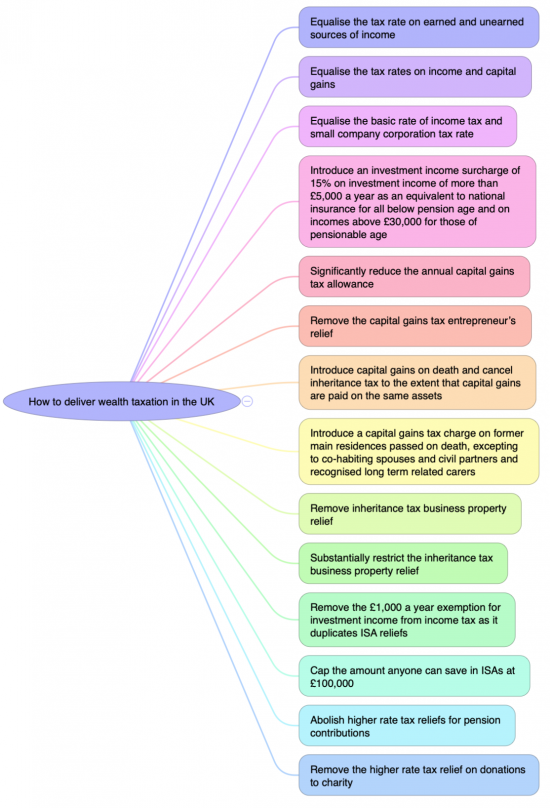

I have just shared a release from Tax Justice UK showing most in the UK want greater and more eq1uitable taxation of wealth in this country. In reation I have prepared this mind map of how to create greater equality in the taxation of wealth in this country without major tax reform or introducing a wealth tax:

I summarise this as follows:

How to deliver wealth taxation in the UK

- Equalise the tax rate on earned and unearned sources of income

- Equalise the tax rates on income and capital gains

- Equalise the basic rate of income tax and small company corporation tax rate

- Introduce an investment income surcharge of 15% on investment income of more than £5,000 a year as an equivalent to national insurance for all below pension age and on incomes above £30,000 for those of pensionable age

- Significantly reduce the annual capital gains tax allowance

- Remove the capital gains tax entrepreneur's relief

- Introduce capital gains on death and cancel inheritance tax to the extent that capital gains are paid on the same assets

- Introduce a capital gains tax charge on former main residences passed on death, excepting to co-habiting spouses and civil partners and recognised long term related carers

- Remove inheritance tax business property relief

- Substantially restrict the inheritance tax business property relief

- Remove the £1,000 a year exemption for investment income from income tax as it duplicates ISA reliefs

- Cap the amount anyone can save in ISAs at £100,000

- Abolish higher rate tax reliefs for pension contributions

- Remove the higher rate tax relief on donations to charity

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Why not tax breathing? If you tax everything there is no point working or saving so let’s all go on the dole. Oh there is nobody working to pay the dole money! Is your tax plan flawed you bet it is!

If that’s the best you can do the case is won

Ian says:

“Why not tax breathing? ”

Why tax yourself breathing….? If it wasn’t a reflex action you’d maybe struggle(?)

Good to see you are not neglecting the ‘day job’ amongst all this silliness of Brexit.

Life goes on and Brexit is a distraction on a monumental scale. The biggest fraud perpetrated on the British people since ….the groundnut scam…(?)

🙂

More of a list than a mind map. Anyway…

What is the “small company corporation tax rate”? We haven’t had a lower CT rate for small companies since 2014, when it was 20%, the same as the basic rate of income tax. But I can certainly agree we should nudge the main rate of corporation tax up from 19% to 20%. That should nudge CT receipts up from around £60 billion to say £63 billion.

You have included two proposals for inheritance tax business property relief: do you want to abolish it entirely, or just substantially restrict it? I wonder what the effect might be for family owned businesses, for example. Either way, it may not matter too much if you are already charging capital gains tax on death.

I would expect the abolition of higher rate tax relief on pension contributions and charitable donations to have a substantial negative impact on the amount that people save for their retirement, and the amount donated to charity. Is that the intention? On the positive side, the government will have more resources to support people in old age and to replace the services that charities currently provide.

We can have a small companies rate of CT again

I would suggest a main rate of 25% or more

And re IHT business property relief, there are options. The best is restrict heavily for now whilst IHT is being replaced, as it must be in due course

I’ve got to be honest – why do we want people to give to charities?

If there is one thing about the paradox of thrift that gets me its how donations to charities work. Why not pay the tax and help towards expenditure for state derived programs for goodness sake?

I’ve seen elderly relatives giving money to charities that actually are quite badly ran. They are not really that accountable, and they seem to me to behave more and more like – well – businesses. Have you ever tried to file a complaint with one? I’ve seen plenty of their workers on expensive MBA courses over the years too.

I’m not impressed. I’ve worked with them at ground level in the town where I work and we’ve got some real horror stories to tell. If there is any weak link – it’s with them.

Maybe others have different views and experiences. I can only relate mine. When I see charities getting money like that it makes my heart sink. Charities are a sign that something is wrong with public policy.

Sorry!

I have my concerns too….although they are in a different sector