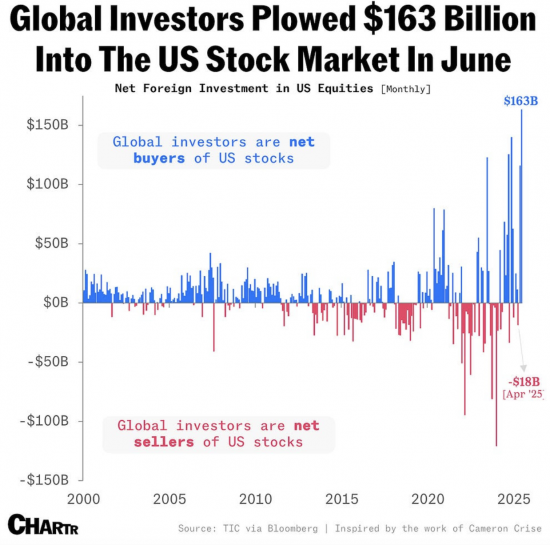

I keep saying the US stock market, and quite possibly its economy, will crash, and this chart explains why.

This was published by Adam Tooze in his newsletter yesterday:

If you want an indication of stock market volatility, that is it.

Wow, is all I can say. This is beyond hype and bubble territory: this is economic insanity driven by loose money pursuing profit unrelated to any real-world activity.

Does that create the potential for the bubble to burst? You bet it does.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The only conclusion I can come to is that money is in the wrong hands. We speak a lot about whether money is a real or not. This just looks increasingly like a parallel universe to me where money is just…………….trying to replicate itself, without adding anything real the world at all?

When you consider what needs to be done – from potholes in your local street to famine in the Sudan, it’s just a mis-appropriation of a valuable resource in broad daylight.

It’s unacceptable to be honest.

Correct.

This is money without purpose bar pleonexia.

This is all ephemeral, notional, “wealth” and can never be realised. Remember the greater fool theory.

Indeed

I watched the first part of a BBC documentary about a fine art fraudster last night.

The people he was fooling were such easy marks, it was easier than taking candy from any baby I’ve ever come across – some of them didn’t want to make a fuss because it might affect the value of their other “assets”. Babies would scream in such circumstances.

And it’s the same sort of people – in some cases the very same individuals – who are investing in US stockmarkets atm.

And will no doubt expect us to bail them out when it all goes wrong.

On Netflix back in the day was a documentary about a south-Asian ‘wine trader’ who bought the cheapest wine available from super markets, rebottled or relabelled it and sold it on as vintage wine to people who seem to think that buying old wine and having cellars is an investment or something to spend lots of money on.

Anyhow, when the subterfuge was discovered, there were a lot red faces – and not because of inebriation either!

All I could think was – what do we make wine for? I thought it was made to drink the jocker?

Another example of how markets distort life. Yet our concern (apparently) is the distortion of markets by intervention!!! Absurd.

Is it ethical to invest in the US right now?

I came to the conclusion that it wasn’t a few months back, so I pulled my pension saving out of my target retirement date fund which was globally invested (huge percentage in the US) and switched into less authoritarian countries. It took a fair bit of soul searching but felt there is no point having some sort of moral compass if you never act on it. (Other moral compasses are available, and I’m not saying I was right but it was right for me).

However I would like your’s (and your readers) view on this question.

I have no chosen exposure to markets at all: I think they are going to crash. But I would most especially avoid the US, not last for the reasons you note.

This is not investment advice.

The investors all seem to have forgotten who the President in USA is and, as incredible as I find it, cannot have understood what he is actually doing.

If there is such a crash, I would expect nothing good to come of it. I don’t think it’s any coincidence that as we are seeing cracks — questions about the sustainability of AI investments; Intel; Meta putting data centers in tents and outsourcing to Google — we are also seeing inflammatory rhetoric about sending armed men and vigilante squads into major urban centers in America. A cornered fascist is very dangerous. I think people really, really underestimate how bad that could be, the lengths these men would go to just to win. There is no established institution or system they would not be willing to tear down. War is only the most conventional route.

The chart really underlines how detached financial markets have become from the real economy. When money chases returns that don’t correspond to any tangible value or productive activity, it not only distorts markets but also starves essential areas—like infrastructure or public services—of needed investment. That imbalance feels unsustainable and makes a correction seem almost inevitable.