The Office for National Statistics has reported this morning that:

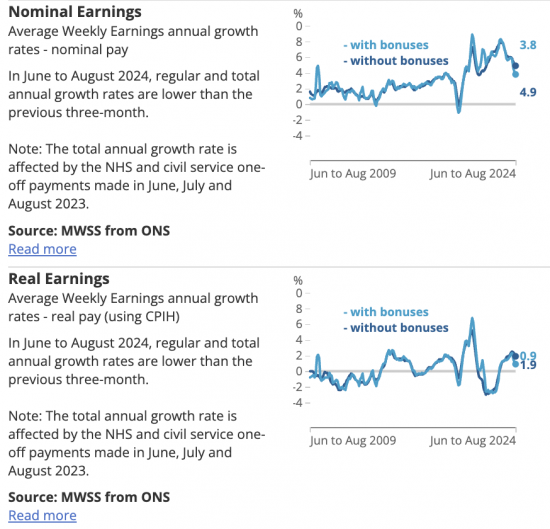

Annual growth in employees' average regular earnings (excluding bonuses) in Great Britain was 4.9% in June to August 2024, and annual growth in total earnings (including bonuses) was 3.8%. This total annual growth is affected by the NHS and civil service one-off payments made in June, July and August 2023.

Annual growth in real terms (adjusted for inflation using the Consumer Prices Index including owner occupiers' housing costs (CPIH)) for regular pay was 1.9% in June to August 2024, and for total pay was 0.9%.

Both of these represent declines, and that is after the one-off impact of the NHS settlement. These charts aren't great, but the downturns are obvious:

In other words, as I long predicted, the wage correction that necessarily lagged inflation and which has been happening to restore the purchasing power of working people is now running out of steam.

It was obvious that this was what was happening many months ago - obvious, that is, to everyone but the Bank of England, which kept declaring itself worried about the rise in wages - as if restoring the value of the wages for working people was something they would really rather not have happened. As a result, they wholly unnecessarily kept interest rates high, based solely on these short-term adjustments to wage rates going on. But now they're not.

So what excuse will they have for keeping interest rates high now?

And there is in all this morning's data a note for Rachel Reeves: the employment market is not looking at all robust. The number of people at work fell between July and August and the overall rise in the last year was small. Big ticket investment that create few jobs are going to do nothing about that. It's small, local businesses that create jobs, and they don't seem to be on Labour's agenda. A cut in borrowing costs is what they need.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The corporatist mindset of Labour – in tune with its corporatist funding – is what is behind this.

Couldn’t agree more about the interest rate issue.

Slightly off post but linking to recent threads. I worry that Reeves and Starmer are seeking big ticket investment as short cut to growth, yet miss the big picture of national building wealth. It seems part of pattern which includes the one sided view view of the National Debt you unpacked yesterday and the failure to understand that people are an asset. I’d argue our greatest asset.

Small, local and independent businesses bring other values that build wealth. Independent retailers have a cultural value.They are the warp and went of the good high street. Innovation in many sectors is led be SME’s and small busineses. In many smaller places local employers are essential to community cohesion.

Historically, the petit bourgeoisie were identified as enemies of the proletariat, but that view was always wrong, with small shopkeepers, tradespeople, and the solo self employed, having almost as little power in terms of the capitalist class, as serfs. They have an even harder time these days.

Making a decent living, preferably doing something a person enjoys, does not make a monopoly capitalist, or require ruthless greed, or aspirational Toryism.

Small businesses were the lifeblood of the UK economy. We are no longer a nation of Asian shopkeepers, more’s the pity.

Much to agree with

Well, small local businesses are definitely on your agenda.

Many of my clients see their business as their pension – and you want Capital Gains Tax over quadrupled for them. Entrepreneur’s relief scrapped and a lifetime’s effort which crystallises in one year and so gets taxed at the highest rate.

What was it you said about such people in a post earlier? Tough luck, they should have been making pension provisions for themselves?

And those that have – after many years struggle – got themselves into a position where they CAN contribute to pensions as a ‘catch-up’ exercise after years of being unable to do so as they built their businesses up? You want to restrict their pension tax relief.

So, yes, these people are on your agenda. They just rather wish they weren’t.

And of course, none of this would affect you at the end of your career. Your gains from businesses were taxed at low rates. Your pension contributions got full tax relief. It’s those behind and below you that you want to cut down.

If you really understood small business – and you clearly do not – you would know two things

One is that the vasty majority sell for very small sums, if at all

The other is that no-one goes into them with the hope of a big capital gain

So, you are talking utter nonsense, including about any gains I made, but the way

Quite right Richard I for one did not start a small business with the hope of selling big in the future.

As ridiculous as it may seem to some I started in the hospitality/bar trade because I really disliked what was on offer at my nearest Pubs and bars within a 10 mile drive of where I lived.

The same generic god awful beers and Lagers pre frozen microwave food sullen staff cold dark premesis, just a joyless sad group of places to go.

Some 20 years later I am still in the trade even the 15 hour days in the summer seem to fly by and I absolutly love it still.

We only employ 8 staff full and part time and it is really difficult to make a profit especially during the winter months where we incur week on week losses.

Right now I have one member of staff on maternity leave and one long term sick so things are very tight but i still wouldn’t swap it for anything else.

What I am trying to say is that People start a business with a passion to do something not for a long term profit or to get rich if that did happen all well and good but it’s not the driving force behind us.

The only small businesses that survive are run by those with a passion for doing something well

Those who do not udnerstand that do not understand small business and the demands it makes

Good luck

I sometimes wonder whether to do another YouTube channel on small business….

But not yet

Anecdotally.

I just filled up my tank – about two months of relatively little driving as been having to use trains for faster necessary long distance journeys.

Paid £1.29 per litre compared to £1.40.

It is now heading back to the levels of before Covid. £1.15 per litre.

During Covid it had dropped to about £1.05 for some months.

What does that mean? To me it looks like the price rises that gave rise to inflation that allowed higher interest rates were manipulated by monopoly/cartel.

Mortgage lenders are getting borrowers into the higher fixed rates.

Private rents have increased.

Basic necessities increased due to fuel charges and the equally multifold overnight increases in gas and electric based on nonsensical sanctions against the much cheaper supplies we used to receive by pipelines being replaced by extremely inefficient and much less reliable LNG shipped gas.

It seems to me it was all aimed at people’s disposable income getting further hammered after 15 years of austerity.

Keep people poor and let the Masters recreate the servile, subdued masses ready to believe all lies. The road to overt fascism. As I also said on the Starmer thread.

John Burn-Murdoch episodes a post well over a year ago that characterized the UK as an island of wealth in sea poverty, something to that effect. This is true of the US.

I think Starmer is on the door of some very wealthy people and nobody in the UK can look at him for doing the right thing by them not less your bank account contains seven figures or more.

And it looks pretty clear that the next cost for small business will be a rise in National Insurance, the tax on jobs. Small businesses thinking of hiring another employee will have probably another £6000 to cough up in addition to wages for a new employee. Not a great incentive to hire.