I have already noted that the cryptocurrency market is crashing this weekend.

The risk of contagion into other financial markets is high because:

- The risk of Trump imposing unsustainable tariff rates of the sort he announced on China on Friday, triggering major market disruptions, is high.

- Far too many large companies now hold crypto assets.

- So too do some pension funds, utterly recklessly.

- By their very nature, crypto investors are volatile and prone to panic, and that sentiment is contagious. The flight for safety can very rapidly create broader financial instability.

These are the basis for my fears.

How far could markets crash? By a very great deal, I suggest.

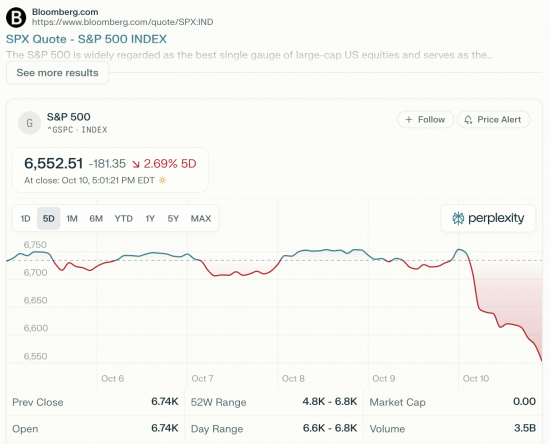

The S&P 500 already reacted on Friday afternoon:

That was a 2.7% loss on the day.

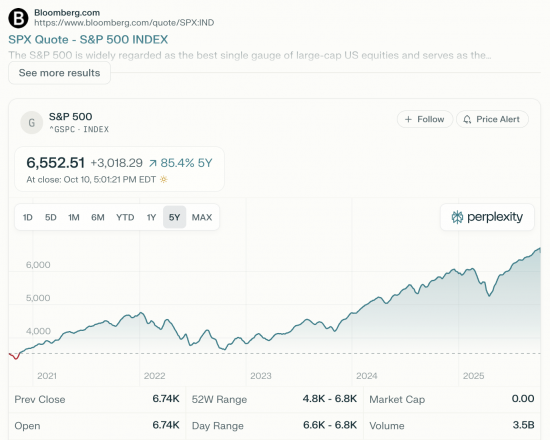

But the capacity to fall a lot further is enormous. Nothing has justified the increase in value since mid-2023, and all of that is AI-based hogwash that is now more than ready to fall apart:

That market would easily fall by 40 per cent in that case.

This has been waiting to happen. It might not all do so this week, but such a fall is now possible. And so far, the UK media is almost entirely ignoring this.

I am not. And although I stress this might all blow over, the fundamentals very strongly suggest otherwise, with even the Bank of England suggesting that was the case last week.

I am worried, not because we do not need a correction, but because of the ramifications.

And the question is, have we got a government courageous enough to deal with this?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The last big crash was 2008. The government has been avoiding creating money since then (with a short break for the pandemic). The government needs to create about £100billion a year (to offset inflation and support growth). It has 17 years of backlog (less some money created during the pandemic). The shortfall is, therefore, considerably more than £1 trillion.

Perhaps this is how the Minsky cycle works. When the crash happens the government is forced to create the money that should have been created before.

It could be a big crash.

“And the question is, have we got a government with the understanding and mental capacity (courageous enough) to deal with this?”

A cursory glance at the current cabinet shows a line up that would grace any circus clown troop. Courage? They have no capacity whatsoever to understand what is going on and what is needed – again a cursory glance at the weekly pronouncements of Reeves is enough to show this. She is utterly clueless and always has been (that is why she is there). The situation offers an opening for parties that have not been groomed by the usual finance suspects to make policy announcements and build a narrative – which could/should fit in with the need for a narrative to counter the garbage that comes from the Deform/Tory party.

Who knows how big the next crash will be?

Start at the current post 2008 bloated CBRA and work your way up from there. The BoE Neo-lib hacks probably set that amount naively with their fingers crossed behind their backs.

Last time it all blew up, the finance sector told us that it was so hard to manage complex transactions and the volume of ‘trades’ but were left to get on with it by your democratically elected governments. Add in the still under controlled derivatives market – code for ‘side betting’ on other people’s assets and insuring other peoples stuff so you get a payout which actually amplifies losses and as I said, who knows?

And now crypto – a shadow banking system added and allowed. It is a lack of courage that got us to this. I can’t see any being generated now.

I’ve been following Ed Zitron’s blog https://www.wheresyoured.at/ ; he’s a big sceptic of AI, not least because he has been looking at the revenues for companies like Open AI and they just don’t justify the investments that have been made; of course, the companies are saying that they are just at the point of take-off and profits will start coming through real soon now. His view, one he has not changed over the two years he has been blogging, is that AI is a classic hype-driven bubble that is close to bursting.

So, if we are looking at the trigger for a crash I would look at the AI-bubble. The 7 biggest tech companies, including Nvidia which makes the specialised GPUs for AI, between them represent around 28% of the S&P500, so any loss of confidence means some really big investors losing shed-loads of money; money that they might otherwise invest in the real economy. Remember, one of the things that aggravated the 2008 crash was banks losing confidence in the value of other banks’ assets and so refusing to lend to them. A crash caused by AI could result in banks calling in loans from the individuals and companies in the real economy to cover their losses.

I have made that point here regularly.

Purely by chance I ran across the following by Warren Buffett who agrees with you, Richard. It was made in May 2025. The first 5 minutes or so are similar in tone, except that from 8:35 onwards he appears to conflate government debt with business debt, which is not our understanding. He talks about the captian of a ship but it’s a pity he doesn’t go as far as to name a certain President. And I don’t mean Biden.

https://www.youtube.com/watch?v=l8doQFhOiSA

Thanks

That video looks fake to me. Just compare with any recent video of Buffett speaking. The repetitive gestures which don’t relate to the words are an obvious giveaway.

I had that feeling

The voice is a bit AI

I asked ChatGPT and in summary it said: “Based on the weight of evidence and context (pattern of scams, Buffett’s posture, prior deepfakes), I believe the video is very likely manipulated (AI / deepfake / synthetic in part or whole).”

There is a disclaimer to the video Viz:

This is a fan-made channel, and its content is not affiliated with Warren Buffett, or any of his associated businesses. The videos are inspired by Warren Buffett’s public statements, interviews, and writings, and are created for informational, educational, and motivational purposes only. A synthesized voice is sometimes used, which does not belong to Warren Buffett. We use lip-syncing and dubbed narration to match the spoken words with on-screen footage purely to improve clarity, enhance the cinematic experience, and make the content more engaging for viewers.

Our aim is to amplify Warren Buffett’s timeless lessons and make them easier to understand and apply for the viewers, while helping to spread his wisdom to a broader audience. We also strive to make Warren Buffett’s messages more accessible to people who are deaf or hard of hearing by applying professional transcription to the majority of our videos. We share his perspectives in a respectful and inspiring manner, without any intent to mislead.

But it has mislead.

It mislead me. And ChatGPT was partly fooled by it. Well spotted, Patrick.

After black tulip mania we have black hole mania plus ca change etc.!

[…] far, markets seem to have shrugged off the crypto collapse over the […]