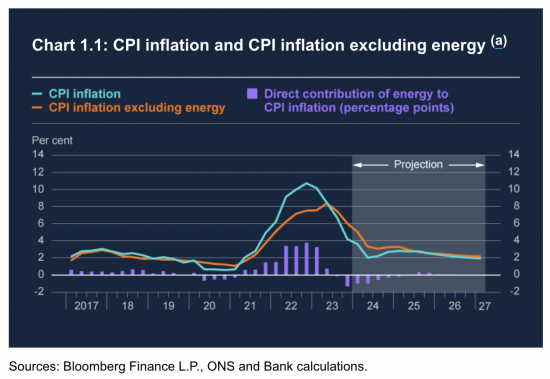

In fact, they knew this in February, because this is the chart from then:

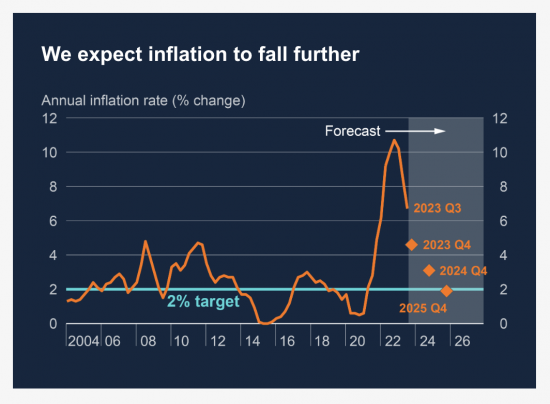

So, let's go back a year:

They thought then that the rate would be higher now than it is.

So, there are three conclusions.

First, today's inflation increase is not news.

Second, inflation is well under control, and lower than expected.

Third, there is no reason for rates to remain high as a result.

But will Andrew Bailey listen? I doubt it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Meanwhile, on the continent with a very similar inflation rate, their base rate is at a more realistic 3.15%. No reason for the BoE to keep UK rates so high !

If Rachel Reeves were a real economist (and not just a bank admin manager), she’d have known in Feb. that inflation was to rise too. The 50% bus fares rise and NI increases should then have then been shelved by her, no?

Knowing that the economy was heading towards recession, Rachel Reeves should have had an expansionary budget.

This would have been in contradiction to the Bank of England’s contractionary stance. Which shows why the BoE should not be independent. Apart from the democratic deficit (we can’t vote the Governor out if we don’t like his policies), it makes no sense to separate monetary and fiscal control of the economy.

Wont cheap money just fuel pointless consumption, inflate house prices and create asset bubbles?

Why?

Depends what you call pointless consumption. Also consider: for the average family with a mortgage lower interest rates will lead to lower payments which will enable them to feed the kids a better diet and not struggle quite so much to pay the bills. For businesses lower debt payments would enable them to either invest/expand/pay their staff more. These are but a couple.

But who wants healthy children? (Irony alert)

“Wont cheap money just fuel pointless consumption”

Pointless consumption is when a millionaire buys another house.

Most of us are looking forward to the day we don’t have to check our bank balance before turning the heating up, or consider buying our first house.

Well said

How much is enough in terms ofhigher interest rates and the duration of? Only the BoE seems know.

More debt servicing = less disposable income = less activity in the economy.

If you are a lender these are good times, and that is all that matters it seems.

But what might the public sector debt figures tell us?

Corporate profiteering is driving inflation, unions warn

The Bank of England must act decisively and cut rates to get the UK economy back on track,’ IPPR says

When Professor Murphy’s right, he’s very very right: “The TUC stressed that Labour’s plan to invest in the “broken economy is important – but they can’t do it on their own.”

“Economists backed the call saying the “real concern” is Britain’s lower-than-expected growth.

“TUC general secretary Paul Nowak warned families and businesses remain under pressure from the steep increase in the cost of living.

“The latest GDP and employment figures show the economy is still fragile, and the priority must be turning this around,” he said.

“So, it’s vital the Bank of England keeps moving and makes another interest rate cut tomorrow.” ”

https://morningstaronline.co.uk/article/corporate-profiteering-is-driving-inflation-unions-warn

That cut did not happen, of course.

There is an upside to interest rates remaining at 4.75%, that’s because our – the UK total debts, owing, will fall. It fell from £3.9 trillion to £2.4 trillion in the Whole of Government Accounts 2022/23 as written about on this blog.

Of course many will not be entirely happy with rates remaining at 4.75%, but by doing so does give The manager of our economy (Rachel Reeves) even less reason to say there is no money.

That said there are still to many people having to check their bank balances before turning the heating up. I wonder when, if ever, the manger of the economy, might release money into the economy knowing there is less debt to pay. Don’t turn that heating up just yet.

[…] the claimed concern is about the supposed re-emergence of inflation – which, as I have shown, the Bank knew might happen at least nine months ago – and which has become, as a result, an excuse to try to hold pay […]