Yesterday's poll on the video that I produced on Gary Stevenson‘s comments in a video earlier this week was interesting.

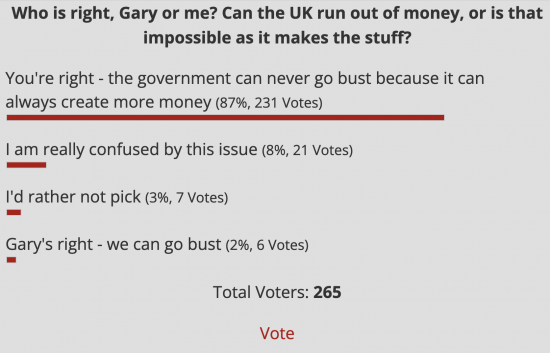

This is the poll result on this blog:

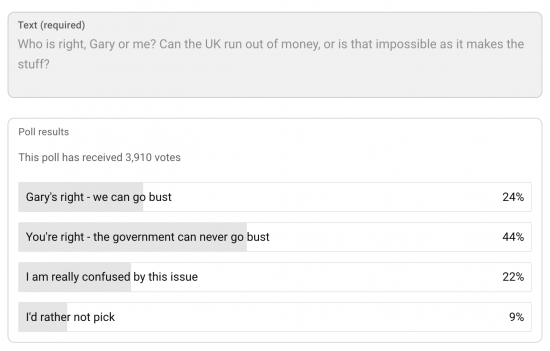

On YouTube, with, as usual, a somewhat larger number of people voting, this was the outcome:

I took a deliberate risk when posting this poll because I quite knowingly set up a situation where I might have lost the vote. Admittedly, in a poll on my own site, that was less likely, but I considered the possibility because I suspected that this video would attract quite a lot of traffic, and it has. A present, it has had more than 69,000 views. In that case, the poll outcome is interesting, but also suggests three things.

The first is that this issue is not definitively decided, most especially with the YouTube audience. I have more work to do.

The second is that there is clearly more understanding that needs to be created as a consequence.

The third is based on the fact that some people did not wish to pick, which suggests that there is commonality between some of those watching those channels, and they would rather cooperate than see differences.

The outcome is that I would still like to have discussions with Gary if possible, whilst acknowledging that we have differences in understanding, which is a perfectly acceptable basis for starting a conversation.

One final point. Steve Keen and I had a discussion yesterday, and I hope to make some podcasts for this channel in a few weeks' time. His travel commitments have to be taken into consideration first.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The You Tube poll & those that agreed with Mr Stevenson “we can go bust”. I wonder if the people supporting this view could explain it. I’m guessing that they could not or at least not coherently. It also points to a lack of curiosity – there is no shortage of literature on the subject. I’m guessing that Mr Stevenson will dodge a debate, perhaps on the basis that he knows he is on wobbly ground. We shall see.

Bonus marks if the reply does not mention Weimar Germany, Zimbabwe or Venezuela. Or if it does, if it can explain why the UK is like a postwar country burdened with reparations, or one with a kleptocratic authoritarian government, or an economy dominated by oil burdened by economic sanctions.

🙂

Hello Mike

I suspect that the vast majority of people in this country (me included), know little or nothing about economics. It’s not taught in schools, only at A level. Nor is economics ‘explained’ properly in the main stream media. Therefore unless you go digging about, it’s a difficult concept to grasp for most people.

It was only when Osborne brought in his austerity that I started to read blogs by people like Simon Wren-Lewis, Flip Chart Rick, Richard and Gary Stevenson.

Economics really ought to be on the national curriculum.

Thanks.

I agree with your conclusion – but they would teach neoliberal crap.

You can’t really blame people if they’re new to Richard’s channel – the true facts he gives us go against everything they see and hear from the MSM. Good old Aunty Beeb had a Panorama about a month ago about whether Britain might go bust (the answer, of course, was yes).

Mrs Gardener: “the true facts he gives us go against everything they see and hear from the MSM” I agree with your point – ref the MSM. But.

The explanation of where does money come from is not hard. Neither is the role of tax. The only point that people need to start from is: many governments that control their currency do so cos, they decide how much or how little is printed. If they did not print money -there would be NO MONEY (apologies for shouting). Working on the basis that most people can read, they just need to look at a bank note – it is a government IOU – it says so on it.

Sadly most people are unable to step out of their day-to-day experience and perceive another reality namely the government is not like a household it can’t run out of money because it creates the stuff. Neither do they bother checking history where they’d discover the UK government has never over-created the stuff to trigger hyper-inflation. In the UK ignorance very definitely isn’t bliss! People most definitely need to be told over and over again they’ll never understand how to optimise the country’s economy by looking at from a household perspective,

Good. Your last sentence was all I was looking for. And, more whimsically, even if you do not agree on the core issue above, it may be possible to find a way to find some common ground on attacking the issue of poverty, and attacking both Labour and Conservative endemic Government indifference. Such an alliance might cut through; again, what I was looking for. Make your opponents uneasy, not potential new networks.

(72 words)

Thanks.

Appreciated.

You are on the exception list if you want to be.

Agreed. This is an issue that will be won over by education and awareness, and indicating the right questions to ask, and growing a constituency over time. I don’t think many people will switch arguments by being told they’re wrong – and it seems to me that Gary is quite combative, but willing if not made a fool of to consider evolving his line if he sees the sense in it. I’d say that vested interests and the media will turn issue will turn into a public fight soon enough, and this will heavily advantage the entrenched point of view and the household analogue. So I’d come down strongly on the side of collaboration, and encouraging people to think things through – “if X happens, what happens down the line and why?” This gets things out there and conversations happen.

Richard and Gary each have strong but different experiences and perspectives in economics and finance, and the opportunity to join the two in public conversation doesn’t come along too often. I personally think that over time, Richard’s argument will win on its merits, if people are given the opportunity, context, and the confidence to ask the right questions.

Media wise, it could be a real killer combo in exactly the right place at the right time 🙂

It seems to me though that – and it isnt my idea BTW that those who dont support MMT never seem to address the question of where money comes from. Clearly if our only currency was gold coin then there are real limits to0 the money supply but this limit was removed when the Bank of England was founded – in the UK at least.

I really hope that Gary and yourself do get together and have a conversation. It could be shown on both your YouTube channels or maybe do two on a ‘home and away’ basis 🙂 (forgive the sporting analogy).

Whilst there are differences, I think it would be a very, very useful discussion and could do much to educate.

As I said previously, I do think your combined efforts would be greater than the sum of the individual parts.

Craig

I like the home and away.

Quite surprised by the YT vote. I would have expected most people to agree with GS. Encouraging that they do not.

Also encouraging is that more people are confused rather than adopting the neoliberal line, it means that more people are actually considering the question

Me too

I was also surprised and happy that ran counter to my own prejudices

This post is probably more relevant to yesterday’s video, however the YouTube poll result kind of demonstrates what can happen when the messaging is misleading.

Quite simply Gary will struggle to pull his observations and thoughts together into practical solutions that make sense until he reassesses his attachment to neoliberal ideology, especially considering that his main solution currently seems to be increasing taxes on the super rich… I think we all know that the process of rebalancing wealth inequality is far more complicated than just that alone!

He is generally keen to suggest that his thoughts are not governed by ideology, however, being immersed in the neoliberal world throughout his time in education and employment would unwittingly make it more difficult to see alternatives… so I guess this progression (or is it regression!) in his thinking is not entirely unexpected.

I’m sure he would benefit from time spent with you Richard, so it is good to see that your comments yesterday leave the door open (providing he accepts them in a positive way).

Gary seems genuine in his attempts to make a difference; he is clearly building a following which makes it even more crucial that he gets the messaging correct; the risk of getting it wrong will be as misleading and damaging as some of the nonsense that we hear from other so called “experts”.

I might suggest that he is at a crossroads in his journey as a campaigner and it’s whether or not he can release himself from the grip of the neoliberal narrative that will determine if he can be part of a catalyst for change or just be another commentator without solutions.

I’ll watch with hope and guarded optimism.

Interesting.

My only concern is Gary – is he egotistical and will he have a problem with backing down? I don’t go anywhere near him to be honest because I’d rather read about MMT. This is the only blog I read/contribute to because as well as being busy (1) It is imbued with a high morality and (2) it is well researched and backed up and (3) it is curious (and yes it gets angry too and I like that). I prevent it just being an echo chamber for my cognition of the world by reading more widely around it.

One thought comes to mind though? My attitude is much like Springsteen’s song ‘No Surrender’ – in that I see a lot of heroism in this seeking the truth about what ails us and I do worry what – if any – the compromises will be? We must be mindful that we are dealing with what Satyajit Das called rightly ‘extreme money’. For ‘they’ have everything but always want more. They are rotting with pleonexia.

Secondly – have we thought about what success in this issue looks like? Will the revolution be televised? What will the epiphany look like? If the epiphany happens then who is first in line? And how do we deal with the political class who are holding the line, in denial of the power, paid to shut up?

https://www.youtube.com/watch?v=tLeZ7EolBDE

https://www.youtube.com/watch?v=QnJFhuOWgXg

I don’t think Gary is wedded to the idea of Neoliberalism at all. He has said many times that current economic models are broken. He has stated that his only goal is for people to understand that large equalities are self perpetuating and that taxing the asset rich is the only way to adfress that. His use of the terminology of neoliberalism seems to be out of utility because the majority of people are familiar with politicians talking in those terms.

I would like to hear h8m say that.

There were a lot of wrong claims in this week’s video; for example about tax rates paid by the wealthy, and the impression given that the taxation of wealth and the income of highly paid people are unrelated. That is simply not true.

Yes.

possibly those who believe that the Government can go ‘bust’ base their decision/understanding on the publicity around various local councils going ‘bust’ (S114 notices = Birmingham, Slough and others) , without considering anything beyond that?

But councils do not have central banks and are currency users.

Sorry – I think that I did not express myself well – what I meant by ‘without considering anything beyond that’ was that as so many politicians speak about balancing the books, some of those who pay taxes, whether to HMRC or to their local council, conceive it as just that – there must be sufficient tax income (national or local) to balance the books – some are not aware that the British government will not go bust because of the use of central banks and because of being currency users, and so, when they hear of local government/councils ‘going bust’ they do not consider that national government can be any different to local council(s). You have educated many on this blog (and elsewhere) regarding this, but possibly not all who responded to your poll have assimilated this. Take it as an ‘up-tick’ that a greater proportion of readers of your blog (as versus YouTube) agreed that the government can never go bust.

Noted. Thanks.

Wealth Inequality. That’s the common ground on which you and Gary stand as campaigners. You are both seek change….and so do the majority.

But you have different messages for different audiences. Gary deliberate over simplifies and endlessly repeats his core message – the system is stacked against you and in favour for the already wealthy, without change inequality will get worse. Gary’s Economics has built a mass audience and a strong, if singular narrative which focuses on the ‘what’ has gone wrong and the ‘why’. It’s fostering an environment against which pressure for change can grow. That’s first base.

Your focus on the ‘how’ of change. That’s second base.

Both necessary. Both valued. The comments and engagement on the video suggest people are with both you and Gary and against wealthy inequality. Their is a desire for greater understanding.

You might want to debate James Meadway, who posted this on X yesterday.

“In case anyone out there needs a reminder: MMT is intellectual toxic sludge and no one who is concerned about inequality should touch it with a barge pole. There are no quick fixes, no easy solutions. Anyone telling you otherwise is a charlatan and/or a grifter.

“There are no quick fixes. There are no easy solutions. Capitalism is a bad system and dealing with it starts by recognising that fact.”

To be fair he’s coming at it from the basis that trying to reform capitalism is a fool’s errand.

I’m also puzzled by his ideas about money creation as being in the hands of commercial banks.

“Meanwhile: I think you’ve got a collectively peculiar conception of the economy in which you focus on the thing that doesn’t matter – the accounting fact that balance sheets have to balance – and ignore the actual processes of production and exchange as mediated by money…

“…money which is created, overwhelmingly, as a property of the private banking system and which you therefore need to have an account of the independent operations of, rather than handwaving it all as ultimately netted off in the national balance sheets.”

Meadway is, very politely, a first order economic ignoramous. He is a small-minded Marxist who thinks MMT is hopeless because, as he ojnce told me, there is no theory of class implicit in it. He exeplifies every reason why socialism is a dead political philosophy offering no hope to anyone. Small-mindedness on the scale that he embraces is very hadrd to comprehend. Like Ann Pettifor, he has also never bothered to find otu what MMT actually says, or understand the double entry that proves it ahs to be right.

To contextualise him, he was the person who wrote the ‘maxed out credit card’ materials for John McDonnell.

He really is clueless as to money.

Fair enough.

He’s been going on about money creation as mostly done by commercial banks and indeed this is what the Bank of England has said. I’m getting confused – have you done an article about this.

More than 30% of UK money supply is govermment created now – and represented by the central bank reserve accounts (see the glossary).

The proprtion created by commercial banks has fallen dramatically since 2008.

But let’s also be clear – most bank created money is only accepted because deposits of it are guaranteed buy the governmmnt, meaning most money is in reality government created or backed. His claim is just wrong but it suits his naive Marxist analysis, if you can credit it with such status.

Perhaps this is too simplistic a view – I’m happy to be corrected – but didn’t the 2008 crash prove we can’t run out of money?

QE saved the day. I accept that was a national emergency and not something that could be done as a matter or routine, but the issue is balancing the economy while meeting the needs of the people (which means vastly more public spending than now) not invoking austerity in case the piggy bank empties or the last slice of the cake is eaten.

You are right.

2008 and 2020 both proved that.

Please keep trying to have a conversation with Gary, I don’t know why his team aren’t prioritising an interview with you. I’m pretty sure he doesn’t believe that government spending has to be funded by tax, I think he is just trying to simplify the issue to get popular support behind taxing wealth.

I follow you and Gary, and I’m trying to learn about aspects of money that deviate from my well honed domestic budgeting skills.

It seems to boil down to asking the correct questions using the exact specific wording. Vague questions get vague answers.

https://chatgpt.com/share/68978b43-f228-8006-a8ba-c9eb50ed9180

Delighted by your postscript. Look forward to hearing how plans for a podcast develop. The.services of a producer could help.

Why? I have recent experince of that, and it was painful to unwind their cuts.

Producer of event, not content (who in my understanding is an editor). Perhaps your Thomas might be the person.

If two principals have busy schedules scheduling the conversation is a pain. If both principals have ideas for comment in the upcoming edition someone needs to compile a list for principals to negotiate and agree issues of priority, amount of time etc. before the discussion. Then podcast goes out as the coversation goes. Sorry for any confusion about what I meant by producer…

OK

I get that

This is a role that may well be required

I totally support your explanation of money creation and accept that the country cannot run out of money, i.e. go bankrupt.

But where Gary certainly gets it right is that, wherever the money comes from, if it just keeps ending up in the pockets of the very rich, they will keep buying assets, pricing others out of the market. They can also use the funds to buy public assets in the great privatisation scandal. A bee in my bonnet is that as the money flows overseas as a result of our annual trade deficits, it comes flowing back to buy up our industrial and commercial assets, selling the family silver (inward investment!!). So we may not go bankrupt but we lose control of chunks of our economy. The book Vassal State, How America Runs Britain is salutary and strongly recommended reading.

His video today though is riddled with errors. It is slightly scary. The sentiments are sound, but he cannot win the debate with misinformation.

The question I have about the governments ability to go bankrupt is can it not be bought about by political decision rather than practical constraints?

I mean if Starmer, Reeves, and the treasury decide that they do not have enough money and therefore don’t spend as much money, they are in effect creating less money. If the government stops creating enough money to cover its debts by choosing to default on it’s loans, then are the practical effects not the same as if it were literally bankrupt?

I’m just thinking that it doesn’t really matter what you, I, or Gary believe about the governments ability to go bankrupt as Rachel Reeves’s actions will be determined by her beliefs. Whilst it is unhelpful that Gary perpetuates the idea that the government can go bankrupt, his prediction of Reeves actions is made more accurate by being constrained by how she thinks.

You raise an interesting point, and one I would rather not think about, because I would like to imagine that politicians are on the side of people in this country, and not on the side of those who might profit from them deliberately crashing the economy.

If the narrative is that as a consequence of neoliberal beliefs being doggedly applied to the point where the government refuses to honour its obligations then the economy could crash, the suggestion is right. Of course, if the government refused to make payment of what it owed then there would be massive consequences. But that would have to be as a consequence of choice, and not because of capacity. I will muse on that.