In this third video in our series on the wealthy, I explore why the comfortably wealthy in the UK — those with £3 million or more — stay so rich. The short answer? The UK tax system is stacked in their favour. From low capital gains rates to massive ISA and pension subsidies, we're handing the wealthy thousands each year while working people shoulder the load. I break down the numbers, show how tax reliefs pour money into the pockets of the top 20%, and reveal why your taxes are effectively funding luxury lifestyles.

This is the audio version:

This is the transcript:

This is the third in our series on the wealthy in the UK, and in it, I want to ask a question which will actually be addressed in two parts, which is, 'Why are the wealthy wealthy?'

In this video, I'm going to look at the ordinarily wealthy in the UK, those people have got maybe £3 million or more in personal wealth, but who are not exceptionally wealthy with £10 million or more of wealth.

What is it that makes these people particularly wealthy? And the answer is, it's the UK tax system that provides them with the opportunity to accumulate wealth in a way that is denied to most people.

In the next video, we'll look at why other people get to be wealthy, but this time it's tax and the accumulation of wealth that we are looking at.

The UK tax system is especially biased in favour of the wealthy in two ways.

First of all, the taxation of wealth is incredibly generous in the UK; in other words, the wealthy are undertaxed.

And secondly, the wealthy enjoy disproportionate amounts of tax relief, which means that actually their wealth is directly subsidised by the UK state.

Let's just look at that income tax issue first of all.

There is a real problem with the under-taxation of income from wealth in the UK at present. This is particularly true when we compare it with the income that most people generate, which is, of course, from their work.

There are a number of big differences that I want to draw out.

First of all, there are low rates of capital gains tax. Now, I know that Labour is at present increasing the rates of capital gains tax in the UK, but they are still much lower than the rate that is paid by people who receive equivalent income from going to work.

So it's just not fair that those who make a gain arising from the sale of an asset that they have owned are somehow taxed at a lower rate than people who have to get up and actually labour to make a living. I see no form of economic justice in that.

Let me explain why for a moment. One pound received in a person's pocket is worth the same to the person who receives it from wherever it comes. In other words, a pound that is received by a person from work and a pound that is received by a person from a capital gain or from interest or from rents or whatever else is in the hands of that recipient still one pound. It doesn't matter what the source is; their wealth has been enriched by that sum.

So, why should they pay less tax if they get it from a capital gain, rent, interest or whatever, than if they get it from work? There is no inherent moral justice in this bias, but it exists, and we're seeing it particularly in capital gains tax rates, which are far too low. Capital gains tax rates in the UK should be the same as income tax rates, and the vast majority of people agree, and that could raise many billions of pounds a year for the UK exchequer.

But let's look at other issues. The reliefs available for investment income in the UK are extraordinarily generous.

Most people get an extra £1,000 a year of tax-free income in the UK if they get up to that sum from investment income. That in itself is quite surprising.

Why should we have an additional tax relief if we get income from investments as opposed to income from work? Why should there be such a bias in the system that some income is considered to be worthwhile leaving outside the system, but work does not get any such bias? That is unfair.

But much more important is the tax relief given on ISAs. ISAs are individual savings accounts; they have now existed for 25 years, although there was a predecessor scheme as well, and some people have more than £1,000,000 now invested in such accounts, even though there is a limit at present of only £20,000 a year - only £20,000 a year - that can be saved in such structures.

All the income and gains which are earned via ISAs are tax-free, and the total cost to the UK government from this is over £9 billion a year, according to the most recent data, which means almost certainly that it is now in excess of £10 billion a year because the data is always out of date. So we are subsidising the wealthy very directly, and I will come back later in this video to explain just what the consequences of that are.

We also have low effective rates on income arising from rents in the UK because there is still generous offset of interest paid on mortgages to buy rental properties in this country, meaning that the effective tax rate on buy-to-let properties is low, and again, I know that there have been changes in this system in recent years, but this is still overall true compared to the tax situation of an owner occupier, meaning that there is a bias again towards the landlord as against the person who actually pays for their home out of their own income derived from work, and therefore the tax system is still biased in favour of the landlord.

But perhaps the biggest and most pernicious of these injustices within the tax system, which biases towards income from wealth and is prejudiced against income from work, is the way in which the national insurance system works.

National insurance is paid by everybody who earns from the age of 18 to 65, at 8% on their income, over about £12,000 a year, up to around £50,000 a year when it falls to 2% and is paid by all employers, irrespective of a person's age, at a rate of in excess of 13%. In other words, the overall rate of national insurance for most people, most of the time in the UK, is around 21% when you combine those two figures together, and employers effectively reduce the pay offer that they make to people to allow for the fact that they're going to pay that national insurance so the real cost of it is paid by the employee.

There is no equivalent charge to this on investment income at all. Investment income does not contribute towards the national insurance base of the UK. This is the most extraordinary bias against income from work. It is simply penalised in a way that investment income is not, and there is no justification for that.

Until 1985, we had something called an Investment Income Surcharge in the UK. It was charged at 15% and it was added on to income tax, on income from investment sources above a set limit, which I would suggest would now be around £5,000 a year, which is still a significant sum to earn from that source.

If you added 15% onto that income tax rate on investment income, you would, broadly speaking, try to address some of this imbalance within the national insurance system, which means that people do not pay national insurance at present on any investment income.

That has to be right. Again, it should not be true that there should be such a bias against work within the tax system, and yet there is.

Finally, I have to make this point. The wealthy, of course, do not need to live on their income. This is why they're wealthy. They can get through the month, pay all the bills and have something left over. In other words, they've got spare money and they can put their money as a consequence into companies, and companies are taxed at lower rates than the basic rate of income tax at present in the UK. That means that there is another inherent bias in the tax system against work and in favour of wealth because the wealthy can shelter their income from tax within the UK corporation tax system, and once more, that makes no sense at all.

We did once upon a time, have systems to address that imbalance, but of course, they've now all gone.

That is just the imbalances, though, within the income tax system. There are also imbalances within the wealth tax system, and we do have wealth taxes in the UK; in particular, inheritance tax, capital gains tax, and we have stamp duties and a few other minor taxes.

By and large, these suffer low rates of tax. Around 95% of all people who die in the UK do not pay inheritance tax. You would not believe that if you read the Daily Express, they think that this is the worst and most hated tax in the UK, but the vast majority of people will never go near it because the allowances that are available are generous: most people do not have personal estates of more than £500,000, as we've seen in previous videos, and couples don't have estates worth more than £1,000,000; again, as we've previously seen, and those sums are normally exempt from tax these days. But there are also massively generous allowances within inheritance tax, even though Labour has clamped down on those in part on business property and in part on farming; they are still enormously generous to people in those sectors.

That means that wealth can pass from generation to generation at low rates of tax, and that is especially true of the very wealthy because they can afford to give away their wealth well before they die, and therefore, inheritance tax may well not apply to them. Why? Because if you give away your wealth seven years before you die, there is no inheritance tax charge, and in addition, there are also some old trust arrangements that still provide major tax advantages to the wealthy, and they still exploit them to avoid these charges. The net result is that the actual effective rate of tax on wealth in the UK is something like 4%, which is completely unjust.

So, where does this get us to?

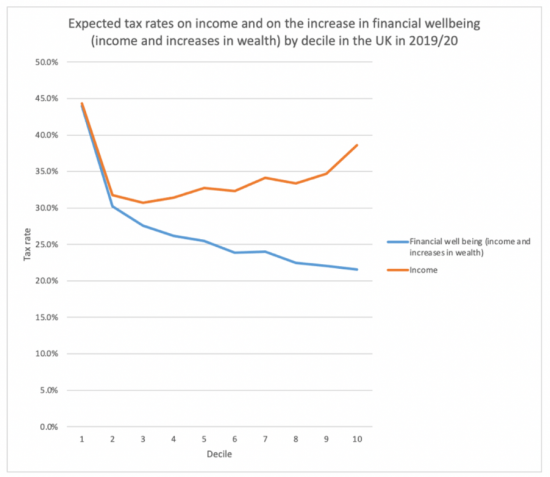

Let me put up this chart, which I prepared a little while ago when I was writing the Taxing Wealth Report.

This was prepared in 2023, and the data relates to the tax year 2019/ 2020, which was the most up-to-date information then available, and I was looking at various bits of data over the period from 2011 to 2020 because that was the period after the global financial crash in 2008 and before COVID broke out, so, I chose a very particular period to look at when things were relatively normal.

Anyway, this data is for the last of those years, 2019/20, and you can see two lines on this chart. If you can see colour, then you will see that the top line is in orange, and that is the overall rate of income tax on income sources split between the 10 decile groups in the UK, categorised by income in this case. And that's important; it is categorised by income, it is not categorised by wealth. And the categorisation is based upon the work done by the Office for National Statistics on household income surveys. But I've allocated the taxes based upon the overall rates of tax on income, so that is not just income tax and national insurance, but it also includes the allocation of taxes such as VAT, excise duties, corporation tax and so on, so this gives a feeling of the total tax burden that a household will pay.

Now, the calculations are a little complicated as a result, but trust me, this is what it looks like, and, actually, whichever way you do this calculation, this pattern of the lowest income decile in the UK having the highest overall tax rate is always reproduced.

Why do they have such a high tax rate? Because there are so many indirect taxes that hit them hard. An indirect tax is something that is not taxed on income, but is instead taxed on consumption. So, booze, VAT, council taxes, if they pay them, the BBC license fee, which is a tax, and all those other things, hit them disproportionately hard.

So they are a decided outlier. The poorest pay the highest overall rate of tax in the UK, and then you will see it drops. But in practice, the rate only increases from a bit over 30% to a little bit under 40% once we get to the very highest decile, and there is some evidence that in that top 10% grouping, the top one or 2% will actually see a significant downturn in their overall tax rate, particularly because large parts of their income is recorded in companies.

But the point is, the tax system is not that progressive. As you go up the income strata, the overall rate of tax that you pay extra on top of what you might expect is not that much, so for all the squealing of the wealthy that they pay too much income tax because they have extraordinary levels of income, there is actually little evidence to suggest that they overall contribute greatly more to the UK economy in proportion to income than do people on middle income, for example.

But then look at that bottom blue line. Now, this one is really interesting, in my opinion, because what I did to calculate the blue line was add in taxes paid on capital - I mentioned those already, that's inheritance tax, capital gains tax and stamp duties - and then added into the total income data, the apportioned part of the increase in wealth over the period in question.

So I looked at the increase in wealth according to ONS data over this period, allocated it to deciles based upon income strata, but nonetheless to take an indication of the increase in financial well-being as a whole over the year in question, and compare that with total tax paid. And when I compare total tax paid with increase in financial well-being, rather than pure income, in other words, taking into account the increase in people's wealth as a result of actions over which they probably have very little control, we see that the tax rate, in fact, falls steadily right across the income strata because, of course, most of the wealth is owned by the most wealthy people, and the increase in wealth is dramatic in proportion to income. Maybe one-third of the total increase in financial well-being over this period is actually due to an increase in wealth and not work, so distorted are financial markets.

And the consequence is that the overall tax rate paid by those in the highest decile is only just over 20%, and the lowest overall rate of tax right across the spectrum is enjoyed by them because their wealth is basically undertaxed, and as a result, they of course, are accumulating wealth in a way that nobody else can because they are literally enjoying high levels of very low taxed income, which are fueling the increase in their wealth which is what we saw earlier.

So let's talk about something else. If it is the tax system on income and wealth that is helping people rise in the wealth spectrum, what else does that?

The other thing that does is the amount of tax relief that is given to the wealthy.

The wealthy enjoy quite extraordinary levels of tax relief within our UK tax system, and I want to explain what that means.

Total tax relief on pension contributions made in the UK costs the UK government in lost tax revenue, £70 billion a year.

That is the total cost in loss of income tax, national insurance, corporation tax and tax due on the increase in the value of pension funds while the funds are retained within those funds each year. That is the combined cost, and the vast majority of that, as we'll see in a moment, goes to the wealthy.

ISA tax relief, we've already mentioned, Individual Savings Accounts cost around £10 billion a year in terms of tax foregone by the government.

And there is another relief as well, which is the fact that capital gains tax is not charged on the increase in the value of people's homes, and the cost of that is around £30 billion a year.

I'm not going to discuss the merits of whether or not that should happen at this moment. All I'm pointing out is that the people who own the biggest and most expensive homes and who therefore get the majority of this tax relief are those with wealth because there isn't a limit on the amount of relief you can claim: so long as you own a home, however expensive it is, you get the relief and therefore this is also biased.

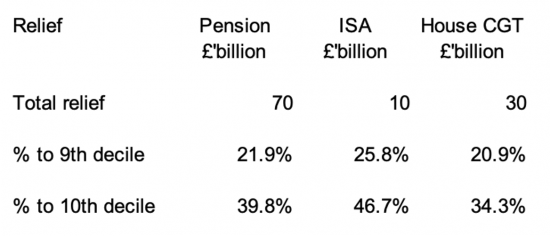

So, how much of these reliefs go to which group within society? I'm now using wealth information, and this information was in the second video in this series, and it looks at the ninth decile and the 10th decile. In other words, the second most wealthy and the wealthiest 10% groups within the UK society.

And as you'll see, of the total pension cost, 21.9% goes to the people in the ninth decile, and 39.8% goes to people in the 10th decile.

And you'll similarly see that there is substantial bias with regard to ISA allocations; in fact, 46.7% of all is tax reliefs go to people in the top 10% of wealth owners in the UK. This policy, which is meant to encourage small savers, does in fact provide a massive bung to the wealthy.

And the same is also true with regard to housing. Because the wealthy own the most valuable properties, they take 34.3% of the total value of capital gains tax relief each year on the sale of domestic properties. One-third of that whole relief goes to the top 10% of people by wealth strata in the UK.

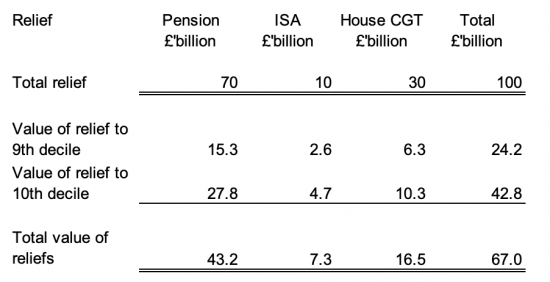

What does that mean in monetary terms? Let's just look at this.

When you look at it, the total value of reliefs given to the people in the ninth decile comes to £24.2 billion a year, and the total value of reliefs to people in the 10th decile is £42.8 billion a year.

In other words, the total value of relief given to the top 20% of wealth owners in the UK is, in total, £67 billion a year.

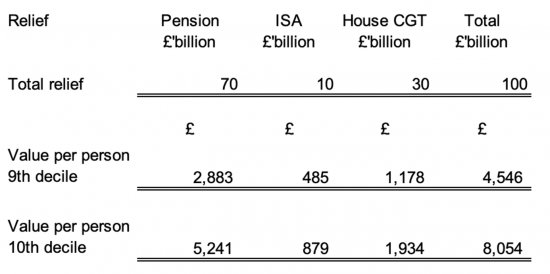

Now, let's just have a look at this and put that into pounds per person terms. This means that on average, a person in the ninth decile by wealth strata gets tax relief from the government of £4,546 a year, and a person in the 10th decile, the wealthiest 10% of people in the UK, gets tax relief of over £8,000 a year.

And this data is quite extraordinary because if we compare it with benefit payments, the contrast is staggering. If we just look at the top 10%, the amount of relief they get at over £8,000 a year - and this data, by the way, related to 2022, because that's the most recent wealth data that we've got, and the figures will have gone up by now - is comparable to the top rate of Universal Credit paid by the government. And if you know anything about Universal Credit, you know you have to struggle to get it.

It's also, broadly speaking, equivalent to the maximum rate of Personal Incapacity Payment made to a disabled person, and the struggle that people have to go through to get that relief is quite amazing, but all the wealthy have to do to get over £8,000 a year from the government is simply fill in a tax return and, no questions asked in most cases, they get the relief.

We are quite literally giving as much benefit to the wealthy as we do to those people who are in need in the lower-income strata of the UK. This is absolutely amazing.

And if you want to know why the wealthy in this group are therefore wealthy, it's quite simply because the tax system really subsidises the growth in their wealth.

Receive that much benefit a year from the government, and of course, your income from wealth is going to rise. You could, over a period of a decade, get £80,000 or more subsidy from the government for your wealth on top of the fact that your income will not be taxed at a fair rate.

This is why the comfortably wealthy, those who've got between, say, £3 and £5 or £6 million a year in the UK, are so wealthy. The tax system has simply been rigged in their favour, and it continues to be rigged in their favour, and that is at a staggering cost to everybody else in UK society, and that is deeply troubling.

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please do make sure you have got the correct MP. ChatGPT can get it wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

They are wealthy because they are greedy.

Their wealth is accumulated by stealing a share of the workers’ output, which we call “profit”.

They keep their wealth by using the government’s monopoly on violence to perpetuate inequality.

If you get Universal Credit AND have any ‘unearned income’ eg a Pension & bear in mind that there are many ‘Pensioners’ on UC because a couple are not eligible for Pension Age benefits until both are over 66 then the ‘withdrawal rate’ is 100% so there are a lot of people paying 100% ‘tax’ in the UK and by definition they are the poorest

Agreed

Many thanks for clearly summarising the tax benefits of being wealthy.

I don’t think you mentioned the additional regressive benefit of the basic tax allowance. This is also a large tax advantage for the wealthy.

Something like 7 million people pay higher rate tax of 40%. The average income of these higher rate tax payers is about £80000. The tax allowance, currently £12570, is applied to one’s highest rate of tax. If you earn £80000 this is a tax benefit of £5028, twice as much as the tax benefit for someone on minimum wage. So the top 7 million earners get an additional tax benefit of £2514 each. This seems quite a substantial additional benefit compared to the benefits you calculate, of £4546 and £8000, for the 9th and 10th deciles respectively.

How could this be avoided? Simply by replacing the tax allowance with a fixed tax deduction. That is, all income would be taxed at the appropriate, progressive, tax rate (20% or 40%). Then the tax deduction, say £2514, would be deducted from that tax. This would mean that anyone earning under the higher rate tax threshold would pay exactly the same as currently. But those earning more would not receive an additional tax benefit.

Now, one might say that, this is a fundamental change to the way we currently tax. It is not, it could be framed in terms of income related tax allowance, rather than a standard tax allowance, which is what is what is currently done for income over £100000. So, actually, it is just a modification of what is currently done. A fixed tax benefit is less messy and easier to understand. But, anyway, so what? In order to address the inequities of the current tax system there will have to be changes. This seems like a good one to make.

Noted, Tim

A fixced deduction is a neat idea…

I’d liked to see a detailed response to this from the HMRC – justification as well.

All I see is a system that panders to the House of Windsor, and the rest of it just increases their circle of friends.

Thanks for the hard work.

Thanks

I think this one is important

This is a very valuable series. Thank you. In my opinion one stand out example is the higher rate tax payer getting the higher rate relief on pension provision. (Disclosure: I have benefitted from this – but as I live in the world as it is, not as I would wish it, I would have been personally foolish not to).

Although it seems hypocritical of me now, I think one flat rate would be better, and I would also support pensioners (such as myself) having to pay some form of national insurance as well given we are more likely to require health and social care as we age.

But as you have so clearly pointed out, we need courageous and compassionate people in charge – and most people with these qualities are very busy elsewhere – including writing this blog…..

Thanks

A stock market crash will wipe out those capital gains, and possibly spread to property, antiques, fine wine, art etc. Then greed, of which there is far oo much, will turn to fear.

Fear is the topic of a future video

Not being a tax expert, I look forward to further comment about the proposal by Tim Kent above (@7.58am). As I understand this, those with higher incomes get an additional tax benefit above that of those with lower incomes, equal to £ (0.40 – 0.20) x 12,570 = £2514. This suggests to me that the current use of a fixed tax allowance rather than a fixed tax benefit exists so as to benefit the wealthy and therefore the change to a fixed tax benefit, as proposed by Tim Kent, would be a welcome progressive move.

It is more complicated than that

I will explain when I get time

The more I see the more I realise this country is utterly broken.

I wonder, just how much money can be recovered to the government by:

1. Taxing all incomes at the same rate, wherever you get the money from.

2. If the tax system was actually as progressive as it’s supposed to be.

3. HMRC had sharp fangs, plenty of enforcers and collected every pound due to them.

4. Government waste was properly audited and cracked down on, not like DOGE, like going after many of these contracts awarded to friends of ministers and lobby groups.

Being realistic, looking at your taxing wealth report, your video or article (it’s past 1am OK) on waste and then on the tax gap I reckon this would be a transformative amount of money anywhere between £100B and £200B.

Let that sink in. That’s the kind of money that could be spent on going green, nationalising critical infrastructure, building and rebuilding homes to be ready for the climate catastrophe, giving “young” people hope again at being asset owners. We’re not that young anymore. I’m sure Richard can correct me but it seems this influx in spending wouldn’t contribute much to inflation as it’s already out in circulation and isn’t being destroyed through taxation already.

I’m not a doomer, I swear!

First, there is no more government waste than in any other human system.

Second, flat taxes would make matters very much worse. The system would become deeply rergreeive.

Third, HMRC does need to be told to uo its game. It is told not to do so right now.

Sorry Richard, I should have been more precise, that’s what I get for typing it out at 1:30am.

I should have said fraud and not waste, however to me fraud is waste, especially when no attempt to monitor or investigate is made.

When I say the same rate I meant equalising of tax rates and not a flat tax.

Ultimately I wonder how much we are losing out on due to all of this? From taxing wealth report £197B or £92B from not releasing pension funds. £58B is from fraud which we know to be a gross underestimation and then the tax gap of £18B, same again, likely understated but it costs to get that back. That is a lot of house building, green energy, renationalisation of services and investment in repairing the damage privitisation has done.

Ah, that now makes more sense.

The housing market is one I feel the HMRC need to focus on and IMO there is a need to do whatever it takes to cause house prices to fall significantly – it is housing that is taking up a significant proportion of peoples’ incomes. However, while I agree with the majority of the blog article (and I must admit, I am taking advantage of some of the items mentioned – ISAs and Pension Relief ), I do feel it is a fine line taxing those whose residential properties have increased in value over the years. For example, my parents (one was a builder and the other a teacher) were on modest salaries. They bought a home in the mid 90s for £100k. I remember as a child we went on no holidays, we didn’t eat out, my father worked 7 days week so I hardly saw him. Now that house is worth £700k. But they aren’t suddenly swimming in £600k (adjustments for inflation aside). They want to downsize and this would free up the house for a family that could do with the bedrooms but stamp duty and agent fees means they’re better off staying where they are. The whole system is broken.

I do not consider them wealthy

And the system is broke